Insights

Five strategies for continuous procurement improvement performance

Author: Praisy R A

Lead Analyst – Pharma Directs

Key insights you'll gain

The pharmaceutical manufacturing sector faces increasing pressure to optimize procurement performance amidst rising costs, regulatory complexities, and supply chain vulnerabilities. This whitepaper explores five strategies for continuous procurement performance improvement, aiming to drive efficiency, enhance resilience, and enable sustainable growth in pharmaceutical companies.

Key findings indicate that adopting a strategic, data-driven approach to supplier relationships, integrating advanced technologies, and embracing regulatory changes are critical to mitigating procurement risks. Through in-depth analysis, we identify key trends in supplier diversification, digital procurement transformation, and process automation, providing actionable insights for pharmaceutical companies.

The recommendedations focus on data analytics for informed decision-making, risk management practices, supplier collaboration, cost reduction, and enhanced transparency in procurement processes. These strategies are aimed at boosting procurement agility and responsiveness, ultimately leading to reduced operational disruptions, increased profitability, and a competitive edge in a rapidly evolving market.

By following these strategies, pharmaceutical companies can address current procurement challenges while positioning themselves for long-term success going into 2026 and beyond.

Why is continuous procurement improvement performance important for pharma companies?

The pharmaceutical manufacturing industry is increasingly facing complex challenges in procurement, driven by supply chain disruptions, regulatory changes, and escalating demand for cost efficiencies. As the global pharmaceutical market continues to expand, procurement teams are tasked with managing a growing range of suppliers, materials, and regulatory requirements. In this environment, traditional procurement methods are no longer sufficient to meet the evolving needs of the industry.

Pharmaceutical companies are under constant pressure to ensure timely availability of raw materials, active pharmaceutical ingredients (APIs), and packaging, while maintaining quality standards and compliance with ever-tightening regulations. A growing shift toward advanced therapeutics, biologics, and personalized medicines adds layers of complexity to procurement strategies. Geopolitical factors, such as tariff impacts and trade uncertainties, further complicate procurement dynamics.

As a result, improving procurement performance has become a critical priority for pharmaceutical manufacturers looking to enhance supply chain resilience, reduce costs, and maintain competitiveness.

What are the challenges and best practices in pharmaceutical procurement today?

Pharmaceutical procurement is challenged by rising operational costs, increased complexity in supply chain management, and an evolving regulatory landscape. These factors have created an urgent need for continuous improvement in procurement performance. Without adopting innovative strategies, pharmaceutical manufacturers risk falling behind in a competitive market, compromising cost-efficiency, regulatory compliance, and supply chain resilience.

Rising costs of raw materials and apis

The cost of raw materials, particularly APIs and excipients, has been increasing steadily due to factors such as inflation, geopolitical instability, and disruptions in global supply chains. This trend poses significant challenges for pharmaceutical manufacturers trying to maintain profitability without compromising on product quality or regulatory standards. In 2025, this trend is expected to intensify, exacerbating the pressure on procurement teams to negotiate favorable terms and secure stable supplies.

Best practices: Rising costs and volatile raw material prices are significant obstacles. Procurement teams must focus on long-term cost reduction strategies, such as negotiating better contract terms, leveraging global sourcing, and implementing efficient inventory management systems

Regulatory compliance complexities

Pharmaceutical companies face stringent regulations across different regions, requiring meticulous monitoring of suppliers and raw materials. The increasing frequency of regulatory updates, particularly concerning quality assurance, environmental sustainability, and safety standards, demands constant attention from procurement teams. Non-compliance can lead to costly delays, penalties, and reputational damage. In the coming years, regulatory challenges are expected to become more complex, necessitating improved procurement processes to ensure ongoing compliance.

Best practices: Pharmaceutical procurement must account for evolving regional regulations, which often include complex approval processes for raw materials and finished products. Procurement teams must stay ahead of regulatory changes to prevent disruptions and ensure compliance, requiring more robust supplier audits and quality control measures.

Supply chain vulnerabilities

Global supply chains have become more vulnerable to disruptions caused by trade wars, pandemics, and natural disasters. The pharmaceutical sector is particularly susceptible due to its reliance on complex, often global supply chains for critical raw materials. Procurement teams are faced with increasing challenges in sourcing materials from reliable suppliers, maintaining supply chain transparency, and managing risks effectively. In 2025, these issues will continue to impact procurement performance, requiring strategic adjustments to mitigate risks.

Best practices: The need for agile supply chains is more pressing than ever. Many procurement teams are now diversifying their supplier base to mitigate risks from over-reliance on a single source. However, this requires careful vetting and collaboration with multiple suppliers to ensure consistent quality and reliability.

Technological gaps in procurement operations

Many pharmaceutical manufacturers continue to rely on traditional procurement methods, such as manual processes and siloed data management. This leads to inefficiencies, errors, and delays in procurement activities. The lack of integration between procurement functions and other business units (e.g., production, quality control) further exacerbates these challenges. To remain competitive, pharmaceutical companies must embrace digital tools to streamline procurement operations and improve decision-making.

Best practices: Procurement teams can improve performance by adopting integrated digital solutions that automate manual tasks and centralize data across functions. Implementing Enterprise Resource Planning (ERP) systems or cloud-based platforms can enhance collaboration between procurement, production, and quality control teams, ensuring real-time data sharing and seamless workflows. Additionally, leveraging AI and data analytics can enable predictive insights, optimize supplier selection, and reduce errors. These technologies streamline operations, increase efficiency, and facilitate better decision-making, ultimately driving cost savings and enhancing supply chain resilience.

Why does procurement performance improvement matter today?

Need for cost optimization | 200 pharmaceutical companies revealed that 68% cited cost pressures and supply chain disruptions as the top challenges facing their procurement teams |

Need for digital transformation | 59% of pharmaceutical companies reported that digital transformation in procurement has improved efficiency and reduced operational costs by an average of 15% |

Need for optimized procurement strategies | Global API market is projected to grow at a CAGR of 6-7% between 2025 and 2028, intensifying the need for optimized procurement strategies |

Table 1 – Need for procurement performance improvement

To evaluate solutions for improving procurement performance in pharmaceutical manufacturing, the following parameters and criteria must be considered.

Benefits | Improved efficiency, reduced operational disruptions, and cost savings |

Risks | Implementation challenges, initial costs, and potential disruptions during the transition |

Limitations | Dependency on technology and the need for continuous monitoring. |

Implementation | Timeframe, training, and resources required for smooth adoption |

Table 2: Criteria for evaluating procurement performance

Five strategies for continuous procurement performance improvement

Compliance: Ensuring procurement processes align with evolving global regulations is crucial for maintaining product quality and avoiding costly penalties. Establishing automated systems for compliance tracking helps minimize errors and ensures adherence to industry standards like GMP and GDP, enhancing operational reliability.

Scalability: Pharmaceutical procurement systems must be scalable to accommodate growth and fluctuating demand. This requires implementing flexible sourcing strategies and digital solutions that can easily adapt to new product lines, expanded markets, or increased production volumes, supporting long-term operational efficiency.

Technological integration: Integrating advanced technologies such as AI, blockchain, and ERP systems streamlines procurement by enabling real-time tracking, better supplier management, and data-driven decision-making. Automation and data analytics also help optimize procurement cycles, reducing time and errors.

Cost effectiveness: To drive cost savings, pharmaceutical manufacturers need to focus on optimizing supplier negotiations, improving inventory management, and leveraging strategic sourcing. Data-driven approaches help identify the best pricing models, reduce waste, and ensure that procurement decisions align with budget constraints.

Risk management: Robust risk management practices, such as supplier diversification, early-warning systems, and contingency planning, are essential in mitigating disruptions from supply chain failures, geopolitical risks, or regulatory changes. Proactive risk assessments help procurement teams secure reliable sources of critical materials.

How should pharma procurement companies approach this?

Solution | Digital procurement transformation | Supplier diversification and strategic partnerships | Advanced data analytics for informed decision-making |

Description | Adopting digital procurement platforms, such as cloud-based sourcing solutions and AI-powered procurement tools, can streamline operations, improve data-driven decision-making, and enhance collaboration across departments | Expanding the supplier base and forming strategic partnerships with key suppliers can mitigate risks of supply chain disruptions and enhance flexibility | Utilizing advanced analytics tools to monitor procurement performance, forecast demand, and optimize supplier selection and contract negotiations |

Benefits | Enhanced efficiency, real-time data access, automated procurement processes | Reduced dependency on single suppliers, improved resilience. | Data-driven insights, improved decision-making, proactive risk management |

Costs | Initial software costs, training, and implementation time | Supplier vetting, potential higher initial costs for diversified supply | Investment in analytics software, data infrastructure, and skilled personnel |

Risks | Potential integration challenges with existing systems. | Coordination complexities and potential quality variations | Data quality issues and potential resistance to adopting new tools |

Implementation considerations | A phased implementation with training for staff and stakeholders. | Establishing clear supplier performance metrics and regular audits. | Integration with existing ERP systems and training staff |

Table 3 – Approach for procurement performance improvement

What actions should pharma procurement functions take?

Pharmaceutical manufacturers must take immediate steps to enhance procurement performance through digital transformation, strategic supplier diversification, and data-driven decision-making. Stakeholders should prioritize these initiatives to remain competitive and achieve long-term success in 2025.

What’s next for pharma procurement?

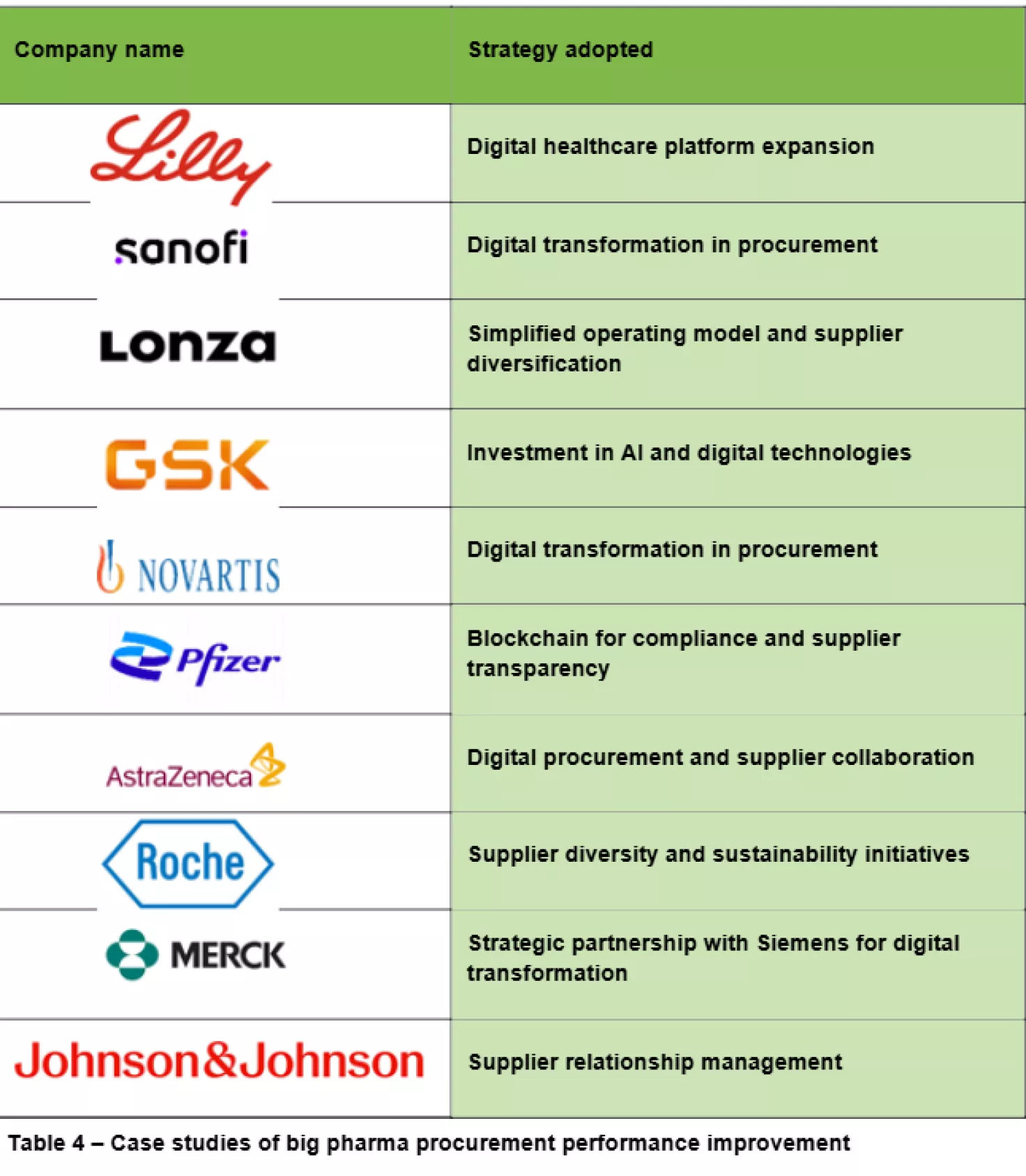

To remain competitive in an increasingly complex pharmaceutical landscape, companies must adopt continuous procurement improvement strategies. This whitepaper highlights five key strategies—digital transformation, supplier diversification, advanced data analytics, cost optimization, and regulatory alignment—that are essential for addressing procurement challenges in 2025. By implementing these strategies, companies can enhance procurement efficiency, reduce risks, and ensure regulatory compliance.

The benefits of adopting these strategies are clear: reduced costs, improved supplier collaboration, greater resilience to supply chain disruptions, and enhanced decision-making capabilities. These strategies also enable companies to meet growing demand and regulatory expectations, positioning them for sustained growth and success.

The recommendations provided in this whitepaper serve as a roadmap for pharmaceutical companies looking to optimize procurement performance. By taking decisive action today, procurement teams can build a strong foundation for the future, ensuring their companies remain competitive and resilient in the face of ongoing industry challenges.

About Author

Praisy R A holds master’s in biotechnology with 12 years of experience, including 9 years in market research, pharma, and procurement. As a seasoned Lead Analyst, she specializes in APIs, Intermediates, Excipients, and Formulation categories, providing strategic market insights and driving key decisions. Skilled in supplier negotiation, sourcing, and cost benchmarking, Praisy excels in competitive intelligence and market analysis. Known for fostering strong relationships with clients and suppliers, Praisy’s communication skills help bridge the gap between strategic sourcing and business success.

Request a demo

Discover how our solutions can benefit you. Partner with us to unlock potential and drive success. Let's work together to achieve outstanding results.

Get in touch

We’re here to assist you! If you have any questions or need support, don’t hesitate to reach out. Contact us today and we’ll respond promptly to help with your needs.

References

“Pharma Procurement in 2025 and 2026: Key Challenges and How to Get Ahead,” Cognition, Jul. 02, 2025.

Himanshu Khanna, “Pharma Procurement Challenges and Solutions | Spendedge,” SpendEdge Procurement Market Intelligence Solutions, Dec. 07, 2023.

Drug Patent Watch, “Procurement Mistakes That Are Costing Your Pharma Business Millions,” Drug Patent Watch – Transform Data into Market Domination, May 21, 2025.

“Procurement in Pharma: What are the major challenges in 2024?” Accelerate, May 15, 2024.

Drug Patent Watch, “Pharmaceutical Procurement Practice Aspects: A Comprehensive Guide to Market Domination,” Drug Patent Watch – Transform Data into Market Domination, Aug 28, 2025.

“Category Management Strategies in Pharma Procurement,” Akirolabs.com, 2025.

Chris Dunne, “How to develop an effective procurement strategy in 2025,” Spendesk.com, Mar, 2025.

K. Geldis, “Bio Pharma Procurement Strategy: Best Practices for Cost and Compliance,” Graphite, Jun. 10, 2025.

Kughong Walters, “Improving Pharmaceutical Procurement and Supply Chain Efficiency in Cameroon with Innovative Models and Strategic Coordination,” International Journal of Research and Innovation in Social Science, Feb 2025.

H. Ayodimeji-Alaba, A. Kafayat Balogun, K. Adebayo, and O. Shodimu, “Strategic procurement practices in healthcare organizations and their impact on Medicaid and Medicare cost containment,” World Journal of Advanced Research and Reviews, vol. 2025, no. 01, pp. 1863–1872

Becky Myles, “Procurement Strategy 2025-2030”, April 2025

Lee Ann Salandy, “Efficient Pharmaceutical Supply Chain Management Strategies for Tertiary Care Hospitals in the Caribbean”, Walden University, Sep 2025

Supplier Interaction

Supplier Websites

Expert Interaction

Annual Reports