Tricky Tour of Reporting Cost Savings

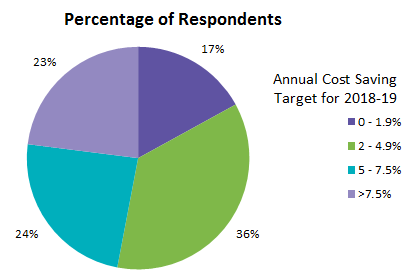

Every business decision has both qualitative and quantitative impacts, of which the latter are easier to measure and report. This is true for the procurement department. In most organizations, the performance of the procurement department is measured based on the cost saving achieved by it. Beroe ran a poll among Beroe LiVE users, a community of thousands of procurement decision makers, to understand the expected percentage of cost savings in their respective spend areas for the financial year 2018-19. The following chart shows the survey results:

Measuring cost savings is in itself a marathon task, but high cost-saving targets make it even more difficult. Procurement teams need to have a detailed approach towards measuring and reporting the true value of the cost savings achieved by them. Reporting cost savings becomes tedious because the procurement task is not limited to cost savings but extends to supply assurance and quality aspects as well, whereas the finance function mainly focuses on the bottom line. Sometimes, the finance department does not accept the cost benefit reported by the procurement department, or the procurement department fails to report the true value of its cost-saving efforts as it does not reduce or match the expenses reported by the finance department. This raises the issue of credibility and reduces the impact of the hard work done by the procurement team.

For more clarity, the difference between cost and expense needs to be understood. According to Accounting Coach, a cost might be an expense or an asset. An expense is a cost that has expired or was necessary in order to earn revenues. For example, the cost of equipment used in manufacturing is initially reported as a long-lived asset, equipment. However, in each accounting period the company will report part of the asset's cost as depreciation expense.

Hence, the procurement department can classify the benefits of its efforts into two types:

- Expense avoidance/reduction

- Cost avoidance/reduction

Although both these terms are closely related, they could significantly influence the management’s evaluation of the procurement department’s performance.

Expense Avoidance/Reduction

Here, we can consider the company’s existing assets whose life cycle or usability has been extended or improved through value addition activities. For example,

- Surplus asset management programs can help companies in extracting the hidden value of unutilized or underutilized equipment and hence avoid the expense of purchasing new equipment or reduce the load on existing equipment, thus increasing their useful life.

- Lean labs or offices increase the effective space and energy utilization and thus avoid the respective expenses. Hence, expenses can be avoided by implementing value addition activities.

- Preventive maintenance cycles increase the uptime of equipment and hence affect productivity.

These steps might not able to produce direct tangible cost savings, but one can extract their impact on the overall capex.

Cost Avoidance/Reduction

Here, we discuss cost savings achieved on new purchases. This could be a tricky task as shown in a few examples:

- Cost per Unit vs. Increase in Volume

For purchase of new items, one should always consider cost per unit and quantity to justify the cost-saving effort put in by procurement. Let us take the example of purchasing ball pens to explain the importance of cost per unit and total volume:

|

Cost per Unit (2016) |

No. of Units (2016) |

Total Cost (2016) |

Cost per Unit (2017) |

No. of Units (2017) |

Total Cost (2017) |

|

$2 |

100 |

$2000 |

$1 |

200 |

$2000 |

The overall cost of purchasing pens is not different between 2016 and 2017 although the per-unit price of a pen is reduced by 50 percent. However, the impact on total cost is zero because of the increase in volume by 100 percent. Such cases must be acknowledged and reported to justify the efforts of procurement departments.

- New Category Purchase

Consider another case. The purchase of a new category can also increase the total purchasing cost and thus reduce the effectiveness of the procurement department. For example, the company starts buying pencils along with pens:

|

Cost per Pen (2016) |

No. of Pens (2016) |

Total Expense (2017) |

Cost per Pen (2017) |

No. of Pens (2017) |

Cost per Pencil |

No. of Pencils |

Total Expense (2017) |

|

$2 |

100 |

$2000 |

$1 |

100 |

$1 |

100 |

$2000 |

The overall purchasing cost is the same even after the launch of pencils. However, a detailed report shows that the procurement department has cut the unit cost of a pen by 50 percent. In such cases, the cost savings must be reported individually.

- Time Savings

Another complex situation for procurement teams could be implementing automation at the workspace. In addition to the direct benefits of speed and agility, one should also consider the benefits in terms of man-hours and include them in the cost-saving report. For example, using a laboratory information management system (LIMS) that allows effective management of samples and associated data in laboratories, one can easily estimate the monetary benefits in terms of increase in throughput. But one must also consider the efficiency benefits it brings in terms of increase in scientific hours. Hence, the best option is to use a cost-time model to capture the overall cost benefits. This could be achieved as follows:

- Calculate how much time a scientist or technician devotes to managing data, apart from doing their core job.

- Translate into monetary terms the working hours that the soft implementation has now freed.

- Calculate the cost benefits of throughput efficiency in terms of reduction in cost per sample.

- Calculate the time saved on data management and translate it into monetary terms.

- Calculate the reduction in costs when subscriptions are negotiated for longer periods instead of yearly renewal.

All these savings must be measured and reported in calculating the overall cost savings from the use of the LIMS software.

Conclusion:

Hence, procurement performance must be measured in terms of both the tangible and non-tangible cost savings. The cost savings report must account for the following:

- Increase/decrease in unit price

- Increase/decrease in volume

- Addition or omission of new or old categories

- Isolated cost savings against overall expenditure

Ultimately, the final decision on cost-saving reporting depends on the policies of individual companies.

References

https://www.accountingcoach.com/blog/cost-expense-2

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe