IMF Flags Growing Concerns for Global Financial Stability

A recent blog post by the International Monetary Fund (IMF) highlights the increasing concerns surrounding global financial stability as geopolitical tensions rise, particularly between the United States and China, and in the wake of Russia's invasion of Ukraine. Financial fragmentation can negatively impact cross-border investment, international payment systems, and asset prices, leading to increased instability and posing serious risks to the global economy.

The IMF's Global Financial Stability Report reveals that heightened geopolitical tensions can significantly affect cross-border portfolio and bank allocation. For example, an escalation in tensions between the US and China since 2016 has led to a 15% reduction in overall bilateral cross-border allocation. Investment funds are especially sensitive to these tensions and tend to reduce cross-border allocations to countries with differing foreign policy outlooks. This sensitivity has major implications for international cooperation and economic growth.

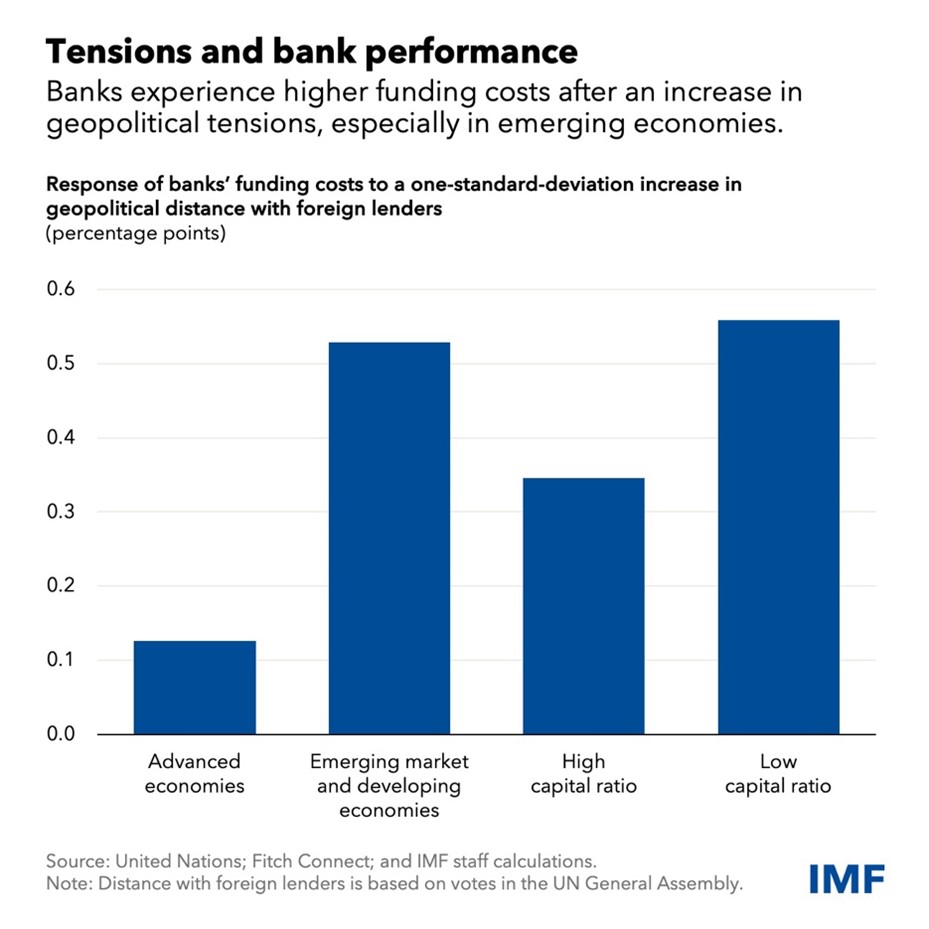

Geopolitical tensions threaten financial stability through both financial and real-economy channels. Financial restrictions, increased uncertainty, and cross-border credit and investment outflows caused by escalating tensions can increase banks' debt rollover risks, funding costs, and interest rates on government bonds. This, in turn, reduces the values of banks' assets and adds to their funding costs. Disruptions in supply chains and commodity markets also impact domestic growth and inflation, exacerbating banks' market and credit losses, and further reducing their profitability and capitalization.

The impact of these financial and real-economy channels is disproportionately larger for banks in emerging markets and developing economies and for those with lower capitalization ratios. This disparity could exacerbate existing inequalities between countries and potentially hinder global economic growth.

The IMF suggests several steps to curb these risks, including adopting a systematic approach to stress testing and scenario analysis to assess and quantify transmission channels of geopolitical shocks to financial institutions. This would involve closer collaboration between supervisors, regulators, and financial institutions to identify, quantify, manage, and mitigate these threats.

Other measures include ensuring adequate international reserves and capital and liquidity buffers at financial institutions, particularly for economies reliant on external financing. Policymakers should also strengthen crisis preparedness and management frameworks to deal with potential financial instability arising from heightened geopolitical tensions.

Additionally, the IMF emphasizes the importance of reinforcing the global financial safety net through mutual assistance agreements between countries, including regional safety nets, currency swaps, fiscal mechanisms, and precautionary credit lines from international financial institutions.

In the face of geopolitical risks, international regulatory and standard-setting bodies, such as the Financial Stability Board and the Basel Committee on Banking Supervision, should continue to promote common financial regulations and standards to prevent an increase in financial fragmentation.

Ultimately, policymakers should be aware that imposing financial restrictions for national security reasons could have unintended consequences for global macro-financial stability. Given the significant risks to global macro-financial stability, multilateral efforts should be strengthened to reduce geopolitical tensions and economic and financial fragmentation.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe