Global Cotton Market Scenario for 2022

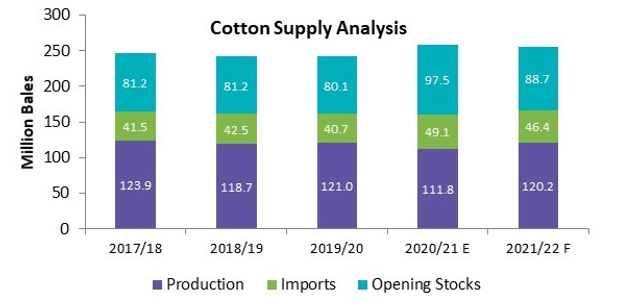

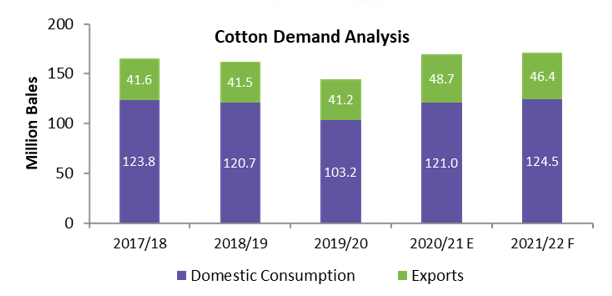

The global cotton market is projected to experience tight supply in 2021/22, with supply estimated to decline by 1.2 percent, coupled with a 4.9 percent contraction in stockpiles. By contrast, the global cotton demand is projected to rise by 2 percent in 2021/22, driven by a revival in consumption from downstream industries such as the textile and apparel sector. However, shipping container shortages, shipment delays, and high ocean freight rates are expected to dampen imports

A strong recovery in global demand amid lower production in key producing countries such as India, the U.S., Pakistan, Brazil, and Turkey during the previous season has tightened carry-over stocks for 2021/22, which is likely to keep prices elevated. Moreover, recent yield concerns in the U.S. and India have raised apprehensions of tighter global availability.

A tighter than anticipated U.S. cotton supply is likely to reduce export volumes, thus restricting global availability with shipments already facing disruptions because of logistical issues, compelling mills in key consuming regions to utilize their domestic stockpiles.

Recent escalations in the Russia–Ukraine conflict are projected to negatively impact the cotton market as a cutback on consumer spending and mill demand for cotton is expected to exacerbate the adverse impact of prevailing deterrents to demand, such as high inflation, rising interest rates, and the withdrawal of stimulus packages. Further, mills are likely to adopt a cautious approach and hold back on orders for cotton amid the global uncertainty in demand, which may raise stocks.

Source: USDA, Cotlook, Beroe Analysis

Market Outlook

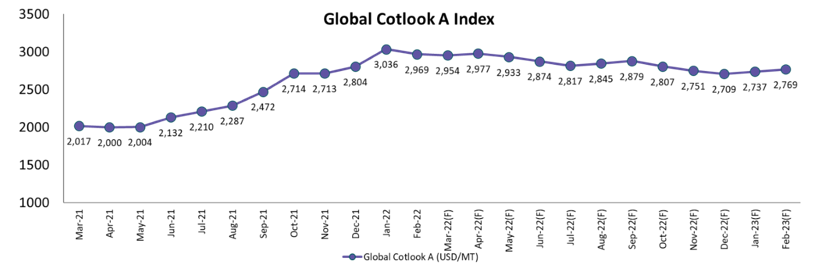

The global cotton prices are projected to witness high inflation over 2022 driven by tighter cotton stocks on account of greater mill use and lower global supply, while rising input costs, higher energy prices, and continued supply constraints are expected to keep prices elevated.

Tighter carry-over stocks for 2021/22 coupled with rising concerns of lower output in the U.S. and India may tighten market availability. Tighter than anticipated U.S. cotton supply is likely to reduce export volumes, thus restricting global availability with shipments already facing disruptions because of logistical issues, thus forcing mills in key consuming regions to utilize their domestic stockpiles. India’s cotton output estimates for the 2022 season have been reduced because of erratic rainfall and pest infestations, with production projected to decline by 4 percent for 2021/22.

Further, higher input costs driven by increasing fertilizer and energy costs are likely to exert upward pressure on prices. While the increase in the minimum support prices to incentivize cotton sowings is anticipated to raise prices in Asian regions.

Source: Bloomberg, USDA, Beroe Analysis

Short-Term

– Cotton prices are likely to be negatively affected by the Russia–Ukraine war as a cutback on consumer spending and mill demand for cotton is expected to exacerbate the adverse impact of prevailing deterrents to demand, such as high inflation, rising interest rates, and the withdrawal of stimulus packages.

– Further, the rise in crude oil prices is projected to increase ocean freight rates, which along with prevailing container shortages, is likely to deter fresh orders for cotton exports. Additionally, the strengthening U.S. dollar may further suppress demand for cotton, and in turn, lower prices. Mills are expected to adopt a cautious approach and are likely to hold back on orders for cotton amid the global uncertainty in demand, which may raise stocks.

Long-Term

– A surge in commodity prices such as wheat, corn, and sunflower because of the Russia–Ukraine crisis is likely to shift spring sowings of cotton to other crops for higher returns, with the initial estimates indicating a 4.4 percent increase in global cotton harvested area for 2022/23, which is likely to have downside risks.

– Further, more clarity in global demand will determine price levels in the medium term, with initial estimates projecting an increase of 1.7 percent Y-o-Y for 2022/23. The rising cost of inputs such as fertilizer and energy is likely to keep prices supported in the long-term, while rising crude oil prices are likely to raise prices of substitute polyester fiber, thereby elevating global demand for cotton.

Growing Demand for Sustainably Sourced Cotton

With the uptrend observed in compliances and accreditations to sustainable standards, the supply of sustainable cotton is projected to rise with a continued increase in market share anticipated for sustainable sources of natural fiber compared with conventional sources.

The demand is expected to surge in the coming years because of the rising sustainability commitments of major brands/retailers coupled with the growing consumer awareness of environmental responsibility. This is likely to tighten the overall availability and keep prices, which are currently at high premiums over conventional sources, at elevated levels in the near term.

The market for sustainable cotton has several standards, within which, the Better Cotton Initiative (BCI) comprises the highest market share and encompasses both the BCI standard itself and other BCI equivalents such as the ABRAPA (Brazilian standard), Cotton made in Africa, and MyBMP (Australian standard), together accounting for a share of ~24 percent in the total global cotton output in 2020, making it the most widely used source of sustainable cotton.

Organic cotton and recycled cotton are the other major sources of sustainable cotton. While organic cotton is estimated to have witnessed tighter supply in 2021, driven by lower output in India, a key producer, because of erratic rainfall and pest infestations, the market supply for 2022 is estimated to recover. By contrast, recycled cotton is projected to continue the uptrend in output supported by the increasing environment-friendly commitments made by downstream industries.

Other sources of sustainable cotton such as Fairtrade, REEL Cotton, Regenerative Organic Certified, ISCC, BASF e3, Field to Market, Cleaner Cotton, and the U.S. cotton trust protocol contribute <5 percent of the market share in total global output.

Key Highlights of the 2022 Global Cotton Market from the Procurement Viewpoint

– China’s cotton production is estimated to decline by 8.5 percent in 2021/22 because of lower acreage and yield for domestic cotton by 4.6 and 4 percent, respectively, for the current crop year.

Further, a contraction in imports because of the prevailing tightness in U.S. export volumes is likely to result in domestic stockpile depletion in China, where cotton stocks are projected to fall by 7.8 percent

– Indian cotton supply for 2021/22 is projected to decline by 6.9 percent because of tighter domestic production on account of lower acreage coupled with erratic monsoons during 2021 and pest infestations in key cotton-growing regions, which is likely to lower yields.

– U.S. cotton supply is estimated to contract by 4.9 percent in 2021/22 because of a significant fall in the opening stock balance by 56.6 percent and a lower recovery expected in domestic cotton output.

U.S. cotton production is likely to recover by 20.6 percent in 2021/22 amid higher acreage for the crop. However, following a 26.6 percent fall in output in the previous year, the expected current season’s volume remains well below the 5-year average for U.S. cotton output. In addition, dry weather and extreme heat conditions in the key cotton-producing region of Texas are expected to lower yields for the current season, further restricting output.

– Global cotton prices are likely to witness inflation over 2022, driven by tighter cotton stocks because of greater mill use and lower global supply; rising input costs, higher energy prices, and continued supply constraints are expected to keep prices elevated.

– With overall global cotton availability likely to remain tight in 2022, engaging in long-term contracts with suppliers is recommended, encompassing both regional and global to safeguard supply and account for inflation. Conventional sourcing countries such as India, Brazil, and the U.S. are expected to witness a contraction in export volumes for 2021/22, while Australia is projected as a prospective alternative sourcing location where cotton exports are estimated to rise by 182 percent to 4.4 million bales in 2021/22.

FAQ

-

What is the current size and value of the global cotton market?

The market size of cotton was valued at USD 38.40 Billion In 2022, and with a growth rate at a CAGR of 2.74% from 2023 to 2030, the market size is expected to reach USD 48.97 billion by 2030.

The growth of textile mills globally has caused a significant upsurge in the cotton industry. The taste and preferences of the consumer are leading the growth of the cotton market all over the world.

Source: https://www.verifiedmarketresearch.com/product/cotton-market/

-

What are the major factors affecting the supply and demand of cotton in the global market?

The demand for cotton around the globe has increased because of the revival in consumption from the downstream industries. The cotton output of India has been reduced because of erratic rainfall and the infection of pests.

So, the supply has been reduced while there is an increment in the demand for cotton. The cotton yield in China is also expected to decline significantly, raising the price.

-

How do changes in government policies affect the global cotton market?

The changes in government policies can affect the global cotton market significantly. The government's trade policies, like export subsidies and import restrictions, can affect the market.

The agricultural subsidy rate provided by the government to the local farmers also affects the price of the global cotton market.

The government regulations regarding the use of pesticides and insecticides during the growth of cotton plants may also affect the cotton market. The currency exchange rates can also be a factor.

-

What are the major trends and innovations in the global cotton industry?

The major trend in the global cotton industry is the supply of sustainable cotton. With the supply of traditional cotton decreasing gradually, traders are looking for a sustainable alternative to make the cotton useful for longer.

The major brands are also looking forward to aligning with the environmental awareness of the customers.

Among the standards of sustainable cotton, Better Cotton Initiative (BCI) has the highest market share, and other equivalents had approx 24 percent of the total global output till 2020.

Source: https://bettercotton.org/wp-content/uploads/2021/09/BCI-2020AnnualReport.pdf

-

How is technology shaping the future of cotton production and processing?

Technology has a significant role in the future of cotton production and processing. Technology includes biotechnology in cotton production. Cotton varieties are made which are more resistant to pests and have better yields using biotechnology

Technology also helps in promoting sustainability in cotton production. By removing the negative environmental impacts of cotton farming, technology helps to keep the process eco-friendly. Technology also helps create textile manufacturing, a great alternative to traditional cotton.

-

What are the key challenges facing the global cotton industry?

The advent of technology and new inventions have not been able to tackle all the problems faced by the global cotton industry. Price volatility is one of the major challenges faced by the cotton industry.

A decrease in the cotton crop yield causes a significant increase in the price of cotton. Climate change is also a factor.

The sustainability of cotton is also a problem the industry faces, while competition with synthetic fibers is another crucial challenge for the global cotton industry.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe