Introduction

The EU sugar market is undergoing a structural shift. Sugar beet acreage is projected to decline by 7 percent in the 2025/26 season, driven primarily by lower processor price signals and reduced planting incentives. [1]. Tereos, France’s largest sugar producer, has projected a 9 percent decline in its beet area for the upcoming season, indicating that major processors are unwilling to raise contract prices sufficiently to sustain acreage [2].

Yield potential is also under threat. The EU Commission forecasts a 2 percent reduction in average beet yields due to persistent dryness, low soil moisture, and pest pressures in key producing regions such as northern France, western Germany, and Poland. Early-season dryness initially enabled sowing to begin up to three weeks ahead of schedule, but subsequent moisture deficits have severely compromised crop emergence. In France, reports indicate uneven establishment, while Poland faces significant pest damage to beet seedlings. [3]

At the same time, imports from Ukraine, which previously helped stabilise EU supply, are expected to decline sharply following the EU’s decision to reimpose tariffs and implement tighter quotas. This will remove a critical buffer for regional processors who relied on Ukrainian inflows during the past two years of market tightness. [4, 5]

Meanwhile, global sugar prices remain subdued due to robust Brazilian and Indian production. Brazil is forecast to produce over 44 million tonnes of sugar in 2025/26, maintaining downward pressure on global prices despite the EU‑specific tightening. [7]

Market Outlook

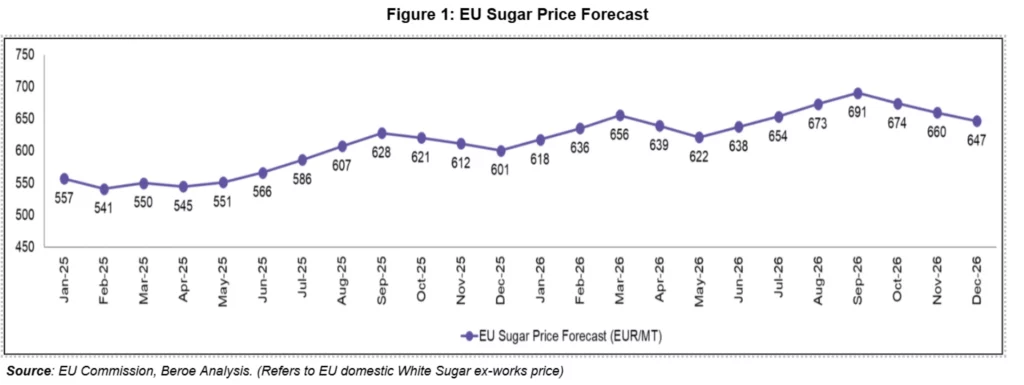

Overall, EU sugar prices for the 2025/26 season are projected to rise, driven by tightening domestic supply as beet acreage declines by 7 percent and yields weaken due to persistent dryness and pest pressures across major producing regions. This is compounded by sharply reduced Ukrainian imports following the reimposition of tariffs and quotas, [4.5] removing a key supply buffer, while rising energy, fertilizer, and processing costs further inflate production expenses.[6] Although global sugar prices remain subdued due to strong Brazilian and Indian output [7], these EU-specific constraints are expected to keep regional prices elevated throughout 2025/26, posing upward cost risks for procurement teams despite global market softness [7, 4, 5, 6].

SHORT TERM: Prices are projected to rise due to tightening domestic supply and weather-related risks:

- Crop emergence challenges: Dry topsoil conditions have prevented full beet establishment in France and Germany, raising concerns over root formation and early growth. In Poland, pest damage to beet seedlings has further reduced yield potential.

- Reduced Ukrainian imports: With tariffs and quotas reinstated, Ukrainian sugar imports are projected to decline by over 50 percent compared to last season, tightening market availability.

- Seasonal demand strength: Summer foodservice, beverage, and confectionery demand is peaking, creating upward price pressure as processors seek spot market volumes to cover near-term needs.

Figure 2: Sugar Beet Yield Forecast (Tons per hectare)

|

Country |

Average 5yrs |

2024 |

MARS 2025 forecasts |

%25/5yrs |

%25/24 |

% Diff June/May |

|

EU |

73.6 |

|

76.3 |

4 |

|

-2 |

|

AT |

78.8 |

79.9 |

79.3 |

1 |

-1 |

-2 |

|

BE |

83.1 |

75.4 |

86.5 |

4 |

15 |

-1 |

|

BG |

|

|

|

|

|

|

|

CY |

|

|

|

|

|

|

|

CZ |

66.8 |

69.6 |

65 |

-3 |

-7 |

3 |

|

DE |

78.3 |

83.9 |

78 |

0 |

-7 |

5 |

|

DK |

75.8 |

77 |

75.9 |

0 |

-1 |

-2 |

|

EE |

|

|

|

|

|

|

|

EL |

|

|

|

|

|

|

|

ES |

84 |

83.6 |

85.3 |

1 |

2 |

0 |

|

FI |

40.9 |

47.6 |

41.9 |

3 |

-12 |

-2 |

|

FR |

77 |

79.1 |

82.6 |

7 |

4 |

-1 |

|

HR |

|

|

|

|

|

|

|

HU |

55.6 |

50.5 |

58.8 |

6 |

16 |

3 |

|

IE |

|

|

|

|

|

|

|

IT |

57.4 |

|

65.8 |

15 |

|

3 |

|

LT |

66.3 |

69.9 |

71.7 |

8 |

3 |

2 |

|

LU |

|

|

|

|

|

|

|

LV |

|

|

|

|

|

|

|

MT |

|

|

|

|

|

|

|

NL |

82.5 |

75.5 |

86 |

4 |

14 |

-1 |

|

PL |

63.5 |

66.4 |

68.1 |

7 |

3 |

0 |

|

PT |

|

|

|

|

|

|

|

RO |

34.8 |

33.5 |

36.5 |

9 |

9 |

10 |

|

SI |

67.8 |

74.4 |

73.8 |

9 |

-1 |

3 |

|

SK |

60.4 |

59 |

60 |

-1 |

2 |

-2 |

Source: European Commission’s JRC MARS Bulletin

MEDIUM TERM: Supply risks are expected to persist through the medium term:

- Soil moisture deficits: Critically low topsoil moisture across northern France, western Germany, and Poland is constraining beet growth during vegetative stages. Without sustained rainfall, beets are unlikely to achieve typical canopy development, reducing photosynthesis rates and limiting root weight gains.

- No significant acreage recovery: Lower processor price signals for the upcoming season have discouraged planting expansion. Farmers are shifting to alternative crops with better profitability such as rapeseed and cereals.

- Global price opportunity: Despite EU price rises, global sugar prices remain 15-20 percent lower, driven by Brazilian export surpluses and India’s domestic market stabilisation. This provides procurement teams an opportunity to lock in spot or forward purchases at competitive prices before EU-specific tightness fully transmits into global markets.

LONG TERM: The long-term EU sugar market is expected to remain structurally tight:

- Declining beet area: Tereos’ projected 9 percent drop in French beet acreage reflects an emerging trend across Europe as farmers respond to uncompetitive contract pricing and rising input costs.

- Rising processing and refining costs: Energy prices are projected to rise 15-20 percent over the next two years, inflating sugar refining and processing margins. Fertiliser and crop protection costs remain elevated due to energy-linked manufacturing price increases.

- Policy-driven import constraints: The EU’s reimposition of tariffs and quotas on Ukrainian sugar imports will remain in place through 2026, removing a key supply flexibility source and increasing reliance on internal production or high-tariff MFN origin imports.

- Environmental compliance costs: EU Farm-to-Fork and sustainability requirements are expected to add compliance costs for processors and farmers, further squeezing margins and incentivising acreage reductions.

Market Risk

The below risk assessment highlights four key categories influencing EU sugar market stability. Production and cost risks are rated high, reflecting yield losses from adverse weather and pests, alongside escalating input and energy costs. Trade policy risks are medium-high, driven by reduced Ukrainian imports under new tariffs and quotas. Market volatility risks are medium, as EU-specific tightness may generate regional price premiums despite global price softness.

|

Risk Category |

Description |

Degree of Extent |

Implications |

|---|---|---|---|

|

Production Risks |

Persistent dryness has lowered soil moisture levels in northern France, western Germany, and Poland. Crop emergence and early root development are impacted, reducing yield potential. Pest damage in Poland further weakens prospects. |

High |

Lower beet yields will reduce processing volumes, tightening sugar availability within the EU. |

|

Cost Risks |

Rising input costs, especially fertilizers and crop protection chemicals linked to energy inflation, alongside a projected 15-20 percent increase in energy prices, are raising production and refining costs. |

High |

Processors will pass increased costs to buyers through higher contract prices, inflating procurement budgets. |

|

Trade Policy Risks |

EU’s reimposition of tariffs and quotas on Ukrainian imports removes a key flexible supply source. Ukrainian imports are projected to decline by 50 percent, tightening the market. |

Medium-High |

Reduced import options increase dependency on domestic production or high-tariff MFN imports, exposing buyers to regional price premiums. |

|

Market Volatility Risks |

Despite global price softness, EU-specific supply tightening could create a price premium over international markets, with limited arbitrage options due to import barriers. |

Medium |

Buyers face exposure to regional price spikes not offset by global market declines. |

Market Opportunities

The below opportunity assessment outlines four key areas for strengthening procurement resilience. Global price leverage and sourcing diversification are rated high, enabling cost-competitive contracts and reducing dependency on EU supply. Supplier collaboration is medium-high, supporting yield stability and sustainability alignment. EU-Mercosur trade pathways hold medium feasibility, offering potential tariff advantages and broader supply diversification once agreements are finalized.

|

Opportunity Area |

Description |

Degree of Feasibility |

Strategic Value |

|---|---|---|---|

|

Global Price Leverage |

Current subdued global prices due to strong Brazilian (44 MMT) and Indian production provide a window for competitive spot or forward purchases before EU prices rise further. |

High |

Enables procurement teams to hedge upcoming EU-specific price escalations. |

|

EU-Mercosur Trade Pathways |

Pending agreements could facilitate Brazilian sugar imports at preferential tariffs, diversifying supply risks. |

Medium |

Reduces EU market dependency on internal production and limited traditional imports. |

|

Supplier Collaboration |

Processors investing in climate-resilient beet varieties, precision farming, and regenerative practices can stabilise yields under climatic variability. |

Medium-High |

Strengthens medium-term supply security and aligns with sustainability goals. |

|

Sourcing Diversification |

Engaging suppliers in Brazil, India, and Thailand offers origin diversification, competitive prices, and supply continuity amid EU tightening. |

High |

Reduces single-region dependency and mitigates regional production risks. |

Conclusion

The European sugar market is at an inflection point marked by structural acreage declines, yield volatility, rising production costs, and tightening policy environments. While these factors pose substantial risks to procurement teams, they also create actionable opportunities.

Procurement professionals must now:

- Move beyond short-term spot buying, adopting forward contracts with global suppliers to hedge upcoming EU price escalations.

- Build diversified sourcing portfolios, reducing dependency on any single region and leveraging Brazil and India’s competitive surplus availability.

- Integrate adaptive contracting models, including input cost indexation, to align procurement costs with supplier viability and ensure contract stickiness in volatile conditions.

- Partner deeply with suppliers, investing in sustainability compliance, traceability systems, and climate-resilient agronomic practices to stabilise supply chains under tightening EU regulations.

- Monitor policy shifts, particularly EU-Mercosur negotiations, to unlock new sourcing pathways and reduce tariff exposure.

Ultimately, procurement functions that act with agility, strategic foresight, and market intelligence will navigate upcoming sugar market volatility successfully, ensuring supply continuity, cost stability, and strengthened supplier relationships in a rapidly evolving European landscape.

References

- National Farmers’ Union, “The beet brief: UK and EU farmers set to reduce beet acreage,” NFU Online, Apr. 2025. [Online]. Available: https://www.nfuonline.com/updates-and-information/the-beet-brief-uk-and-eu-farmers-set-to-reduce-beet-acreage/ . [Accessed: Aug. 10, 2025].

- Reuters, “Tereos sees EU sugar beet area falling by 9% next season,” Reuters, Apr. 23, 2025. [Online]. Available: https://www.reuters.com/markets/commodities/tereos-sees-eu-sugar-beet-area-falling-by-9-next-season-2025-04-23/ . [Accessed: Aug. 10, 2025].

- Vesper, “Sugar prices hit four-year low as global surplus outlook emerges,” Vespertool.com, Jun. 2025. [Online]. Available: https://vespertool.com/news/sugar-prices-hit-four-year-low-as-global-surplus-outlook-emerges/ . [Accessed: Aug. 10, 2025].

- Osservatorio Balcani e Caucaso Transeuropa, “EU and Ukraine reach agreement in principle on modernised agricultural trade as tariffs are reinstated,” Balcanicaucaso.org, Jun. 6, 2025. [Online]. https://www.balcanicaucaso.org/eng/Areas/Ukraine/EU-and-Ukraine-reach-agreement-in-principle-on-modernised-agricultural-trade-as-tariffs-are-reinstated-238733 . [Accessed: Aug. 10, 2025].

- Reuters, “EU to cut Ukrainian wheat, sugar imports by 70-80% under new quotas,” Reuters, Jul. 4, 2025. [Online]. Available: https://www.reuters.com/markets/commodities/eu-raises-import-quotas-ukrainian-wheat-sugar-eu-official-says-2025-07-04/ . [Accessed: Aug. 10, 2025].

- Industry energy cost projection cited in text requires proprietary data or subscription-based market outlooks.

- Nasdaq, “Sugar prices sink as global production and supplies set to increase,” Nasdaq.com, Jun. 2025. [Online]. Available: https://www.nasdaq.com/articles/sugar-prices-sink-global-production-and-supplies-set-increase. [Accessed: Aug. 10, 2025].

Author

Related Reading