Vegan Cosmetics: Emerging Sourcing Destinations for Vegan Ingredients

Product innovation and sustainable sourcing are expected to be the two buzzwords dominating the cosmetics market space. As the regulatory environment for cosmetic ingredients becomes more stringent, and consumers become aware of the toxic effects associated with synthetic chemicals, they will be willing to experiment and spend money on natural cosmetic products despite the premium prices associated with such products.

Consumers are giving up on animal-based food products and embracing veganism. They are looking to adopt veganism with respect to all products that they use. Thus, vegan cosmetics is an emerging segment in natural cosmetics that is expected to experience a significant rise in demand in the next five years. Vegan cosmetics and skincare products do not contain any animal products, including animal by-products or derivatives.

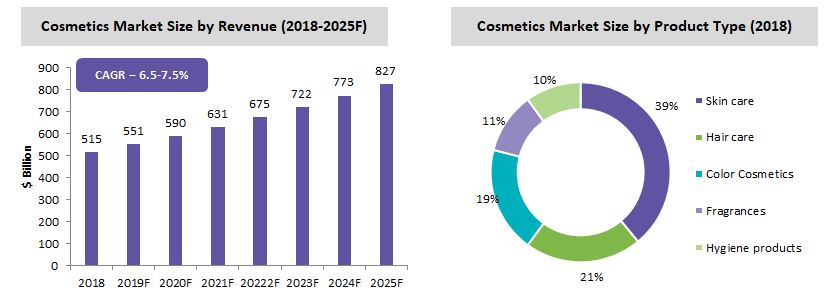

Cosmetics Market Overview

The quest for beauty will continue to remain unaffected by the ups and downs of various economies. The cosmetics market is expected to exhibit a high growth rate of 6.5–7.5 percent until 2025. Skin care will continue to occupy the maximum market share for the next few years, while the hygiene products segment (oral care, feminine hygiene) is expected to record its highest growth rate. The three main factors favoring growth are:

- Acceleration of urbanization and disposable income in developing countries, and subsequently, the consumers’ interest in high-end, prestige products

- Decline in fertility and mortality rates have led to a robust demand for new anti-aging products

- The selfie syndrome and the millennial population who are constantly experimenting with their looks

Two main trends to watch out for in the cosmetics market are driven by both the regulatory environment and consumer preference. An increasing awareness among consumers on the harmful effects of chemicals has led to a shift toward natural ingredients. However, this trend is no longer restricted to ingredients. Most manufacturers are aiming for sustainability on three fronts:

- Ingredients

- Packaging

- Applications (includes dry/waterless shampoos, solid shampoos delivered via paper blotters, etc.).

The rise of E-commerce will see a shift in cosmetic sales from traditional retail purchases to online sales; most of the major cosmetics manufacturers are focusing on their online marketing campaigns.

Natural and Vegan Cosmetics—An Overview

Vegan cosmetics constitute 40 percent of the natural cosmetics market. Skin care occupies about 35 percent of the vegan cosmetics market followed by hair care at about 20 percent. Vegan fragrances are expected to increase at a rate of 8–9 percent among all the product segments. Cannabidiol (CBD) infused products are gaining popularity as they are being used to address health concerns, such as anxiety and insomnia. Counterfeiting in the vegan cosmetics product space coupled with short shelf life are major barriers for growth. Consumers are no longer satisfied with ingredient transparency and origin of the ingredients. The demand for certified organic and natural products is rising with COSMOS and ECOCERT standards for organic products, and Fairtrade International standards being the two most common and sought-after certifications. Cosmetics manufacturers are also focusing on promoting the performance of their natural ingredients, especially in the case of botanical extracts like polyphenols, etc., rather than focusing on the origin of the products.

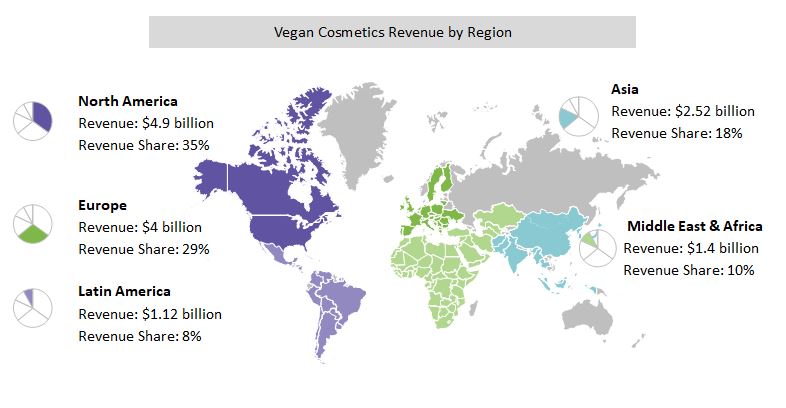

Vegan Cosmetics Market—Revenue by Region

Developed regions dominate the vegan market space - Europe and North America together occupy around 60 percent of the overall vegan cosmetics market share owing to increased awareness generated by beauty bloggers and social media channels. Millennial users in these regions have more freedom of choice in buying and experimenting with different kinds of cosmetic products. Asia Pacific is expected to exhibit a high growth rate, closely followed by the Middle East where consumers are increasingly being inspired by ethical choices.

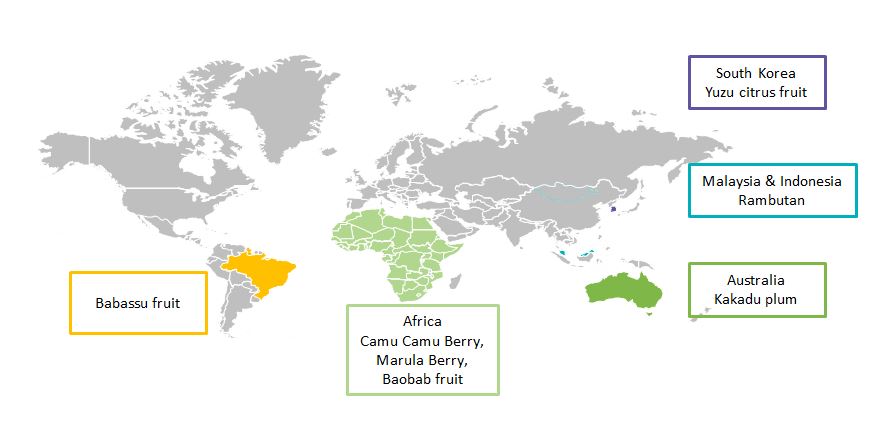

Emerging Sourcing Destinations for Innovative Vegan Ingredients

Cannabidiol-Based Cosmetic Products

Cannabidiol (CBD) is one of the many naturally occurring chemical compounds found in the cannabis plant. CBD is not a major component of marijuana. CBD is present in different amounts, and is commonly found in the flowers and buds of the cannabis plant. Cannabidiol-based cosmetic products and CBD oil are gaining popularity due to their antioxidant and anti-inflammatory benefits. CBD is widely used in various skincare products such as masks, facial serums, body lotions, creams and moisturizers, and lip balms as it helps to reduce redness, promotes collagen production, and tightens skin. It can be used in bath products like bath bombs and scrubs for its potential anti-anxiety benefits. It is also being used to replace beeswax (animal-based product) in mascara and eyebrow gels.

|

Brand |

Product Name |

Product Type |

|

Herbivore Botanicals |

CBD + Adaptogens Deep Moisture Glow Oil |

Skin Care |

|

Cannuka |

CBD Calming Eye Balm |

Eye Cream |

|

Milk Makeup |

Kush Mascara |

Color Cosmetics |

|

Lord Jones’ |

High CBD Pain and Wellness Formula |

Body Care |

|

Milk Makeup |

Kush Lip Glaze |

Color Cosmetics |

|

Kiehl’s |

Cannabis Sattiva Seed Oil Herbal Concentrate |

Skin Care |

|

Cannuka |

CBD Cleansing Body Bar |

Body Care |

|

CBD for Life |

Pure CBD Eye Serum |

Eye Serum |

|

Kana Skincare |

Lavender CBD Sleeping Mask |

Skin Care |

|

India, Waterman, Bambeautiful |

Various Products |

Hair care |

Major Vegan Brands in North America and Europe:

These brands have been certified by PETA and are also cruelty free, which means that their products are not tested on animals at any stage of production. They also include vegan cosmetic tool brands:

|

Vegan Brands |

Country |

Product Types |

Sustainability Claims |

|

Cover FX |

USA |

Skin care, Color cosmetics |

|

|

Arbonne |

UK |

Skin care, Bath and Body, Hair care, Color cosmetics |

|

|

Pacifica Beauty |

USA |

Skin care, Perfumes, Color cosmetics |

|

|

Nature’s Gate |

USA |

Skin care, Hair care, Oral care, Sun care |

|

|

Beauty without Cruelty |

UK |

Skin care, Hair care, Color cosmetics, Nail care |

|

|

Billy Jealousy |

USA |

Male grooming products (Beard oil, Pomade, Shaving products) |

|

|

ColorProof Evolved Color care |

USA |

Hair care for color treated hair |

|

|

MuLondon Organic |

UK |

Skin care |

|

|

EcoTools Nanshy |

USA UK |

Makeup brushes, Hairbrushes |

Recycled materials, Tree free (made from cotton and recycled bamboo fibers) |

Vegan Brands Launches and Acquisitions by Major Personal Care Companies

|

Unilever’s launch of Love Beauty and Planet |

|

|

L’Oréal’s acquisition of Logocos |

|

References

- Market News, Suppliers Websites, several articles

- Beroe Database

- Bloomberg Business Intelligence

- Market News, Suppliers Websites

- www.cosmetics-design.com

- www.cosmeticsbusiness.com

- www.byrdie.com

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe