Category Scan: Contact Center Market

The global contact center market is forecasted to grow at a CAGR of 9-11 until 2024. The outsourcing market is expected to register continuous growth, but at a slower rate due to sluggish demand while the in-house segment is estimated to note higher growth due increase in the new captive center set up.

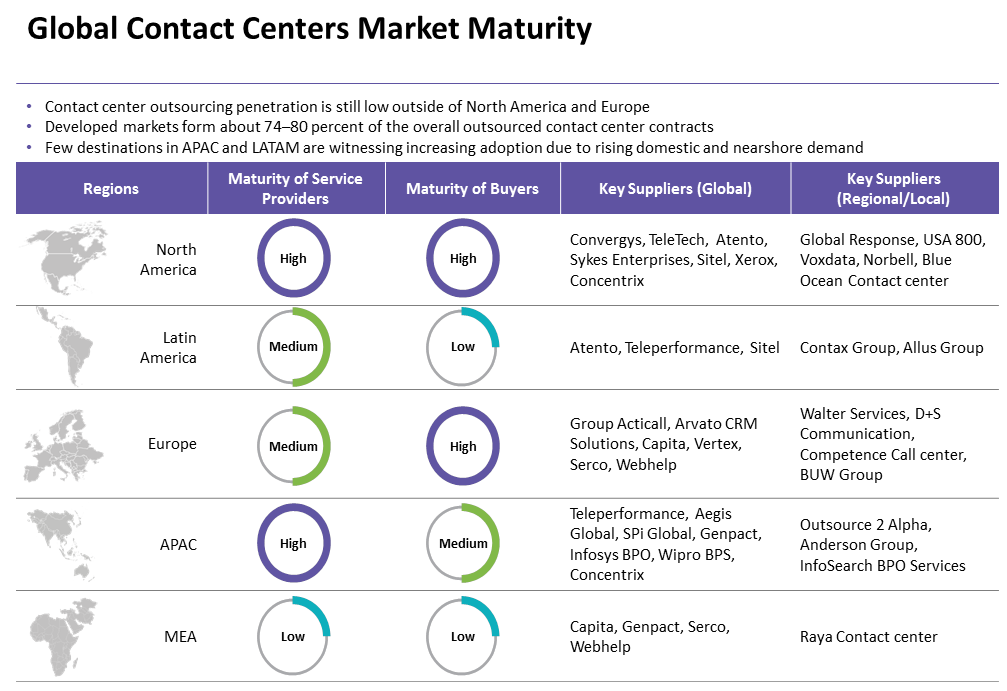

North America is the leading buyer of customer care outsourcing services, followed by Europe (mainly Western Europe), the UK and some parts of the MEA. India and the Philippines are the foremost countries in managing contact center outsourcing demand and will continue to maintain their top positions in the near future. Developed markets form about 74–80 percent of the overall outsourced contact center contracts.

Earlier, buyers’ focus was mainly on cost-saving, but now the focus has shifted to maximizing value to end-consumers due to rising customer demand and competition, driving the market for contact centers and need for specialized service capabilities. Rising quality concerns, and very limited cost savings pose challenges to the market influencing the buyer’s decision of outsourcing.

Around 65–75 percent of global contact center services are kept in-house and the remaining 30-35 percent is outsourced to third parties. The industry is dominated by in-house contact centers, and this trend will sustain in the future as well.

Other prominent trends include the adoption of cloud-based contact centers, higher use of social media for customer services, omnichannel strategies, self-service support and usage of analytical tools. Buyers are shifting their focus from cost saving to value-added services to create strategic relationships wherein both parties contribute to each other’s success.

Key Findings:

- Rising customer focus and complexity to provide a better customer experience will encourage buyers to outsource contact center services to third parties. Therefore, it has been noticed that outsourcing spending has grown between 5 percent and 6 percent annually, while in-house spending has been relatively flat.

- There is an increase in the adoption of work-at-home agents in the industry and service providers’ emphasis on service levels and transparency. High-impact cost drivers like staff turnover rates and handle time are likely to reduce in the next three years. This trend is likely to reduce the cost of services.

- Various regulations, such as the Dodd-Frank Act, Basel III, MIFID II, OCC Guidelines and FRB restrict companies to keep personal, financial and confidential data within the country’s boundary and restricts outsourcing various processes to other locations.

- Key performance indicators in the contact centers market are first call resolution, average speed to answer, transfer rate, abandoned call rate and net promoter score. Negotiation factors include call volume, adjustment of seasonal call rates, reduce agent–supervisor ratio, and upgrade technological infrastructure.

- Buyers are exploring opportunities to engage only with their list of preferred service providers for their contact center requirements, consolidating their contact center spend for multiple locations and engaging in strategic relationships. This enables them to negotiate discounts, as the volume of business is higher with the shortlisted pool of service providers.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe