Key Trends in Sustainable Food Retail Packaging

Most fast-moving consumer goods (FMCG) companies have committed to 100 percent sustainable packaging by 2025. In line with this goal, these companies have been opting for recyclable, reusable, and compostable packaging.

Retailers are moving towards eco-friendly materials for packaging of food products, because consumer preferences for sustainable and recyclable materials are growing. As of 2017, over 60 percent of the total production of bioplastics was used for product packaging—of this, 50 percent comprised food and beverage packaging [1].

Sustainable Packaging Trends

The paper and paperboard segments are expected to grow at a faster rate during the forecast period. These materials are the most preferred for hot food packaging among retailers [2]. Figure 1 shows the preferred packaging for deli and hot food.

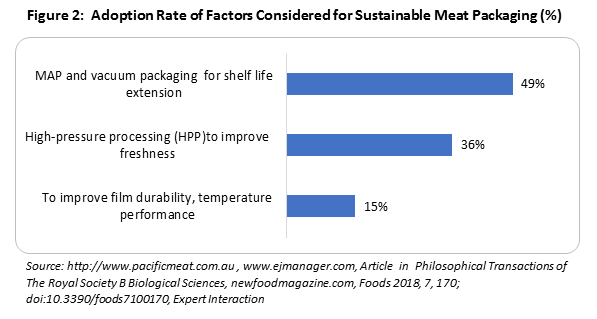

Among retailers, the need for extended shelf life is considered an important factor for sustainable packaging of fresh meat [3]. We find that 49 percent of retailers prefer modified atmospheric packaging (MAP) for fresh meat (Figure 2).

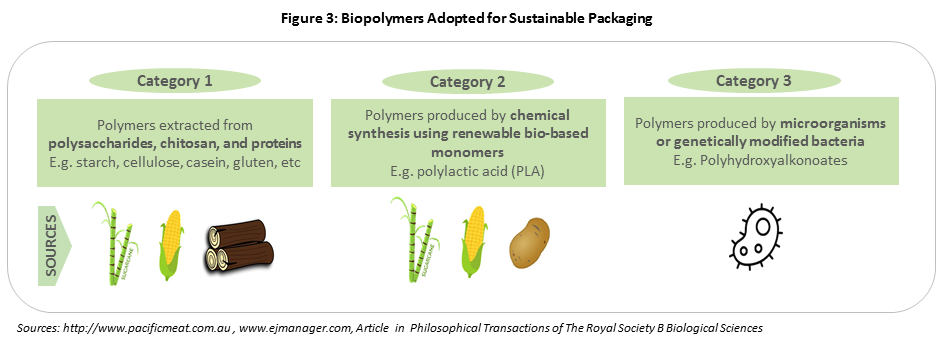

Polymers derived from chemical synthesis of bio-based monomers—such as, polylactic acid (PLA), polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS), polycaprolactone (PCL), and polyhydroxyalkalonates (PHAs)—are widely used to produce sustainable films, trays, and boxes. Starch (cellulose) is also widely adopted for producing sustainable trays. Though PLA is largely used by retailers for meat, there is a need to move to more rapidly degradable packaging materials, such as starch-based tray, wood pulp, moulded recycled paper pulp, plant fibre, and biofilms [4] (Figure 3).

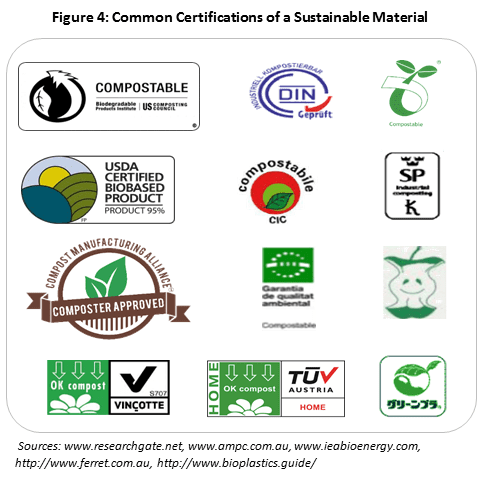

Retailers are now moving towards compostable material for food packaging. For a material to be called “compostable,” global standards such as ASTM, CEN, ISO, and AS4736 specify the criteria for biodegradation, disintegration, and eco-toxicity of the material [5]. Based on the testing criteria of the above standards, many institutes issue their own independent certificates for biodegradable materials (E.g., DIN Certco, Vincotte, TUV, Seedling logo, etc.) (Figure 4). Retailers must thus ensure that the sustainable packaging being procured is certified.

Supply Market Insights

The supply market for sustainable packaging is consolidated with few players globally. The supplier power varies from medium, for a niche player, to high, for an established player with a patented product. With increasing demand from retailers, food service and catering, and restaurants, the market will witness increased mergers and acquisitions as well as partnerships to stay competitive.

Bioplastics as such PLA, biocane, biocornstarch, and recycled polyethylene terephthalate (PET), as well as plant fibres and moulded paper, are some of the widely adopted sustainable material among suppliers. Some of the core factors that suppliers focus on other than sustainability include durability, extended shelf life, product freshness, moisture resistance, shelf appeal, weight, ease of peeling, and food safety.

Suppliers are actively innovating to provide better sustainable products through technology as well as collaborations or consortiums funded by governments. Table 1 reports an overview of the latest partnerships.

Table 1: Examples of Partnerships for Sustainable Product Innovation

|

Project Name |

Partners |

Objective |

|

REFUCOAT: Spain-based non-profit AIMPLAS |

12 partners from five countries, funded by the EU |

|

|

Moy Park Meat and Poultry Distribution: AINIA Technology Centre, Spain |

Linpac, Moldpack, and AINIA

|

|

|

Compostable pack for De Halm |

Futamura and Bio4Pack |

|

|

EU-funded project, YPACK: consortium |

20 partners, three-year EU-funded project |

|

For single players, mergers and acquisitions among suppliers specialising in different areas help in creating one-stop shops for buyers’ complete packaging needs—e.g., Faerch’s acquisition of Sealed Air’s Food Tray Business and Klöckner Pentaplast becoming a leader in rigid and flexible films through acquisition of LINPAC Group.

Conclusion

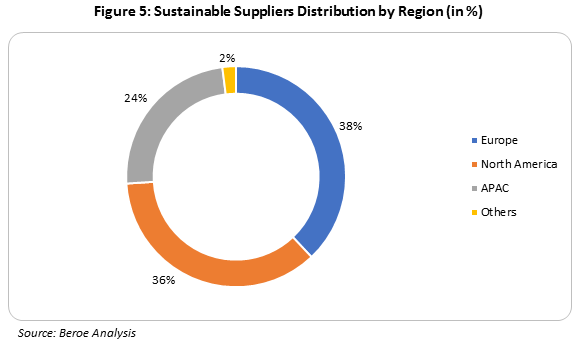

New environmental laws and regulations are being implemented by governments to increase recycling rates and recycled contents. This is driving the demand for sustainable packaging among buyers in terms of new material innovation. Suppliers for sustainable packaging are largely established in North America and Europe, followed by Asia Pacific. Figure 5 shows the distribution of sustainable packaging suppliers by region.

Buyers should be aware of the material innovations among these suppliers, and their capability for future partnership. Engaging with niche players with patented material could provide a first mover advantage and access to new material.

To obtain a medium to high negotiation power, buyers could bundle their food packaging needs, such as for hot foods, fresh meat, or fresh vegetables, enabling volume discounts. They could adopt fast- and medium-rate degradable materials in future to achieve their sustainability goals faster. Being a part of consortiums, along with technology and packaging suppliers, would also enable first-hand access to innovation.

References

[1] Packaging Insights, “Packaging Insights,” 2019. [Online]. Available: https://www.packaginginsights.com/news/packaging-trends-2019-part-1-the-search-for-sustainability.html.

[3] V. Guillard, S. Gaucel, C. Fornaciari, H. Angellier-Coussy, P. Buche and N. Gontard, “The Next Generation of Sustainable Food Packaging to Preserve Our Environment in a Circular Economy Context,” Frontiers in Nutrition, no. doi: 10.3389/fnut.2018.00121, p. 5: 121, 2018.

[4] K. Helanto, L. Matikainen, R. Talja and O. J. Rojas, “Biobased Polymers for Sustainable Packaging and Biobarriers,” 2019 2019. [Online]. Available: https://bioresources.cnr.ncsu.edu/wp-content/uploads/2019/02/BioRes_14_2_Review_Helanto_MTR_Biobased_Polymers_Packaging_Biobarriers_Review_15100.pdf. [Accessed 2019].

[5] World Centric, “Compostable Plastics,” 2017. [Online]. Available: http://www.worldcentric.org/biocompostables/bioplastics. [Accessed 2019].

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe