Pandemic Fallout: Cost Savings and Contract Renegotiation have become top priorities

Data Collection and Compilation by Mirza Zack

The Coronavirus (Covid-19) pandemic continues to wax and wane across the globe with no end in sight. Countries across the globe continue to instruct its citizens to avoid discretionary travel while encouraging people to work from home where possible.

The pandemic has resulted in prolonged lockdown in many countries around the world, impacting the trade flows.

Manufacturing sector is the heartbeat of any economy. The sector plays an important role in the global growth.

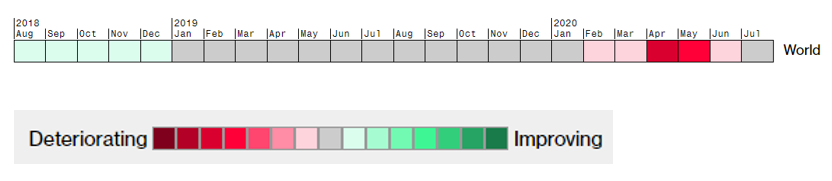

The Bloomberg heat map given below highlights what purchasing managers are saying about the manufacturing outlook—positive or negative. From the depths of April and May, the situation seems to be slowly improving but still not in the green territory.

Amidst this great disruption to trade, business and normal way of life, Beroe has been receiving multiple queries from Procurement Managers relating to supply uncertainty arising out of this situation.

In order to get a clear picture, we ran a survey among users of Beroe LiVE, a community of thousands of procurement decision makers, to find out their priorities in these challenging times. This was a continuation of our previous survey where we mapped out the level of preparedness when it comes to BCP.

The Survey

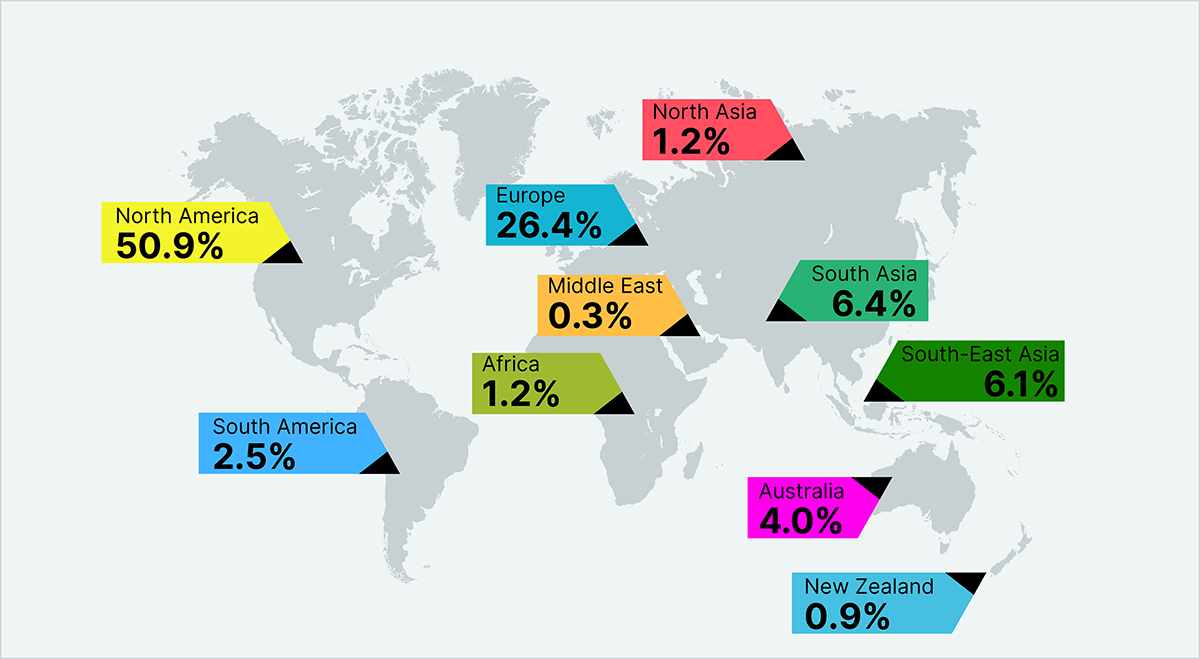

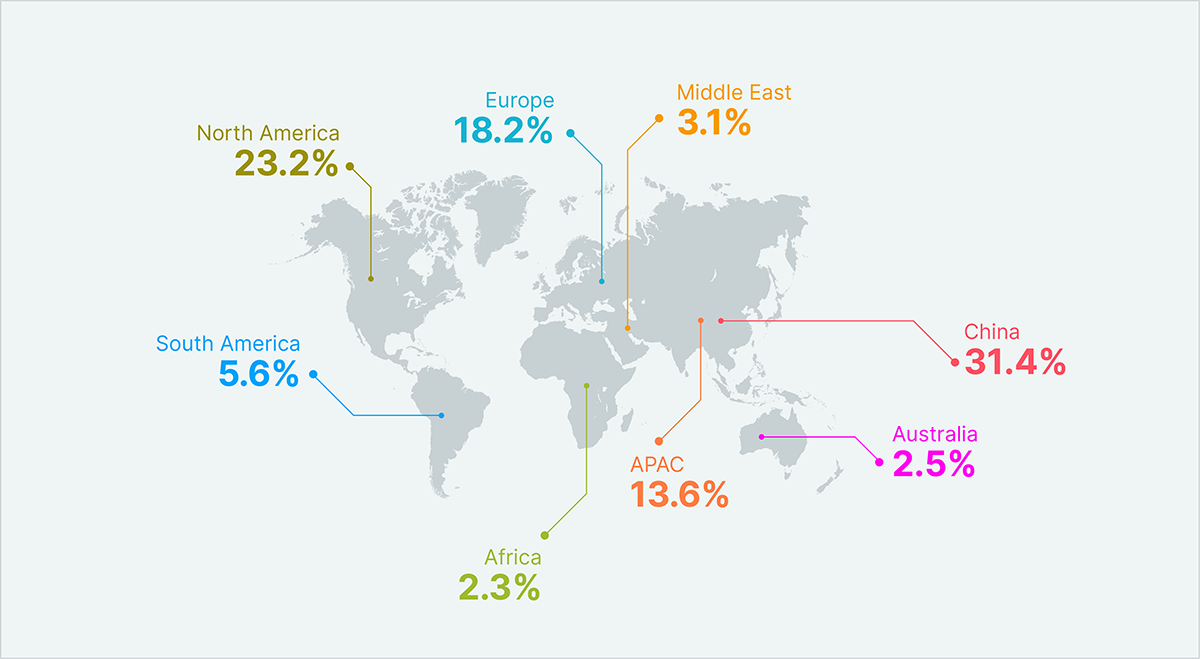

Sourcing and Supply Chain professionals from nearly 300 companies across the globe participated in the survey. A majority of them were from North America while a quarter of the respondents were from Europe.

I am based in:

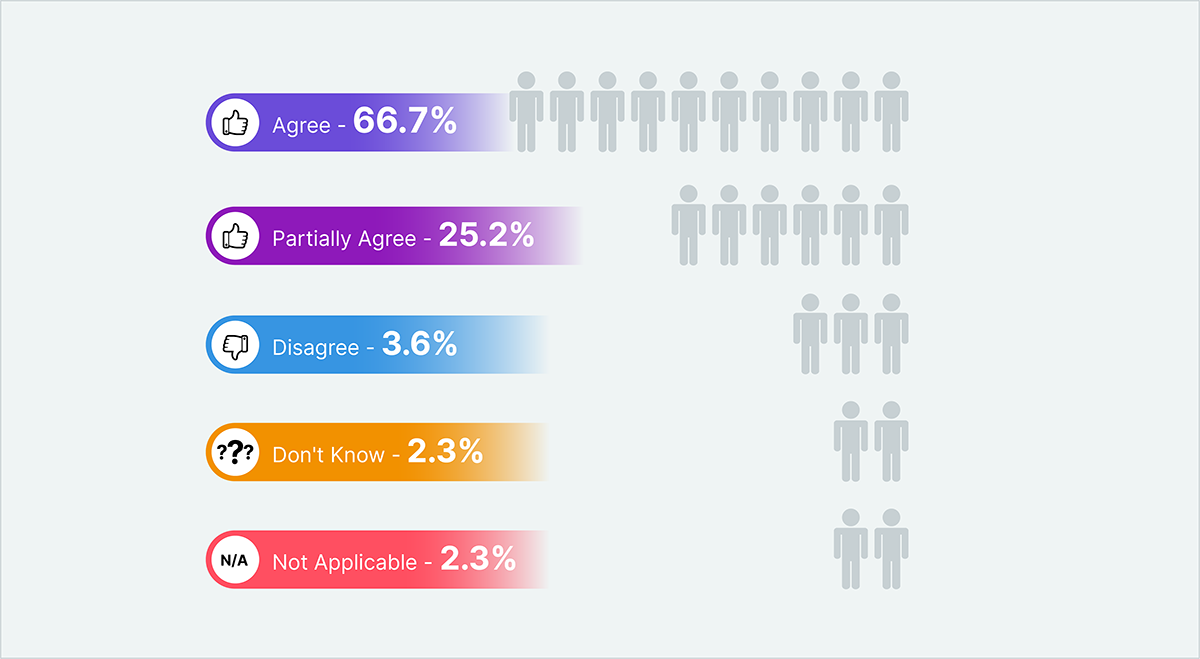

My company rolled out a Business Continuity Plan (BCP) to tackle disruptions relating to Coronavirus (Covid-19) outbreak

Almost all the respondents said their company has rolled out Business Continuity Plan (BCP), a marked improvement from our previous survey. However, 4 percent of respondents still said their company has not implemented a BCP plan to tackle disruptions.

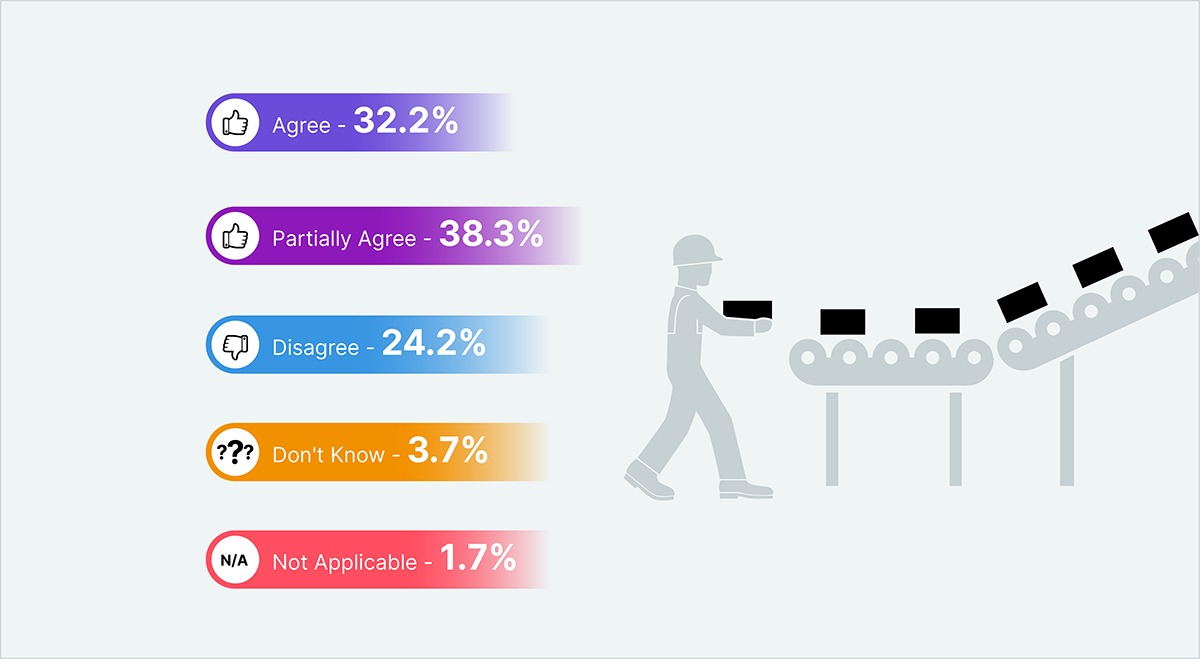

We continue to experience supply chain disruptions for some of the materials/inputs/ products

Nearly one-third of respondents said they continue to experience supply chain disruptions for some of the materials/inputs/ products. This is significant given that it has been nearly 5 months since the pandemic outbreak and things don’t appear to have settled down.

However, 25 percent have people have said they don’t experience disruption.

I see longer lead times -- as compared to historical average -- from our suppliers based in the following regions

Delivery lead time is an important element in supply chain management. Nearly one-third of respondents have said they are experiencing longer lead times -- as compared to historical average -- from suppliers based in China. This shows even though the country managed to quell the spread the Covid-19 infection, the business is slow to come back online.

More importantly, over one-fifth of respondents said they are experiencing longer lead times -- as compared to historical average -- from suppliers based in North America (mainly the U.S.). This could be because the country is continuing to witness a spike in the infection rate.

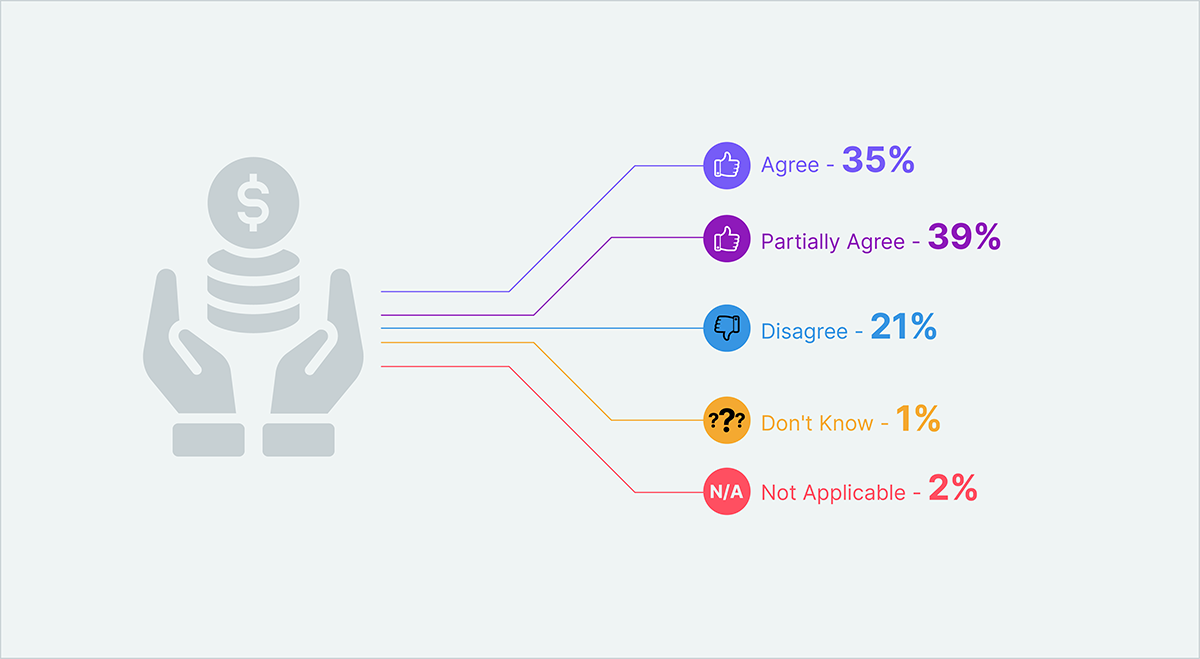

“Cost Savings” is now my team’s primary goal as we expect the revenue to be weak for the rest of the year

The verdict is out. “Cost Savings” is back in vogue -- but many would argue that it never went out of fashion. Companies are looking to rein in costs in the face of uncertain global economic situation. 35 percent agreed that “Cost Savings” is now the team’s primary goal due to weak revenue forecast for the rest of the year. 39 percent of people partially agreed.

Interestingly, 21 percent disagreed. They could be from those sectors that continue to do well despite the pandemic.

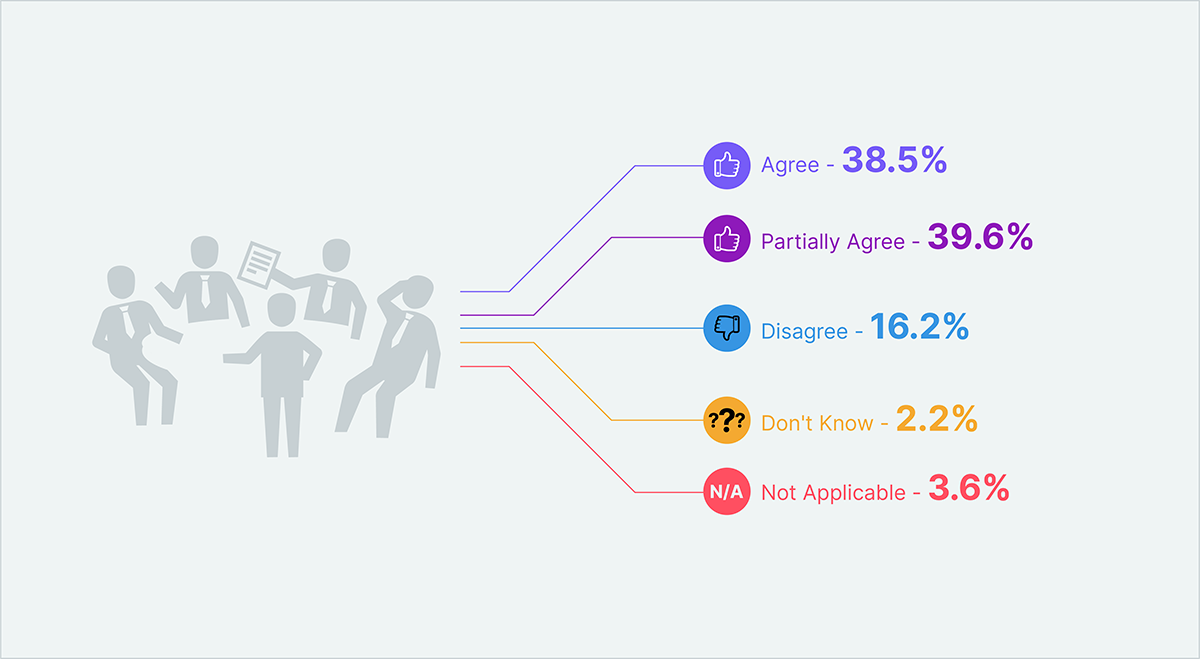

My team is working on contract renegotiation with suppliers to reduce costs

Nearly 80 percent of respondents either agreed or partially agreed when Beroe asked them whether they are looking to renegotiate supplier contracts with the aim of reducing the cost base.

16 percent disagreed.

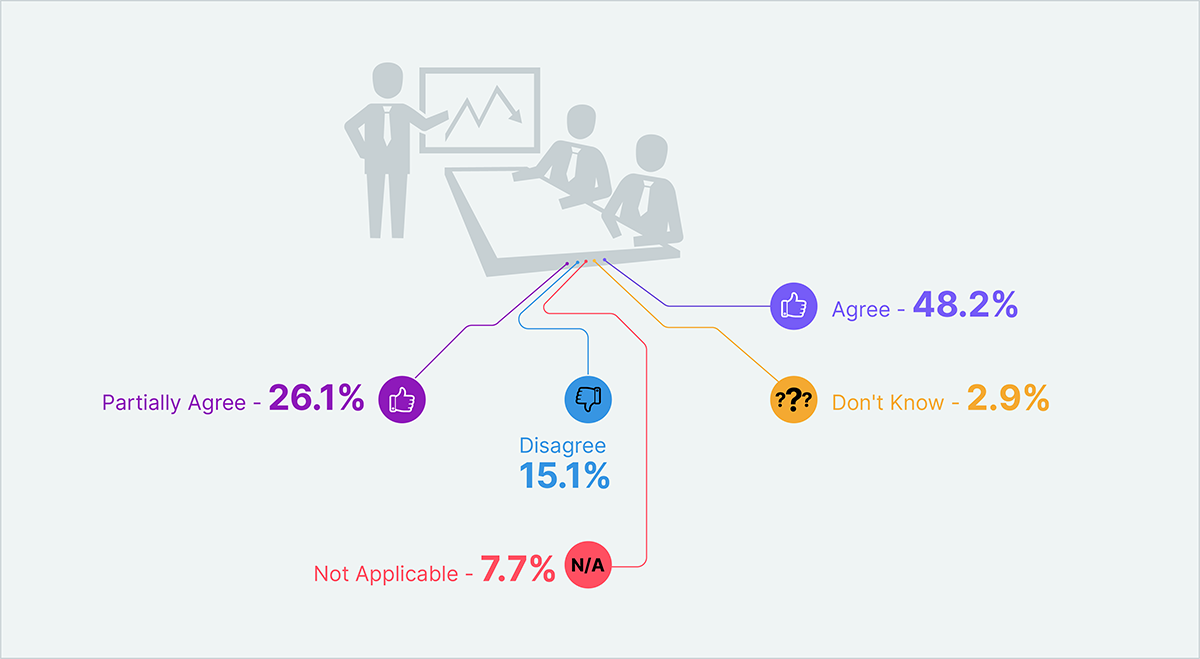

My team is working to mitigate the impact of reduction in demand for the company products/services

Many countries are experiencing demand contraction, which is prompting companies across affected sectors to plan for the demand shift.

Nearly 50 percent said they are working to mitigate the impact of reduction in demand for the company products/services, while 26 percent partially agreed. 15 percent disagreed.

A Senior Vice President of Procurement based in North America said that protein markets continue to have issues.

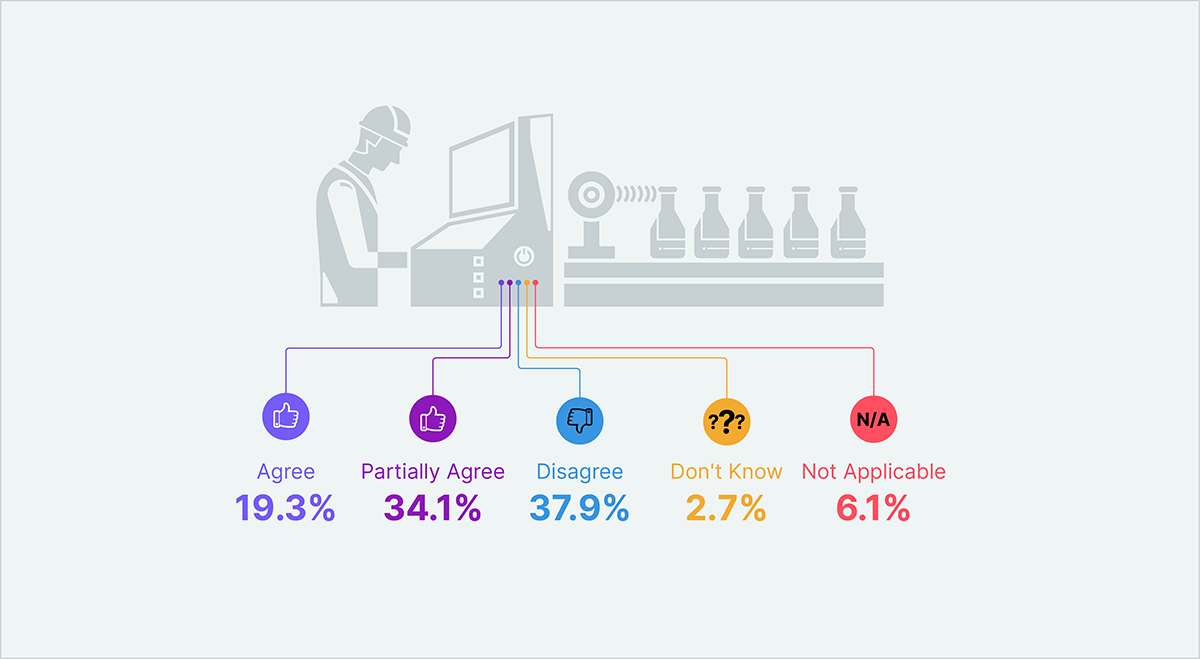

In a contrarian move, we are experiencing a surge in demand for our company’s products/ services due to the Covid-19 pandemic

It is not all gloom and doom. While many sectors continue to feel the pain of weak demand and supply uncertainty, there are some sectors that are doing well even during the pandemic.

Nearly 20 percent of respondents said they are experiencing a surge in demand for their company’s products/ services due to the Covid-19 pandemic. However, nearly 38 percent of people outright disagreed.

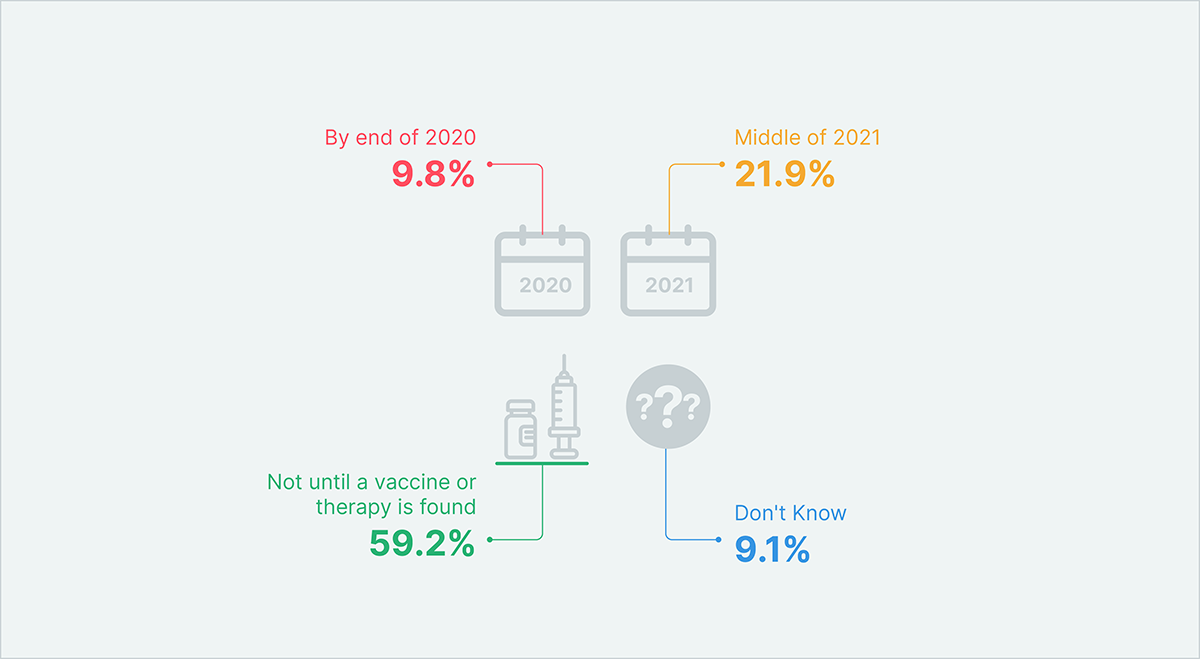

When do you think the Covid-19 Pandemic will eventually end?

An overwhelming majority of respondents said that the pandemic will not end until a vaccine or therapy is found. 22 percent of respondents said they expect the pandemic to peter out by the middle of 2021, while nearly 10 percent expect it to end by the end of 2020.

Yet another 10 percent of people said they don’t know when the pandemic will end.

The results show it will take a long while for normalcy to be restored.

Voice of Community

Here are the selected comments from respondents. We are not revealing their names as they are not authorised to speak on behalf of the company.

Supply Disruption

- “Yes we are still experiencing disruption in the supply chain”.

-- Strategic Procurement Director based in North America

- “We are currently experiencing very minimal disruptions to any of our supply chains”.

-- Category Manager based in North America

- “Shortages of everything from laptops, headsets, and even webcams. Delays due to customs/shipping are common. Suppliers are holding less inventory due to cash flow constraints, lead times are increasing substantially across common commodity goods like computers”.

-- Category Manager based in North America

- “Situation is much better now compared to period March to May. Monitoring closely some markets which are witnessing increasing stress from resurging cases or wide spread community infection case”.

-- Category Manager based in South East Asia

- “We instituted our BCP in early February, having pulled in orders for all forecasted components. To date this strategy, plus the human strategy has allowed us to run without any disruption. Raw PCBs (Printed Circuit Boards) are seeing disruption in the U.S. market, and some components have pushed out”.

-- Strategic Sourcing Director based in North America

- “Our BCP was in place. We then created Covid-19 Task Force (For which I am the leader) reporting to the CEO. This has been very successful and followed our very thoughtful protocols”.

-- Senior Vice President based in North America

- “We setup a task force and activated our 2nd and 3rd sourcing possibilities”.

-- Sourcing Director based in Europe

- “Special attention was given to continuous supply of material, especially high lead time supplies. Supply network was given the visibility of future orders and asked to stock raw material”.

-- Category Manager based in South Asia

- “While we were well prepared for the immediate disruptions in March/April, we are still experiencing a few minor pain points in the form of extended lead times. However this is quite manageable as we were well positioned with risk mitigation protocols -- geographically dispersed supplier portfolio”.

-- Procurement Director based in North America

- “Disruption in Feb/March/April to components from Far-East but now getting back to normal ; services in Europe largely unaffected as supplier BCP cut in. Only one Force Majeure discussion, which was withdrawn as solutions were found”.

-- Procurement Director based in Europe

- “A few of our smaller Vendors have experienced disruptions in service due to a fear of the Pandemic. We are continuing to experience a serious lack of skilled labor”.

-- Procurement Director based in North America

- “Our recovery in demand has surpassed volumes from first quarter while supply base still struggles with materials and labor availability”.

-- Vice President, Global Sourcing based in North America

Cost Savings

- “Sales are down 90 percent, so yeah save everywhere”.

-- Purchasing Manager based in North America

- “Cost savings as a priority has normalized, we have accomplished 100 percent of our base target due to the additional COVID19 related contract negotiations, and we are at 90 percent of our annual stretch target 7 months into the year. Cost savings is going very well, and we see the revenue forecast has corrected and is back to growth mode”.

-- Category Manager based in North America

- “While cost savings is a primary focus, we seek best overall value, which includes both qualitative and quantitative attributes to be considered. "It doesn't matter if it's free if we can't get it".

-- Procurement Director based in North America

- “Cost savings is always a critical function of the organization, along with long term sustainability and product leadership. I never want the company to focus purely on costs. I have been with organizations that become too cost focused and end up missing on product leadership with the market. Balance is the key”.

-- Supply Chain Director based in North America

- “Cost is always a consideration, but cheaper is not always better. We are increasingly more concerned with quality and value for money”.

-- Supply Chain Director based in Europe

- “Cost savings has always been a targeted goal of every project. Revenue has gained significantly”.

-- Procurement Director based in North America

- “Our business has not been impacted financially due to the product and customer mix, mostly all being ‘essential’”.

-- Strategic Sourcing Director based in North America

- “Cost Savings is our primary goal but our revenue is going very, very strong”.

-- Head of Supply Management based in Europe

- “Primary focus currently is 100 percent continuity of supply”.

-- Vice President based in North America

- “We are trying to minimize our costs as usual but we are not in a position to reduce our costs considerably”.

-- Supply Chain Director based in North America

- “While cost savings is always our primary goal, we are taking increases in the short term to get additional supply of materials to keep up with the exponential increase in demand for household products”.

-- Sourcing Manager based in North America

- “Cost savings is extremely difficult in these times due to smaller volume and less engineering resources to switch suppliers. Cost avoidance is more of a focus”.

-- Strategic Sourcing Manager based in North America

- “Revenue will be weak, but cost savings not possible as vendors are weakened and not in a position to grant price concessions”.

-- Purchasing Manager based in North America

- “As long as the whole picture is taken into consideration, tariff charges/freight, costs/lead time/quality. Companies need to look at and review production plans that were put into place prior to the pandemic. Demand for products and/or services has changed dramatically, increasing inventory levels”.

-- Purchasing Manager based in North America

- “The problem here is how we generate cost savings with weak revenue”.

-- Category Manager based in Australia

Contract Renegotiation

- “Selective negotiations underway”.

-- AVP and CPO based in North America

- “Focused on subscription-based costs”.

-- Vice President of Procurment based in North America

- “We are maintaining our regular schedule of negotiations based on contract term endings”.

-- Sourcing Director based in North America

- “In some areas, yes, where costs are fixed; or we are looking to move to ticket based pricing in some specific areas to match demand to what we pay. Cash management also important”.

-- Procurement Director based in Europe

- “What we are seeing is vendors not honoring quotations, or written Purchase Orders. Invoices are for increased unit costs with no regard for the established relationship. That is the single most egregious activity provoking management concern”.

-- Sourcing Director based in North America

- “We are not in a position to renegotiate our contracts”.

-- Procurement Director based in North America

- “We have asked for some extended terms, other suppliers have offered extended terms to us proactively”.

-- Sourcing Director based in Europe

- “We are doing our best to negotiate pricing however we are at a disadvantage - as other sectors are willing to pay the price for the product and then we lose the order”

-- Sourcing Director based in North America

- “Yes. We had 70 percent of spend contracted already. We are working on another 15 percent of the suppliers and in parallel increasing our consignment contracts etc”.

-- Senior Vice President based in North America

- “My Team is working closely with the contractor for all avoidable cost measures”.

-- Procurement Manager based in South Asia

- “We are working with our suppliers to keep them whole and financially stable”.

-- Category Director based in North America

- “Procurement's focus needs to shift further to cost reduction and move into targeted negotiations with current and new suppliers”.

-- Strategic Sourcing Manager based in Australia

When do you think the Pandemic will end?

- “Since Covid-19 Pandemic across the globe, the Supply chain is impacted by being a cross-linked function of various and variety of producer presence at the various regions. Government policy changes, political reforms, and business strategies change. Need continual changes in our business practices. It takes some time to restore”.

-- Procurement Manager based in South Asia

- “I expect further significant disruption once cold and flu season hits in the fall since we aren't able to differentiate these common illnesses from COVID-19”.

-- Vice President Procurement based in North America

- “COVID-19 will not disappear. Hopefully we will be able to manage the spread but it will not end until a vaccine is found”.

-- Procurement Director based in North America

- “The world cannot operate in isolation or lockdown over extended period. A balance between economics and health safety will continue to be debated; people movement and non-compliance to precautionary acts will likely not keep the virus at bay”.

-- Category Manager based in South East Asia

Conclusion

One thing is clear: the supply situation has certainly become better compared to the dark days of March and April. However, business uncertainty still lingers as many countries continue to experience a spike in infection rate.

Stay safe and follow your local government guidelines.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe