CATEGORY

Customer Relationship Management (CRM)

CRM is a system which manages the organization's relationships and interactions with current and potential customers.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Customer Relationship Management (CRM).

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

CRM provider Zoho to expand presence in Saudi Arabia

February 14, 2023KPMG Australia awarded contract to manage Microsoft Dynamics at Melbourne Airport

February 13, 2023Publicis Sapient acquires Tquila ANZ, to expand Salesforce service presence in Australia

February 09, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Customer Relationship Management (CRM)

Schedule a DemoCustomer Relationship Management (CRM) Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoCustomer Relationship Management (CRM) Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Customer Relationship Management (CRM) category is 5.90%

Payment Terms

(in days)

The industry average payment terms in Customer Relationship Management (CRM) category for the current quarter is 68.8 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Customer Relationship Management (CRM) market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCustomer Relationship Management (CRM) market frequently asked questions

As per Beroe's customer relationship management industry analysis, the global market size of CRM software was $28 billion in 2016.

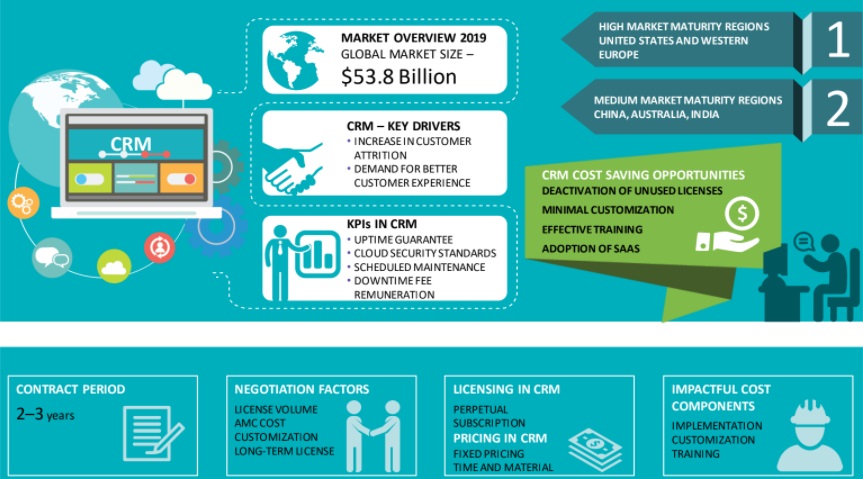

The customer relationship management market regions in the U.S. and Western Europe have high market maturity, while parts of APAC, such as Australia, China, and India have medium market maturity.

The key drivers for the CRM market growth globally are the demand for improvement in customer experience, better customer retention and acquisition, lead management, the voice of the customer, and field management.

With the shifting CRM market trends on segments like SaaS, Mobile CRM, and analytics, the APAC and LATAM are the emerging CRM markets.

From CRM market analysis reports by Beroe, the following presents significant CRM cost-saving opportunities. ' Deactivation of unused licenses ' Minimal customization ' Effective training ' Adoption of SaaS

The top global service providers in the CRM market are SAP, Oracle, Salesforce, Microsoft, Pegasystems, Infor. According to the latest CRM market news from Beroe, Salesforce is leading the global market due to its complete focus on the SaaS model.

The key differentiator among CRM vendors is the ability to integrate cross-functional data, for instance, customer data across sales, marketing, and customer support. Moreover, vendors who offer one-stop solutions and integration-ready partnerships are preferred more by buyers.

There is a rapid shift in the CRM market size and deployment model as factors like increased cost savings, diversified user base, and low maintenance are causing buyers to move to SaaS models from the on-premise models.

Veeva and Cegedim are the key vendors who offer CRM modules specifically designed to cater to the needs of the pharmaceutical industry.

The key factors that are used in the selection of CRM vendors are ' maturity of the buyer, industry, existing business processes, customer segment (whether it is B2B or B2C), and budget. Most leading vendors can successfully deliver across all these parameters.

Customer Relationship Management (CRM) market report transcript

Global CRM Industry Outlook

-

The global customer relationship management software market is estimated to grow at a rate of 10.6 percent, from $42.41 billion in 2021

-

Due to increased competition among service providers and quickly growing businesses, the North American market will continue to dominate the market, in terms of size over the projection period

-

The US and Western Europe have high market maturity in CRM. Parts of the APAC, such as Australia, China, and India have medium market maturity

-

The key CRM market drivers are increase in adoption of CRM by SMEs, better customer retention, and acquisition

-

The key factors that drive CRM software revenue are lead management, voice of the customer, and field service management

Global CRM Industry Analysis

- APAC and LATAM are emerging markets with shifting focus on SaaS, Mobile CRM, and analytics

CRM Supply Analysis: Supply Market Outlook

Global/Regional Supplier

-

Mature and Diversified Market: CRM market is highly matured and key differentiator among CRM suppliers is the ability to integrate cross-functional data. E.g., Customer data across sales, marketing, and customer support. In addition, buyers prefer suppliers who has integration-ready partnerships and one-stop solutions. E.g., Oracle’s Marketing Cloud should connect seamlessly with Salesforce sales cloud

-

Increase in SaaS CRM Adoption: There is a rapid shift in the CRM deployment model, as the buyers are moving from on-premise model to SaaS model due to the shift in operating models caused by the COVID-19 pandemic, digital transformation initiatives and benefits of moving to cloud

CRM Supplier Perspective: Vertical/Local Supplier

-

Experience Across Industries: In CRM, Tier-2 suppliers are also known as vertical specific suppliers. Enterprises are more focused on product capability rather than the supplier strength (revenue/client base, etc.)

-

E.g., Veeva and Cegedim are key suppliers, who deliver SaaS based sales CRM module specific to pharmaceutical industry

Engagement Trends

-

Most Adopted Engagement Model Globally: Multi-supplier sourcing strategy

-

No One Size Fits all Solution: No CRM solution is complete and all CRM solutions require custom development or third-party applications to achieve 100 percent efficiency. An enterprise can have more than one CRM solution based on their business requirement, such as marketing, sales, e-Commerce and customer support. Due to constant change in business models/geo location enterprises are seeking better CRM solutions that can keep them ahead of competition and help achieve better customer service

-

Contract Length: 2–3 years, with an option of contract extension based on performance linked with SLA’s

Global CRM Drivers and Constraints

Drivers

Evolution of Artificial intelligence (AI) based CRM:

- Increase in Big data, adoption of SaaS delivery model and advancements in machine learning and analytics have made AI inevitable in CRM transformation. The role of AI in CRM would be minimizing the manual work, create an automatic process, reconfigure the interfaces based on the usage patterns of customer/business. Major application of AI in CRM are, Virtual customer support, workflow automation, predictive sales analytics and customer engagement, Social media monitoring and sentimental analysis

Demand for Better Customer Experience:

- Due to the usage increase of digital channels, such as mobile devices and social networks, customers expect a quick response on their queries and complaints without any delay. CRM provides solutions to support and stay connected with their customers by deploying an effective contact center management, to solve their queries and increase customer loyalty

Cloud CRM:

- The demand for cloud-based CRM software has increased significantly in the past 2-3 years. The cloud-based CRM software market accounts for more than 70 percent of the overall CRM software market and is forecasted to grow further as enterprises are transitioning to cloud

Constraints

GDPR Compliance:

-

Compared to other applications, CRM deals with vast amount of sensitive/personal data and enterprise are in a position to comply with the European General Data Protection Regulation (GDPR). It is expected that in the next 3 years, the cost of GDPR compliance will increase across information security, CRM and customer experience (CX) especially in Western Europe

-

In addition, if enterprise do not comply with GDPR, they might end-up in losing customers due to lack of trust on customer data protection or customers will provide false data or will close accounts. This would reduce the chances for enterprise in reaching to right customers with the right offers at the right time

Integrating CRM with external platforms:

-

Although the enterprises have started to integrate and synchronize their existing CRM with other platforms and sources, the development in this area is still in a work-in progress state

-

For example, enterprises should have a strong vision towards integration such as integrating mobile and web solutions to enhance productivity. Enterprises are in a phase of synchronizing their social media inputs, Omni-channel support, and customer analytics data to extract intelligence

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.