Folic acid prices and supply seen to ease up in 2016-17

In collaboration with Vaishnavi Loganathan, Research Analyst and Hariharan B, Domain Lead -- Pharma

Folic acid, which belongs to Vitamin B class, is needed to prevent anemia. Pregnant women with folic acid deficiency are more likely to have babies with birth defects.

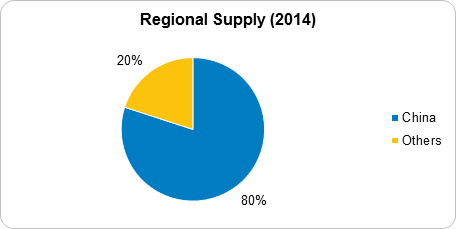

China is the primary producer of Folic acid. Owing to implementation of the Environmental Protection Law in early 2015, several Chinese manufacturers of Folic acid were forced to shut down operations, leading to global supply squeeze and price increases.

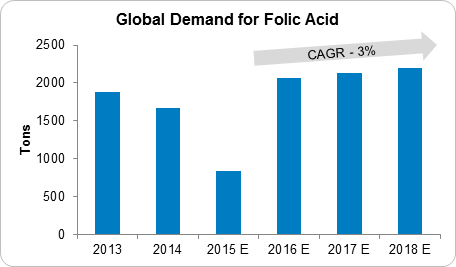

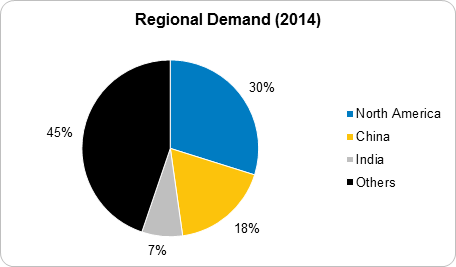

Adding of folic acid in food grains has become mandatory in many developed countries like the U.S., UK, New Zealand and Australia -- contributing to the growing demand.

The prevailing supply squeeze of folic acid has begun to affect millers - especially in Australia - as they were unable to add this vitamin needed in bread to help pregnant women protect their unborn children against birth defects. (http://beroeinc.co/1J201Gp)

The global demand in 2014 was 1675 MT of which Chinese suppliers contributed to 1300 MT. Overall capacity in China was around 3000 MT in 2013. Hence, market had adequate capacity to meet the demand until the environmental law kicked in.

Top five folic acid manufacturers alone held close to 80% of China's total capacity. And all but one of these manufacturers have shut down their manufacturing plant.

Owing to the shutdown, average price of Folic acid shot up to $445 per kg in the first quarter of 2015 compared with about $22 per kg in the year-ago period.

However, lured by increasing price of Folic acid, several players have announced their entry into the market.

Most of the new players who are planning to enter the market have either received environmental clearance or have submitted their environmental impact statement. Prices are beginning to climb down as a consequence of new starts.

From a high of $445, prices are slowly coming down over the past few months as shown in the below table.

| Month (2015) | Price(USD/kg) |

| May | 445 |

| June | 480 |

| July | 400 |

| Aug | 310 |

| Sep | 266 |

The fall in prices coincided with Nuitang Chemical resuming production in June; the company also plans to construct an intermediate facility.

In July, Hebei Global Feed Additive Ltd received approval for manufacturing feed grade folic acid.

Besides these two companies, at least four others have submitted proposals with Chinese regulators to start Folic acid production:

| Companies expected to start Folic acid production in the near future | Potential capacity (MT/annum) |

| Jiangxi Tianxin Pharmaceutical | 500 |

| Jiangxi Zhangle Fine Chemicals | 500 |

| Anhui Shengda Pharmaceutical | 600 |

| Shangdong Hongzhi Biotechnology | 300 |

As more and more capacity comes online, prices are expected to go down to $90 per kg in the next 12-18 months.

To avoid supply disruption of such critical inputs, companies need to qualify one or more vendors who could act as an alternative supplier. Having such an option would not impact the lead time of raw material supply thereby ensuring continuous production.

However, it is rare that the top 4 suppliers will go out of market all at once -- as it happened in the case of Folic acid.

Hence, in case of low volume-high critical input, it is better for companies to hold adequate inventories that will absorb any immediate supply shock.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe