CATEGORY

Warehousing Services

A warehouse is a building for storing goods. Warehouses are used by manufacturers, importers . A warehouse can be defined functionally as a building in which to store bulk produce or goods (wares) for commercial purposes.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Warehousing Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Australian Industrial Warehouse Space Seeing Increased Demand From F&B Industry

February 16, 2023US Industrial warehouses see rental increase

July 20, 2022UPS to acquire BOMI Group

August 11, 2022Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Warehousing Services

Schedule a DemoWarehousing Services Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoWarehousing Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Warehousing Services category is 4.00%

Payment Terms

(in days)

The industry average payment terms in Warehousing Services category for the current quarter is 58.1 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Warehousing Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoWarehousing Services market report transcript

Global Warehousing Services Industry Outlook

-

The global warehousing market was valued at $660 Billion for 2022 and is projected to reach $714 Billion by 2023. The Global Warehousing Industry is forecasted to grow at a CAGR of 8.2 percent between 2021 and 2026, to reach around $907 Billion by the end of 2026

-

Owing to growing rates of quality space absorption spurred on by e-commerce activity, occupier demand for logistics continues to be dominant. The norm for new logistics facilities has indeed been occupants' interest on sustainability and their demand for spaces integrating energy-saving devices and solar panels. The continued high demand for last-mile facilities is expected to drive increased uptake in the upcoming quarters. Due to inflationary tensions and rising construction costs, rents are under pressure to increase

-

The APAC region dominated the warehousing market for previous year with a market share of 39.1 percent, followed by North America 28.43 percent, Western Europe by 18.44 percent, Eastern Europe 4.33 percent, South America 3.84 percent, Middle East 3.16 percent, and Africa 2.70 percent

Warehousing Services Market Drivers and Constraints

Key advancement in robotics and IoT will be driving automated truck loading and unloading product/equipment market in the future. High initial cost of investment required for developing automated truck loading system is expected to hamper the Automated Truck Loading System market growth.

Drivers

-

Cost Benefit: Lower labor requirement, improved efficiency in logistic through automated loading system, and quick return on investment have been the key reasons for the growing demand. Exponential increasing labor cost in APAC and Europe makes it more desirable for manufactures

-

Favorable government initiatives helping in the growth for automated material handling systems: Government incentives, such as low-interest loans, tax relief, and land rental incentives do support the domestic manufacturers

-

Competition within the Industry: Emergence of large number of small to mid-size manufacturing and integrators in the market with superior service capabilities are challenging existing players to be more innovative and productive. Buyers are gaining more power to leverage negotiations

-

Impact of digitalization: Robotics and IoT, the key drivers of logistics industry, which has encouraged warehousing practices of many manufacturing, retail and e-commerce companies. The advancement in the field will encourage more manufacturers to adopt automated system for better execution and monitoring

Constraints

-

Costs: Initial investment costs are too high, which restricts the adoption of such system

-

Competition from global supplier: The global players do dominate the ATLS market, due to their advanced equipment and upgraded features. Local manufactures though have good knowledge on technology and standalone fall short, in terms of providing end-to-end solution to client

-

Complexity in implementation is a major constraint

Material Handling Equipment: Global Market Overview

-

The global material handling market size is estimated at $56.69 Billion in 2021 and is projected to reach $97.77 Billion by 2026, exhibiting a CAGR of 11.52 percent during the forecast period 2021-2026

-

Asia accounted for 46 percent of the global material handling equipment market, followed by Europe (34 percent) and North America (18 percent)

-

The APAC market is expected to grow at a CAGR of 12.37 percent between 2021 and 2026

-

The major players in this Industry include Dematic, Daifuku, Swisslog, Honeywell, Jungheinrich, Muratec, Knapp AG, TGW, Kardex, Mecalux, Beumer Group, SSI Schafer, Vanderlande, Witron

-

The industrial sector in North America, Europe, and Australia is witnessing a fast growth, with an increasing number of companies implementing robots and automated solutions for material handling

-

Major players are engaged in mergers/acquisitions and collaborations or partnerships to enhance their market presence and expand their product portfolio. For instance, recently, the acquisition of Vega Conveyors & Automation and Australia-based InterSystems by Daifuku in late 2019

-

Coming out of this pandemic, there is an expectation that companies possibly spend more to automate their operations. This optimistic outlook depends on the health of companies emerging from the pandemic and the amount of capital spend available for projects

Automatic Truck Loading/Unloading Systems (ATLS)

- Fully automatic loading and unloading always requires two combined systems:

–System in the truck or trailer

–Fixed installation on the loading platform or in the warehouse

- Truck loading conveyors and automated solutions allow increased efficiency. By adding elevators, lift platforms, turntables, and conveyors, which interface with the automatic loading and unloading systems, the rate of truck turns increases dramatically

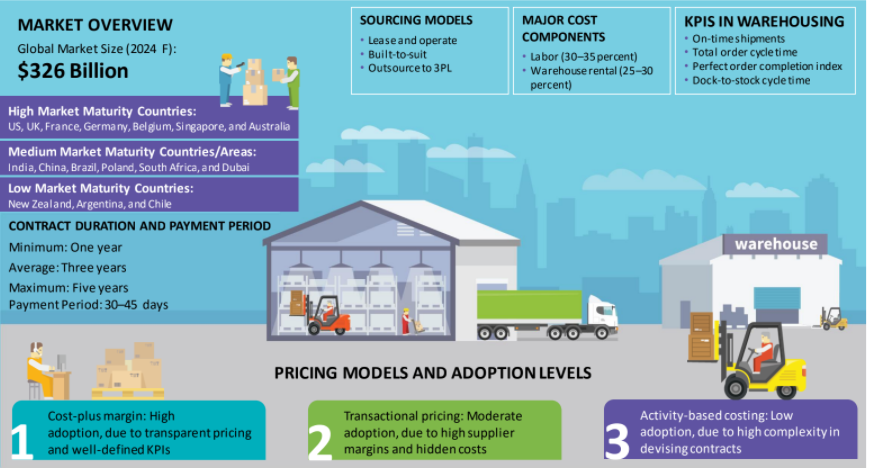

Cost Structure Analysis : Warehousing Services

-

The main driving factor behind this increase in wage is because of supply demand imbalance in the labor market with increasing demand for warehouse workers during the pandemic and shortage or reduced workforce due to safety norms

-

The second major cost driver being the rental rate is expected to be on the rising trend, due to increasing demand for quality warehouse space owing to pandemic effect

Why You Should Buy This Report

The report consists of the analysis of the global warehousing services market size, demand-supply analysis, and trade dynamics of global and regional markets. Moreover, the report elaborates all the historical trends in the global warehousing services market price and the factors driving the same. Various geographic regions and their inner dynamics such as price trends, logistics services, market dynamics as well as market maturity are also explained in the research study.

Moving ahead, the global warehousing market size study has scrutinized prominent countries that offer large-scale global transport and warehousing facilities and their revenue share. If there is anything unique to differentiate one region from the other in the global logistics & warehousing services market, they are detailed. The global warehousing market report gives Porter’s five forces analysis of the major warehousing markets.

The cost analysis section of the report studies the global warehousing services market price from the global as well as regional perspective. The report lists out global warehousing services market industry suppliers, drivers and constraints, and price analysis, as well as provides the SWOT analysis of major suppliers. It also offers information about market aspects such as warehousing services, logistics and transportation, storage services, fulfillment center, distribution center, deport storage, bonded storage, public storage, third-party storage facility, leased storage, rented storage, automated warehouse, WMS, VAS, ASRS, and AGV. The industry report provides the global services warehousing market size analysis and cost structure breakdown and lists the best sourcing and contract models for manufacturers and distributors.

Further, the global warehousing services market report talks about the innovations that aim at reducing costs while making the industry more sustainable in sync.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.