Beroe LiVE Poll: Procurement Community worried about China’s Zero-Covid Strategy, expect longer lead times

Data Collection and Compilation by Mirza Zack

Ever since the outbreak of the COVID-19 pandemic, China has been following a zero-tolerance approach, leading to frequent lockdowns of major economic centres whenever cases flare up.

China is now in the midst of its worst wave since the initial outbreak in Wuhan. Shanghai, a city of 25 million people, is currently under lockdown. Besides being the financial nerve centre and home to the world’s busiest port, Shanghai is also a hub for semiconductor, electronics, and car manufacturing. Important cities in China are experiencing on and off restrictions, affecting goods movement.

On April 11, news emerged that the U.S. has ordered all non-emergency consular staff to leave Shanghai, which is under tight lockdown to contain a COVID-19 surge. The order covers "non-emergency U.S. government employees and their family members from U.S. Consulate General Shanghai."

The State Department said the order is an upgrade from the "authorized" departure issued last week that made the decision voluntary. https://beroeinc.co/38zvgmo

BBC China correspondent, Stephen McDonell, posted a tweet that said China’s Foreign Ministry lodged solemn representations with the U.S. after the decision to get non-essential staff, from the Shanghai Consulate due to COVID lockdowns.

#China’s Foreign Ministry says it’s lodged solemn representations with the #US after the decision to get non-essential staff, from the #Shanghai Consulate, out of the locked-down city b/c of the #Covid crisis. #Beijing worried it makes the situation appear to be out of control?

— Stephen McDonell (@StephenMcDonell) April 12, 2022

There are multiple reports on social media accounts of food shortages in Shanghai. Lately, food stockpiling has become a hot topic on Chinese social media as news spreads of the plight of Shanghai residents who are struggling to secure food supplies under lockdown, according to a report published in South China Morning Post (SCMP).

Over the past week multiple survivors’ guides have been published by media outlets and bloggers. These include a well-known medical site called Doctor Clove, which published a list of what items people will need if they are suddenly quarantined and advice on storing food for the long term, SCMP reported. (https://beroeinc.co/3Jzx5wr)

Dr Eric Feigl-Ding, an epidemiologist and a Covid expert committee member for the World Health Organization, told BBC's Newsday program that China’s zero Covid policy is “at a tipping point”. “If they don’t control covid… it could kill hundreds of thousands if not millions… this could actually break down the core social contract” and the world’s global supply chain. He says: “It is in our interest that China succeeds in controlling this". To listen to the audio, please click here: https://beroeinc.co/37DKvdB

As countries across the globe learn to live with COVID-19, China is continuing to pursue “Zero-Covid Strategy” while trying to not cause economic pain -- a tough balancing act. In light of this, Beroe ran a survey to find out the opinion of Beroe LiVE Procurement community about supply security.

The Survey

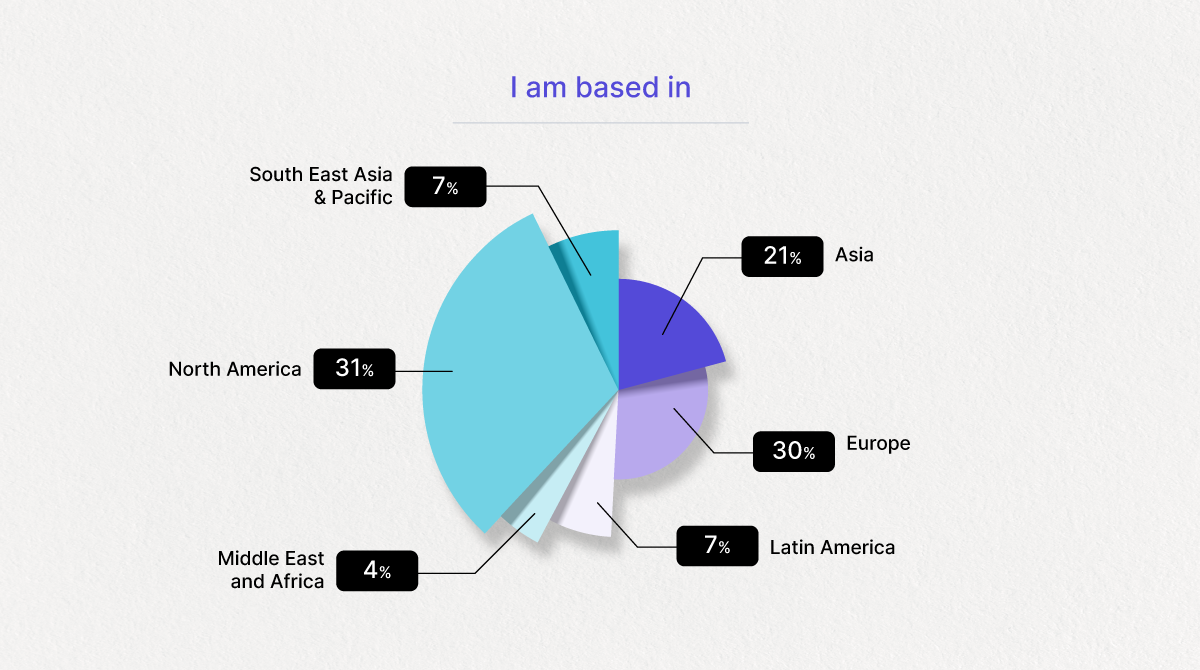

Sourcing and Supply Chain professionals from more than 300 companies across the globe participated in the survey. 30 percent each were from North America and Europe. About 21 percent respondents were from Asia.

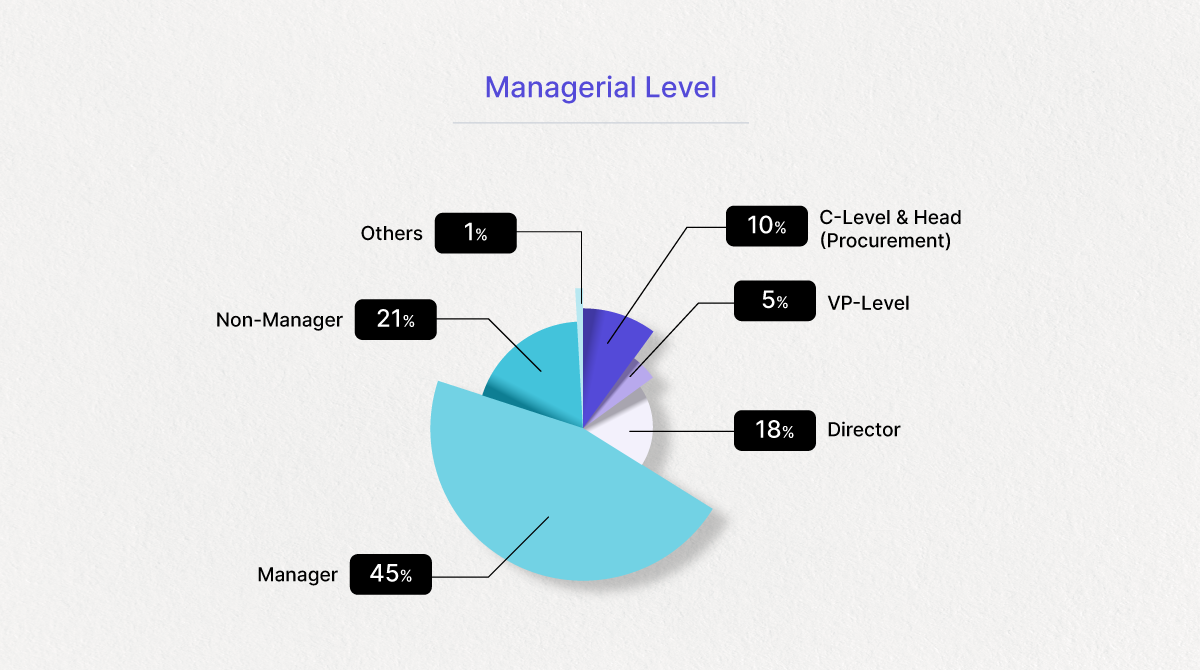

Nearly half the respondents were Managers; nearly 20 percent were Directors. About 10 percent of respondents were C-Level or Head of Procurement.

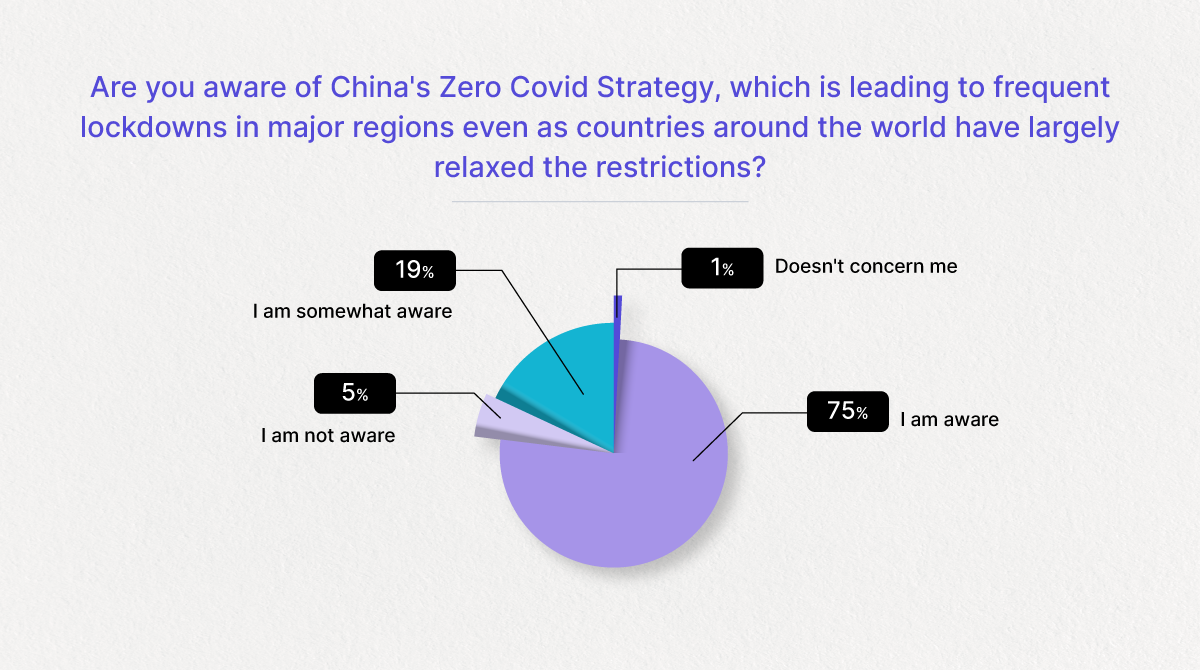

An overwhelming majority of respondents said they are either aware or somewhat aware of China’s Zero-Covid strategy. A miniscule percentage of respondents said China’s Zero tolerance approach doesn’t concern them. About 5 percent answered they weren’t aware of this policy. This shows the community is very much watching the developments in China.

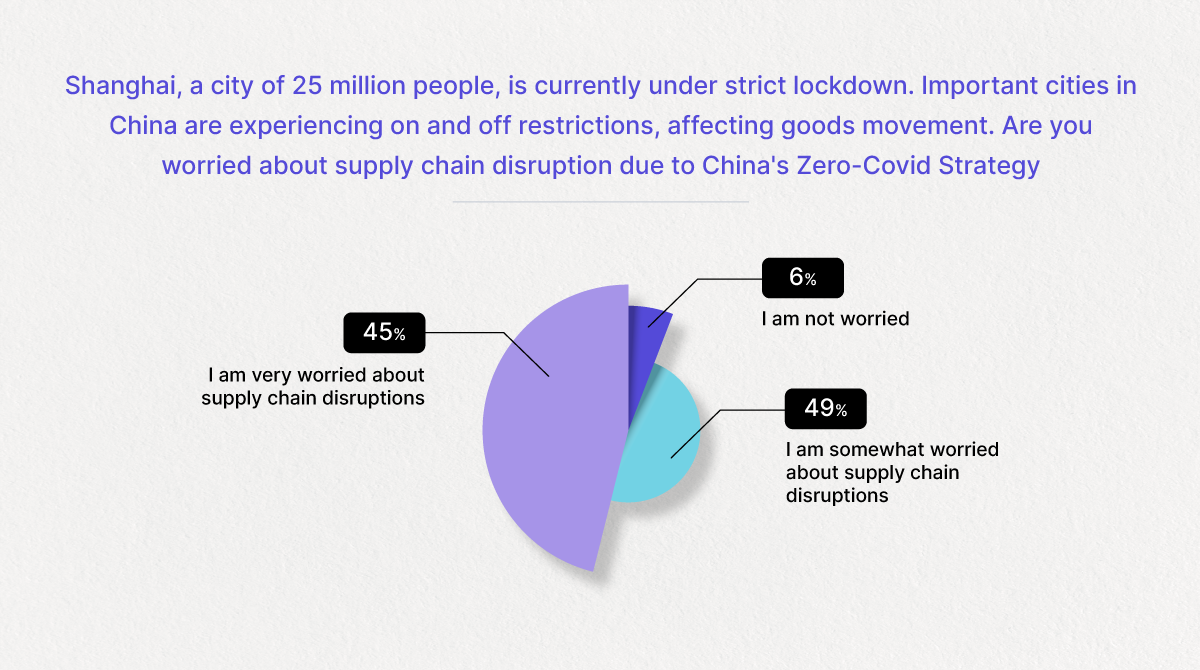

Again over 90 percent of the respondents who took the survey said they are either very worried or somewhat worried about supply disruption. Only 6 percent said they are not worried about any disruption.

Shippers are facing logistics challenges for ocean and airfreight in Shanghai.

More than 90 percent of truck capacity is out of service. Trucks are prevented from moving in and out of the city without a special permit, which is only valid for 24 hours and only on specific routes. “Even with this arranged, it is possible for booked trucks to be commandeered by the government to transport aid supplies,” Seko Logistics said in an update for clients, according to a report by Freighwaves. Logistics providers are also redirecting cargo to airports in Wuhan, Hangzhou and Nanchang. https://beroeinc.co/3jvnwUP

The below table was published by logistics company, AIT Worldwide on April 7. (https://beroeinc.co/3rixLjq)

|

Airport |

Situation |

|

Shanghai |

No truck service within Shanghai; government permit required for other locations. |

|

Beijing |

Normal operations. |

|

Tianjin |

Normal operations. |

|

Nanjin |

Import operations suspended. |

|

Ningbo |

Increasing confirmed cases found in Ningbo. Additional quarantine restrictions expected in the coming days. |

|

Zhengzhou |

Backlogs of as many as seven days with a turnaround time of at least three to four days. |

|

Hefei |

Dedicated truck service only. No service to cities with outbreaks. |

|

Qingdao |

All import cargo must be stored in the terminal for 10 days following disinfection. |

|

Guangzhou |

Trucking service to Shanghai and Ningbo/Hangzhou is suspended. |

|

Xiamen |

Trucking service to Shanghai and Ningbo/Hangzhou is suspended. |

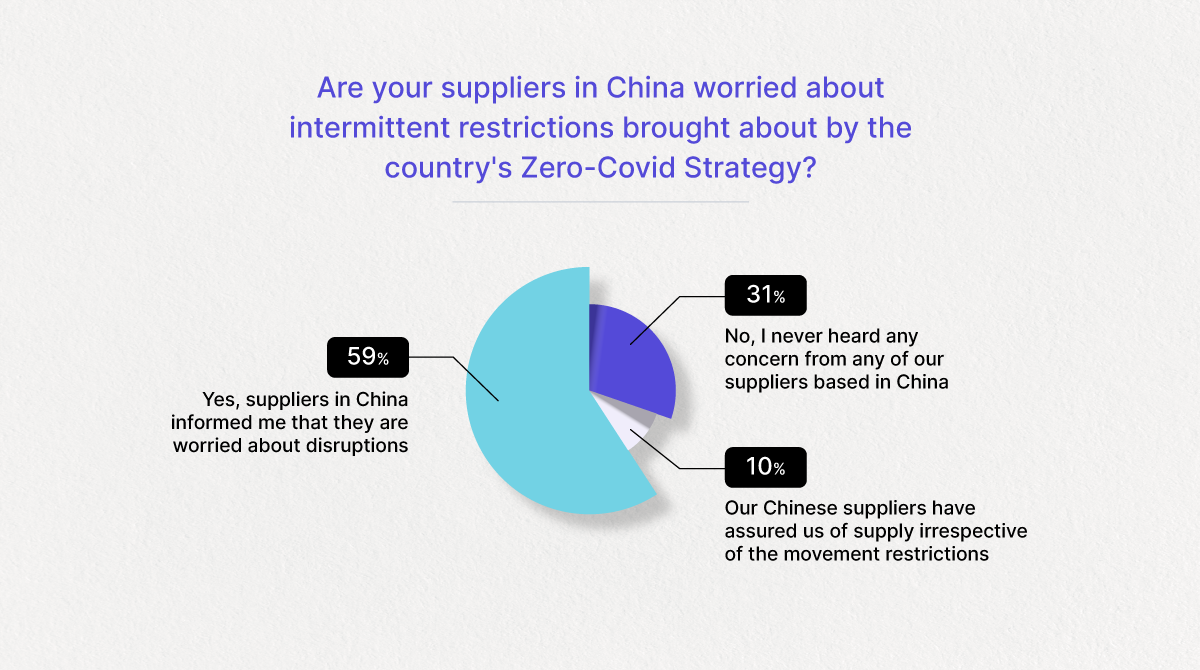

Worryingly, 60 percent of respondents told Beroe that their suppliers in China informed them that they are worried about disruptions caused by current lockdowns. Nearly a third of the respondents said they never heard any concerns from their suppliers in China, while about 10 percent said their suppliers assured them of timely supply.

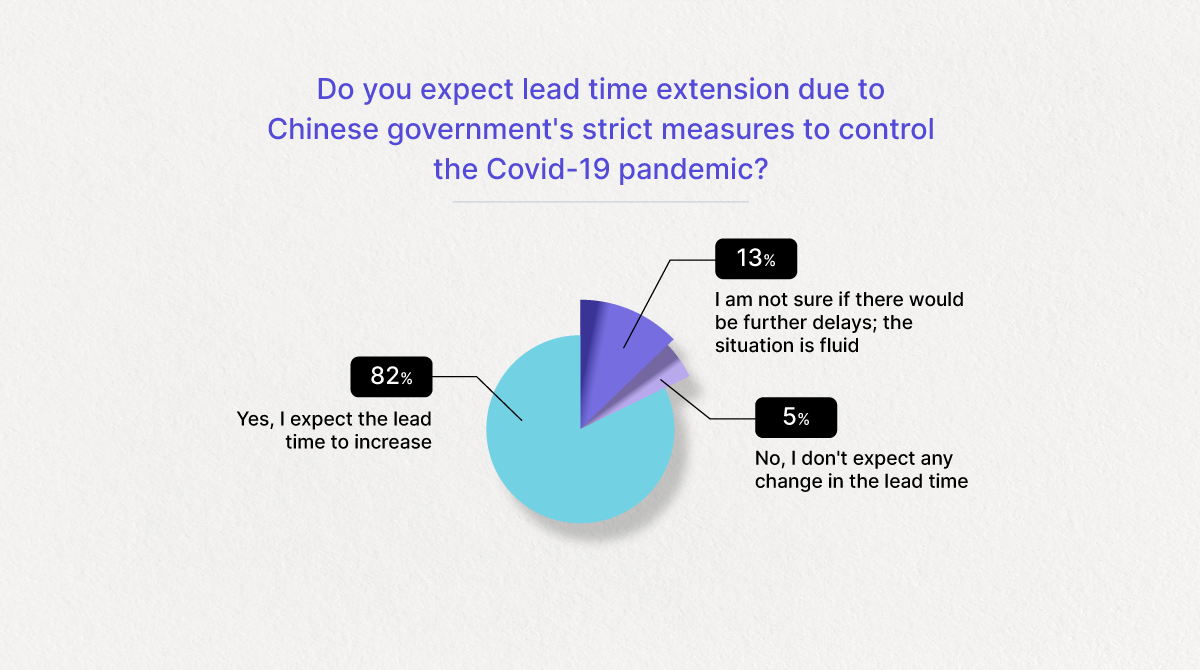

When Beroe asked the respondents whether they expect lead time extension due to Chinese government's strict measures to control the Covid-19 pandemic, an overwhelming majority, i.e., over 80 percent said they expect lead time extension. Further 13 percent said they aren’t sure because the situation is very fluid at the moment. Only 5 percent are assured of no delay.

When questioned whether they have planned for such a scenario, 55 percent said they did, while nearly 20 percent answered they had backup plans during peak covid period but not now. Nearly 27 percent of respondents said it is currently business as usual.

Here are the selected comments from respondents received by Beroe. We are not revealing their names as they are not authorised to speak on behalf of their companies.

- “We buy many raw materials from China and have "mapped" them by Province and react accordingly”.

-- Procurement Manager based in Europe

- “Currently I'm dealing with service providers in West China so no impact at present”.

-- Procurement Executive based in South-East Asia

- “We have placed orders with our suppliers based in Shanghai. Currently nothing is shipping, disrupting our production / planning and deliverables”.

-- Procurement Executive based in Europe

- “I think all the world should learn how to live with covid and keep safe in order to maintain a stable economy. Looks like China government will not relax the restrictions about covid”.

-- VP Procurement based Latin America

- “If 1 million+ lives lost as in the U.S. is the cost of relaxation, or to ensure that 75%+ of the population is vaccinated before relaxing restrictions, then China is pursuing a higher moral goal than other countries to protect its citizens”.

-- Procurement Manager based in North America

- “I will personally try to not have anything sourced in China; with their reaction for a virus the rest of the world is living with, makes me extremely worried about any future similar situations”.

-- Procurement Manager based in North America

- “As a Procurement category lead for a team of Senior Procurement Officers who are responsible for the provision of Insurance Claims Suppliers, we are monitoring events in China and trying to under the impact this might have on, in particular our Motor Supply Chain which includes vehicle repairers and glass providers and the manufacturers who supply replacement parts”.

-- Procurement Executive based in Europe

- “For the category I am handling, I expect no or minor influence from China's lock down”.

-- Procurement Executive based in Asia

- “According to suppliers, the delay is not caused by movement of goods to the port, main reason is due to availability of shipping space”.

-- Procurement Executive based in South-East Asia

- “Whilst suppliers give assurances, I am concerned these are just empty promises in order to reassure customers”.

-- Procurement Manager based in Europe

- “Not all my concerned suppliers are in China, but some of my sources in S. Korea and get their material from China. There are not current shortages on material, but there have been this concern last year”.

-- Procurement Manager based in North America

- “This is unknown, but my commodity Managers are telling me China’s Zero Covid strategy may last up to the end of the 2022”.

-- Procurement Executive based in North America

- “Our Chinese suppliers have assured us of supply irrespective of the movement restrictions. We have increased materials inventory for stocking in case of emergency. We also have packaged our consumables at other sites that can directly deliver during long lead or shortages”.

-- Procurement Executive based in North America

- “The zero covid policy, combined with shipping space and port delays increase complexity in receiving goods from China, and for reliability of supply overall”.

-- Procurement Executive based in South-East Asia

- “We have seen lead times increasing by 1 to 2 weeks”.

-- Procurement Manager based in Middle East

For questions or clarifications, please write to contactus@beroe-inc.com

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe