Key Highlights

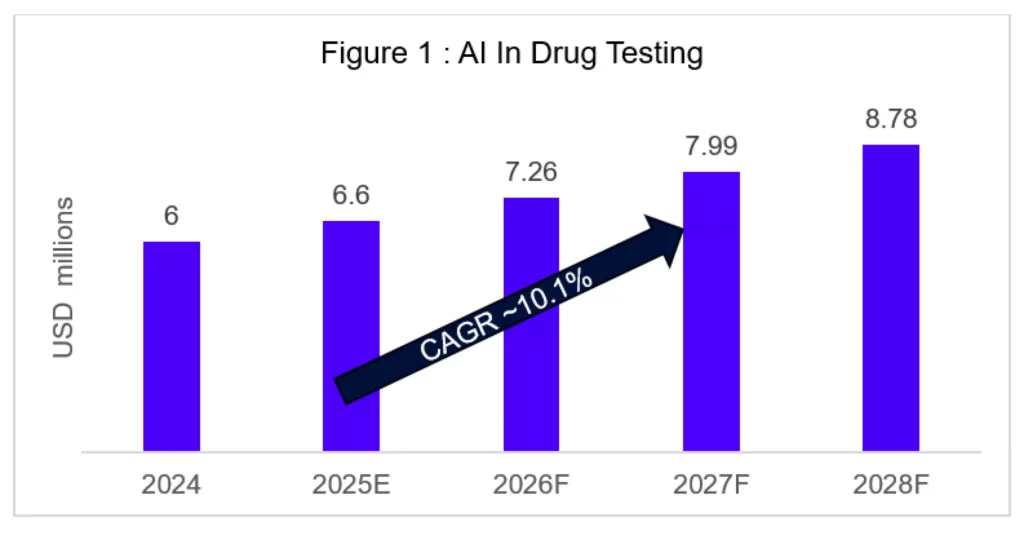

- The global AI in drug discovery and testing market is projected to grow from USD 6.3 billion in 2024 to USD 16.5 billion by 2034 (CAGR 10.1%) [1].

- Leading players such as Insilico Medicine, Recursion Pharmaceuticals, and BenchSci are driving adoption through partnerships with Sanofi, Pfizer, and Bayer.

- AI is enabling faster toxicology screening, improved biomarker prediction, and optimized trial design, reducing R&D cycle times by up to 30–40% [1].

Introduction

AI in drug testing applies machine learning (ML), natural language processing (NLP), and data mining to enhance the efficiency, accuracy, and speed of preclinical and clinical testing. Applications include in silico modeling, toxicity prediction, virtual screening, and patient response modeling [4]. As timelines and budgets tighten, pharmaceutical companies are increasingly adopting AI tools to optimize trial outcomes and reduce development risks [5].

Market Outlook

The AI in drug discovery and testing market is projected to grow from USD 6.3 billion in 2024 to USD 16.5 billion by 2034 (CAGR 10.1%). Within this, AI in drug testing is expected to reach USD 6.93 billion by 2025 [1].

- North America leads with ~56% market share, driven by advanced infrastructure, strong regulatory oversight, and high adoption rates [6].

- Asia Pacific shows the fastest CAGR (~21%), supported by regulatory initiatives, clinical trial expansion, and AI–pharma collaborations [1], [6].

- Over 300 companies now compete in this space, from AI startups to CROs and large pharma companies building in-house AI capabilities [1].

Key Technology and Innovation Snapshot

AI in drug testing is being transformed by a combination of cutting-edge innovations and supplier-driven technology solutions that together accelerate R&D, reduce costs, and improve trial outcomes [7]. These advances enable pharmaceutical companies to identify and eliminate high-risk compounds earlier, design more adaptive trials, and leverage multi-source data for precision medicine.

Table 1 – Key Innovations

| Innovation / Technology | Year Introduced & Penetration | Description | Impact for Buyers (Pharma/CROs) | Key Suppliers / Solutions |

| In Silico Toxicology | ~2014; Medium-to-High Penetration | Uses deep neural networks and large toxicology datasets (e.g., DeepTox, eTOX , AIDTox ) to predict compound toxicity before lab/animal testing. | Cuts preclinical timelines by up to 30%, reduces in vivo studies, improves detection of subtle toxicity risks, aligns with global animal-testing regulations, lowers late-stage attrition, enables high-throughput screening. | Insilico Medicine (Pharma.AI), Recursion Pharmaceuticals |

| AI-Enabled Virtual Clinical Trials | ~2018; Medium Penetration | Uses EHR, genomic, and RWE data for predictive modeling and creation of synthetic control arms. | Reduces patient recruitment burden, lowers trial costs, accelerates study timelines, and increases design flexibility. | AstraZeneca (internal AI trial modeling tools) |

| Multi-omics Data Integration | ~2020; Early-to-Medium Penetration | Combines genomics, proteomics, and metabolomics datasets with AI analytics to enhance patient stratification and biomarker identification. | Improves target selection, personalizes trial cohorts, and boosts predictive accuracy for therapeutic response. | BenchSci (AI reagent & model prediction), Insilico Medicine |

| Phenotypic Data Analytics | ~2017; Medium Penetration | Uses AI to process large phenotypic datasets for drug repurposing and toxicity profiling. | Enables rapid candidate prioritization and risk scoring before costly development phases. | — Recursion Pharmaceuticals, Insitro, BenevolentAI, Biovista, AICURA Medical |

Source : Deep Chm, Aidtox, Recursion, Astrazeneca

Strategic Developments – 2025

AI-driven drug discovery and testing accelerated significantly in 2024, marked by major pharma–tech collaborations, breakthrough AI models, and scaled laboratory automation [7], [10], [11], [13], [14]. The trend shows a clear industry shift toward integrating advanced AI platforms across early-stage R&D, from molecular modeling and toxicology risk scoring to high-throughput phenomics.

Table 2- Strategic Developments – 2025

| Year | Company | Strategic Development | Relevance to AI in Drug Testing | Impact for Buyers (Pharma/CROs) |

| Feb-2025 | Parexel | Piloting an AI model to speed up safety report generation. | Automates pharmacovigilance/safety case processing | Faster SAE/AE processing, lower compliance risk, quicker trial decisions |

| Mar-2025 | Insilico Medicine | Raised $110M Series E to advance AI drug discovery platforms. | Expands in-silico screening/tox modules | Greater throughput in early tox triage |

| Jun-2025 | AstraZeneca | Up to $5.3B AI-led research deal with CSPC. | Scales AI across discovery → preclinical | Larger AI toolchain for safety prediction |

| Jun-2025 | BIO 2025 | AI Summit emphasized cross-company collaboration & rapid scaling. | Validates adoption of AI across tox and clinical ops | Broader vendor ecosystems |

| Jul-2025 | BenchSci | Added former Pfizer CSO Dr. Mikael Dolsten to Board. | Strengthens translational safety leadership | Closer alignment with workflows |

| Aug-2025 | Recursion | $7M milestone; partner programs | Phenomics + AI for safer candidate selection | Early toxic liability detection advancing via Recursion OS. |

| Aug-2025 | Chai Discovery | Raised $70M; commercializing Chai-2 model. | Earlier in-silico liability checks | Lower early attrition |

| Jun-2025 | BioNTech | £1B UK R&D investment incl. AI hub. | Builds internal AI capacity | More AI-ready collaborations |

Source: FDA, Insilico, AstraZeneca, DeepMind, BenchSci, Recursion

Conclusion

AI in drug testing is revolutionizing pharmaceutical R&D by enhancing precision, reducing timelines, and optimizing trial performance. Beyond operational efficiencies, the strategic value lies in its ability to de-risk portfolios early, enable data-driven go/no-go decisions, and improve the predictive accuracy of safety and efficacy outcomes. With continued advances in modeling, multi-omics integration, and compliance with emerging AI regulations, this segment is set for accelerated adoption and market expansion. Companies that invest now in AI partnerships, internal capabilities, and interoperable infrastructure will not only shorten R&D cycles by up to 30–40% but also improve regulatory success rates, strengthen competitive positioning, and open new revenue streams through faster time-to-market and expanded pipeline throughput. In an era of increasingly data-driven drug development, AI adoption is transitioning from a competitive advantage to a strategic imperative for long-term growth [8].

References

[1] Precedence Research, Artificial Intelligence in Drug Discovery Market Report, 2025. https://www.precedenceresearch.com/artificial-intelligence-in-drug-discovery-market

[2] Insilico Medicine, “Pharma.AI Partnership with Sanofi,” 2024.

[3] BenchSci, “AI Solutions for Preclinical Research,” 2025. https://www.benchsci.com

[4] Reuters, “FDA Centers Deploy AI Internally,” 2025. https://www.reuters.com/business/healthcare-pharmaceuticals/us-fda-centers-deploy-ai-internally-immediately-2025-05-08/

[5] Clinical Leader, “Global AI in Clinical Trials Market Trends,” 2024. https://www.clinicalleader.com

[6] Globe Newswire, “Asia-Pacific AI in Drug Development Growth,” 2025. https://www.globenewswire.com/news-release/2025/01/13/3008553/0/en/Artificial-Intelligence-Ai-in-Drug-Discovery-Market-Size-to-Reach-USD-15-50-Billion-by-2032-at-a-CAGR-of-29-89-SNS-Insider.html

[7] DeepTox, “AI for Toxicity Prediction,” 2024. https://www.globenewswire.comhttps://www.frontiersin.org/journals/environmental-science/articles/10.3389/fenvs.2015.00080/full

[8] eTOX Project, “In Silico Toxicology Tools,” 2024.

[9] AIDTox, “Deep Learning for Early Toxicity Screening,” 2025.

[10] Recursion Pharmaceuticals, “Phenomics Platform Launch,” 2024. https://ir.recursion.com/news-releases/news-release-details/recursion-announces-release-openphenom-s16-google-clouds-model

[11] AstraZeneca, “AI in Preclinical and Clinical Screening,” 2024. https://www.astrazeneca.com

[12] Google DeepMind, “AlphaFold 3 Launch,” 2024. https://www.deepmind.com/research

[13] Pfizer, “Expansion of AI Toxicology Division,” 2024. https://www.pfizer.com

[14] U.S. FDA, “AI-Based Safety Monitoring Pilots,” 2025. https://www.fda.gov/medical-devices/software-medical-device-samd/artificial-intelligence-and-machine-learning-software-medical-device

Disclaimer: Strictly no photocopying or redistribution is allowed without prior written consent from Beroe Inc. The information contained in this publication was derived from carefully selected sources. Any opinions expressed reflect the current judgment of the author and are subject to change without notice. Beroe Inc accepts no responsibility for any liability arising from the use of this document or its contents.

For more information, please contact: info@beroe-inc.com.

Author

Related Reading

02 Mar, 2026

Why are Category Management Platforms a Gamechanger for Modern Procurement Teams

26 Feb, 2026

Navigating Risks and Opportunities in Oil Extraction: A PESTEL Analysis for Procurement Leaders