Introduction

Electricity systems are undergoing a major structural shift as renewables move from the margins to the core of generation. The International Energy Agency (IEA) reports that global power demand will keep growing through 2026, driven by cooling needs, electrification, and data centers, while wind and solar supply most of that new demand. This shift is reshaping price patterns, and increasing the importance of flexibility, storage, and interconnection for reliability and cost stability. [1] [2]

In markets that allow negative pricing, events are becoming more frequent. In Europe, negative prices occurred in 8–9% of hours in H1 2025. In California, Q1 2025 monitoring showed continued midday negative prices and lower averages versus 2024. Such dynamics are making portfolio outcomes more volatile for both buyers and sellers. [2] [3] [10]

Despite this volatility, the economics of renewables remain strong. Data shows most new utility-scale renewable projects produced power cheaper than fossil alternatives, with solar photovoltaic averaging around $0.04/kWh and storage costs dropping sharply since 2010. These enduring cost advantages continue to drive new capacity even as revenue cannibalization pressures increase. [5]

This blog examines the drivers of price volatility in renewable-heavy grids, highlights market trends, and outlines practical strategies for corporate energy buyers to manage risk and optimize sourcing.

What are the key drivers for price volatility?

Structural price dynamics: merit order and cannibalization

When renewable sources like wind and solar generate, they push more expensive power plants out of the market since their fuel costs are nearly zero. As capacity grows, simultaneous generation drives prices down – a dynamic known as the cannibalisation effect.

Weather, demand shocks, and the new volatility regime

Electricity demand is increasingly weather-sensitive, while supply remains tied to wind and solar variability. Electrification and data center growth are shifting daytime demand lower but sharpening evening peaks. During unfavorable conditions, scarcity pricing and limited flexible capacity amplify price spikes. [2]

Grid constraints and local congestion

Transmission bottlenecks convert system-wide surpluses into local negative prices and turn moderate shortfalls into acute scarcity. ENTSO-E’s Summer Outlook 2025 flagged higher risks of negative prices during periods of strong renewable output. In nodal markets such as Electric Reliability Council of Texas (ERCOT) and the California Independent System Operator (CAISO), congestion causes large, shifting price differences between grid locations – cheap power where generation is abundant, costly where lines are constrained. For companies with hub- or node-settled Power Purchase Agreement (PPAs), congestion risk can materially alter returns versus hub-price expectations. [11].

Market design, negative price floors, and balancing costs

Market mechanisms such as negative price floors, scarcity adders, and balancing charges all add volatility. The IEA notes that while average wholesale prices fell in 2024, negative price events increased. The European Network of Transmission System Operators for Electricity (ENTSO-E) reports rising redispatch and curtailment costs as renewable shares climb without matching system flexibility – costs that can flow back into tariffs and system charges. [7] [18].

Rapid changes in supply mix and flexibility

With over 90% of new renewable projects in 2024 cheaper than fossil benchmarks (IRENA 2025), wind and solar continue to dominate capacity additions. However, their low marginal cost underscores the growing importance of system flexibility to ensure energy is available when it’s needed most.

Volatility in action – case studies

- Case study 1: Australia’s National Electricity Market (AEMO) Q2-2025. AEMO’s Quarterly Energy Dynamics report shows that just three days in June 2025 contributed more than eighty percent of quarterly volatility, with the highest daily price on record on 12 June 2025. Cold and still conditions suppressed wind and lifted heating load, highlighting the need for flexible capacity and storage to bridge weather-related troughs. [10].

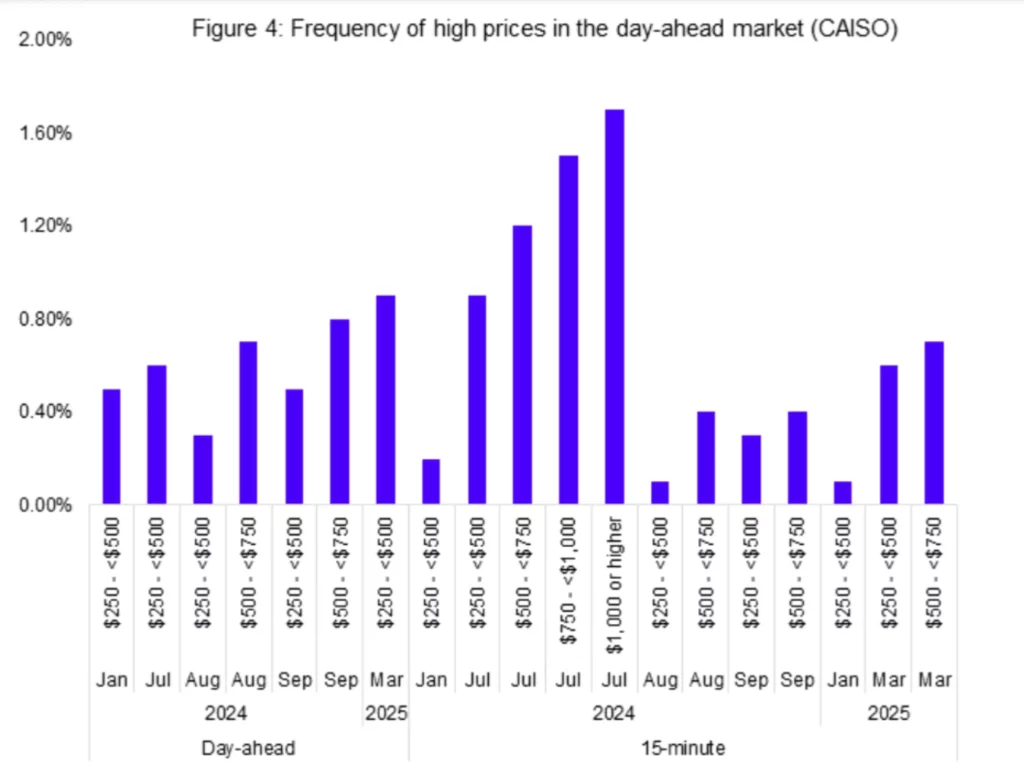

- Case study 2: California’s battery fleet. California Independent System Operator (CAISO)’s Q1 2025 report shows that prices fell sharply year-over-year, mainly due to less extreme cold weather. Still, negative prices and deep midday net-load valleys remained common in spring, even with more solar on the grid. Batteries are increasingly shaping price patterns, charging during the day and discharging in the evening. On average, battery discharge rose by 59% in California and 132% in the Desert Southwest compared with Q1 2024. Steadier supply and milder weather reduced scarcity risks and volatility. This suggests lighter portfolio hedging and reserve needs, though cold snaps still pose a risk. Improved conditions also eased ramping pressure, underscoring the stabilizing role of day-ahead markets and storage.

Evaluation metrics

Any mitigation strategy for corporate electricity procurement in renewable-heavy grids should meet these requirements:

- Cost certainty and budget protection – Cap downside and upside exposure to wholesale volatility over multi-year horizons while avoiding hidden basis risks such as nodal congestion [11].

- Carbon integrity – Ensure carbon integrity by maintaining or enhancing Scope 2 claims and establishing a credible pathway to hourly, time-matched procurement where it materially affects load and emissions [14] [19].

- Operational flexibility – Reduce exposure to hours with cannibalized prices and increase resilience during scarcity, for example, with storage-tied products or load flexibility [3] [17].

- Scalability and liquidity – Instruments and contracts should be supported by active markets and counterparties to avoid stranded positions or excessive transaction costs [12].

- Policy alignment – Procurement should be durable under current and anticipated reforms, such as the EU market design that promotes PPAs and two-way contracts for differences [15].

How can organizations build resilient, future-ready renewable procurement portfolios?

As renewables reshape market dynamics, buyers need portfolios that combine diversity, flexibility, and policy alignment. Key considerations include:

Diversified and shaped PPAs: Combine solar and wind from different geographies and weather regimes to reduce correlation and exposure to negative pricing. Add storage where available to shift delivery into higher-value evening hours. For example, in Europe, 2025 PPA prices are stabilizing, with solar P25 offers declining – creating a window for favorable deals [3] [12].

Contract innovation: Structure agreements to manage operational and market risks. Use virtual PPAs (financially settled against hub prices) or sleeved physical PPAs via retailers. Advanced forms like proxy generation PPAs, cap-and-floor mechanisms, and proxy revenue swaps can stabilize returns and hedge against weather or price swings [5] [19].

Financial hedges and congestion management: Layer PPAs with swaps, collars, or Financial Transmission Rights (FTRs) in nodal markets to offset price gaps between generation nodes and settlement hubs – critical for buyers exposed to ERCOT or CAISO congestion risks. [11].

Demand flexibility and behind-the-meter assets: Align procurement with flexible demand and on-site batteries to capture more renewable output and reduce imbalance costs. CAISO’s experience shows batteries are increasingly smoothing evening peaks and providing regulation services.[17] [10].

24/7 carbon-free energy via hourly certificates: Move from annual Renewable Energy Certificate (REC) matching toward hourly carbon-free energy portfolios that reduce residual emissions in every hour. Initiatives like EnergyTag and accredited registries in 2025 are enabling time-based tracking of emissions reductions. This pathway both improves integrity and can naturally incentivize flexible, location-appropriate resources. [14].

Policy-aware contracting: Adapt to evolving regional reforms. In the EU, PPAs and Contracts for Difference are reshaping price formation; for example, in Germany and other markets, capacity and bidding zone design debates will affect long-term contract bankability. [15] [16].

Recommendations to buyers

How can organizations turn their blueprint strategy into clear, actionable steps for procurement and sustainability teams?

- Build a balanced procurement portfolio: Pair long-term, low-cost PPAs with storage-shaped contracts that target evening and winter peaks. Diversify across technologies and locations to manage volatility. Run hub and congestion analysis early to avoid basis risk.

- Layer financial hedges: Use virtual PPAs with swaps or collars to fix cashflows, and Financial Transmission Rights and Congestion Revenue Rights in nodal markets to offset congestion. For added stability, consider proxy revenue swaps or settlement guarantees to convert variable payments into fixed returns.

- Deploy flexible demand and storage: Shift energy-intensive loads into high-output hours and install behind-the-meter batteries where viable. Participate in demand response programs to earn revenue while supporting grid stability.

- Pilot hourly CFE matching: Start small – one or two large sites – using hourly carbon certificates to test feasibility, track premiums, and prepare for Scope 2 disclosure updates.

- Align timing with policy shifts: In the EU, favor Contracts for Difference and long-term PPAs; in the US, watch for reforms in capacity and storage markets that influence evening pricing. Time contracting to major policy or regulatory milestones to minimize risk.

Conclusion

As zero-marginal-cost resources like wind and solar reshape power markets, price patterns are changing. Flexibility, location, and timing now define value.

Data from 2025 shows the trend clearly: more frequent negative prices during high renewable output, sharper price spikes when weather or grid constraints tighten supply, and evolving revenue dynamics for storage and ancillary services.

Rather than stepping back, corporate energy buyers need to adapt. Building a balanced, two-part portfolio – diversified and shaped PPAs combined with selective financial hedges and flexible demand – can stabilize budgets while continuing to cut emissions. Early adoption of hourly carbon certificates will also future-proof reporting as disclosure standards evolve.

This isn’t just about managing risk. It’s about competitive advantage in an electrified economy where resilient, verifiably clean power is a core strategic asset.

REFERENCES

[1] “Electricity 2025 — Analysis,” International Energy Agency (IEA). Available: https://www.iea.org/reports/electricity-2025

[2] “Electricity Mid-Year Update 2025 — Analysis,” International Energy Agency (IEE). Available: https://www.iea.org/reports/electricity-mid-year-update-2025

[3] “Global Electricity Review 2025,” Ember. Available: https://ember-energy.org/app/uploads/2025/04/Report-Global-Electricity-Review-2025.pdf

[4] “European Electricity Review 2025,” Ember. Available: https://ember-energy.org/latest-insights/european-electricity-review-2025/

[5] “Renewable Power Generation Costs in 2024,” International Renewable Energy Agency (IRENA). Available: https://www.irena.org/Publications/2025/Jun/Renewable-Power-Generation-Costs-in-2024

[6] “Renewable Energy Statistics 2025,” International Renewable Energy Agency (IRENA). Available: https://www.irena.org/Publications/2025/Jul/Renewable-energy-statistics-2025

[7] “Report — Summer Outlook 2025,” European Network of Transmission System Operators for Electricity (ENTSO-E). Available: https://eepublicdownloads.entsoe.eu/clean-documents/sdc-documents/seasonal/SOR2025/Report-Summer_Outlook_2025.pdf

[8] “Bidding Zone Review,” European Network of Transmission System Operators for Electricity (ENTSO-E). Available: https://www.entsoe.eu/network_codes/bzr/

[9] “Bundesnetzagentur: 457 Stunden mit negativen Strompreisen im Jahr 2024,” pv magazine Deutschland. Available: https://www.pv-magazine.de/2025/01/03/bundesnetzagentur-457-stunden-mit-negativen-strompreisen-im-jahr-2024/

[10] “Quarterly Energy Dynamics (QED) — Q2 2025,” Australian Energy Market Operator (AEMO). Available: https://www.aemo.com.au/energy-systems/major-publications/quarterly-energy-dynamics-qed

[11] “Q1 2025 Report on Market Issues and Performance,” California ISO, Department of Market Monitoring. Available: https://www.caiso.com/documents/2025-first-quarter-report-on-market-issues-and-performance-may-21-2025.pdf

[12] “2024 State of the Market Report for the ERCOT Electricity Markets,” Potomac Economics. Available: https://www.potomaceconomics.com/wp-content/uploads/2025/05/2024-State-of-the-Market-Report-for-the-ERCOT-Electricity-Markets.pdf

[13] “2024 Special Report on Battery Storage — May 29, 2025,” California ISO, Department of Market Monitoring. Available: https://www.caiso.com/documents/2024-special-report-on-battery-storage-may-29-2025.pdf

[14] “Texas: A high stakes frontier for US battery energy storage systems,” Rabobank RaboResearch. Available: https://www.rabobank.com/knowledge/d011484585-texas-a-high-stakes-frontier-for-us-battery-energy-storage-systems

[15] “European PPA Price Index — Q2 2025,” LevelTen Energy. Available: https://www.leveltenenergy.com/post/q2-2025-ppa-price-index

[16] “Navigating Negative Pricing: Access Critical Analysis of European Wholesale Electricity Prices,” LevelTen Energy. Available: https://www.leveltenenergy.com/post/navigating-negative-pricing

[17] “EnergyTag Accredits First Granular Certificate Issuers, Marking a Major Milestone for Hourly Clean Energy Tracking,” EnergyTag. Available: https://energytag.org/press-release-jen/energytag-accredits-first-granular-certificate-issuers/

[18] “Resources & Tools — 24/7 Carbon-Free Energy,” World Resources Institute (WRI). Available: https://www.wri.org/initiatives/247-carbon-free-energy/resources-tools

[19] Pexapark, “Pexapark’s PPA times,”. Available: https://pexapark.com/ppa-times/

Author

Related Reading