Insights

Addressing Commodity Price Volatility Through Smarter Contracting: A Case Study with Propylene

Author: Staines Stephen

Senior Analyst, Chemicals

Contracting in Volatile Commodity Markets

In today’s commodity markets, volatility is no longer an exception; it's the norm. Structural shifts in global supply chains, evolving production technologies, policy interventions, and repeated logistical disruptions have eroded the reliability of traditional pricing mechanisms.

At the same time, buyers are grappling with a more fragmented and fast-moving market environment, where conventional long-term contracts and fixed benchmarks fail to capture real-time movements or emerging risk premiums. As a result, procurement teams across categories, including energy, chemicals, metals, and agricultural inputs, are increasingly exposed to basis risk, contract misalignment, and margin leakage. Static contracting models that once offered predictability now struggle to reflect the complexity of global trade, shifting arbitrage flows, and rising freight volatility.

To stay ahead, procurement leaders are rethinking how contracts are structured. They are moving away from rigid, index-linked frameworks toward more dynamic models that flex with market conditions, share risk more equitably, and embed tools like auto-indexation, volatility-based margin triggers, and embedded hedging aligned with futures or feedstock benchmarks.

These modern mechanisms not only protect against adverse swings but also create opportunities for negotiation advantage when the market moves in favor of the buyer.

Similar approaches are already widely used in commodity markets such as crude oil, natural gas, and select agricultural products, where floating-price models, basis differentials, and futures-linked pricing have become the norm. The chemical industry is now beginning to follow suit, adapting these strategies to its own complex value chains.

A Case Study With Propylene

In this article, we take a deep dive into Propylene, a commodity currently undergoing profound structural shifts, to demonstrate how this new approach can be applied in practice. From freight shocks to PDH capacity surges and contract volatility, Propylene offers a real-time case study in how smarter contracting can turn uncertainty into advantage.

Global propylene pricing has entered a structural volatility phase as on-purpose PDH capacity surges in China, European steam-cracker closures tighten regional balances, and freight shocks from Red Sea and Panama Canal disruptions add a new logistics premium.

Traditional contracts that track a single monthly contract price (CP) now expose buyers to basis risk swings of US $50-60/MT.

In this article we explore the existing system and provide insights that will ensure a shift to dynamic indexation using auto-shift-to-spot, margin-sharing contract models that auto-adjust when spreads breach volatility triggers, and embedded hedging tied to propane or propylene futures in the existing system providing a comprehensive contract model that accounts for all possible risks including freight.

Early adopters can potentially cut cost and turn market turbulence into negotiated advantage. The same framework can be extended to polypropylene once conversion-margin and grade-differential layers are added.

Primary Loss Of Value in Traditional Contracting Systems – Basis Risk

For Propylene, the contracts are generally structured as a MCP + $/MT margin model, here the basis risk is the hidden gap between a static MCP-linked contract and the fast-moving spot and feedstock forces that really determine cost. For example, even if spot prices crash mid-month, the MCP for the next month get revised only at the end of the current month, leading to a loss for the reminder of the current month. This loss is especially pronounced in markets where spot prices are volatile and very dependent on the supply such as the US market. Recognising, measuring, and embedding protection against that gap is the difference between nominal risk cover and genuine risk mitigation.

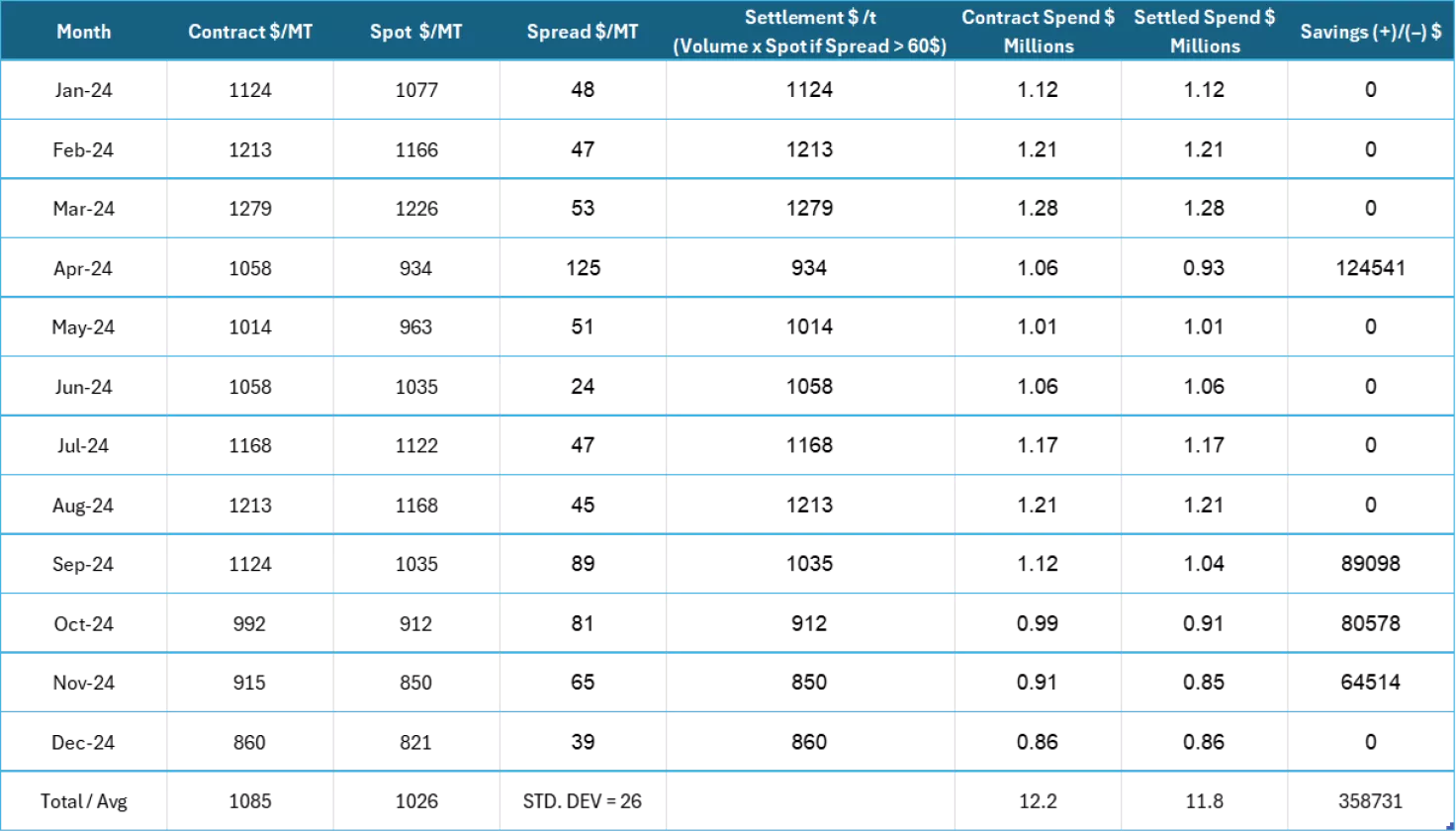

The below table provides two potential scenarios that shows how significant this loss in value through basis risk is on material pricing:

| Situation | Contract reference | True economic driver | Basis Risk Exposure |

|---|---|---|---|

| Formula contract: “PGP = CP + $X /MT” | Monthly Contract Price (MCP) published for US or EU | Spot PGP trading at hubs; PDH cash costs; freight | If spot PDH economics crash mid-month, CP lags ⇒ contract price stays high and you over-pay. |

| Fixed price hedge with propane swaps only | Mont Belvieu propane futures | PGP market price (propane → PGP conversion spread) . | Propane falls, but PGP premiums collapse faster; hedge gains don’t fully offset lower selling prices. |

Volatility in polymer-grade propylene market has shifted from being cyclical to structural. A wave of PDH additions China alone is on track to carry about 7.4 million t of excess propylene capacity in 2025, up from roughly 2.7 MMT in 2024 has pushed PGP away from traditional naphtha-cracker economics. At the same time, geopolitical tensions have increased logistics costs, rerouting around the Red Sea now adds about three weeks to voyages and pushes freight costs for US-to-Europe chemical tankers up by about US $60-90/MT. The result is a market where regional spot quotes move in opposite directions and contract mechanisms anchored to a single monthly index lag reality by weeks.

In the US market, average contract-versus-spot spreads widened from roughly $35.5/MT in 2023 to about US $59.2/MT in 2024, a 58 % jump in a single year. Against an average PGP price of around $1085/MT, this basis risk equates to roughly 5 % of feedstock cost, or about US $21 000 for every KT procured under the traditional MCP-plus-margin formula.

That leakage compounds quickly: a buyer buying 50 kt per year is facing an unbudgeted US $1 million drift straight to the cost line.

The impact does not stop at the monomer level. Polypropylene (PP) contracts in North America and Europe reference PGP almost one-for-one; a 5 % rise in feedstock cost can wipe out 70–80 % of a converter’s typical conversion margin unless downstream price pass-through keeps perfect pace. In tight customer markets, that rarely happens, forcing converters and brand owners to absorb the hit unable to pass on the costs to the consumers.

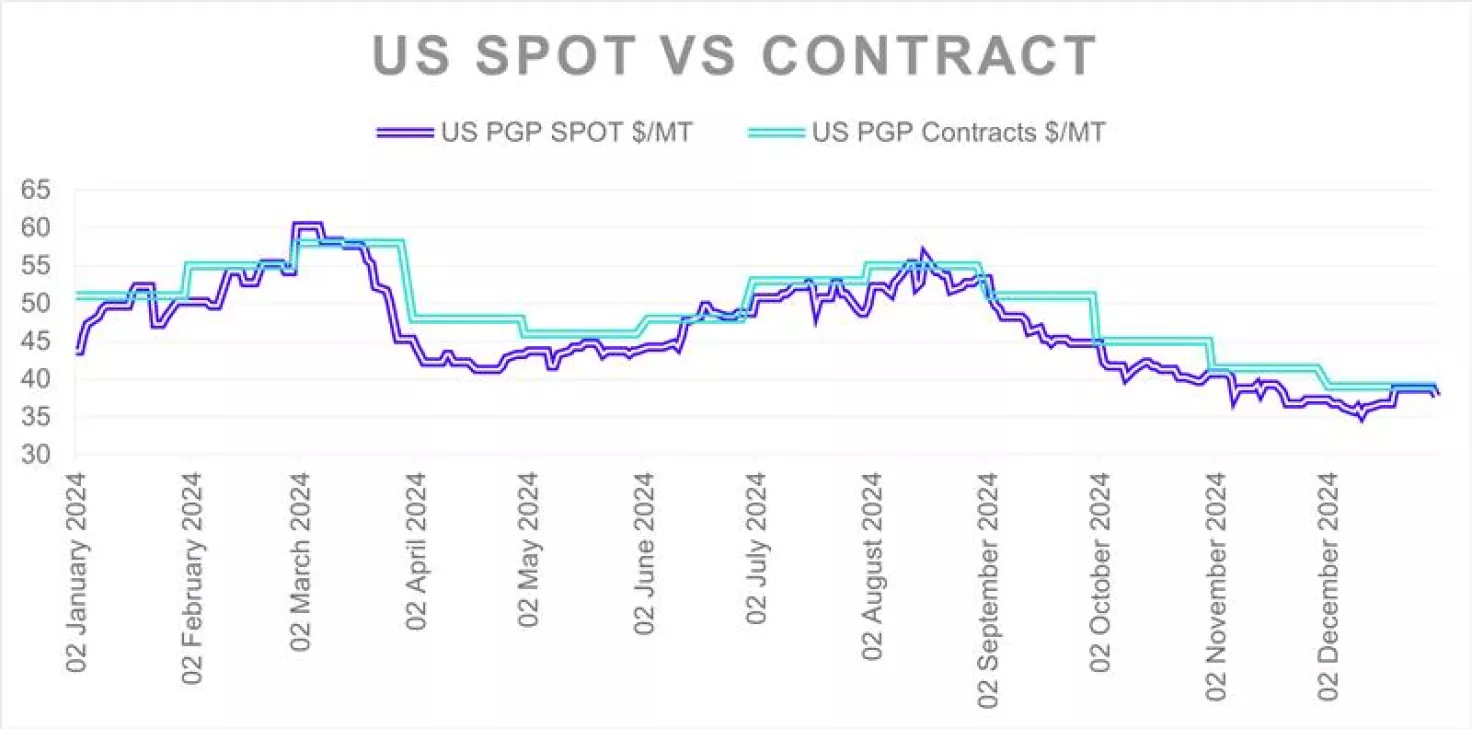

The chart below shows the daily movement of PGP spot prices in the US market, against monthly settled contract prices (MCP), to further visualize the time lag between spot and contract prices. The visible gap between the Spot and Contract trend lines can be used as a visual cue to the potential difference in cost of procurement using a traditional MCP + $margin model vs an auto switching model.

Mitigating Basis Risk – Auto Switch to Spot Model

To curb the widening gap between published contract prices and real-time market conditions, we propose a self-adjusting settlement clause built into the standard purchase order. Under this mechanism, you keep the same monthly call-off volumes and logistics, but the invoice price automatically flips to the month’s spot-price average whenever the contract–spot spread breaches a mutually agreed collar say, ± $60/MT. Because the trigger is calculated only once at month-end, neither party needs to issue additional P.O.s or change shipping schedules; the adjustment appears as a single line on the invoice (or a credit note on the next cycle). The result is a contract that behaves like a built-in hedge, capping basis risk while preserving operational simplicity for both buyer and supplier.

The contract keeps your existing purchase-order cadence and volume commitments but embeds a dynamic settlement clause:

If the arithmetic average spread between the month’s published contract price (MCP) and the corresponding spot-market index exceeds ± US $/MT (mutually agreed threshold), the settlement price for the entire volume delivered that month shall default to the month’s spot-price average; otherwise, it remains MCP + $ Margin.

This turns the monthly invoice into a “smart” hedging layer that neutralises extreme basis drift without changing logistics or planning cycles.

The table below shows a simple calculation that points out potential cost savings for a 12000MT annual procurement, using 2024 average PGP prices. The example threshold is set at 60$/MT of spread between spot and contract prices. Ie. If spread crosses 60$/MT, then the settlement is through spot pricing rather than the existing contract price.

It is visible from the table, that an auto-switching model would have provided a cost savings of around 350,000$ annually as compared to the traditional contract model. This sample calculation provides tangible proof that this is a viable option that converts a procurement contract into its own simultaneous hedging tool embedded within.

Implementation Roadmap

The immediate logical question that arises out of this novel model is, Are “auto-switch” triggers workable when you place orders only once a month? – The answer is yes, and it is very simple to implement, if the trigger is built into the pricing clause, not the P.O. cadence. You still place and receive material on a monthly (or even quarterly) schedule, but the settlement price for that material adjusts automatically when the spread crosses the previously agreed threshold. Below are two field-tested formats that buyers and sellers already use in chemicals, fuels, and metals.

| Mode | Formula/Modus Operandi | Benefit For the Supplier | Changes in the admin/system required |

|---|---|---|---|

| Monthly collar with one-time reconciliation | Contract price = MCP + Margin $. At month-end, compare average MCP–spot spread to a collar (e.g., ± US $60/MT), If outside, issue a single debit/credit note for the difference on the entire month’s volume. | They keep the MCP linkage but limit downside on extreme moves; cash-flow hit is only once a month. | One extra line on the invoice; ERP can calculate from published indices. |

| Dual-bucket formula | Base 70 % of forecast volume stays MCP + Margin $, Flex 30 % is priced at weekly spot averages only if the month’s running spread > threshold. Otherwise the flex bucket reverts to MCP + Margin $. | Protects supplier plant coverage (base volume) yet proves price competitiveness on the flex volume. | Forecast file needs two price codes; no extra POs. |

This method is already proven in multiple other commodity markets such as Jet fuel, sulfur-sulfuric acid and aluminium coils, moreover since the widely used indices in the chemicals markets such as ICIS, PLATTS or CME all provide direct APIs that can be fed into the existing ERP system, requiring no manual work except for the adjustments in the formulas to fit the newer model.

Implementation steps for a monthly-buying organisation:

- Pick the reference values: The indices and the threshold for the auto-switch should be mutually agreed upon. The threshold spread must be wide enough to avoid constant flipping and narrow enough to ensure margin protection.

- Amend the commercial clause: “Should the arithmetic average of MCP-Spot spreads for the delivery month exceed ± US $60/MT, the Contract Price shall be adjusted by the amount above the threshold, applied to the entire contractual volume for that month.”

- Pilot on a partial volume: Start with 30 % of annual tonnage; review variance after three months, then scale up.

- Overlay a hedge only on the residual exposure: Once the clause caps the basis to ± US $60/MT, hedge the remaining spread (max ± 30-50$/MT) with PGP futures or propane swaps, this hedging operation is far smaller, cheaper, and easier to manage than hedging the fully open position.

- This hybrid switching model is especially helpful in the second and third quarters where the spreads between spot and contract are historically wide in the US market.

- From the seller’s perspective, this model enables them to not lose out on spot volumes while at the same time not compromise too much on margins.

To conclude, the auto-switch model turns a blunt MCP+ margin contract into a self-correcting instrument that protects against the very volatility now hard-wired into PGP markets. It is operationally light, legally straightforward, and immediately quantifiable in dollar-savings making it both practical in monthly procurement cycles and persuasive at the negotiation table.