CATEGORY

Commercial Print Services

Commercial Print Services category we mainly track, print, management companies who provide end-to-end solutions related to pre-press (designing, platemaking, typesetting), print production and post press services (binding, warehousing, fulfilment) and various approaches of marketers to engage with them for their marketing activities & major end products including brochures, leaflets, magazines, bill-boards, labels for packaging, direct mails, signs, business forms etc.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Commercial Print Services.

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoCategory Alerts

Quad, plans to close it's printing plant in Merced, California USA

February 21, 2023Australia's Color Concepts renamed as "ColorBase"

February 15, 2023IVE Group rebrands its latest acquisitions and calls it "Brand Activation"

February 07, 2023Become a Beroe LiVE.Ai™ Subscriber to receive proactive alerts on Commercial Print Services

Schedule a DemoCommercial Print Services Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Commercial Print Services category is 10.10%

Payment Terms

(in days)

The industry average payment terms in Commercial Print Services category for the current quarter is 66.0 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Commercial Print Services Suppliers

Find the right-fit commercial print services supplier for your specific business needs and filter by location, industry, category, revenue, certifications, and more on Beroe LiVE.Ai™.

Schedule a Demo

Commercial Print Services Market Intelligence

global market outlook

- The global commercial print market size is estimated to be $725–730 billion USD in 2022. The region with the highest market size is APAC with $268 billion, followed by Europe and North America with the market size of $228 billion and $158 billion respectively.

- Global players in the commercial print category include HH Global (HHG), RR Donnelley (RRD), Toppan Inc., Dai Nippon Printing (DNP).

- According to the industry experts, the commercial print industry will grow at 0.6 - 1% CAGR by 2024.

- The top industries that contribute to the commercial print market are FMCG, retail, BFSI, Telcom.

- Increasing demand for sustainable printed materials and usage of latest technologies including cloud printing has seen a major growth in the commercial print category

Use the Commercial Print Services market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoCommercial Print Services market frequently asked questions

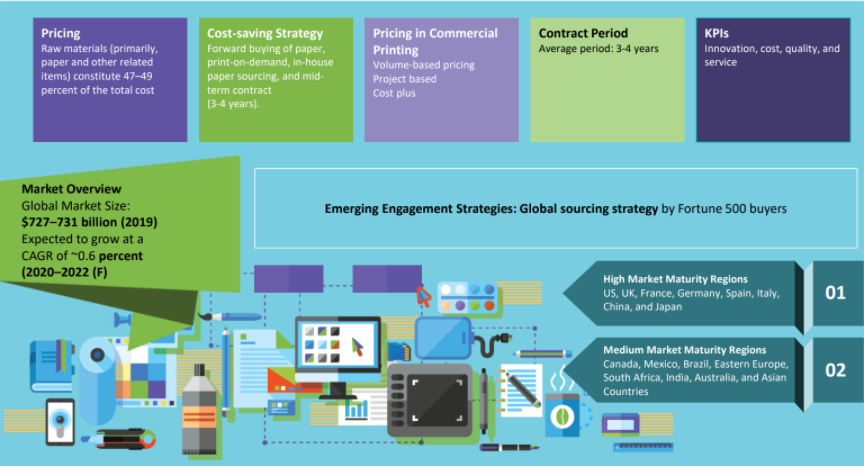

According to the Beroe printing industry report, the global market size of commercial print services is between $721 and $731 billion. As per the printing industry forecast by industry experts, it is predicted that the commercial printing industry will grow at a CAGR of approximately 0.6 percent from 2020 until the end of 2022.

According to the Beroe printing industry report, the global market size of commercial print services is between $721 and $731 billion. As per the printing industry forecast by industry experts, it is predicted that the commercial printing industry will grow at a CAGR of approximately 0.6 percent from 2020 until the end of 2022.

As per Beroe's printing industry overview, the top suppliers include Cenveo, RR Donnelley, Quad/Graphics, and HH Global.

As per Beroe's printing industry overview, the top suppliers include Cenveo, RR Donnelley, Quad/Graphics, and HH Global.

The print industry marketing high market maturity regions include Japan, France, China, Italy, the US, Spain, the UK, and Germany. The medium market maturity regions for the commercial print services market include Australia, Mexico, Eastern Europe, Asian countries, Canada, Brazil, and South Africa.

The print industry marketing high market maturity regions include Japan, France, China, Italy, the US, Spain, the UK, and Germany. The medium market maturity regions for the commercial print services market include Australia, Mexico, Eastern Europe, Asian countries, Canada, Brazil, and South Africa.

As per the printing industry analysis by Beroe, print production, post press, color management, and premedia services are some of the industry trends to watch out for in the future. Turning towards cost-effectiveness is going to be a trend and so will the focus on print-on-demand services as these are high in demand according to several industry experts. Value-added services will be provided by providers such as 3D printing, and BTL marketing consulting which will encourage people to consider commercial print services. Manufacturers will focus on reducing wastage and this will be more dominant in the future.

As per the printing industry analysis by Beroe, print production, post press, color management, and premedia services are some of the industry trends to watch out for in the future. Turning towards cost-effectiveness is going to be a trend and so will the focus on print-on-demand services as these are high in demand according to several industry experts. Value-added services will be provided by providers such as 3D printing, and BTL marketing consulting which will encourage people to consider commercial print services. Manufacturers will focus on reducing wastage and this will be more dominant in the future.

The prepress and artwork, print on demand, marketing materials, and cloud print services are some of the services that are likely to help grow the printing market in the forecast period. The use of printing services in warehousing and fulfillment such as product packaging can help boost the printing market growth in the coming years. Other services such as security and document printing, are likely to increase thereby helping to propel the growth of the market according to the Beroe industry experts. The print market is more likely to witness growth even if it slows down or becomes steady. Industries such as publishing, packaging, food and beverage, retail, and financial services will help the printing market growth. These industries generate demand for printing services and as long as this holds true, the printing market will witness positive growth. Another driver of the printing market growth is a continuous focus on eco-friendly practices. As more suppliers and manufacturers are focusing on this, people are more positive towards buying eco-friendly printed items. This can encourage people to buy printed material. The willingness of people in developing countries to buy can help further grow the printing market.

The prepress and artwork, print on demand, marketing materials, and cloud print services are some of the services that are likely to help grow the printing market in the forecast period. The use of printing services in warehousing and fulfillment such as product packaging can help boost the printing market growth in the coming years. Other services such as security and document printing, are likely to increase thereby helping to propel the growth of the market according to the Beroe industry experts. The print market is more likely to witness growth even if it slows down or becomes steady. Industries such as publishing, packaging, food and beverage, retail, and financial services will help the printing market growth. These industries generate demand for printing services and as long as this holds true, the printing market will witness positive growth. Another driver of the printing market growth is a continuous focus on eco-friendly practices. As more suppliers and manufacturers are focusing on this, people are more positive towards buying eco-friendly printed items. This can encourage people to buy printed material. The willingness of people in developing countries to buy can help further grow the printing market.

While the demand for printing paper is still present, there are chances of the demand diminishing for printing services such as digital printing. The focus is going to be on proving electronic printing materials. For example, e-catalogs and e-reports are likely to be more popular due to their ease of sharing and cost-effectiveness. If people start to prefer digital material over printed material, then this can slow down the growth of the printing market. Price can play a major role in being a constraint in the printing market according to industry experts. Feedstock prices dictate the prices of inks and paper among other materials. If there are changes that occur too often then these can act as constraints in the printing market. The volatile pricing can also become a constraint that can slow down the market growth to some extent.

While the demand for printing paper is still present, there are chances of the demand diminishing for printing services such as digital printing. The focus is going to be on proving electronic printing materials. For example, e-catalogs and e-reports are likely to be more popular due to their ease of sharing and cost-effectiveness. If people start to prefer digital material over printed material, then this can slow down the growth of the printing market. Price can play a major role in being a constraint in the printing market according to industry experts. Feedstock prices dictate the prices of inks and paper among other materials. If there are changes that occur too often then these can act as constraints in the printing market. The volatile pricing can also become a constraint that can slow down the market growth to some extent.

Commercial Print Services market report transcript

Global Commercial Print Services Industry Outlook

-

The global commercial print market was valued at $725–730 billion in 2023 (E) and is forecasted to grow at a CAGR of ~0.6 percent and reach $730–734 billion in 2025(F)

-

Regions such as North America and Western Europe and some parts of APAC, such as China and Japan, have high market maturity, and the commercial print market is expected to decline in North America and Western Europe, due to an increase in digitization

-

The future growth of the commercial print industry would be driven by parts of APAC, the MEA, and LATAM, owing to considerably less internet penetration and a high customer base

Global Commercial Print Services - Market Maturity

-

Commercial print penetration is still low outside Europe, North America and parts of APAC

-

About 52–57 percent of the total commercial print market is contributed by the developed markets, such as North America and Europe. China and Japan are the next biggest markets

-

The central and southern parts of APAC and parts of LATAM and the MEA are driving the commercial print market, owing to a large consumer base, increase in spending by buyers, and low internet penetration compared to the developed markets

Global Commercial Print Services - Industry Trends

-

Commercial print service providers are increasing their service portfolios by adding value-added services, such as data management, BTL marketing consulting and 3D printing, in order to provide end-to-end solutions to buyers.

-

With the help of digital printing machines, faster turnaround is possible, facilitating print-on-demand and hence, avoiding wastage to achieve cost savings.

Global Commercial Print - Drivers and Constraints

To counter the effect of the digitization of commercial print, service providers are adding value-added services, such as data management, consulting and e-publishing to retain their clients. However, major segments, such as labels, packaging materials and books for educational institutes, still have sustained demand

Drivers

-

Value-added services: A wide range of value-added services, like mailing, fulfillment, consulting, graphic design and data management services, enables print suppliers to deliver innovative services to their buyers. Suppliers in the market are competing with each other by providing value-added services to their clients at competitive prices, and they help buyers consolidate multiple print-related activities to a single service provider

-

Potential industry sectors: The demand for print services is primarily driven by the retail, financial services, publishing and food and beverage industries. Demand for on-demand print materials, packaging, wide-format printing, digital printing and other promotional materials by the retail, food and beverage industries is a key driver

-

Eco-friendly practices: The introduction of eco-friendly practices, like soy ink instead of the traditional petroleum-based ink, has reduced the printing industry's impact on the environment and has helped both the buyers and suppliers control their carbon footprints

Constraints

-

Increase in digitization: With the increase in digitization, it is expected that buyers will adopt more electronic versions of printing materials, such as e-annual reports, e-vouchers and e-catalogues, or use more online channels, like email, the internet or websites, rather than printing materials to target consumers, which, in turn, will affect the demand for print-related items

-

Dependence on feedstock prices: The print industry is dependant on feedstock prices, such as the price of paper, inks, solvents, etc. Price fluctuations for these items have an impact on the print industry. The volatility of the raw material prices poses a risk to the buyers because it has a direct impact on the final prices

Printing Industry Forecast: Key Innovations

Marketers should consider the following innovations while engaging with a print management company or local printers. This would help companies to source the latest end-products in the print industry

Web-to-print

Clients, print designers can upload any document that needs to be printed to cloud services, get it printed by printers closest to where it is required.

On-demand Printing

As technological advancements are getting better it is easier for companies to print commercial print items in and around desired locations, in adequate amounts and get it delivered without any delay.

Digital Content Distribution

With the increase of web-to-print and on-demand printing, digital content distribution platforms are also gaining momentum. Downloading the content on requirement basis provides flexibility, and helps in brand uniformity.

3-D Printing

Printing is expanding from flat sheet printing to 3-D printing. Commercial printers are technically upgrading themselves to capitalize on the same. 3-D printed materials have greater likelihood of being noted.

Hybrid Print Technologies

Print industry is migrating towards integration with digital channels: computer-to-print plate automation. This technology allows the designer to send finished image files to electronic plates which can read them and help execute complex projects faster.

Software Innovation for Print Businesses

The graphic design software used in the pre-press stage has a wider range of tools and features enabling lean workflow, compatibility across different files and collaboration among designers across different geographies.

Supply Market Outlook: Supply Trends and Insights

Global supplier

Increased M&A

-

As buyers are focusing more upon consolidation opportunities. For example: HH Global is in full swing in acquisitions and expansions worldwide. They acquired Alecom in 2019 and completed the acquisition of InnerWorkings in October 2020, which is considered as one of the major acquisitions in the commercial print industry. HH Global will acquire InnerWorkings for $3.00 per share in an all-cash transaction representing approximately $177 million in equity value. Also, they expanded their presence in LATAM with the opening of a new office in Panama City and the upgrading its Mexico City offices

-

Shifting priorities: RR Donnelley has shifted some of the production at its packaging facilities in North Carolina and Mexico to create single-use face shields to protect businesses and communities across the country. The company is currently able to produce approximately a million pieces per week by completely automating the production cycle

Regional/ local supplier

-

Value-added services: Tier-2 suppliers are increasingly including value-added services, such as warehousing and fulfilment, which decrease the lead time to market for the buyer

-

Raising brand profile: Tier-2 suppliers are investing heavily in marketing their offerings to improve their brand perception. This has resulted in huge engagements during the pandemic as buyers prefers local/regional service providers

-

Owing to the higher tariff rates and labor costs, the North American buyers started evaluating alternate locations like Vietnam and Mexico. There has been a huge demand for regional and local suppliers in Asia as well as in LATAM lately

Engagement trends

-

Most-adopted model globally: Global and regional sourcing strategy and owing to the on-going pandemic, buyers' preference has changed to local service providers as well

-

Why: To achieve spend visibility and cost savings

-

Contract length: 3-4 years, with a contract extension option based on performance linked with SLAs

-

Pricing strategy: There is an increased tendency to adopt a volume-based pricing model. The performance-based pricing model is also being looped to the project-based pricing model as a percentage of compensation in order to drive better results

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.

Get Ahead with AI-Enabled Market Insights Schedule a Demo Now