Russia - Ukraine War: Category Impact

The world was shocked when Russia launched a full-scale invasion into Ukraine -- a scenario not many thought would unfold despite warnings issued by Western intelligence agencies. Beroe put out an initial update on the potential fallout from the conflict a few days before the war began -- but the fast-paced developments on many fronts, which caught almost everyone unawares, necessitated a deeper study of the impact.

We have released our impact assessment for few select categories in this edition. This is an evolving situation, and we will be continuously providing updates to our clients. If you would like to know more, please write to contactus@beroe-inc.com

Batteries

- Russia’s invasion of Ukraine is expected to hit the American and European Automotive industry, which is already struggling with supply chain bottlenecks caused by the surging demand post easing of lockdown measures. Continuous surge in lithium prices through 2021 have forced battery makers to raise prices in Q3 2021. Presently automakers are facing the challenges of increased battery prices and semiconductor chips shortage.

- APAC is expected to have relatively low impact from this invasion with tight nickel supply in the short term. However, market conditions are expected to improve in China in Q2 and Q3 2022 on account of expected capacity addition in Indonesia.

Threat of increased Battery Prices

- Nickel prices have shot to record high levels following the Russian invasion. Nickel is a major component of the high nickel chemistry batteries (NCM 6, 7 and 8 series, NCA etc.) which is predominantly used in the U.S. and Europe. A significant share of the plug-in vehicles on road are powered by high nickel chemistry batteries in the U.S. and Europe. Hence, surge in Nickel prices is expected to raise battery prices.

- Russia ranks third globally in terms of nickel production and, therefore, constrained nickel supplies is likely to slow down EV battery production -- in turn delaying EV adoption (a major focus area for the U.S. and Europe governments). This scenario is also expected to hinder Europe’s Local Battery raw material sourcing strategy whose aim is to lessen dependence on China.

Battery Production Disruption

- Russia is a major natural gas producer in the region for electricity generation. The on-going invasion is expected to create a huge energy deficit with increased prices thus negatively impacting industrial production capacity, especially in Russia and Europe. Germany, which is also an automotive hub having battery manufacturing footprint is expected to be the worst hit country as majority of its energy demand for manufacturing and electricity is generated from the natural gas supplied by Russia.

Sources: Battery Car Congress, News Articles

Palladium

- Russia is one of the largest producers of Palladium, accounting for around 35% of the global palladium production. Nornickel the largest palladium producing company located in Russia.

- Palladium prices have jumped by 37% since the start of year 2022, as Russia-Ukraine conflict risks the Palladium supply chain with Russia being a major producer and buyers looking to secure supplies. Growing tensions and sanctions on Russia could affect palladium trade and increase price volatility.

- Ongoing Russia-Ukraine conflict and associated sanctions are causing buyers to secure extra material and are also willing to pay a premium for it.

- Automotive industry is the largest consumer of palladium where it is used as catalyst, accounting for around 81% of consumption followed by electronics and chemical industries.

- Prolongation of conflict and hard sanctions could further affect already finely balanced palladium market, causing price escalation.

Nickel

- Russia produces around 7% of the world's nickel supplies and a major exporter of high-grade nickel to both Europe and China. Western sanctions could add to current supply tensions in the stainless steel value chain

- The U.S. and EU will encumber Russian foreign reserves and disconnect major Russian banks from the global financial system. The threat of more sanctions on Russia raises the risk that commodity trade flows will be disrupted between Russia and its trading partners.

- Amidst this crisis, it is also expected that the commodity and raw material prices, including coking coal and natural gas will see a steady increase and this will in turn impact the input cost of nickel production.

- Russian nickel is SHFE's key delivery product and the full-blown crisis in the region could further tighten SHFE's nickel warehouse receipt volume

- Higher energy prices and the potential for energy flows could be disrupted, posing yet another threat that could hit nickel metal producers

- Nornickel is the second biggest nickel producer in the world, and the company accounted for 4.9% of global refined nickel production and 7.3% of global mined nickel production in 2021. The company exports 96% of its metal, 45% of which is sent to customers within Europe.

Industries Impact: Stainless Steel, Batteries and Electric Vehicles

- While nickel supply in the near term could tighten due to worsening crisis in the Black Sea region, it is expected that nickel supply could potentially improve in Q2 and Q3 on the expectations of Indonesia gradually raising its nickel output capacity later this year.

- The EU relies heavily on Russia for its energy needs and with the sanctions, Russian sales of oil and natural gas will be capped. As such the EU is already facing record high prices energy costs and this might exacerbate the situation further and lead to production outages in nickel market.

- Until the build-up of high-grade Indonesian supply can offset the trend of declining LME stocks, market participants will continue to stay bullish about nickel prices, which will only rise further if the Russia-Ukraine war worsens.

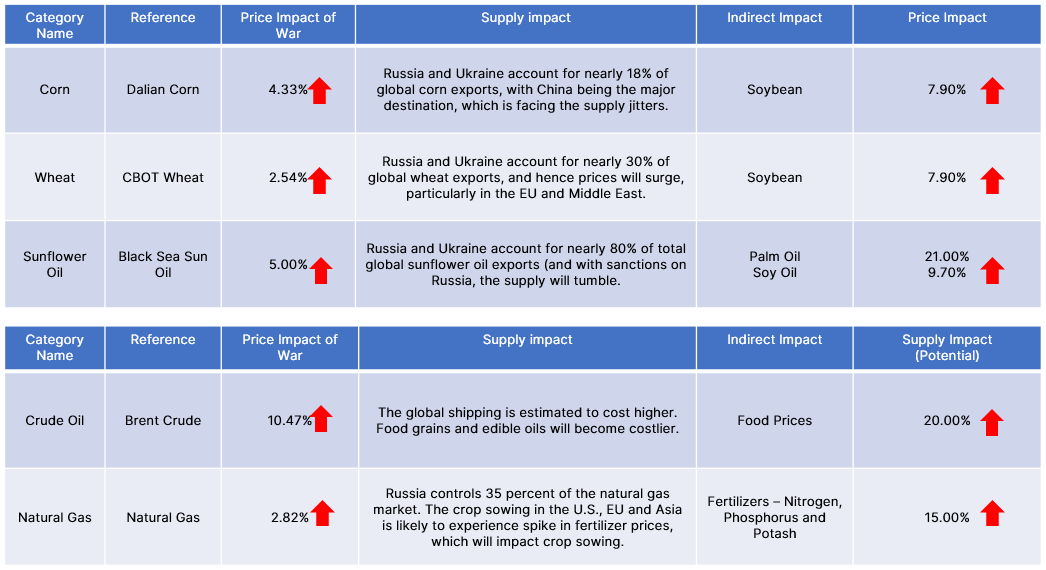

Agro Commodities

- Shipments of top agro commodities such as wheat and sunflower oil have been stopped from Russia and Ukraine. Speculation and cascading effects have resulted in price rise of substitutes and parallel commodities such as corn and palm oil.

- Countries such as India has not received even a single shipment of sunflower oil from Ukraine since the start of February against an average import of 200,000 MT from the country per month

- It is also anticipated that if this conflict does not settle before spring planting season, prices of some grains could witness significant increase.

Wheat and Corn: Global wheat prices have started seeing significant rise

- Russia and Ukraine account for nearly 30% of global wheat exports. A major portion of wheat consumed in the Middle-East including Turkey and Egypt comes from Russia and Ukraine, hence prices would rise by over 10 percent with an immediate cut-off of supplies in the region. Meanwhile, the war could push the food security of Ukraine on the brink and push for more domestic food stockpiles. CBOT futures witnessed an immediate increase of 5.4% on Feb 24, the first day of the Russian invasion of Ukraine. Active contract settlement of Chicago SRW futures was seen at $9.42/bushel compared to $8/bushel on Feb 18.

- In a similar note, the corn price in CBOT witnessed an increase of 2% and settled at 6.94 USD/bushel for May contract. The corn shipments from Russia and Ukraine has been stalled due to the disruptions in Black Sea.

Edible Oils: Rising cost of sunflower oil showing cascading effect on palm oil and soybean oil

- Ukraine is the largest producer and exporter of sunflower oil accounting for 33% of global production and 50% of global exports. Export prices from the country has reached $1550/MT on Feb 24, an increase of 7% compared to previous week. Large importers such as India are expected to face severe shortage of the edible oil.

- The effect has already started cascading on other edible oils, with palm oil seeing an increase of 7% and soybean oil 3% in top producing markets.

- Cargill-chartered vessel was hit by a projectile in the Black Sea on Feb 24, as Russian military advanced towards Ukraine. The trader operates multiple facilities across Russia and Ukraine. It owns a majority stake in a deep-sea port near Odessa, Ukraine.

- Grain exports have been halted from Ukraine and Russia as major traders suspend their operations.

- Shipping costs are feared to rise as the oil prices test new highs, which will add to the global food grain prices. The swings in energy prices will impact the ethanol and bio-diesel production which again will impact the crop prices.

- Russia has kept its Black Sea ports open, but the Port of Azov on the Azov Sea has been closed to all commercial traffic. Most of Russia’s wheat exports go through the Black Sea ports.

Major Traders Shut Operations

- ADM suspended its operations in Ukraine. ADM’s Ukraine facilities include an oilseed crushing plant in Chornomorsk, a grain terminal in the port of Odessa, six grain silos and a trading office in Kyiv.

- Bunge suspended operations at processing facilities in Nikoalev and Dnipro in Ukraine. The company operates two processing facilities as well as grain elevators, and a grain export terminal in various parts of the country.

- CHS Inc., a farm cooperative and major grain shipper and retailer of seeds and chemicals, has temporarily shut down its operations in Ukraine.

Ukrainian Ports Shut

- Amidst the ongoing turmoil, Ukraine has suspended the shipments from their major ports of Chornomorsk, Mikolayiv, Odessa, Kherson and Yuzhny.

Sources: Bloomberg, Beroe Analysis

Impact on Commodities and Crop Prospects for Next Season

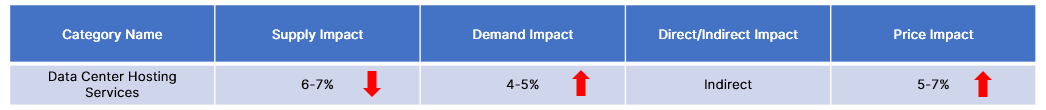

Data Center Hosting Services

Impact on supply & demand

The Russia-Ukraine military conflict has strained the already fragile supply chain for semiconductors as both Russia and Ukraine provide neon gas and palladium, which are essential for semiconductor production. This would in turn affect the supply of components for data center assets, whose demand is growing exponentially.

Impact Level

Impact on price

The price of Data Center Hosting services are expected to increase significantly as the Palladium prices increased by 7% upon the news of Russian invasion into Ukraine. This supply constraint coupled with the increasing demand for data center infrastructure especially in the U.S., Europe and the Asia Pacific, is expected to increase the prices significantly due to the military conflict.

Impact Level

Impact duration

With China immediately conducting air raids over Taiwan, after the Russian invasion of Ukraine, it is highly likely that the impact duration would continue for the medium to long term, as the geopolitical stability has become the key external factor in deciding the supply chain stability.

Impact Severity

Regional Impact

- The sanction by the U.S. government would impact the access to key materials.

- The sanction imposed by the U.S. government is applicable to the NATO countries and hence the raw material shortage is imminent in the European region.

- Australia and New Zealand have imposed sanctions, but other countries like India and China have not announced sanctions, hence a medium impact is expected.

- The LATAM market impact is likely to be less compared to other regions due to their low level of exposure.

- The MEA market impact will be significant but lower compared to its peers due to the penetration level of data centers.

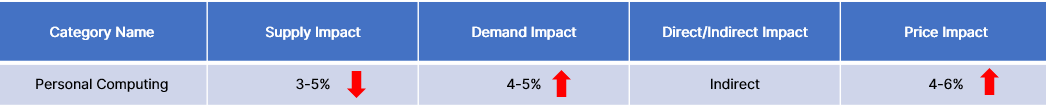

Personal Computing

Impact on supply & demand

Though large semiconductor enterprises have stocked high level of inventory and diversified their procurement, the delicate supply chain for chips has been further stressed by the military invasion of Russia into Ukraine. Hence, while the near-term impact could be handled by the PC companies, the medium- and long-term impact could be high.

Impact Level

Impact on price

While companies like Lenovo previously expected the semiconductor shortage to continue till end of 2022, the miliary conflict between Russia and Ukraine is expected to prolong the chip shortage -- and the rise of oil prices would escalate the shipment cost, which in turn is expected to increase the prices of PC as well as smartphones.

Impact Level

Impact duration

There will be transportation delays in the Black Sea region. The growing prices of power and freight might exacerbate the situation. It is tough to estimate the duration of this military operation. However, the sanctions on Russia may be extended for a longer period of time.

Impact Severity

Regional Impact

- The sanctions imposed by the U.S. would have a high effect on access to critical materials thereby impacting the Personal Computer supply.

- The sanction imposed by the U.S. applies to the NATO member countries, which would disrupt the in-house semiconductor manufacturing initiatives undertaken in the European Union.

- China is likely to continue purchase from Russia. While, India is expected to negotiate with the U.S. to relocate their PC and Smartphone manufacturing.

- Supply disruptions due to delays and shortages of chip manufacturing materials. Alternate sourcing being explored.

- Inability to manufacture chips due to scarcity of raw materials would impact supply chain in the region.

Warehousing and Logistics

Freight Companies are shutting down operations in Ukraine until further notice.

- Freight forwarders such as DSV and Germany-based DHL express and freight units suspended services to and from Ukraine and have closed offices in the country.

- A.P. Moller-Maersk will refrain from calling any ports in Ukraine until further notice. FedEx and UPS have suspended service into and out of the country.

New restrictions on airspace

- U.S. and EU closed its airspace to Russian planes. French logistics operator Geodis said it expects further airspace closures or airline-specific restrictions that could cause delays, reductions in capacity and rate increases. Aircraft from U.K have been banned, with Russia announcing that countries that impose sanctions will be denied permission in Russian airspace. As of date, air cargo freighters are re-routing through the Middle East.

Rerouting air freight from North Asia to Europe is adding another 12-14 hours to flight time for cargo while reducing the available air capacity.

Shutdown of Major ports for commercial vessels in Russia and Ukraine.

- Lloyds Market Association has placed Ukrainian and Russian waters in the Black Sea and the Sea of Azov under a high-risk category since Feb.15 . A blockade of the ports in the Black sea is expected: most major shippers will halt sending commercial vessels into the region. This in turn has pushed up the insurance premiums for freight, further escalating the freight charges.

List of Closed/ restricted Sea and Airports

- Ports on the sea of Azov, include Taganrog, Mariupol, Yeysk and Berdyansk.

- Federal Agency for Air Transport has closed airports in Russia, these closures are currently in force until March 2.

- The closures include airports in Rostov, Krasnodar, Anapa, Gelendzhik, Elista, Stavropol, Belgorod, Bryansk, Kursk, Voronezh, and Simferopol.

Sources: Interos, Beroe Analysis, Forbes, Loadstar

IT Services

Prominent IT service providers are aware of the political instability in Ukraine, as they have alternate offices in eastern European countries such as Poland, Romania and so on. They would shift employees during this crisis. They have started moving critical resources to safer areas since December 2021. However, homegrown IT startups are expected to be impacted the most.

Emerging IT Destination

- The country is known for software development services including web and mobile development, User Interface/User Experience design, quality assurance and testing, R&D services, IT consulting & big data analytics.

- Ukraine’s IT export increased 36% to $6.8 billion in 2021, up from $5 billion in 2020 and $4.2 billion in 2019, according to the IT Ukraine Association. It is estimated that there are over 100,000 IT employees in software engineering and other IT services. The overall IT resources would be around 285,000 in Ukraine.

- Ukraine’s IT Industry includes hundreds of startups and larger IT Service providers (EPAM, Intellias, Ciklum, ELEKS etc.) and IT centers of global Tech firms such as Google, Uber, Facebook.

Impact on IT Service Providers

- The Russian invasion has majorly impacted the Banking, Financial Services and Insurance companies due to internet outages across Ukraine. Soon after the outage, control has been taken from IT Service providers’ present in other location.

- Before the invasion, most of the IT Service providers have shifted their employees to other neighbouring countries such as Poland, Romania, Turkey where they have presence. Those who wished to stay in Ukraine have been asked to move to western Ukraine.

- ELEKS, an IT service provider with major presence in Ukraine have created a delivery centre in western Ukraine with backup generators, satellite phones, satellite and dark fiber internet to provide business continuity. SAP has closed its Kyiv office.

- EPAM has over 13,000 employees across Ukrainian cities, including Kyiv and Kharkiv, among the cities bombed by Russian forces. In recent times, the company has expanded in Latin America and India so that work can resume from other locations.

Sources: The Register, The Wall Street Journal, Tech Crunch

If you would like to know more, please write to contactus@beroe-inc.com

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe