Container Shipping – a Market Reset After Prolonged Disruption

The container shipping industry entering 2026 bears little resemblance to the market that existed prior to 2020. What began as a demand shock during the pandemic quickly evolved into a prolonged period of capacity tightness, congestion, and unprecedented freight rate inflation. For several years, pricing was driven less by fundamentals and more by disruption.

Now a gradual reset is underway. New vessel deliveries are entering service at scale, global consumption growth is slowing, and inventory normalization is largely complete across major importing regions. These forces are pulling the market back toward structural oversupply.

However, this reset is not smooth. Instead of a clean transition back to predictable cycles, the market has entered a phase where normalization is repeatedly interrupted. For shippers, this means that while rates may trend lower, the path remains uneven and difficult. (1)

Breakdown of Traditional Seasonality

One of the most important changes for procurement teams is the erosion of traditional seasonality. Historically, peak and slack periods provided a reliable framework for contracting decisions. Since 2024, that framework has weakened significantly.

Red Sea rerouting absorbed capacity and distorted supply signals. U.S. tariff uncertainty triggered front loading of cargo at irregular intervals. Carriers responded with tactical blank sailings and service reshuffling, often independent of demand patterns. As a result, freight rate movements became reactive rather than cyclical.

This shift has meaningful implications. Procurement strategies built on historical timing assumptions now carry higher risk. Contracts signed at what would normally be considered safe points in the cycle have quickly become misaligned with the market. (2)

What This Means for Shippers Heading Into 2026

The challenge now lies in navigating a market where volatility, execution risk, and cost uncertainty persist even as pricing pressure eases. Shippers must recalibrate expectations. A softer market doesn’t eliminate risk, it reshapes it. Procurement’s focus must shift from chasing the lowest headline rate to managing timing, flexibility, total landed cost exposure, and securing capacity with deliberate carrier allocations and well-timed strategic commitments. (3)

Why Procurement Is More Complex in 2026

Structural Oversupply, Unevenly Felt

Fleet expansion is the most important structural driver of the 2026 outlook. A large volume of vessels ordered during the high rate years continues to enter the market. Scrapping activity remains limited, partly because extended routings and inefficiencies have kept older tonnages economically viable.

On a global level, capacity growth exceeds demand growth. In theory, this should translate into sustained downward pressure on freight rates. In practice, the impact is uneven.

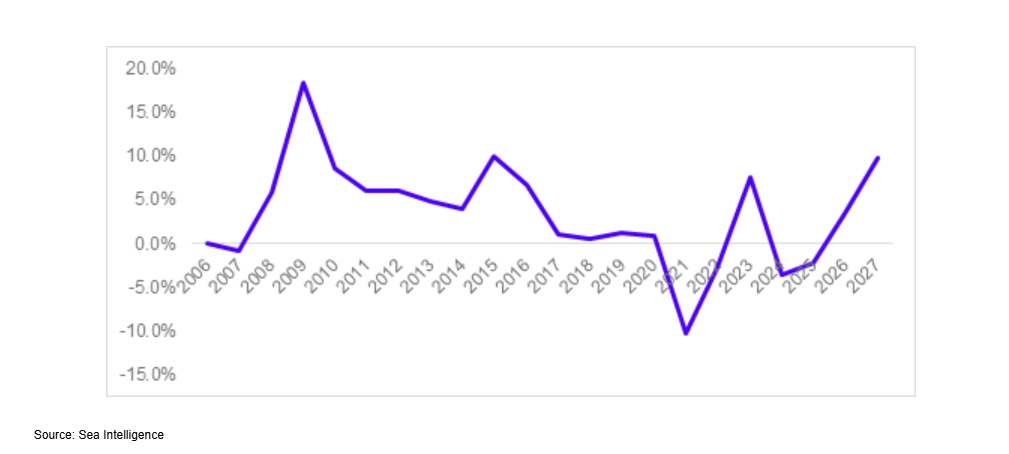

Figure 1: Global Capacity Growth

The container market is moving from tight capacity into oversupply, likely peaking in 2027 at levels similar to 2016 an intense price war cycle. The forecast assumes Red Sea normalization by 2026, unlocking latent capacity. Scrapping momentum from 2026, including ageing vessels (20+ years, which is 13% of the total fleet), is critical to balance the surplus. The outlook remains exposed to disruption risks, fresh newbuild orders, and downside demand pressure from U.S. trade policy uncertainty. (4)

Red Sea Normalization as a Volatility Multiplier

Red Sea disruptions have played a critical role in absorbing excess capacity. Rerouting vessels around the Cape of Good Hope increased transit times and temporarily tightened supply, which supported rates and masked underlying oversupply.

As security risks ease, carriers are beginning to test selective transits. A full return to Suez is unlikely to be immediate, but even a gradual shift has implications. Shorter routings release effective capacity back into the market quickly.

The timing of this shift is more critical than the shift itself. If capacity returns during slack demand periods, rate pressure may accelerate. Congestion risk exists in both scenarios, but if the transition lands in peak season, the impact will be significantly higher amplifying port bottlenecks, schedule disruption, and network strain which could last for several months. This creates volatility that makes planning more complex and execution more fragile. (2)

Pricing Volatility Without Seasonal Anchors

Freight rate behavior since 2024 highlights a broader issue: price signals have become less reliable. Rates respond rapidly to geopolitical developments, policy announcements, and carrier interventions. This increases the risk of mistimed contracts.

Shippers locking in long-term rates face two asymmetric risks. Contracting too early exposes them to overpaying in a falling market. Waiting too long increases exposure to short term spikes triggered by disruption. Navigating this balance is one of the central procurement challenges for 2026. (5)

Demand Uncertainty Driven by U.S. Trade Policy

On the demand side, uncertainty remains elevated, particularly in the United States. Tariff discussions and trade policy shifts continue to influence importer behavior. Front-loading, cautious inventory planning, and delayed purchasing decisions have created uneven volume patterns.

While overall demand growth appears subdued, sudden shifts remain possible if policy signals change. This makes demand forecasting less reliable and increases the risk associated with fixed volume commitments. (6)

Regulatory and Cost Stack Complexity

Even as base freight rates soften, regulatory costs are becoming more visible. Emissions related charges, fuel regulations, US policy changes and sustainability surcharges are increasingly embedded in pricing structures. These costs vary by trade, vessel type, and regulatory regime.

Carriers are deploying newer, alternative fuel capable vessels into European networks, driven by regulatory direction and long-term fleet strategy. The result is a two-tier cost structure where the chosen service can materially influence end-to-end freight spend. Shippers benchmarking solely on headline rates may miss the real cost divergence forming under the surface, and with it, the risk attached to service selection. (7)

Fragmented Carrier Capacity Strategies

Carrier behavior itself adds complexity. Alliances no longer pursue uniform capacity strategies across trades. Some trade lanes see deliberate capacity restraint to defend pricing, while others absorb excess tonnage to protect core lanes.

For shippers, this means global indices alone are insufficient. Procurement decisions must be informed by trade-specific capacity behavior and carrier strategy. (6)

Criteria for Evaluating Procurement Strategies

Lean cost efficiency only delivers when contracts can truly hold through disruption. This pattern appears repeatedly when vessel space or equipment supply tighten during market shocks; spot rates react first and react fast. Contracts that sit far below live market levels may look efficient in a softer cycle, but the moment shippers are forced into spot exposure to keep cargo moving, that gap becomes a real and measurable risk.

Contracts should reflect market reality, not mirror peak levels but acknowledge fair market ranges so that cargo is onboarded without friction, even when the network is under severe strain. In constrained capacity environments, the right contract isn’t defined by the lowest rate signed in stable months, but by allocation backing, capacity priority, and commercial alignment with market levels that keep execution barriers low when disruptions intensify.

A softer market in 2026 should not be mistaken for a safer one. The risk doesn’t disappear it changes shape. Contracting outcomes must balance cost ambition with the ability to secure space and move cargo reliably, without onboarding challenges, when the network is operating under maximum stress.

The market remains volatile, driven by Red Sea routing risk, recurring network disruptions, and accelerating regulatory actions around emissions and fleet compliance. Procurement planning must assume instability as the baseline, not the exception. (7)

How Shippers Should Respond

Contract Timing

It is advantageous to contract in February/March following Chinese New Year, when the market typically sees demand weakness and carriers push to fill open capacity. Contracts aligned to realistic market ranges help ensure cargo onboarding remains smooth. The market remains volatile due to Red Sea risk, recurring disruptions, and tightening regulations. (8)

Pricing Structure: Fixed vs Index-Linked Models

Index linked pricing models are better suited to a volatile downcycle, reducing the risk of fixing above-market rates while keeping protection against sudden spikes. Index linked contracts are also gaining traction, with recent carrier commentaries highlighting increased adoption of this model. In a market where volatility is driven by disruptions, not cycles, pricing flexibility becomes a strategic edge. (9)

Network and Port Diversification

Diversifying ports and routings reduces reliance on single gateways and strengthens resilience. Given the recurring Red Sea risk and the likelihood of major hubs facing congestion, it is prudent to secure alternative port options during negotiations, or contract with carriers offering wider port call flexibility. This optionality safeguards cargo flow when primary gateways are impacted, delivering a safer execution path despite added complexity.

Detention, Demurrage, and Execution Risk Control

As free time tightens, detention and demurrage control become core cost levers. In door-to-door contracts, the execution risk is largely absorbed by the carrier, improving predictability for shippers. In port-to-port, the risk shifts to the shipper, making inland coordination and cargo evacuation speed critical to avoidable cost.

Carrier Selection and Volume Consolidation

Carrier selection must prioritize network reliability and execution strength. For example, Alliance services like Gemini are being positioned for higher schedule reliability, while MSC continues expanding port coverage and market share adding more port calls and capacity, particularly across Transatlantic and Transatlantic-linked networks. Larger carrier share, broader port options, and stronger alliances provide safer routing alternatives when primary gateways face stress.

Even in an oversupplied market, volume remains a strategic negotiation lever. Consolidated, selectively deployed commitments with reliable network carriers consistently outperform opportunistic spot buying, especially when disruptions test allocation priority and service stability.

Combine forward planning with stronger visibility, real-time market monitoring, and agile contracting frameworks

The 2026 container shipping market presents meaningful commercial opportunity, supported by structural oversupply and moderated demand growth. However, pricing variability and operational risks continue to shape execution reliability. In this environment, procurement outcomes will favor shippers that combine forward planning with stronger visibility, real-time market monitoring, and agile contracting frameworks. Success will rely less on point rate forecasting and more flexible pricing structures, proactive carrier allocations, and tighter total cost governance. Enhanced supply chain visibility and collaboration with carriers and service partners will be critical to secure savings alongside capacity assurance, particularly as external developments, including Red Sea dynamics and policy led vessel network changes, continue to influence market stability and outcomes.

References

[1] Global Container Trade: 2025 Performance Review and 2026 Forecasts

https://www.vizionapi.com/blog/global-container-trade-2025-performance-review-and-2026-forecasts

[2] The coming overcapacity to peak in 2027

https://www.sea-intelligence.com/press-room/349-the-coming-overcapacity-to-peak-in-2027

[3] A Resiliency Roadmap For Navigating Ocean Freight in 2026

https://www.ismworld.org/supply-management-news-and-reports/news-publications/inside-supply-management-magazine/blog/2025/2025-10/a-resiliency-roadmap-for-navigating-ocean-freight-in-2026/

[4] 2025 Q4 Global Freight Transportation and Logistics Trends

https://developer.ups.com/ca/en/supplychain/resources/news-and-market-updates/quarterly-freight-and-logistics-trends

[5] Ocean Freight Market Report

https://www.bertling.com/news-pool/market/ocean-freight-market-report-october/

[6] How Rates, Capacity Cuts, and the China Trade Truce Are Reshaping Global Trade

https://www.vizionapi.com/blog/how-rates-capacity-cuts-and-the-china-trade-truce-are-reshaping-global-trade

[7] Shipping Market Outlook: 2025 Forecast

https://veson.com/blog/shipping-market-outlook-q4-2025-forecast/

[8] October spot rate spike: what it means for 2026 ocean freight tenders

https://www.xeneta.com/blog/october-spot-rate-spike-2026-ocean-freight-tenders

[9] Global Container Trade: 2025 Performance Review and 2026 Forecasts

https://www.vizionapi.com/blog/global-container-trade-2025-performance-review-and-2026-forecasts

[10]Index Linking: The Future of Stable, Market-Aligned Contracts

https://www.freightos.com/logistics-technology-insights/logistics-technology/index-linking-freight-contracts-guide/

Author

Related Reading

02 Feb, 2026

Managing volatility: Predictive Commodity Risk Management for Diesel and Gasoline