Evolving Technologies in the External Audit Industry

The External Auditing market is undergoing transformation from a backward-looking and reactive function, to a forward-looking and proactive one, enabled by the efficient use of technology. The transformation has just begun and the way forward might dramatically change the face of auditing. Developments in Artificial Intelligence, Data Analytics, Blockchain technologies, Cloud computing, and Cloud storage have a significant impact on the auditing industry. These developments demand that auditing firms invest in technology and hire skilled professionals who are proficient in information technology.

The technology transformation began in the early 2000s when companies converted their information to digital data. This was followed by automation and analytics, which continue even today. Data Analytics is the most mature technology currently used by auditing firms.

The advancement in technology will not only revolutionize the way auditors work, but also impacts the very business model of auditing firms. Audits will not be as time intensive as they used to be, which might change the time-based billing model. The role of CFOs might become more strategic, since access to a vast amount of information and the ability to decode it quickly would help them to obtain an extraordinary view of the organization.

Evolving Technologies that are Impacting the External Audit Industry

1. Big Data Analytics

Traditional audits perform only sample-based testing as it requires a tremendous amount of time to go through an entire set of data that is relevant to an audit. There is more data to analyze today and more variables and outliers to identify. Traditional approaches cannot keep up with the growth of data.

Data Analytics enable auditors to analyze complete sets of data and visualize the results graphically. It is easier than ever to find anomalies in the data. The data analytics tools can be used by auditors in risk analysis controls testing and analytical procedures to make judgments and provide insights. However, the UK Financial Reporting Council (FRC) has found that the Data Analytics used in audits is not as advanced as is expected to be used in the market.

Data analytics demands a large-scale and long-term investment by auditors. Although there are third-party providers that can be engaged for data analytics, most firms choose to build their own platforms. Although these firms have not yet achieved the efficiencies that such projects require, this would change over time as auditors, regulators, and standard-setters work out how to integrate the new techniques into the regulatory infrastructure.

2. Artificial Intelligence

Artificial Intelligence (AI) is no longer a theory. Many auditing firms have already started investing in AI to automate many tasks that were previously done manually. AI helps in understanding the entirety of a ledger and identifying anomalies based on risk rather than rules. This further facilitates the flagging of unusual payments or activities that would not normally be caught by traditional testing practices. AI-based systems can continuously learn and adapt to data, and reduce the amount of work from both firms and clients. AI would not replace a human workforce; rather, it would work alongside people, automating large and complex data tasks and aiding in decision making.

Artificial Intelligence (AI) is no longer a theory. Many auditing firms have already started investing in AI to automate many tasks that were previously done manually. AI helps in understanding the entirety of a ledger and identifying anomalies based on risk rather than rules. This further facilitates the flagging of unusual payments or activities that would not normally be caught by traditional testing practices. AI-based systems can continuously learn and adapt to data, and reduce the amount of work from both firms and clients. AI would not replace a human workforce; rather, it would work alongside people, automating large and complex data tasks and aiding in decision making.

AI technology itself is not proprietary, and hence it is not necessary that only large firms offer auditing solutions using this technology. Garbelman Winslow CPAs—a professional tax and accounting firm—is a perfect example for this. The firm—which has a total of 6 CPAs and 15 employees—uses artificial intelligence as part of its auditing process to identify risky transactions. The platform powered by AI analyzes general ledger transactions and classifies them as high risk, medium risk, or low risk.

Deloitte has recently acquired Magnetic Media Online Inc.’s artificial intelligence platform business, which signals the strategic importance of AI investments.

3. Robotic Process Automation

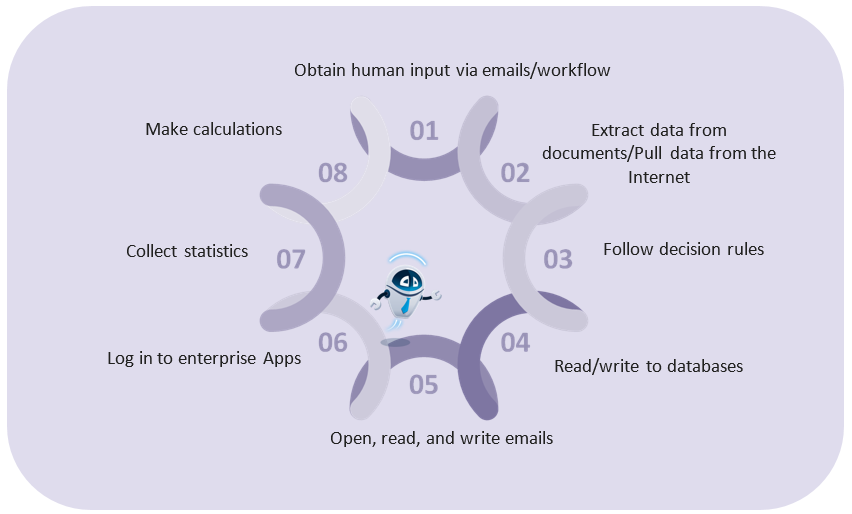

Robotic Process Automation (RPA) differs from Artificial intelligence as RPA cannot learn from data patterns and make judgments. RPA is commonly used by auditing firms to collect audit evidence when the data are in different organizational systems that are not integrated. Areas such as reconciliations, audit confirmations, generation of emails, and so on can be facilitated using RPA. RPA is somewhat expensive to implement but can provide financial as well as non-financial benefits.

Functions performed by Robotic Process Automation

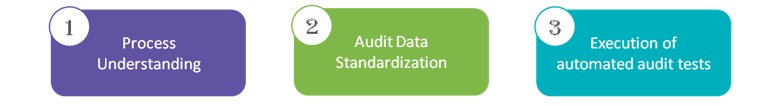

According to the RPA implementation roadmap suggested by K. Moffit, A. M. Rozario, and M.A. Vasarhelyi, there are three main stages:

Process Identification: This involves identifying auditing processes where RPA can add value. One of the factors that can be considered to justify automation is the number of times the task is repeated. Once the audit processes are identified, they have to be broken down into small audit modules so that software programs can interpret them.

Audit Data Standardization: The audit-related data may come from different sources and hence, nomenclature may differ. Thus, audit data has to be standardized for the software to execute the process.

Execution of RPA-based Audit Tests: The final step involves programming the software to automatically execute the audit tests.

4. Distributed Ledger Technology

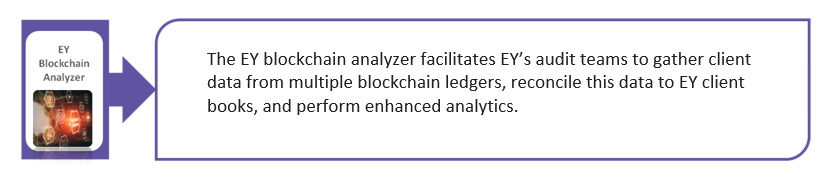

Distributed Ledger Technology (DLT) includes a family of technologies including blockchain technology. Blockchain technology eliminates multiple databases and provides one universal bookkeeping service. Immutability is the key principle of DLT, which means that entries that were made cannot be changed, but can be corrected with a balancing entry.

Technological Benefits of Using DLT in the Audit Process

- Client privacy is preserved through encrypted communication

- DLT eliminates the need for a trusted central third party

- The database of information is fraud proof since the entries cannot be changed once made.

5. Cloud Technologies

Cloud technology is widely used by organizations. The biggest advantage of the Cloud system is that files can be accessed by employees from anywhere in the world, provided they have an Internet connection. Cloud technology is also not very expensive to implement. The benefit for auditors is that organizations will have a single data source that they refer to, which will help avoid confusion and eliminate errors.

However, the use of Cloud technology is accompanied by cyber security risk. Since the data are of a highly confidential nature, there is a high risk involved, and hence, Cloud technology should be selected considering the risk mitigation strategies offered by the Cloud provider.

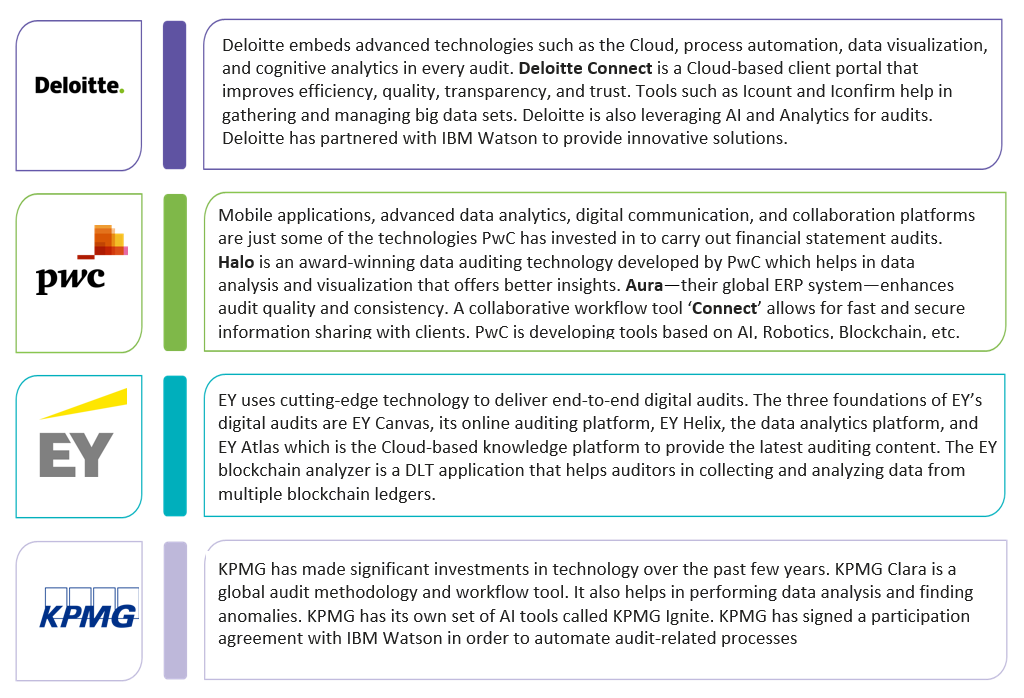

Advanced Technology Initiatives Taken by the Big Four

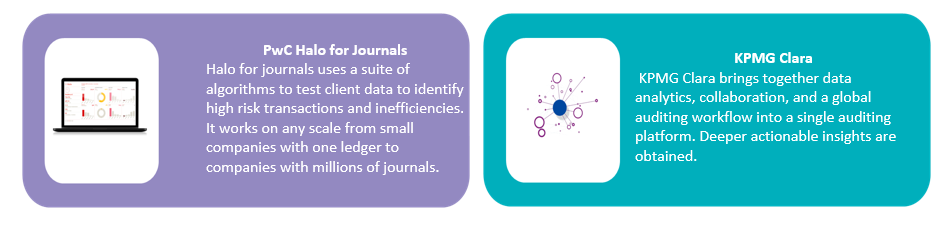

The table below provides some of the advanced technology initiatives taken by the Big Four.

Conclusion

The power of emerging technologies such as AI, Cloud Accounting, Distributed Ledger Technology, Robotic Process Automation, and so on indicates that audits in the future will be based on more granular and sophisticated data analysis. Thus, auditors will be able to provide richer insights, more detailed auditing evidence, and strategic opinions based on their analysis.

With technological advancement, redundant tasks will be eliminated. Hence, there may be a reduction in the clerical headcount; nevertheless, human intervention will still be required as the need for human oversight increases with technology. The fundamentals of auditing will remain the same, since human judgment and professional skepticism is always necessary. The technology simply enables auditors to obtain the corroborating evidence that is needed in an audit more easily, more quickly, more accurately, and more extensively than ever before.

References

accaglobal.com, Supplier Websites, Supplier publications

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe