Global Factory Output Slowdown Persists

The slowdown in world's factory production, easing supply bottlenecks, and cooling commodity prices all seem to coincide this January, according to latest economic data.

Third Consecutive Month of Decline for U.S. Manufacturing

The U.S. manufacturing sector slowed down in January, as the Manufacturing PMI registered 47.4 percent, indicating a general contraction in the sector for the third consecutive month.

The index has been in decline since June 2022, with two of the five subindexes - Employment and Inventories --- showing growth, though at a slower pace compared to December. The PMI recorded its lowest level since May 2020. Only the Transportation Equipment sector saw weak growth in January, while the Production Index was in contraction for a second month.

The January Manufacturing PMI suggests a contraction in the overall economy for the second consecutive month, after 30 months of expansion. A PMI reading above 48.7 percent over time generally indicates an expanding economy, while a reading below 50 percent suggests contraction. The January PMI of 47.4 percent corresponds to a -0.5 percent change in real GDP on an annualized basis.

New Orders: ISM's New Orders Index Contracts for Fifth Month

ISM's New Orders Index contracted for the fifth month in a row in January, registering 42.5 percent, a decrease of 2.6 percentage points from December. None of the six largest manufacturing sectors reported growth in new orders, as uncertainty about future demand and supplier disagreements on prices and lead times continue to weigh heavily on the index. None of the 18 manufacturing industries reported growth in new orders in January, with 17 industries reporting a decline.

Production: Only Computer and Electronic Products Industry Reports Growth

The Production Index registered 48 percent in January, indicating a second month of contraction after 30 consecutive months of growth. Only the Computer and Electronic Products sector reported growth in production, with 14 other industries reporting a decrease. The weak contraction in the Production Index supports manufacturing executives' strategy to stretch output during the first half of 2023, as companies attempt to retain workers for better performance in the second half of the year.

Employment: Machinery and Transportation Equipment Industries Report Expansion

ISM's Employment Index registered 50.6 percent in January, indicating weak employment growth for the second month in a row. Only two of the six largest manufacturing sectors - Machinery and Transportation Equipment - reported expansion, while the majority of companies attempted to hire workers to support projected growth in the second half of 2023. The labor management sentiment reversed, with a 4-to-1 hiring to reduction ratio, compared to a 2-to-1 ratio in the previous four months. Five of the 18 manufacturing industries reported employment growth in January, while nine industries reported a decrease.

Inventory

The Inventories Index registered 48.8 percent in January, 1.3 percentage points higher than the seasonally adjusted reading of 47.5 percent in December. "Inventories expanded for the third consecutive month, although at a slower pace. Inventories increased at a 4-to-1 ratio over reductions, with panelists indicating a need to build inventory to meet second-half demand. Half of the big six manufacturing industries reported inventory expansion," Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee said in a press statement. An Inventories Index above 48.5 percent, over time, is generally consistent with an increase in the Census Bureau's manufacturing inventories data.

Of the 18 manufacturing industries, four reported inventory expansion in January: Computer & Electronic Products; Furniture & Related Products; Miscellaneous Manufacturing; and Transportation Equipment.

The 14 industries reporting a decrease in inventories in January, in the following order, are: Textile Mills; Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Chemical Products; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Paper Products; Electrical Equipment, Appliances & Components; Primary Metals; Fabricated Metal Products; Wood Products; Machinery; Petroleum & Coal Products; and Miscellaneous Manufacturing.

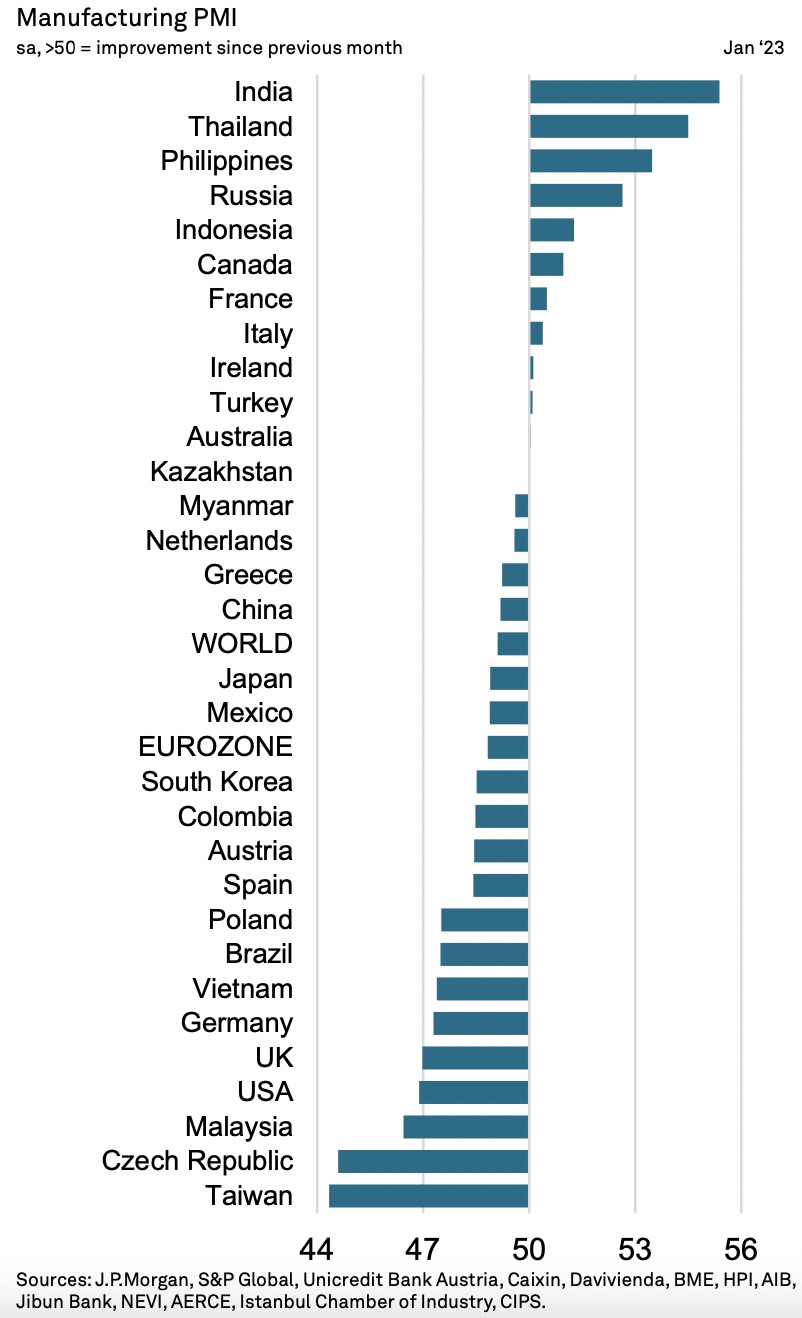

Global Factory Output Slowdown

The J.P.Morgan Global Manufacturing PMI, a composite index produced by J.P.Morgan and S&P Global in association with ISM and IFPSM, was 49.1 in January, below the 50.0 mark that separates contraction from expansion. However, it rose from 48.7, signalling a slower rate of decline. The survey's Output Index, which predicts worldwide factory production trends, showed a second successive month of slower decline and was at its highest since August 2022. Only nine of 31 countries had expansions in output.

The global manufacturing sector appeared to be easing at the start of 2023, with rates of contraction in output and new orders slowing and employment slightly increasing.

However, the largest industrial regions of China, the U.S., the Euro area, and Japan all saw output decline, albeit at a slower rate. The downturn was mainly centered on intermediate and investment goods, while consumer goods production rose for the second consecutive month.

Despite manufacturers' business confidence rising to a ten-month high, incoming new business fell for the seventh consecutive month, and the pace of contraction in new export business was a six-month low.

Spare capacity remained in the global industry, as shown by a solid decrease in factory backlogs of work. Staffing levels increased after two consecutive months of decline, with job creation seen in the U.S., Japan, and the Euro area, offsetting cuts in other regions.

Price Ease

The global manufacturing sector saw relatively steady prices in January. The Global Price Pressures Index only rose slightly from December's 30-month low of 0.3 to 0.4 in January, according to the latest data from S&P Global's Global PMI Commodity Price & Supply Indicators.

Out of 26 monitored commodities, only seven registered above average price hikes, with electrical items and semiconductors showing the strongest price pressures. Despite this, there was a marked decline in the number of reports of price increases for semiconductors (a 26-month low). Energy and electricity also saw fewer reports of price hikes.

The rates of input price and output charge inflation increased slightly in January, and supply chain pressures continued to ease, with vendor lead times lengthening to the lowest extent in three years. The Global Supply Shortages Index also declined from 2.2 at the end of 2022 to 2.1 in January, its lowest level since October 2020. However, there was a notable increase in reports of oil shortages, which hit the highest since June 2022.

"After having seen intense price and supply pressures since the onset of the pandemic, the latest indicators provided further signs that these pressures have eased noticeably as we start 2023. Reports of price rises were the second-lowest in just over two-and-a-half-years in January, with energy cost pressures moderating to the lowest since July 2021 and reports of higher electricity costs hitting the lowest since April 2021. Semiconductors and electrical items recorded the most severe price pressures of the monitored categories, with reports of inflation running at or near six times the respective average.

"Supply chain pressures moderated to the lowest since October 2021. Seven categories saw supply shortages ease, most notably packaging and iron. However, reports of oil shortages rose to a seven-month high," Annabel Fiddes of S&P Global Market Intelligence said in a recent report.

Time for Collaboration

The economic data from the January Manufacturing PMI report indicates a continued contraction in the global manufacturing sector, with weak growth in Employment and Inventories and decline in New Orders, Production and Supplier Deliveries.

The slow contraction has been continuing since June 2022, and the data suggests that it is likely to persist in the coming months, with companies attempting to retain workers to prepare for better performance in the second half of 2023.

The recent economic data highlights the need for Procurement Managers and Suppliers to collaborate in addressing the uncertainty in demand, price disagreements, and overordering to support the recovery of the manufacturing sector.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe