Zero Based Budgeting: Best Practices

Despite having a strong procurement and finance team, many companies often spend hours arguing what constitutes savings and how it should be reported. The first and foremost step towards efficiently calculating and tracking procurement savings starts with having a standardized, transparent and clean budgeting method. An increasing number of organizations have considered rebuilding their budgets on a periodic basis by following Zero based budgeting method to ensure accuracy of budgets and savings and to gain high visibility of spend.

Procurement savings calculation methods may vary from company to company depending on the nature of the industry, however, the Best Practices that companies should follow to manage and track the savings effectively is the same.

Procurement Budget Allocation methods

There has been high level of adoption recently among both public and private sectors for Zero based budgeting. The contemporary fiscal constraints by 2008 recession have caused the increase in adoption among public sector. Privately-held companies in the CPG and FMCG industries are high adopters of Zero Based Budgeting. Zero based budgeting is best suited for dynamic organizations that focus on changing their procurement process and practices to improve efficiency.

| Baseline Budgeting | Zero Based Budgeting | |

| Description |

Baseline budgeting involves a method of preparing a budget which considers previous year's budget as a base |

In ZBB, a budget is calculated/ allocated by reviewing the activity/expenditure at the beginning of each budget cycle and must justify each projected expenditure to receive funding |

|

Factors considered |

Previous year’s budget for direct and indirect categories |

Considers factors such as market price, necessity of expenditure etc. for direct and indirect categories |

| Stakeholders involved |

|

|

| Accuracy of budget projection |

Medium: In most cases, this method does not account for the market price factor. Therefore there might be some instances where the market price is low compared to previous year’s purchase price and the budget is not projected appropriately |

High: Considers market price and negotiated price factors which helps in determining the budget accurately |

| Priority of budget allocation |

Low to medium level of priority to activities. Last year's budget is adjusted considering inflation factor |

High Priority: Budget is allocated based on revenue generating and critical activities |

| Budgeting process of companies (example) |

All Low: Medium procurement maturity companies |

Best in class companies |

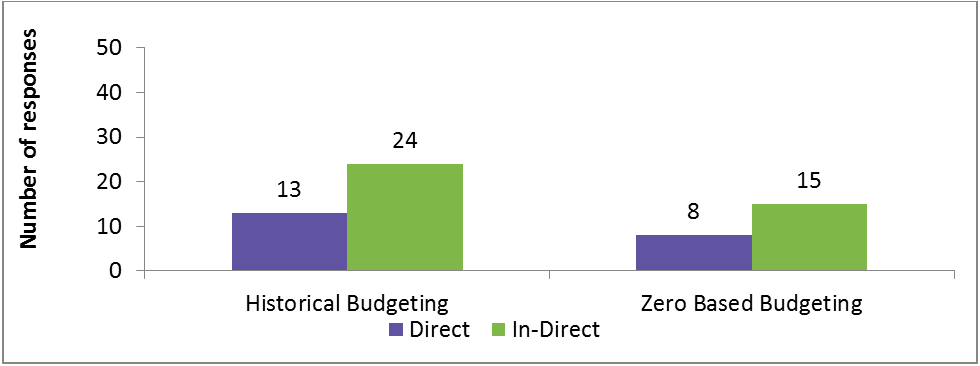

Budgeting method - Adoption level by companies across industries (Beroe LiVE Research)

While a majority of the respondents still seem to follow the historical budgeting model, there is a shift in the industry toward adopting a zero based budgeting model. This is expected to increase in the near future considering the flexibility and utility of the model.

Source: Beroe LiVE research Methodology (Sample size: 30+ organizations from Pharma, CPG, FMCG, Manufacturing industries)

- Indirect categories: Zero based budgeting for corporate travel and creative advertising categories are highly used by companies across industries

- Most of the companies that have responded to the survey carry out baseline budgeting for other indirect categories such as media planning, IT and legal outsourcing, temporary labor and MRO

- Of the responses received from pharmaceutical and healthcare industries, there is close to equal responses for both models

How to shift from Baseline to Zero Based Budgeting?

- Obtain C-level support for moving from traditional to ZBB as it involves change in organization's budgeting culture

- Develop visibility into cost drivers and use it to create budgets

- Create a detailed budget template with cost drivers, justification, market price etc., for requesting the budget

- Facilitate collaborative financial discussion among finance, procurement and procurement compliance team and seek approval for the budgeting method template

- Conduct regular meetings for quarterly budgeting based on market benchmark price analysis and last year price difference

Zero Based Budgeting – Best Practices

The projected and actual expenditure should be tracked using a budget template which is developed collaboratively.

Zero Based Budgeting activity performed on a quarterly basis

Project Category wise Expenditure

Category managers project all category related expenditure which includes:

- Expenditure for sourcing projects planned in the next quarter

- Expenditure for sourcing support activities like travel to supplier location, subscription expenses etc for next quarter

Review projected expenditure

- Finance team in collaboration with procurement compliance team review the expenditure projected by the category managers

- Justification is required for all proposed expenditure

Validate projected expenditure data

- Procurement compliance team analyzes if the projected expenses are on par with the market prices

- If there is any variance in the projected expenditure for a sourcing activity and current market price, a detailed justification is required

Approval of budget

- Based on the level of justification, the finance team allocates a budget based on the approval given by the procurement compliance team

Review of actual expenses

- Actual expenditure reports should be submitted to the finance team. Discounts/saving claims are validated by compliance team

- In certain cases where the expenditure has exceeded budget under agreed conditions (ex: incase of for sudden price increase), the excess expense is still accepted by the finance and procurement compliance teams

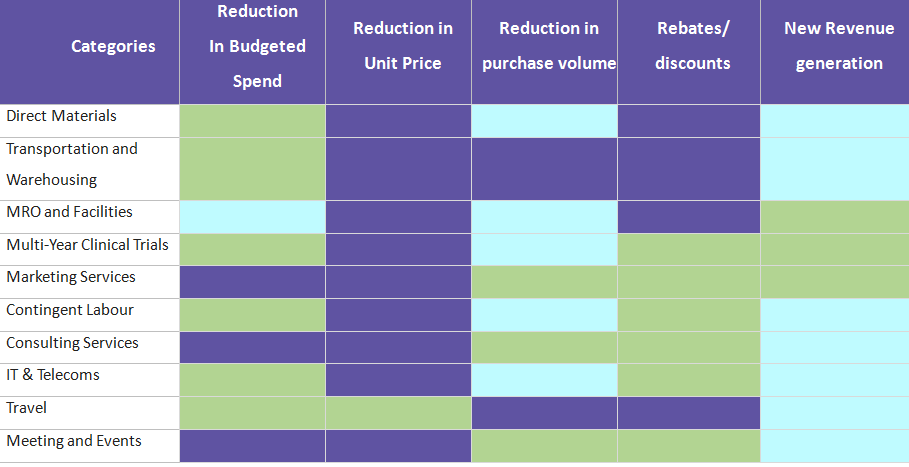

How is Cost Savings from Zero Based Budgeting achieved for direct and indirect categories?

Cost saving is calculated using the following methods for direct and indirect categories. Based on Beroe’s analysis of the industries, we have observed that most companies use the ZBB model for indirect categories. However, in Beroe’s understanding it would be ideal to run it across both direct and indirect categories.

Best Practices in Accounting and Reporting Savings

1. Accounting Savings: reconciling savings figures from Procurement and Finance

- Prior to accounting the savings in the P&L/using it as an internal metric, it is necessary to have a centralized savings tracker that is approved by finance.

- In certain cases where a specific category sourcing activity does not involve historical price baseline for savings calculation, procurement need to list down the different types of savings for the category and get approval from finance

- Develop a savings tracking approval form which must be signed by finance and procurement for each sourcing project.

- Develop a consolidated savings report template which shows all types of savings, expected cost center impact etc.

2. Savings Reporting:

- There is variance in the recording of saving based on the category. For categories with annual/quarterly saving the achievement is recorded for the year of achievement. For other categories where saving is achieved over a period of years the saving is estimated for the entire duration and taken for the first year. Any variance is then adjusted upon actual achievement.

- While the reporting of saving is done regularly under each model, under ZBB model the reporting is done more frequently (quarterly basis). The recording of saving will depend based on the category.

- For categories such as hotels management, Catalog based discounts which are negotiated annually the savings is recorded on an annual basis

- For categories such as CapEx where the contracts are usually long term and the discounts are amortized over the duration of the contract, the total saving is estimated during the first year and recorded for the entire spend. Any change in the actual achievement is modified based on annual changes

Conclusion

Historical-based budgeting is still greatly utilized by B2B sector while Zero based budgeting (ZBB) is gaining increased utilization across consumer-driven enterprises as it is considered the most appropriate form of budgeting method, which closes all loopholes and ensures transparency and credibility in the savings reporting process.

The savings tracked from Zero Based Budgeting is the actual savings realized from efficient budgeting and negotiation. Disagreement as to who takes credit for category and non- category related savings achieved can be eliminated by following this method as there is clear documentation of how savings is achieved. Category Savings realized is accounted for by the procurement team which is then added to the bottom-line (into the COGS/ SG&A section in the P&L account) by finance team.

The savings achieved can also be used as a metric to measure the efficiency level of the buyer/ the procurement team as a whole to show savings. Companies that are dynamic and ready to revamp their budgeting and savings tracking methods to improve efficiency can adopt this method.

References

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe