App economy all set to shake up the trucking industry

In collaboration with Mohammad Azhar - Senior Domain Lead

Popular app-taxi service provider Uber Technologies is entering the trucking business as a consequence of its recent acquisition of self-driving truck startup Otto, sending ripples across the fragmented industry.

Uber has already started pitching services to shippers, truck fleets and independent drivers, Reuters reported. Uber’s planned service offerings go well beyond Otto's initially stated goal of outfitting trucks with self-driving technology. It also plans to compete with the brokers who connect truck fleets and shippers.

On-demand service is catching up in all spheres of business and the latest sector to be impacted is the trucking market. Can app-based trucks become a credible sourcing alternative for Fortune 500 procurement organizations in the long run?

Industry Landscape

The $700-billion U.S. trucking industry remains competitive and fragmented and has low margins. Truckers move about 10 million tonnes of freight annually across the country. It is estimated that trucks run empty for about 15-25 percent of total miles.

The truck driver shortage in the U.S. reached nearly 48,000 workers by the end of 2015, or about 10,000 more than the previous year. The operating cost of the service providers have gone up by 8-10 percent.

Self-driving trucks may eventually ease the driver shortage in the trucking industry. But even without autonomous technology, Otto says it could help decrease the cost of trucking goods by more quickly finding freight, mapping more efficient routes and reducing fuel consumption (http://beroeinc.co/2fyBbJe).

Supply Market and Utilization

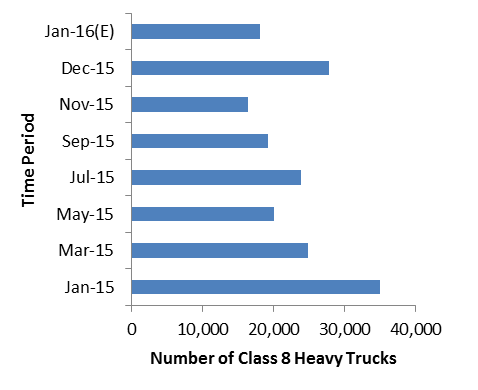

It is expected that the supply of class 8 trucks will be steady in 2016 on the backdrop of stable economic growth.

U.S. Supply of of Class 8 Heavy Trucks

Source: FTR, Truck OEM’s – Total North America Class 8 orders, JOC

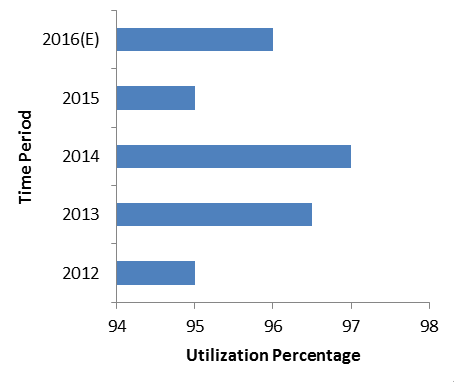

Utilization levels of trucks were about 95 percent in 2015 due to tighter capacity amid higher demand from FMCG, retail sector. Utilization is expected to be around 96 percent in 2016 – thanks to holiday season which will drive the market.

Utilization Level of Trucks

Source: DAT, JOC

Supplier Engagement Model

Engaging directly with Trucking Service Providers

In this model, shippers have a higher bargaining power as compared to trucking service providers. The flip side is that the category managers will have to engage with an array of service providers to manage the volumes.

App-based trucking service providers will fall under this engagement model. However, in the immediate term, they don’t offer large volumes. And they also have geographic limitation.

Engaging with 3PLs

3PLs offer better quality of service with regards to managing the shipment volumes. They also integrate transportation, warehousing and other value added services.

Shippers have lower bargaining power in this model when compared to engaging directly with trucking service providers.

Tri-Party Contract/Hybrid Engagement

In this model, shippers engage with select trucking service providers (say top 10) who would manage 95 percent of the shipment volumes. Shippers then engage with 3PL service providers to manage the contract as well as ancillary services like customs, distribution, etc.

Challenges posed by app-based trucking service providers

Irrespective of the engagement models, buyers have the option to sign up standard contracts with the established suppliers in the industry; also there are KPIs for which industry benchmarks are available. However, industry wide contract terms and KPI benchmarks are not yet available for app-service providers.

- Generally, contract agreements between a logistics service provider and a shipper is for about 2-3 years (along with one-year extension). Sourcing managers can engage with app-service providers only in the spot market, or for less-than-truck-load trips. Hence, long-term category strategy is not possible as of now.

- Shippers sign long term contracts with few of their priority carriers and look to ink 1–2 year period contracts with majority of smaller carriers. App-service providers, in the current form, cannot be a long-term strategic partner for Fortune 500 procurement organizations.

- New trucking service providers will continue to enter the market. And with low supplier switching costs, shippers would opt to engage with new providers who aggressively quote competitive rates. Supplier selection and supplier fit analysis will become a challenge with eventual proliferation of app service providers.

- Payment terms are still evolving in the nascent app-trucking industry.

KPI – Performance measurement

The performance indicators in trucking contracts can be effectively monitored only when a buyer hires at least 50 trucks. Currently, app-based trucks don’t have the capacity to cater to huge volumes. However, “the times they are a-changin” and app service providers could very well emerge as a credible alternative for sourcing managers.

The below gist of KPIs govern established players. The question is whether app service providers will adhere to such terms considering that when the marketplace flourishes they may act as a “broker” between shippers and truck owners, and not necessarily play the role of a full-fledged service provider.

|

Standard Key Performance Indicators for Trucking Contracts |

|

|

On time delivery |

~ 98% |

|

Damage-free deliveries |

~ 99.5% |

|

On time pick up |

~99% |

|

Reporting (minimum negative reporting, max. truck and trace available) |

~99% |

|

Loss-free deliveries |

~99.9% |

|

Claims management |

< 21 days |

Conclusion

U.S. trucking industry is very fragmented with about 97 percent of service providers having 20 or fewer trucks. Big players such as UPS, FedEx, XPO Logistics, J.B. Hunt and YRC Worldwide have a fleet of more than 10,000 trucks -- holding the rest of the 3 percent. App-based players, who would like to transform themselves into brokers, can team up with only small truck owners until they are able to prove great traction in the market.

Nevertheless, apps have its own advantages: they enable buyers to connect with a wide array of smaller service providers, thereby potentially providing an opportunity to better manage the tail-end spend. Moreover, intermittent demand management, seasonal surges in terms of spot trucking can be managed through app service.

Things are beginning to spice up in the trucking market. And watch this space for more developments.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe