Demand for recycled resins has regained strong momentum amid a wave of new regulatory mandates across geographies, placing renewed pressure on brand owners to revisit their internal sustainability targets. The key concern is no longer why to act—but how to source enough recycled resin to meet these escalating commitments. With companies facing scrutiny from both regulators and consumers, the question looms large: Are we producing enough PCR to meet surging demand?

As industries compete for limited supplies, prices are beginning to spike. In India, PCR prices have risen by up to 30% in some segments, and by 2026, recycled resins are projected to maintain a 20% price premium over virgin alternatives globally. This article examines global PCR supply pressures and outlines strategic steps procurement leaders must take to mitigate risk and ensure supply continuity.

Regulatory Pressures Driving Demand

- European Union: The new Packaging and Packaging Waste Regulation mandates that all packaging must be recyclable by 2030 and sets compulsory recycled content thresholds—for example, 25% rPET in beverage bottles by 2025 and 30% by 2030.

- United States: While no federal regulation exists, five states (including California, Washington, and New Jersey) have adopted minimum PCR content laws. California leads with a phased approach—15% by 2022, 25% by 2025, and 50% by 2030 for beverage bottles.

- India: In a bold move, India’s Plastic Waste Management Rules require rigid plastic packaging to contain at least 30% recycled content from April 2025 onward, increasing by 10% annually thereafter.

Brand Owner Sustainability Targets are Fueling PCR Demand

Beyond regulations, major brand owners across fast-moving consumer goods (FMCG) and beverage industries have set ambitious sustainability targets that are dramatically increasing demand for recycled PET, HDPE, and other resins. These voluntary corporate pledges often even exceed regulatory requirements, as companies race to meet public commitments and avoid reputational risks associated with plastic waste.

- Unilever pledged that by 2025, 25% of the plastic in its packaging will be recycled material.

- Similarly, Nestlé has a global commitment to average 30% recycled content in its plastic packaging by 2025.

- The Coca-Cola Company announced, as part of its World Without Waste initiative, a goal to use at least 50% recycled material in its packaging by 2030.

However, in the light of the ongoing supply shortages, especially in India, companies are also relooking at their recycled resin commitments.

- PepsiCo initially set a similar target of 50% recycled content in plastics by 2030, though recently, it revised the goal to 40% PCR by 2035, considering current supply and cost challenges.

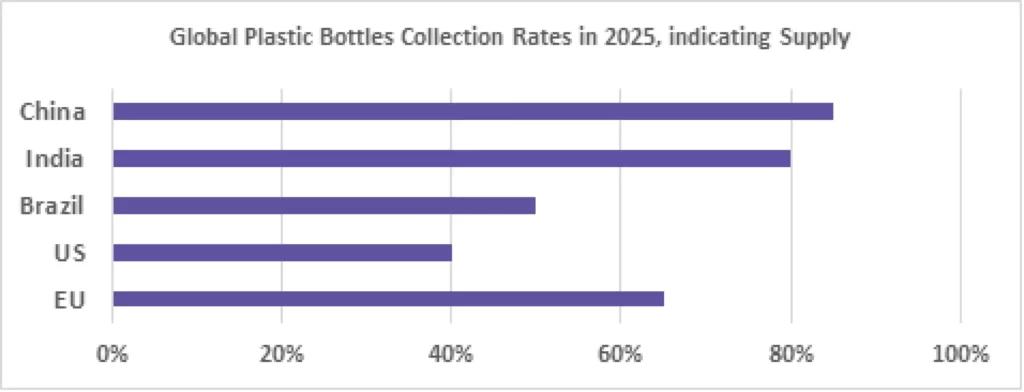

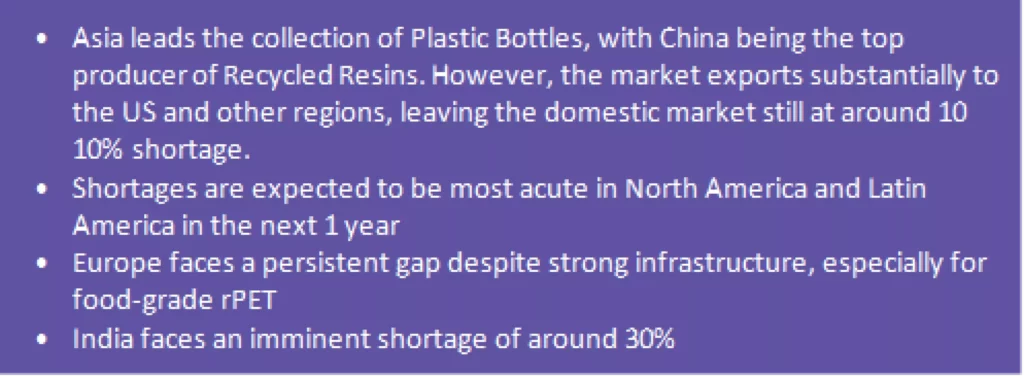

Supply Shortages and Price Volatility in PCR across Markets

The collection and recycling infrastructure is struggling to keep pace with the new demand. In many regions, only a fraction of plastic waste is being collected and reprocessed into high-quality PCR. For instance, in the U.S., the supply of recycled PET amounts to only 20% of total PET demand, leaving a substantial gap. Globally, it is estimated that the recycling capacity needs to at least double for PET by 2030 and increase 5-fold for polyolefins, HDPE, to meet announced targets.

There are multiple recycling capacities being added at the time of writing, but PCR availability can become a serious bottleneck. Even if the current expansion plans come online, the market is going to experience an acute shortage through the end of this decade.

The effect of the supply gap is already evident in the pricing in many markets. The case study of India can be a precursor to what is to come in Europe and the U.S. shortly.

- In India, the regulatory mandate of 30% PCR in beverages came at a time when the market’s PCR share was only 5%.

- The entire market’s food-grade PCR capability could scale up only to around 15% of the demand, with only 5 food-grade approved suppliers in the market.

- With the substantial supply gap, prices have reportedly spiked as high as 30% in many cases, with some players reverting to virgin due to availability challenges.

OVERVIEW OF GLOBAL SUPPLY & SHORTAGE OF PCR IN 2025

| Region | Estimated Shortage of rPET in 2025 (%) | Commentary |

|---|---|---|

| North America | 30–40% | The U.S. produces around 1 MMT of rPET, while demand (especially from beverage & FMCG industries) exceeds 1.5MMT. Imports (especially from Latin America and Asia) partially fill the gap, but a significant deficit remains. |

| Europe | 15–25% | Europe has ramped up rPET production around 2 MMT, but with 2025 mandates (25% rPET in bottles), demand is surging. While better in collection, the market is experiencing relatively less tightness. |

| Latin America | 35–45% | LATAM, except Mexico, lacks sufficient recycling infrastructure. Many countries rely on imported rPET or export bales due to lack of domestic reprocessing. |

| India | 25–35% | India is scaling up rPET capacity, but demand is rising sharply due to 2025 recycled content mandates (30% in rigid packaging). Imports from China are being considered. |

| China | 20–30% | While China is the world’s largest rPET producer, most output is fiber-grade. There’s a growing domestic shortage of food-grade rPET, especially as China tightens regulations and shifts to bottle-to-bottle recycling. |

Strategies to Navigate the PCR Shortage Scenario in the next 5 years

Investments in Recycling Capacities

The In-House Vs Outsource question has seldom been part of feedstock procurement in the past, but with the current pressures on availability and price spikes, any large buyer of PCR needs to consider the option of investing in feedstock either directly or through partnerships to secure volumes with control over prices. This is a market that is not regulated with multiple indices and reference drivers like polyolefins, and any change in collection rates can instantaneously impact pricing with no control by the buying market. We have seen some of the large buyers make investments in PCR collection and processing. In India, to handle PCR, Coca-Cola is in partnership with Ganesha Ecoshpere and PepsiCo has entered an indirect partnership with the largest PET recycler in the world, Indorama, through its primary bottler, Varun Beverages.

Joining Recycling Infrastructure Alliances

Players are also making alliances to tackle their lack of power over PCR supplies, which eases capital pressure and helps targeted efforts in a large-scale supply revamp.

- Closed Loop Partners Recycling Fund, started in 2020, has investments from multiple large players like Nestle, Coca-Cola and several top CPGs who invested around 30 million USD.

- Africa Plastics Recycling Alliance – companies like Unilever, Coca-Cola, Diageo, P&G, and others collaborate to develop recycling infrastructure in regions like Africa and Southeast Asia. These alliances serve the companies’ long-term sourcing interests by creating more recycled material supply in high-growth markets.

Investments in Novel Recycling Technologies

To supplement mechanical recycling and alleviate supply shortages, companies are exploring advanced recycling technologies (chemical recycling, depolymerization, etc.). These can potentially convert a broader range of plastic waste into usable resin.

- Coca-Cola has provided financing to startups like Ioniqa and CuRe that use chemical processes to recycle mixed plastics, with the expectation that this will create new streams of rPET for bottles.

- P&G is collaborating with Dow to create a new recycling technology to make virgin-like recycled resins. The product is licensed to Purecycle. PureCycle is currently functioning with an expected capacity of approximately over 53,000 TPA at Ironton, Ohio and 500,000 TPA at Augusta, Georgia, in the U.S., over 65,000 TPA in South Korea, Asia and 250,000 TPA in Belgium, Europe for UPR. PureCycle is also further expanding its facilities across Asia and Europe by 2030, China and Latin America by 2032, and Africa by 2037. P&G has realized a revenue of 1.4 million USD in the last year from resins.

Contractual Intervention

For players with limited volumes, direct investments might not be advisable. However, in this case, it is imperative to secure prices against any future volatility. Although the reference indices for rPET and rHDPE are not exhaustively used in contracts to fix prices, in a short- to medium-term view of up to 6 months, the following contractual tools can be used to negotiate towards price stability:

- Accumulate volumes for a contract with volume commitment: Small to medium-sized buyers would be the most affected, and hence, securing volumes until most new capacities come online is critical. Smaller recyclers would be open to contracts of 1-2 years with volume commitments. The critical aspect of the contract is a price shield linked to the virgin resin prices, e.g., 15% over virgin resin prices.

Conclusion

As the world accelerates toward circular packaging targets, recycled resin is no longer just a commodity—it’s a constrained strategic resource. For procurement, the traditional buy-on-demand approach is no longer viable. Procurement teams must act to secure future supply and mitigate risk. Inaction could lead to price volatility, regulatory non-compliance, and reputational setbacks.

Key Procurement Recommendations

- Secure long-term contracts with recyclers to lock in volumes and cap price premiums amid rising demand and regulatory pressure.

- Co-invest in recycling infrastructure or join industry alliances to gain early access to feedstock and shape regional supply ecosystems.

- Build internal PCR sourcing intelligence to track regulations, partnerships, and recycler capacity movements — enabling proactive sourcing decisions.

Author

Related Reading