Now we have our sea legs, supply managers should create contingencies for whatever is next

(Photo Credit: CAPS Research)

More than two years ago now, the world seemed to go topsy turvy, with healthcare and supply chains bearing the brunt of what seemed to be one catastrophe after another. Since then, as supply management professionals, we have adopted new policies, expanded infrastructure, implemented more strategic decision making, and increased agility, but we’re not done yet. With continued pressure on our supply chains, growth despite economic uncertainty, and the looming pandemic, what’s next for supply chain?

So how exactly did we get here?

In the November 2021 CAPS Research report, What is Wrong with Global Supply Chains?, Robert B. Handfield, Ph.D., aptly summarizes the supply chain challenge:

“The current set of supply chain disruptions is precipitated by a combination of COVID-19 cases and energy disruptions in manufacturing hubs around the world, labor shortages, lack of capital infrastructure investment, misaligned transportation resources, and surges in consumer demand.”

Supply chain managers faced the perfect storm. In addition to a series of brown-outs from coal-fired energy reduction in China and a series of natural disasters that decreased production and increased the price of raw materials, consumer demand was unpredictable. Handfield continues that consumers’ buying-selling behaviors were irrational following the pandemic, and manufacturers were not logistically prepared to meet this demand. Each node of the supply chain was its own bottleneck. All of these issues became inextricably linked.

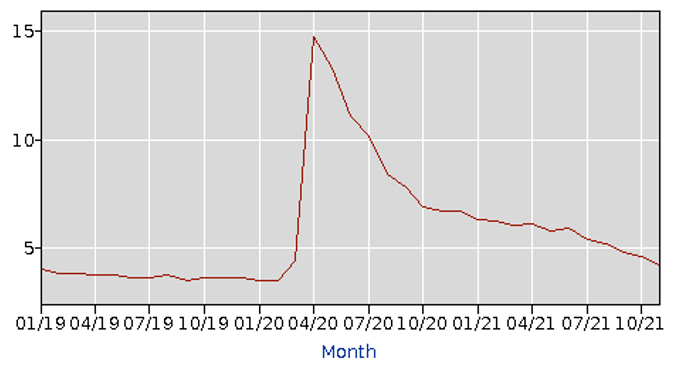

Figure 1: Unemployment rate, 2019-2021, Bureau of Labor Statistics https://data.bls.gov/eag/eag.us.htm

Figure 1: Unemployment rate, 2019-2021, Bureau of Labor Statistics https://data.bls.gov/eag/eag.us.htm

When consumer buying patterns normalized or at least became more predictable, we faced labor shortages. According to Handfield, “Executives found that the shortages were leading to increased labor costs, reduced productivity, and higher operating costs.” These labor shortages especially affected transportation and shipping: ports, railways, and trucking.

The U.S. job market is on the upswing, consumer behavior has normalized, and supply chains are adapting but let’s take a look at issues that continue to affect our supply chains and could impact our practice going forward in transportation and shipping, environment, supply v. demand, and inflation.

Planes, trains, automobiles, ships, and congested ports

We have quickly discovered that there is no business as usual lately and that when it comes to supply chain in recent history, borrowing the words of Heraclitus, the only constant is change. As shipping and freight affected supply chains throughout 2021, issues have evolved.

COVID-19-related shipping delays, caused by labor shortages and fewer workers to unload cargo, have increased dwell times and congestion in ports. Exacerbating issues are airfreight and truck capacity limitations, container shortages, and, as a result of all of this, exponentially higher costs.

Further, global policy on COVID-19 has made it more difficult for trucks to cross borders. As different regions work through the variants, timing and policy will continue to play a role in this aspect of supply chain.

A recent Bloomberg article, dove into the macro effects of shipping on larger supply chain issues: “Higher freight costs are feeding an inflation beast that’s eating away a bigger share of consumers’ incomes and raising costs for companies.” Citing U.S. Department of Labor data, Bloomberg details how the cost of moving freight across oceans in November was up 26% from one year before, while freight by truck was up 16%. Ocean liners on the Drewry Hong Kong to Los Angeles route were up 120%. Air and rail are also experiencing record high transportation prices.

Figure 2: “Freight Rates on Every Mode of Transport Are Boosting Inflation,” Bloomberg, Dec. 20, 2021. https://www.bloomberg.com/news/newsletters/2021-12-20/supply-chain-latest-how-freight-rates-are-adding-to-inflation

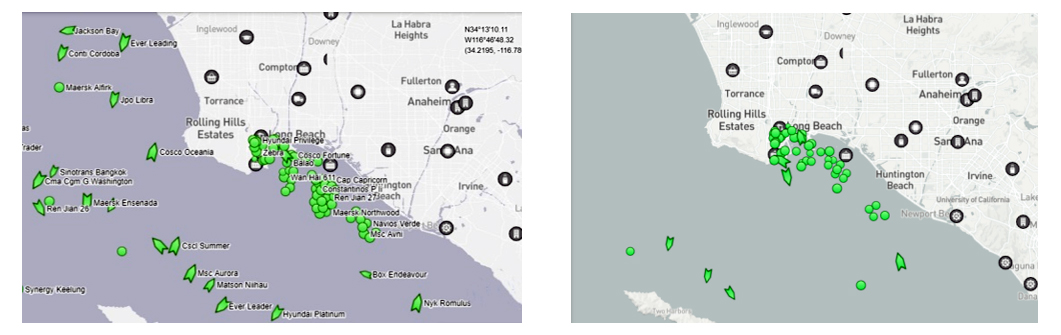

Congestion at the ports touches both land and sea, as ships line up to dock, and empty containers pile up in residential neighborhoods surrounding the ports. In addition to several foreign ports like Yantian in China, the ports in Long Beach and Los Angeles, California, have been hit hard.

“Before the pandemic and before the surge in the American consumer buying patterns,” Port of Los Angeles Executive Director Gene Seroka said, “during the peak season we would have one or two months where we move 900,000," but over the previous 17 months, he said, Los Angeles has been unloading 900,000 containers per month, with Long Beach unloading 800,000 per month, according to a recent article in the Los Angeles Times. Seroka expected the numbers to remain high through the holidays and beginning of 2022 as inventories get refreshed.

To stem port congestion, as of Nov. 16, 2021, shipping trade groups have set a new policy asking ships to wait 50-150 miles offshore, depending on point of origin, as they wait to unload cargo.

Figure 3: Traffic off the coast of California, Sept. 21, 2021, https://www.marinetraffic.com/

Figure 4: Shift of port congestion off the coast of California, Jan. 6, 2022, https://www.marinetraffic.com/

Policies like this, adopted in reaction to pandemic-related supply chain problems, have sped up the pace of trade, increased adaptability of shipping protocol, and positioned cargo shipping better for any future issues but future shipping issues are still unpredictable.

Lee Klaskow, senior industry analyst at Bloomberg Intelligence, says, “The omicron variant has created more headaches for the liner industry, ports and shippers following recent lockdowns across China’s Zhejiang province. Further outbreaks will add more stress to supply chains.”

Does it all depend on the weather?

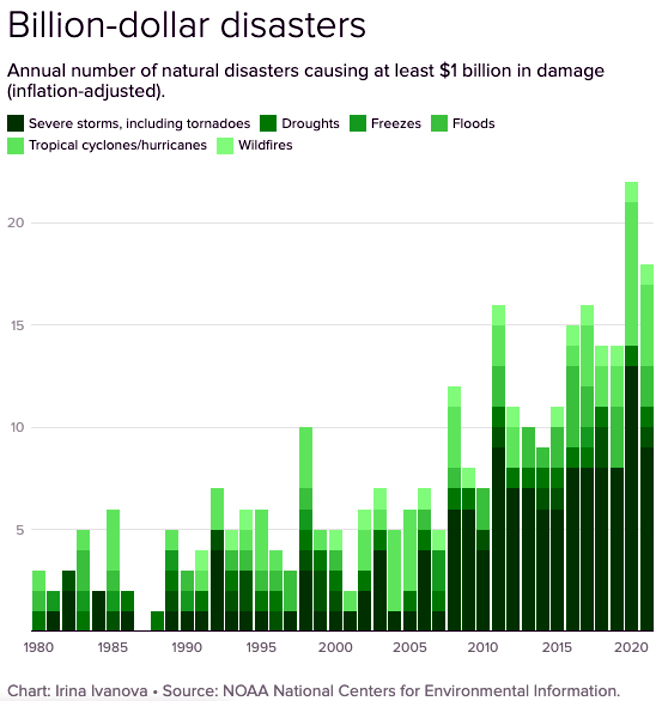

In the last few years, in addition to unprecedented shipping challenges, we faced numerous record-breaking natural disasters: the Texas freeze, Hurricane Ida and tropical storms in the Gulf Coast, floods in Vietnam, wildfires in the Amazon, and Cyclone Amphan in India to name a few.

Each event sent ripples through the supply chain. According to Handfield’s report for CAPS, What is Wrong with Global Supply Chains?, “Major supply chain disruptions due to weather-related incidents are on the rise, and one can’t dismiss these as a ‘once-in-a-century’ event anymore.”

Each event sent ripples through the supply chain. According to Handfield’s report for CAPS, What is Wrong with Global Supply Chains?, “Major supply chain disruptions due to weather-related incidents are on the rise, and one can’t dismiss these as a ‘once-in-a-century’ event anymore.”

To further examine just one of these climatological event’s impact on the supply chain, Handfield explains how the winter storm in Texas in February 2021 reduced the supply of resins and plastics, citric acid, carbon dioxide, nitrogen, and other process chemicals, as well as petrochemicals used to make auto parts, computers, packaging, and plastic products.

And according to a United Nations report, “One of the ways in which the COVID-19 pandemic compounded disasters was by disrupting supply chains for necessary materials used in response to disasters,” such as plumbing parts to repair homes in Texas, increased food insecurity from decreased production in agricultural areas, limited disaster response because of capacity issues in storm shelters, and more.

We do not expect these events to improve in the near term, and we will have to be responsive as they arise. For example, A Dec. 14 CBS News article looks at how Tornado Alley in the U.S. is moving east toward the Mississippi Valley in the Midwest and other parts of the Southeast plains. "That's leading to higher costs, especially in areas where we do see a lot of these manufacturing facilities and a lot of the central portions of much of the supply chain that is really critical," according to Steven Bowen, managing director for catastrophe insight for insurer Aon.

Supply managers should develop a strategic risk management plan that takes into account climatological events and natural disasters in the supply network as well as availability of supply, political and government risk, and security issues, as well as financial, sustainability, legal, brand, and financial factors (Supply Chain Disruption: Where to Invest, CAPS Research, 2021).

Supply chain hurdles in making supply meet the moving target of demand

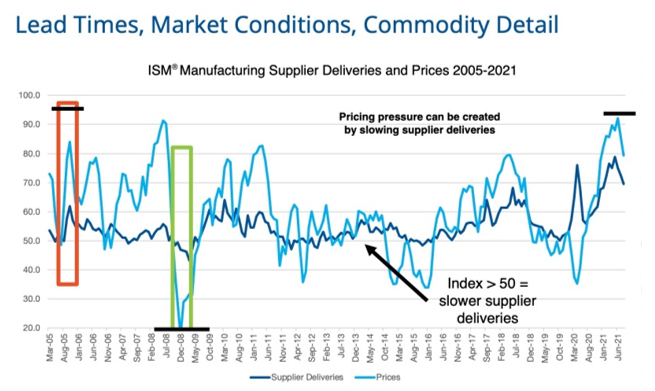

Figure 5: Institute for Supply Management® Manufacturing Supplier Delivers and Prices 2005-2021

As a result of labor shortages, supply chain disruptions, and erratic consumer behavior, compounded by the pandemic, commodities have gone up significantly in price across and are experiencing significant lags in delivery.

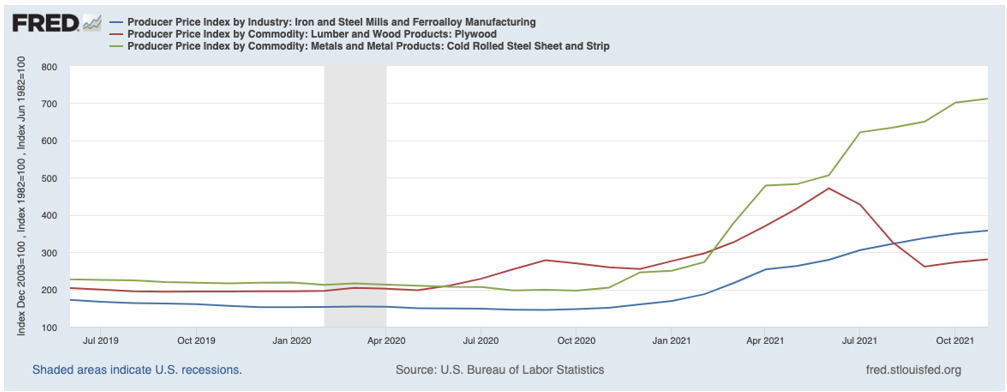

To examine lumber as a case study, this raw material experienced an increase of 406 percent in one year, at $1,686 in May 2021. This is due namely to the housing boom, Canadian lumber tariffs, and transportation issues. Supply chain issues slowed production, reducing supply, and with the labor shortage, rail transportation from mills to lumber yards was slowed. Similar pricing increases were seen in metals, plastic resins and petrochemicals, freight supplies, packaging, and famously, semiconductors.

Figure 6: Data: U.S. Bureau of Labor Statistics; Chart: Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCU33113311#0

Going forward, as organizations adapt to recent consumer spending patterns and meet demand with supply, even minor degradations in delivery performance could mean massive declines in revenue. Some companies face make vs. buy decisions to reduce lag time and others will shift production from overseas to local or within trade regions.

When this new higher demand is sustained, such as is the case with consumer electronics in the new work-from-home environment, it may be best for companies to expand capacity. However, as Handfield points out, some companies are reluctant to invest in capacity, “as they do not foresee whether this is a blip in time, with things returning to normal and utilization dropping back to normal levels again or not. Many believe that as fast as everything went into ‘supercharged’ mode, the slow-down could likewise be very quick,” resulting in oversupply.

The shelves are stocked but prices are high

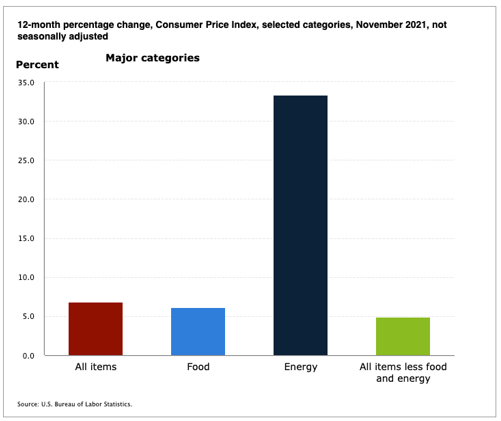

Figure 7: U.S. Bureau of Labor Statistics, https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

Figure 7: U.S. Bureau of Labor Statistics, https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

Consumer spending is finally returning to a normal mix, companies are better able to maintain their inventories, and the job market has grown, yet supply managers have price hikes and inflation to contend with. Handfield says, “Inflation is likely and many productivity improvements will not be able to mitigate the rising costs of materials and labor that are now firmly embedded in our industrial infrastructure. Shortages are likely to be part of our economic reality for most of 2022 and maybe into 2023.”

Until recently, the Federal Reserve thought shortages were short-term and that inflation would ease when supply chains normalized, but on Dec. 15, 2021, Board Chairman Jerome Powell said the Fed was taking action to help the economy expand. “We will use our tools both to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched,” Powell said at a news conference.

According to PBS, “The Fed’s new forecast that it will raise its benchmark short-term rate three times next year is up from just one rate hike it had projected in September,” and federal officials expect inflation to cool by the second half of this year.

People, planet, products, and the future of supply chain

In the wake of the pandemic, supply chain has been tested like never before, delicately balancing health and human issues, climatological events with manufacturing needs, supply and demand. These series of interwoven events have exposed gaps and faults, they’ve revealed opportunities, and sometimes they’ve deconstructed and required rebuilds, but as a result, the profession has become more resilient, aware, and adaptable. Capitalize on the lessons learned over the last few years, utilize this time to build strategic plans, and prepare for the future.

(NOTE: Bryan Fuller is the outgoing Executive Director at CAPS Research. Denis Wolowiecki is the new Executive Director effective January 2022)

(CAPS Research is a leading B2B non-profit research center serving supply management leaders at Fortune 600 and Global 1000 member companies. CAPS Research was established in 1986 at the W. P. Carey School of Business at Arizona State University (ASU) in partnership with Institute for Supply Management (ISM))

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe