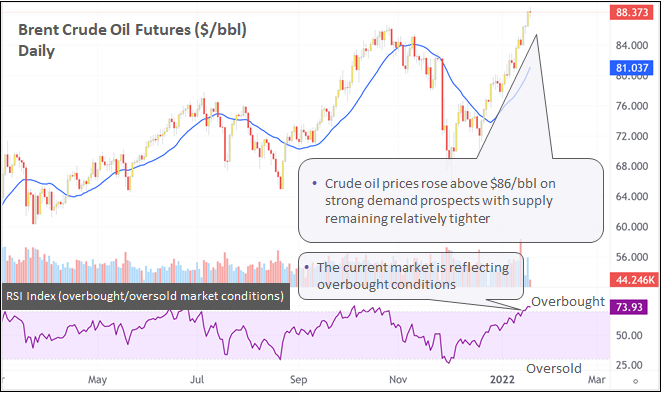

Crude Oil Touches 7-year high owing to tight supply and higher demand

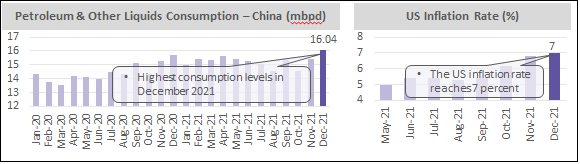

Crude oil prices rose significantly in the past two months due to strong global demand, especially from China. The current price momentum may push the oil prices to a range pf $90 to $95/bbl. Oil prices may face headwinds if and when OPEC eases production cuts. Higher interest rate expectations in the U.S., appreciation of the U.S. Dollar can also slam down the brakes and eventually the price is expected to consolidate in a broad range of 60–95 $/bbl in 2022.

2022 Implications/Risks

-

High inflation, especially led by energy prices

-

Increase in interest rates

-

Increase in crude oil derivative prices

(Source: Beroe Analysis)

Trend Expectations

Short Term

Prices are expected to test 90 $/bbl plus levels

- Oil prices have increased at a significant rate, reflecting speculative trend, and hence, can test 90 $/bbl plus levels. WTI oil prices have diverged with the gasoline price trend in the recent increase, reflecting low probability of the current uptrend sustaining

Long Term

Prices expected to consolidate within 60–90 $/bbl for the next 6–12 months

- The increase in the U.S. yields and a stronger U.S. dollar are expected to apply pressure on oil prices in the coming months. OPEC is expected to raise production levels, which will lead to a broad consolidation in 2022.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe