Interview: Category Management has the Power to Drive Competitive Advantage

(Pic Courtesy: Erik Stavrand)

The concept of “category management,” which originated in the retail industry, has now found a firm footing in the world of Procurement. There are several variations in the definition of category management, and oftentimes one gets buried in terminologies.

With the aim of decoding this concept in practical terms, Beroe spoke to Erik Stavrand, a category management expert with nearly three decades of experience, to gain insights into the kind of impact category management can create in an organization.

Erik is the co-author of The Global Procurement Leader’s Handbook and will be releasing his next book, The Global Category Manager’s Handbook, in early 2022.

What is category management in simple terms? There is no single version of truth, and each person gives his or her own perspective.

First, what is a Category? A Category is a grouping of similar products or services available from a supply base. Category Management is the process of creating a strategy to buy these needed goods or services on behalf of the company or a subset of the company over a defined period, often 3-5 years.

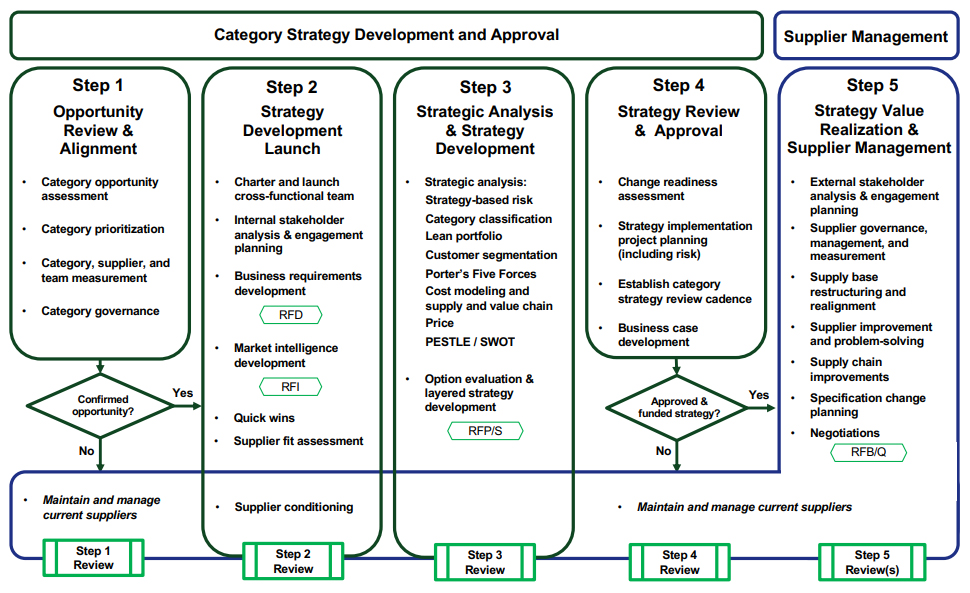

Category management is much more than selecting suppliers. It includes the sub-processes of strategy development and approval, supplier value realization, and supplier management.

Category management is an intellectually curious process of exploring current and future company requirements and how this may change. It also asks the deeper question of why the category is needed. We ask those questions as those needs will change over time.

Not long ago, if you bought a washer, dryer, or refrigerator, those products were shipped individually in corrugated boxes. Manufacturers sought to avoid waste and optimize costs by eliminating corrugated boxes, opting instead for a lean packaging solution. Similarly, category management thinks more broadly and asks, what is the purpose of a category, and are there other ways to address these needs?

Years ago, I worked on a category called Medical Rubber. Labelling the category, ‘medical rubber’ was limiting. Rubber is difficult to buy in the medical field because of the constrained supply and added complexity of regulatory requirements. After a conversation with the stakeholders, we relabeled the category as “flexible seals.”

All of a sudden, the category is not just about rubber. The category team considered different types of plastic resins in addition to medical rubber. There are multiple supply choices for flexible plastic resins that also tend to be cleaner and easier to certify.

That’s a very good point. However, would this obviously require close coordination with business? If the business is looking for rubber, but you want to buy a different kind of resin, do their manufacturing processes need to accommodate it?

Exactly. Category management sinks or swims entirely through stakeholder cooperation and collaboration. It is a team sport. If a procurement team buys something based on historical requirements, then that is termed as “sourcing or buying.” However, if you want to unlock and improve future choices, then you should have the key stakeholders around the table participating in the category management process. Therefore, this has to be a collaborative process.

From your experience, what percentage of companies deploy category management?

I estimate 25 percent of companies are actually doing category management.

Many companies say that they use category management but are actually sourcing -- sometimes strategic and often tactical buying. There is nothing wrong with sourcing, but picking a supplier is a narrower, more tactical approach than reviewing the nature of internal demand while considering all supply options.

A few years ago, I worked with a fellow category management expert, Ron Guertin, who had very simple questions for category managers to determine their use of the category management process. He would ask, “What is your strategy for your category?” Then, we would listen to how long the category manager would talk about the strategy before mentioning the supplier name. If someone could describe their category strategy without introducing a supplier name, it was likely a plausible category strategy. However, if the category manager says, “My strategy is ‘supplier x’….” This was a red flag because it amounted to a “pick the supplier” strategy, and not category management.

What was the impact of COVID-19 pandemic on category management plans?

COVID stopped many category management strategy development activities as companies struggled with the basic assurance of supply. What was exposed by COVID was the number of companies relying on sole or single sources of supply and the assumption that this supply would never be interrupted. The cost of this assumption is evident worldwide. Currently, category management is used to create new strategies that address supply risks and ensure robust, capable, and ethical supply strategies.

This argument about not having to depend on a single source, well, there are industries where companies have to rely on a single source supplier; for example, certain specialty chemicals come only from China. At the height of the trade war, someone challenged us to find an alternate source of supply for the material they sourced from China. What about the truly immovable items that do not have alternate sources of supply?

The number of truly immovable items is actually pretty small. About 85 to 90 percent of items have alternate sources of supply.

Additionally, many companies buy goods and services that are more narrowly specified than required. Many times, they buy marketing features and benefits that do not translate into their customers’ requirements, effectively locking their category into single or sole sources of supply. Category management involves finding opportunities for value creation and risk reduction and creating choices that meet fundamental business requirements.

How to set the stage for implementation of category management -- what steps need to be taken in order to prepare the ground for successful implementation?

Strong senior management support for the category management process is critical for successful deployment of category management in an organization. Without the support of senior management across the organization, category teams will face changes in stakeholder resistance.

Some executives are more open to category management and the idea of approaching supply decisions more strategically than others, and we will begin with them. Executives who view procurement as a tactical purchasing function will not support the investment of time and cross-functional resources to create a strategy, and may openly resist implementing category management.

One of the first indicators of readiness to embrace category management is business structure. Numerous discrete operating units with separate P&Ls encourage and reward very different executive behaviors than organizations with collaborative, cross-business leadership structures. In short, implementing category management brings about changes that require investment and executive commitment. The results can be immense, but without executive leadership, broader organizational resistance to change may block efforts.

What kind of business impact can category management create? If the concept is not just about buying stuff, then surely it has a lot more depth to it -- where can it shine light on hidden opportunities, thereby creating competitive advantage?

Yes, category management can help create new opportunities for businesses. My first experience with creating new opportunities was in the medical imaging field. I worked with the medical imaging category management team of physicians and support staff. During our supply market review, we uncovered upcoming technological innovations that were potentially transformative and outside the current specifications. One of the suppliers mentioned 3D, color, and high-resolution ultrasound and asked if it would be useful for Obstetrician-Gynecologist (OB-GYN). For context, back then the best available in utero imaging was 2D, black and white, with a low resolution. OB-GYNs were asked how this could improve their practice of medicine. They jumped at the opportunity and it was transformational for the field.

Later, I worked with a CEO and his leadership team at a company that manufactured asphalt. I took them through the primary tools of category management. During the workshop, they realized that their commodities could also be sold to higher-value customers. The CEO had a “lightbulb moment", and he enlarged the company strategy; they branched out to paving racetracks! This gave them higher brand value because it differentiated them from their competition and grew their main business, the general pavement segment.

Another example of using these approaches to differentiate one’s market offerings is airplane interiors. One company sold seats to aircraft manufacturers, such as Boeing and Airbus. A number of companies make airplane seats and compete with each other, primarily on price. This company’s leadership thought, ‘What if we can sell an entire interior versus just seats?’ By doing so, they moved out of the price-competitive seat market and moved up the value stream to the entire interior market.

Companies that use the category management strategic thought process differentiate themselves from their competition.

There are a number of start-ups that are getting a lot of funding, but many of them do not have a proper sourcing team, even after growing to a decent size. Can category management be applied even to start-up companies? In addition, how prevalent is the procurement function in the famed Silicon Valley -- would you like to take up this point first?

Yes, there is a technology company in Silicon Valley that dubbed the procurement department "the boneyard" and sent employees there to await retirement. They viewed procurement solely as a transactional, clerical function with no added value. Typically, when there is supply constraint or profit pressure, executives do not pay attention to procurement. Many companies do not understand the value of procurement, because they have never seen it in practice.

Now, let us consider the case of start-ups. I developed a self-assessment instrument for procurement leaders as part of The Global Procurement Leaders’ Handbook. After reading the book and taking a self-assessment, one of the individuals moved from a large medical company to a cannabis start-up.

Later, he and I were talking about his assessment results, plans for his procurement function, and the company’s needs. We realized that “Capital Equipment” needed category management. The company is growing fast -- the cannabis market demand is skyrocketing -- and they cannot adequately source capital equipment; they need a strategy to address this issue.

For start-ups, whether it is a pharmaceutical startup or an IT start-up, again, what is the one category that, if you do not get right, will slow down your growth? That one category may need category management. Sometimes, it is going to be people. Therefore, your category could actually be something around HR; or it could be financing. There are some categories that will matter for the start-up depending on the market, but they do not need to worry about other categories until they rise to the surface.

Let us assume that a company has implemented category management for a set of categories. We also assume that the procurement team was able to showcase success to business stakeholders. What then happens after five years at the end of the category management lifecycle? I mean, do they redo it all over again?

A category strategy typically lasts 3 – 5 years and then it is due for a “refresh.” A refresh is a review of the prior strategy and an update to reflect changes in the stakeholder base, business requirements, and the supply market.

Current events in the world such as a recession, geopolitical issues, or a pandemic may accelerate the “refresh” timing.

For example, I helped a large pharmaceutical company create a car fleet strategy before the 2006 recession. The initial category strategy included key client assumptions: Toyota was not big enough; Honda was not interested; and Ford, GM, and Chrysler would never go bankrupt.

The recession was the trigger to refresh the strategy because the assumptions were no longer correct.

Category and Supplier Management

(Source: Erik Stavrand, SEAK LLC)

The triggers that would require the procurement teams to revisit the category management strategy -- are they pre-decided or are they left open?

Pre-decided triggers include the time horizon, which varies by category; changing business requirements; fundamental changes to the supply market; recession; inflation or deflation; and geopolitical events. Unknown or unknowable events such as pandemics or natural disasters are addressed on a category-by-category basis.

I get a sense that category management is like an “always on” approach -- too involved -- that can potentially tire out people?

Category management is not meant to be a “too intense, always on approach.” A number of variables influence the demands of the role, including the complexity of the company, category, stakeholder base, and supply market. Category managers’ skills and abilities are key. Executive and key stakeholder support for the category leader can ease the process, which would minimize the ‘always on’ perception.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

R

S