Global Inflation Pressures Rise in July Due to Increased Staff Costs

Worldwide inflationary pressures saw a slight uptick in July, primarily attributed to escalating staff costs in companies across over 40 economies, as indicated by data from the Global PMI compiled by S&P Global.

Consumer price inflation experienced a dip globally in June, with rates dropping from 5.3% in May to 4.7% in June, marking its lowest since October 2021. This is a significant decline from the 8.3% peak observed in September 2022. However, forward-looking data suggests that while there might be further room for a decrease in the coming months, a drop beyond 4% seems unlikely. This is due to certain indications of "stickiness" in the leading indicators.

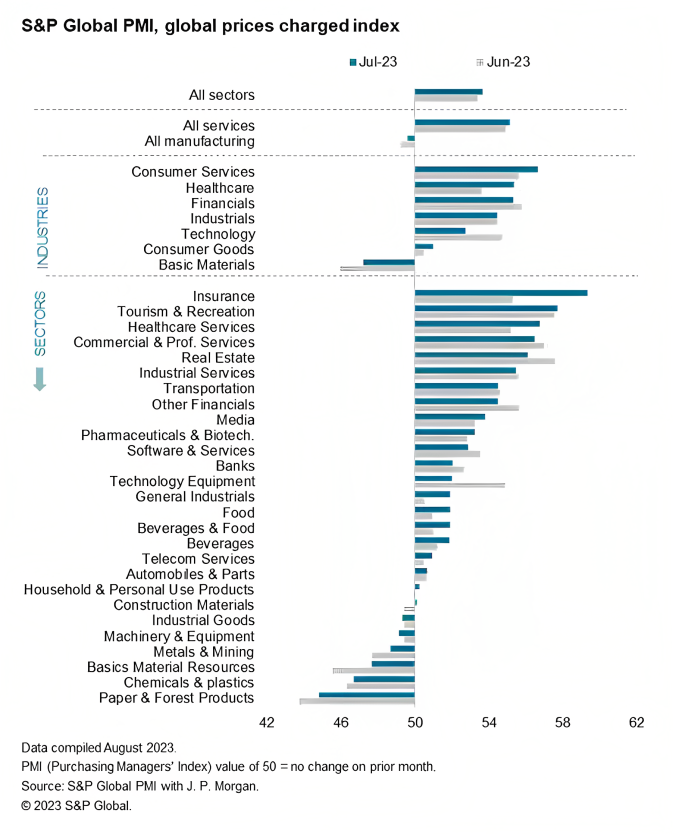

The service sector appears to be a primary contributor to this inflationary "stickiness." The PMI surveys revealed that the rates charged for services increased slightly in July. These rates, although lower than the 2022 peaks, are considerably higher than any figures recorded before the pandemic. In contrast, the manufacturing sector offers a more positive outlook, with global prices falling for the third consecutive month in July. However, this decline was less pronounced than in June, indicating a slower rate of goods price deflation.

A deeper dive into S&P Global's sector-specific PMI data provides further insights into inflation's drivers. The most significant price increase in July was noted in consumer services, particularly within travel and recreation, likely due to the surge in post-pandemic demand during the summer. Healthcare prices also saw a global rise, with financial services continuing to report strong inflation rates, albeit at a reduced pace.

On the other hand, basic materials experienced the most significant price drop, a result of increased discounting due to an oversupply and reduced demand. This situation has been exacerbated by companies reducing their inventory, which had been built up as a safety measure during the pandemic.

Labor costs have been identified as the most significant factor driving inflation. Data from PMI survey respondents indicates that the inflationary impact from labor costs in July was five times the long-run average. In contrast, pressures from raw material costs were over two and a half times the long-run average.

Among the world's major economies, Russia and the UK recorded the highest rates of PMI selling price inflation. Only Italy and China reported falling prices. Notably, the US, Australia, Russia, and Japan saw accelerated inflation rates, while China's deflation rate moderated. The PMI data suggests that the UK, eurozone, and US might experience persistent above-target inflation in the upcoming months.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe