“At first, we faced a lot of No’s from suppliers” - Philip Morris International CPO

(Pic Courtesy: Hafed Belhadj)

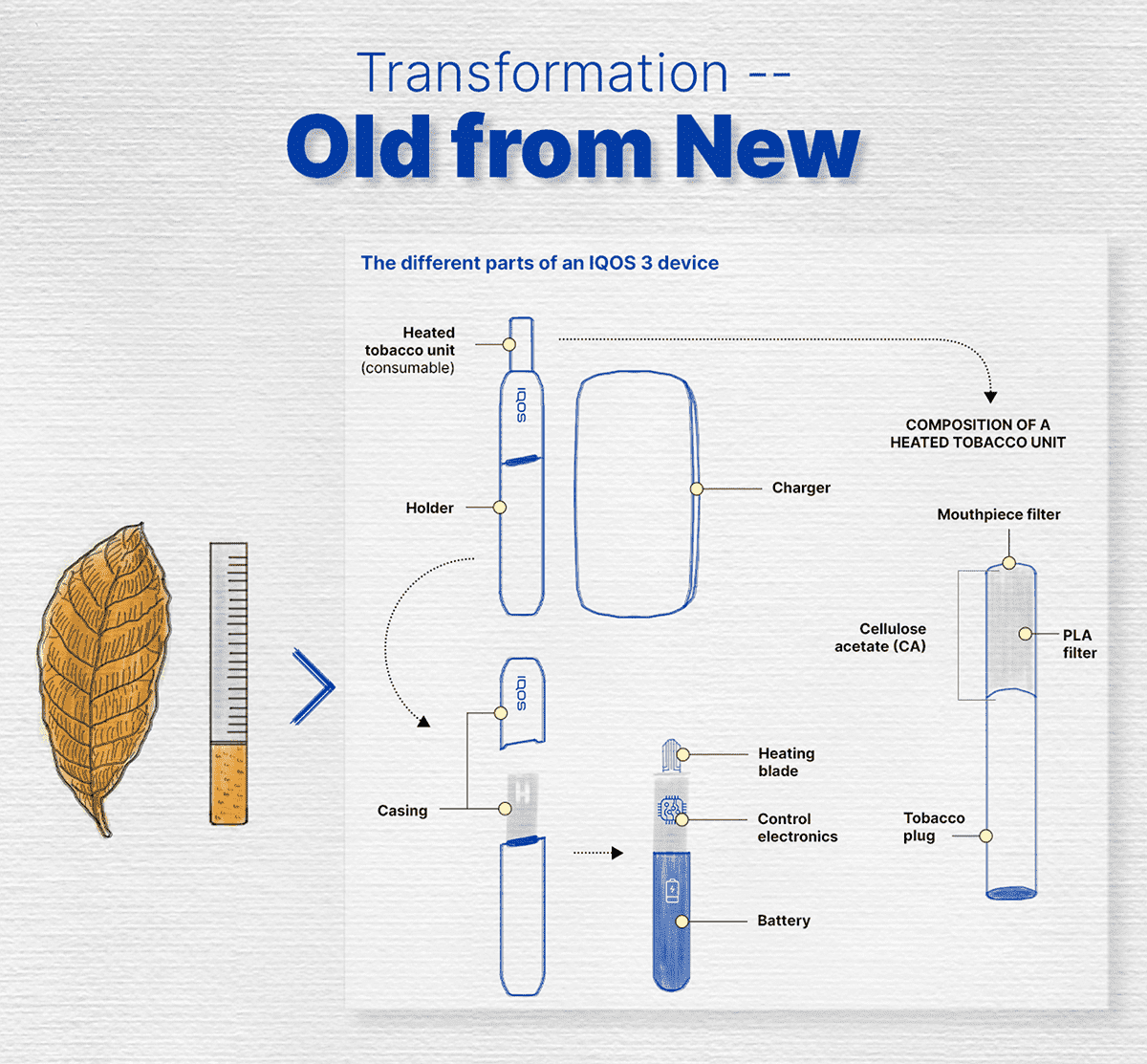

Philip Morris International (PMI) gets to source both the “old” and the “new.” The “old” here refers to tobacco leaf, the main ingredient found in a cigarette, and the “new” comprises electronics that are part of the innovative heated tobacco technology.

PMI, a leading international tobacco company, known for its Marlboro and Parliament brands, has embarked on a mission to offer better, smoke-free alternatives to adults around the globe who would otherwise continue to smoke; needless to say, it has found success. Smoke-free products accounted for about 29 percent of the company’s net revenue in the third quarter of 2021.

Beroe spoke to PMI’s Chief Procurement Officer (CPO), Hafed Belhadj, to gain insight into Procurement’s role in fulfilling the company’s smoke-free future vision.

It was 9 a.m. in Lausanne, Switzerland, when Hafed received Beroe’s video call. The conversation began with the usual controversy surrounding the tobacco industry. He was candid when asked whether he faced any criticism for being part of this industry, “To be honest, very rarely have I faced personal criticism. Having said that cigarettes and smoking have a significant impact on public health, and that is why, as a company, we are committed to a smoke-free future and have invested significant resources in enabling this vision.”

The Transformation

PMI embarked on a business transformation to deliver a smoke-free future. Hafed then began to realign his Procurement function with the aim of supporting business stakeholders in this transformation.

“How can we improve and increase the engagement with stakeholders to deliver value? How can we change our operating model in tune with the changes happening within the company?” said Hafed, who spent years in business operations before moving to Procurement.

The five key shifts the PMI Procurement team is working on are:

Stakeholder Alignment and Business Partnering: Fulfilling sourcing requirements in an agile manner.

Category Management: Standardizing category management practices across teams while deepening the existing knowledge repository.

Procurement Operating Model: Focus on business partnering and category expertise.

Digital: Building self-service capabilities for internal stakeholders and suppliers. The Procurement function also enables data analytics by combining the internal and external data.

Building Capabilities: Focus on strengthening industry and category knowledge while fostering relationship management and ensuring that the organization has the skills and technology of the future.

Hafed stated that the transformation program is important because the company’s product mix is going through a sea change. “Numbers tell a very good story, a significant part of the revenue is now coming from our smoke-free products, and the Procurement transformation initiative is actively aiding this,” Hafed said.

Inflation and Shortages

The discussion then veered toward the current hot topic: inflation and supply shortages.

“Clearly, these are challenging times globally. During the pandemic, most companies reduced their inventories to preserve cash, and that led to strong demand everywhere upon exiting the COVID-19 waves; and then, there was significant monetary stimulus in the developed economies, especially Europe, the U.S., and many other countries that created this strong demand that has put a lot of pressure on all commodities.

"The key consideration is you have to prepare for these kinds of crises before they happen and not just react to them when you are in the middle of it. We predicted that the global economy would experience inflationary conditions. This is very similar to what happened in 2010; however, we did not expect it was going to be to this extent.

"We structure our purchasing contracts as a mix between long-term and short-term obligations. You know you are going to get hit by some of these inflationary pressures, but at least you have the ability to mitigate them by not having all contracts expire at the same time,” Hafed explained.

The Sourcing

In addition to tobacco leaf, PMI procures a wide variety of direct materials from about 400 suppliers. In 2020, the company’s top ten percent of direct material suppliers represented over 50 percent of total direct material purchases.

Managing an expenditure of over $10 billion, Hafed’s global team of about 500 people is responsible for sourcing everything except tobacco leaf, which is separately managed by a dedicated group. “This is because leaf purchasing is a complex undertaking of an agricultural product that requires special attention. We deal with farmers and tobacco merchants to ensure our stringent quality and sustainability requirements across the globe.”

In 2020, PMI purchased tobacco in many countries, including Argentina, Brazil, Colombia, Italy, Pakistan, Malawi, Indonesia, and Poland.

Besides tobacco leaf, the four most significant direct materials that PMI procures are:

- Printed paper board used in packaging

- Acetate tow used in filter making

- Fine papers used in the manufacturing of cigarettes

- Flavors and ingredients

Early Days: A Lot of “No’s” from Suppliers

Hafed is passionate about the possibilities offered by the smoke-free alternatives. However, this was not an easy task.

“We started working on the smoke-free products years ago and worked with the R&D team—right from idea stage to prototype. We scouted for suppliers who will partner with us to supply the necessary electronics. We partnered with manufacturing, engineering, and other functions to build the key manufacturing capabilities internally; and then, of course, we had to ensure that the product is cost efficient. It is really a combination of a lot of effort from a lot of people, and having to go from not buying electronics at all to buying hundreds of millions of dollars’ worth of electronics, which required us to acquire the necessary knowledge and work effectively with our partners,” Hafed elaborated.

Heated tobacco devices heat tobacco within a specific temperature range using an electronic heat-control system to prevent the tobacco from burning or combustion. This is a critical function because burning tobacco and paper is known to produce high levels of toxic chemicals that are harmful when inhaled. Heated tobacco devices also produce toxic emissions, albeit at lower levels.

“Now you can say it is easy to work with large scale partners, who supply us the necessary electronics, but at the beginning it was not easy because when you meet suppliers and say, ‘Hey I'm from PMI and I want to work with you in developing electronics or manufacture electronic assemblies,’ they would look at you funnily and say ‘well, are you not you a cigarette company?’ It was not easy to find the right partners. We had to face a lot of rejections, take a lot of noes from suppliers,” Hafed said.

“We eventually overcame all the challenges and have now developed a solid network of business partnerships as the industry leader in smoke-free products; and of course, all of the challenges require certain capabilities that, as Procurement, we had to help build across the company to ensure success; and it is very significant when you talk about a new product going from practically zero in 2015 to a $6.8 billion net revenue business as of full-year 2020 for smoke-free products. If you look at it from the point of view of consumer brand standards, we have built a sizable brand in a very short period of time,” Hafed said, referring to the company’s leading heated tobacco product, IQOS.

The below chart captures the PMI’s purchasing transformation:

(IQOS 3 design source: PMI) Note: Tobacco is used in both heated tobacco products and cigarettes

“Our smoke-free product IQOS does not burn tobacco—instead it heats the tobacco without combustion, which means that it releases flavor and nicotine while significantly reducing the levels of harmful chemicals compared to cigarettes—this does not make it risk free but it is much better for adults than continuing to smoke; and we had to source all the necessary components to build this product,” Hafed said.

He said that by 2025, as publicly announced, the company aims for its smoke-free products to contribute to more than 50 percent of its total net revenue.

Embedded with Business

Hafed said that Procurement teams are embedded within the PMI’s business. There is a team called Advanced Procurement when it comes to working with R&D. They work from ideas to the industrialization of a product, partner with R&D on design for quality, design for sustainability, design for manufacturing, design for cost, and design for supply security. Once the product becomes commercial and is industrialized, the responsibility for sourcing is handed over to other teams.

“You have to have certain credibility, and this is a philosophy that we have embraced. In order to have an effective engagement with the stakeholder and the business partners, you should have the required product and market knowledge. So, for R&D, we make sure that we send engineers who know electronics. When they talk with the R&D people, they have instant credibility.

The same principle is employed in categories such as marketing and logistics, where we have subject matter experts who have spent time with creative agencies and shipping companies. Such professionals have instant credibility and engage with the stakeholders to find solutions that meet their needs, not just take an order. This is one of our key initiatives as part of our Procurement transformation program,” Hafed said.

He also added that many of his team members are part of business staff meetings of various functions; R&D sourcing managers are part of R&D staff meetings, and electronics purchasing managers are embedded in that department. This set-up accelerates the decision-making process and ensures early involvement.

“We’re highly intertwined with the business because we believe that this is the only way to deliver value. Otherwise, it becomes traditional Procurement, which is, ‘Can you just negotiate a better price?’ which will not deliver great value in the long run,” he added.

Hafed also said that Procurement and Finance work like true partners when it comes to budgeting as well as cost savings, especially when it comes to indirect spend. Also, the savings achieved by his team are validated by the finance team.

Reporting to CEO or CFO?

CPOs do not yet directly report to CEOs in many companies. Some firms report to CFOs or COOs. When questioned whether CPOs should report to CEOs, Hafed offered his perspective.

“Honestly, the reporting line is not material for me. It is not very important, but what is more important is that you're able to have access to all the people in the company—and I do have access to the CEO; I also have access to CFO. I have access to anybody who is very senior in the company—so if we need to align, if we need to get direction or a decision, we are able to do it effectively in a timely manner.

So, what is critical is whether you have access to the right people and the ability to align and get direction when it is needed, and not necessarily who you report to,” Hafed concluded.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

L