Consolidation in 3PL sector Problem or Opportunity for Shippers?

In collaboration with Mohammad Azhar, Domain Lead — Warehousing and Distribution

Third-party logistics (3PL) providers are important intermediaries in the logistics sector as they connect large and mid-sized shippers with various transportation service providers.

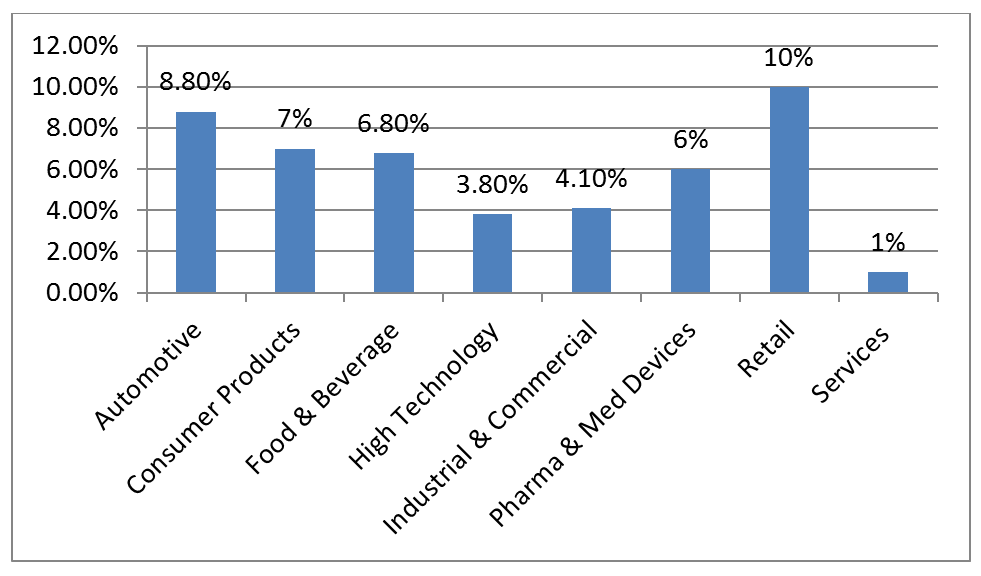

Large shippers are those whose annual revenue exceeds $1 billion and small or mid-sized shippers are those who clock less than a billion dollars in revenue. And companies in some industries, on an average, spend upto 10% of sales on logistics.

Average Annual Logistics Costs As a Percentage of Sales

Source: Tompkins Supply Chain Consortium Benchmarking & Best Practices

Classification of different type of buyers of logistics services

| Definition of Maturity Class | Mean Class Performance | |

| Best in Class | • Reduced freight spend relative to revenues year-over-year • 97%+ on-time delivery • 3% or less annual freight spend relative to revenue |

|

| Industry Average | • No change in freight spend relative to revenues year-over-year • 85-96% on-time delivery • 4-7% annual freight spend relative to revenue |

|

| Laggard: | • Increased freight spends relative to revenues year-over-year • 84% or less on-time delivery • 8% or more annual freight spend relative to revenue |

|

Source: Aberdeen Group Inc

Given the importance of logistics in general and 3PL in particular, it is imperative for sourcing managers to maintain good relationships with suppliers. However, lately, there is lot of M&A activity in 3PL space.

For example, One Stop Logistics was bought over by Echo Global Logistics for about $37 million. Also, deals involved Coyote Logistics buying Access America Transport, creating one of the largest freight brokers in the U.S. And when it comes to big names, XPO Logistics bought Pacer International for $335 million. Also, XPO acquired Con-way for $3 billion and bought Norbert Dentressangle for $3.5 billion – both prominent 3PL service providers in North America and Europe.

Should logistics procurement managers – especially those working with large shippers – worry about the rapid consolidation in the 3PL sector?

“Consolidations tend to be a problem more than an opportunity, since you are reducing the number of players, and per se reducing the competition among them and eliminating the market balance,” said Edson Carillo, CEO of Connexxion, a Brazil-based supply chain engineering firm.

Johan Ström, a logistics consultant, concurred that supplier consolidation can be a problem for shippers in the near term.

“Supply base consolidation will enable efficient transport planning and execution for buyers, but on the other hand limit the possibilities of productive tender management,” Ström said.

Charles Intrieri, a logistics and warehousing consultant, said that 3PL Service Providers’ consolidation can be both a problem as well as an opportunity.

“If you have a contract, set pricing, and Service Level Agreement with one 3PL and they are merging or acquired by another larger 3PL or 4PL, renegotiations will be needed. A new contract will have to be put in place, new terms and conditions, new pricing negotiations, a new Service Level Agreement, new locations and new Transportation. A new Quarterly Business Review (QBR) will have to be negotiated as well,” Intrieri explained.

He also added that IT systems may change requiring new interfaces – all of which can be an added cost to the buyer. And in order to manage IT system transition, buyers may have to insist on IT Service Level Agreement.

Given this scenario, how can sourcing managers with considerable logistics spend protect from the risk of supplier consolidation?

Contracts can protect the shipper with correct legal information and a cancellation/modification clause. Terms and conditions on purchase orders, invoices and web sites can also protect the shippers from risk. A risk KPI should also be part of a Service Level Agreement as well as Quarterly Business Review.

On the other hand, Intrieri said that KPIs depend on the core business of the 3PL/4PL: are they a warehouse-only or transportation-only provider or do they focus on both warehouse and transportation? Depending on the mix, KPIs will have to be framed.

“Service Level Agreements manage KPIs. This has to be a collaborative “win-win” for both parties. This needs re-negotiation so both parties are content with the SLA. A visit to the new 3PL/4PL is in order to meet the new contact people and top management. Financials should also be checked,” Intrieri said.

While M&A is sweeping through the 3PL industry, mobile technology and the App phenomenon is beginning to encroach on trucking sector too. The rise of apps can potentially lead to “gig-economy” among truckers in the future.

“I think with the growth on E-commerce, a change of paradigm is needed within the logistics industry. But I don’t think the future will be M&A but on 4PL services as a single node for transport,” Ström said.

As per Council of Supply Chain Management Professional (CSCMP) 4PL organization acts as a single interface between the shipper and multiple logistics service providers. And they manage as well as orchestrate all aspects of the shippers’ supply chain.

Ström added that in the long run price will be less important (but still very important) and areas to compare the service providers will be more focused on time and sustainability.

“As of today the one with the most trucks win, I don’t think this will be the future,” Ström concluded.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe