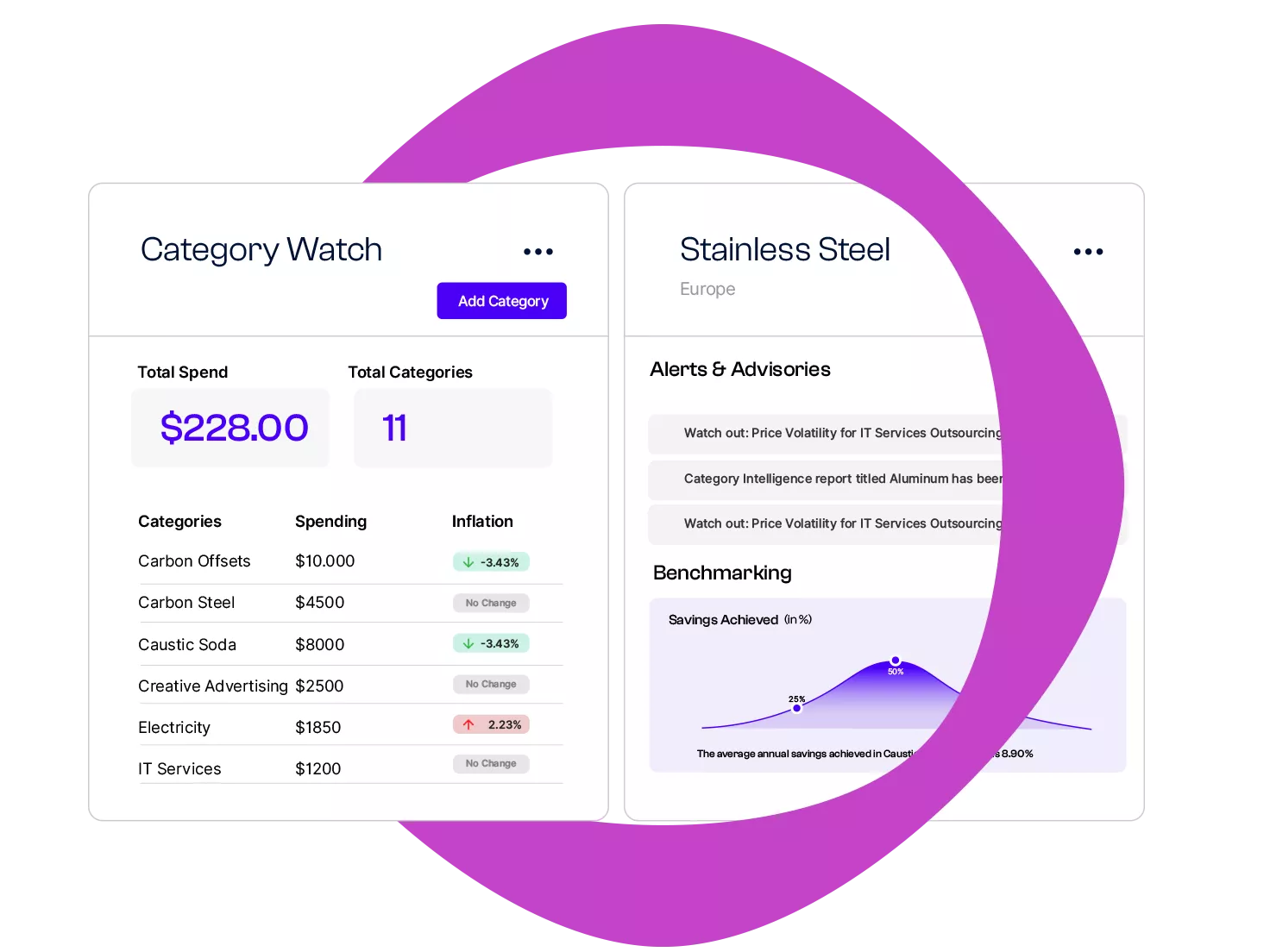

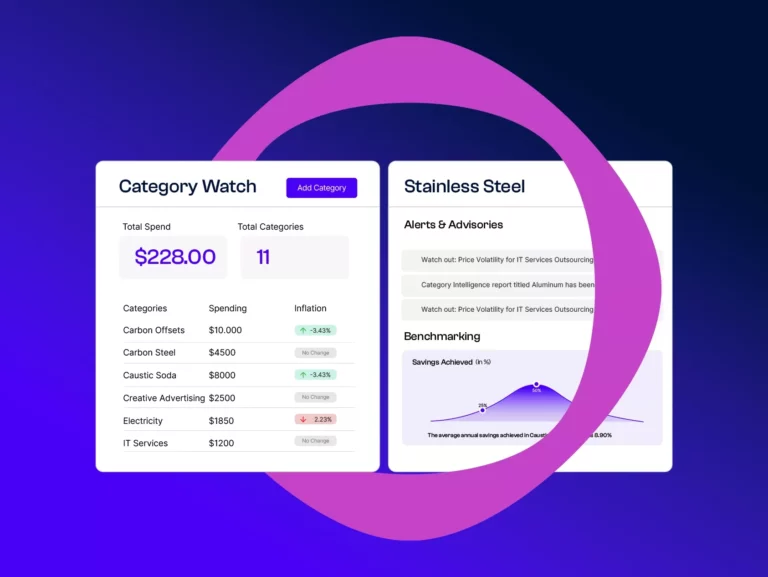

Category Watch

Persistent global uncertainty is severely straining procurement teams, making it increasingly difficult for category managers to stay informed and make agile decisions.

Beroe’s Category Watch, powered by AI and enhanced by human ingenuity, delivers a comprehensive view of your categories through its four specialized sub-modules: Category Insights, Geopolitical Alerts, Benchmarking, and Alerts & Advisories. Align your category strategies, uncover opportunities on an ongoing basis, and navigate market risks with precision.

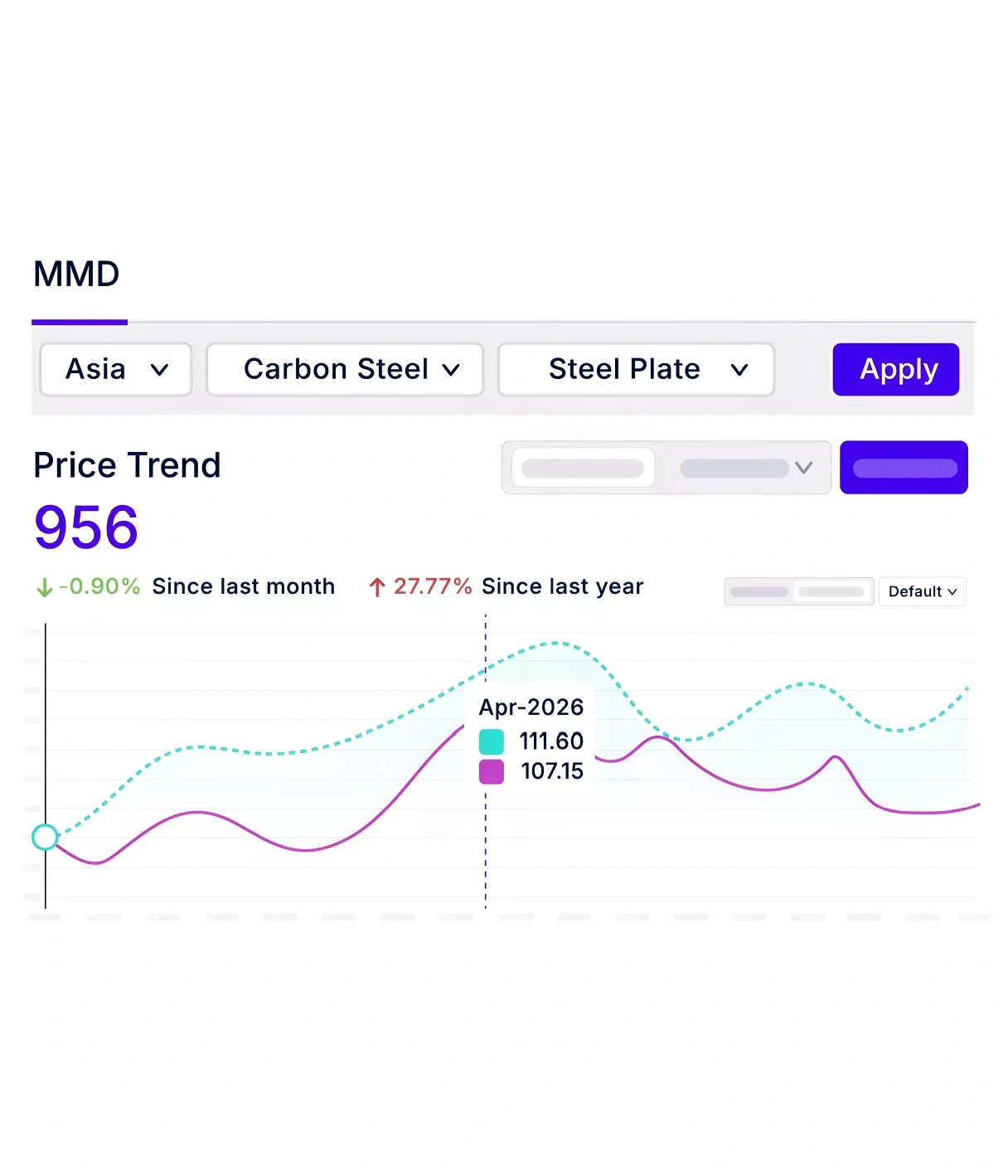

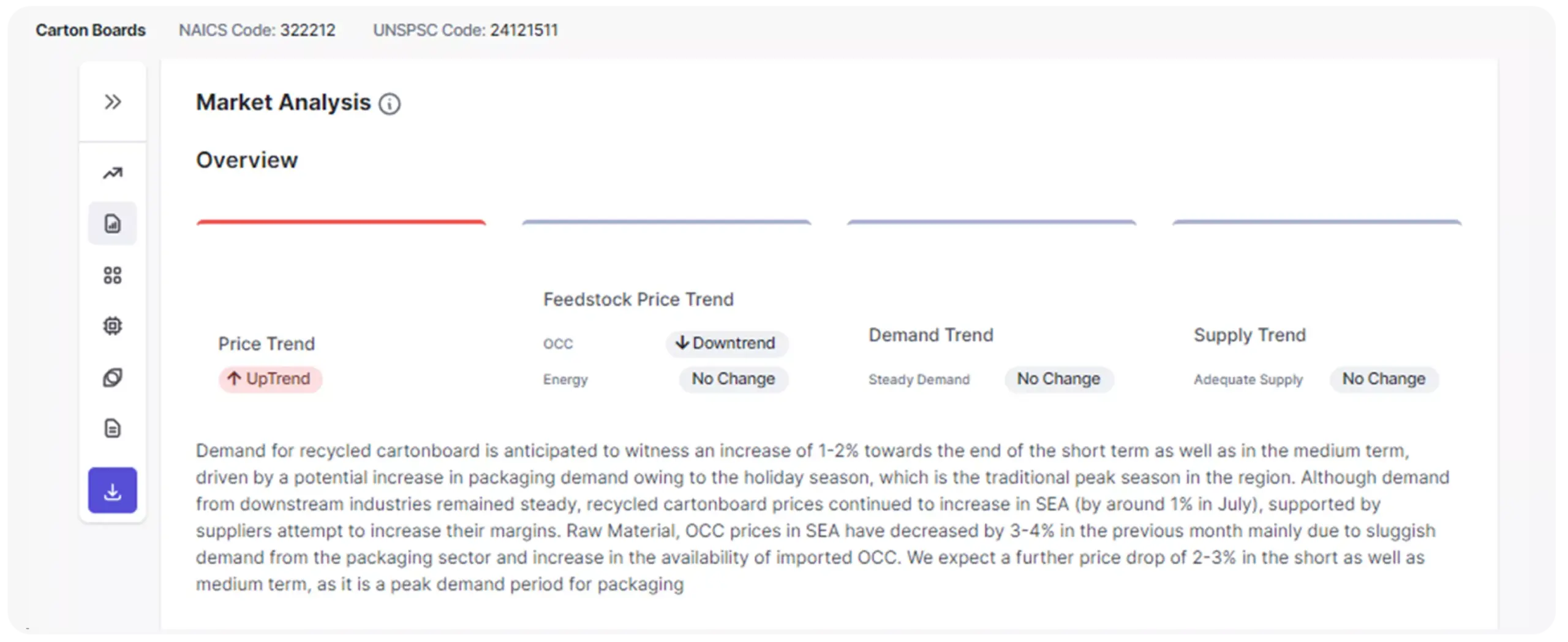

Category Insights

Benefit from in-depth knowledge across more than 2,500 categories, gaining a panoramic view of market trends, cost fluctuations, and evolving dynamics to capitalize on cost-saving/avoidance opportunities and minimize risks.

Geopolitical Alerts

Build a robust category strategy by staying ahead of global risks with a 360-degree view of geopolitical and economic factors. Enable procurement teams to identify savings opportunities and avoid material shortages with actionable intelligence that helps smarter category management.

Benchmarking

Evaluate your procurement performance against industry standards with 18 essential questions, uncovering gaps and providing actionable insights to refine your category management practices.

Alerts & Advisories

Stay informed with Abi’s timely alerts. Receive daily news, proactive supplier alerts, and strategic insights to adjust sourcing locations, negotiate better contracts, and maintain supply assurance.

2,500

Comprehensive insights into 2,500 direct and indirect categories.

1,000+

Empowering over 1,000 procurement organizations with cutting-edge category intelligence.

40,000+

Engaging with a growing community of more than 40,000 active procurement professionals.

Actionable intelligence on more than 2,500 categories

Get in touch

We’re here to assist you! If you have any questions or need support, don’t hesitate to reach out. Contact us today and we’ll respond promptly to help with your needs.

Request a demo

Discover how our solutions can benefit you. Partner with us to unlock potential and drive success. Let’s work together to achieve outstanding results.