As tariff tensions escalate, the global procurement landscape is entering a new phase of disruption.

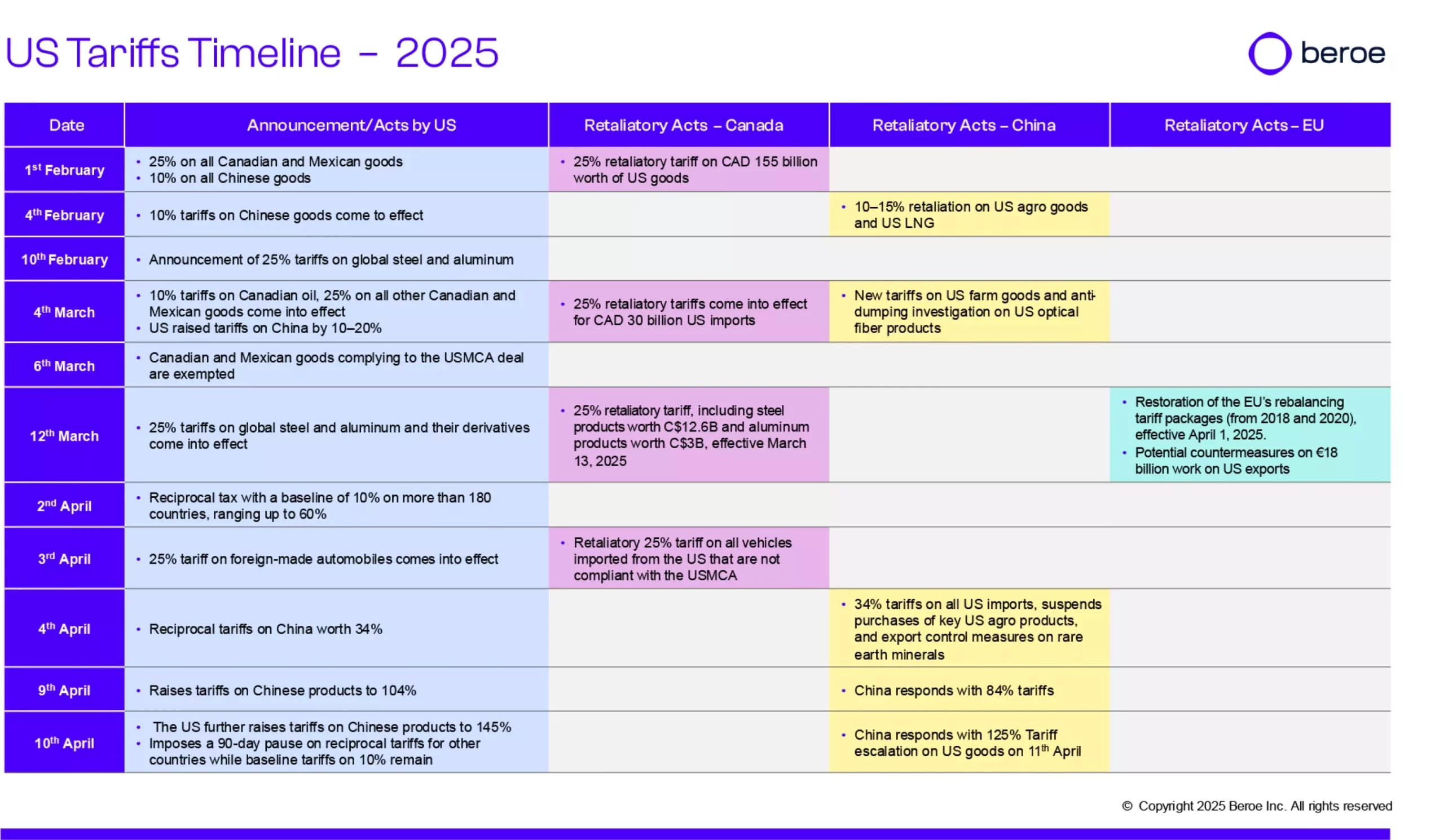

The U.S. has rolled out sweeping tariff hikes, most notably a 145% tariff on China, and 25% duties on Canada and Mexico, and the steel, aluminum, and auto sectors. While some reciprocal tariffs are on a 90-day pause, China has retaliated with a 125% tariff, and more trade partners are expected to follow.

These shifts are not just political—they’re reshaping trade routes, altering supplier dynamics, and heightening procurement risk across sectors and regions.

Tariff Timeline and Economic Impact

The escalation ramped up at the start of April 2025, and unless paused or renegotiated, broader reciprocal tariffs could take effect by July, with countries like Vietnam, Thailand, Japan, Taiwan, and India facing the brunt of U.S. measures.

Procurement teams are already grappling with:

- Higher import costs

- Production delays from nearshoring/relocation

- Decline in consumer confidence and investment flow

- A rising risk of recession in the U.S., currently estimated at 30% according to Bloomberg consensus

What This Means for Global Trade

- Export-heavy economies like Germany and APAC nations may experience lower growth rates.

- Companies sourcing from China, Vietnam, and African nations are actively exploring alternate import destinations.

- Across sectors, there’s a shift toward local production, joint ventures, and flexible supplier contracts

Tariff Impact by Industry

- Food & Beverage: Increased costs for ingredients and packaging, especially from APAC and North America.

- Pharmaceutical & Biotech: Tariffs on active ingredients and lab equipment are disrupting supply continuity.

- Telecom & Electronics: Higher component costs threaten margins; 5G rollouts may face delays.

- Chemicals & Capital Equipment: Supply chain realignment required due to high tariffs on inputs and machinery.

- Personal Care & Consumer Goods: Tariffs on packaging and raw materials are squeezing margins.

- Containers & Packaging: Pricing volatility expected due to higher duties on steel and plastic-based imports.

- Oil & Gas / Metals & Mining: Tariffs on critical minerals and industrial inputs may push up production costs.

- Healthcare Equipment: Import costs rising for precision devices and consumables sourced from Asia.

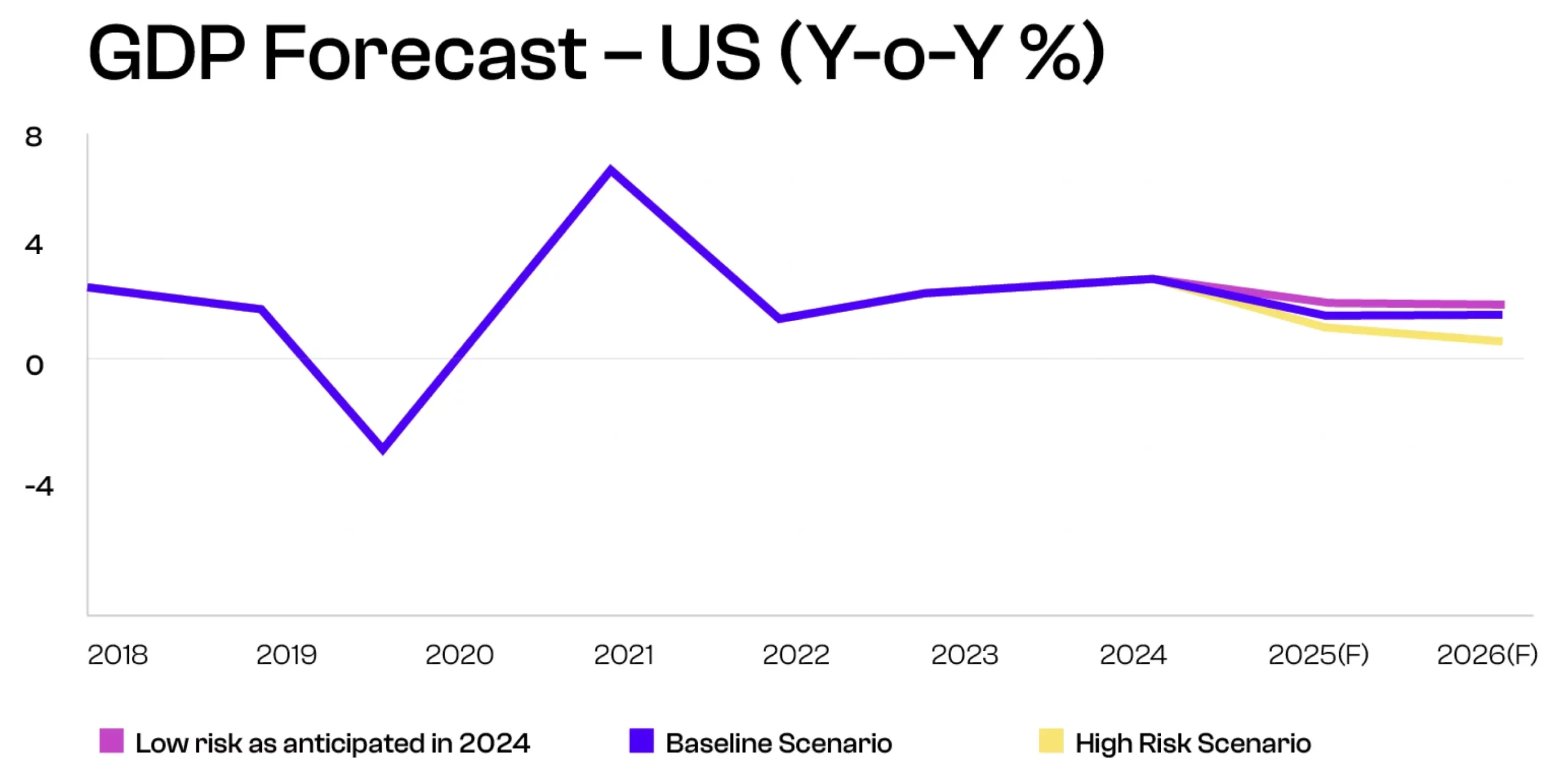

High-Risk Outlook for 2025

The outlook in the US projects turbulent conditions ahead, which will likely have major knock-on effects with trading partners:

- Drop in consumer confidence suggests economic slowdown risk for 2025.

- Unemployment projected to increase to 4.5% in 2025 and 2026 up from 4% in 2024.

- Downward revision in Fed rate is expected to be limited, due to inflationary pressures, and the rate is expected to reach 4.0% by the end of 2025 or early 2026 to support economic recovery.

- A tight labor market amid federal job cuts and immigration constraints

- Further escalation of tariffs on other sectors, like semiconductors, copper, pharmaceutical, and critical minerals

- Termination of the USMCA deal in 2025/2026 and withdrawal from other trade agreements

While tax cuts and cautious Fed policy may offer limited support, a broader downturn could still unfold. Further retaliatory tariffs by other countries are expected.

Risk Mitigation for Procurement Teams

What can procurement leaders do in this environment?

- Diversify sourcing across untapped or low-tariff regions.

- Build regional resilience through joint ventures and better logistics planning.

- Negotiate smarter contracts that account for price volatility linked to tariffs.

- Countries that are imposed with high tariff rates, like China, Vietnam, and African countries, should look out for alternate import markets

Final Thought

Tariff-driven disruptions are here—and they’re real. Whether you’re in food processing, critical minerals, telecom, or manufacturing, it’s time to adapt quickly and intelligently.

To learn more about the industry-specific impact of tariffs, please click here

Let Beroe help you stay informed and future-ready.

Related Reading

02 Mar, 2026

Why are Category Management Platforms a Gamechanger for Modern Procurement Teams

26 Feb, 2026

Navigating Risks and Opportunities in Oil Extraction: A PESTEL Analysis for Procurement Leaders