SOW-based sourcing helps E&P operators and service companies to tackle labor shortage

Introduction

In this whitepaper, the focus is on analyzing the issue of labor shortage in US shale fields and looking at suitable sourcing strategies for operators and service companies. Analysis will be based on the impact of labor shortage on development activities of E&P operators and service operations of field service contractors.

Background

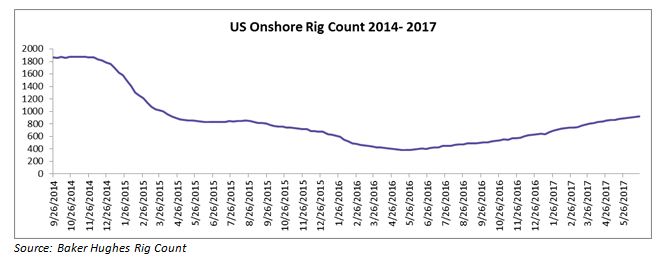

As oil prices fell rapidly in Q4 2014, E&P companies made substantial cutbacks in capital expenditure spending. As a result, development activities planned were put on hold. This resulted in significant drop in demand for field services and field equipment. As the price crashed further E&P operators started layoffs to reduce cost. Budget cuts from E&P operators’ left field service contractors with contracts cancelled or shortened. Reduction in demand for well services forced field service contractors to reduce the cost. Therefore, Big 4 oil field service companies and local contractors in Shale fields started massive layoffs to manage their operational expenditure.

Settling of crude price

After a year and plus long volatility, crude price settled around $50/barrel in Q1 2016. As chances of crude price bouncing back to its earlier level looked bleak, E&P operators optimized their operational costs and achieved a break-even price of $45/barrel. In an attempt to increase the production, shale operators decide to scale up the development of shale fields. To stay afloat in the market, field service companies started underpricing the well service contracts. As the demand of service picked up, operators and contractors faced new challenges in the form of labor shortage.

Labor Shortage in Shale fields

Lower oil prices led to several layoffs and people switched industry to take new jobs to support the livelihood. 60 percent of the field service workforce left the industry and took jobs in other industries leading to severe labor shortage for key services such as fracking, tubing and cementing. Shortage of labor has affected the developmental activities of E&P operators and service offerings of services companies as they could not find enough labor force to perform the required well services.

Increase in incomplete wells

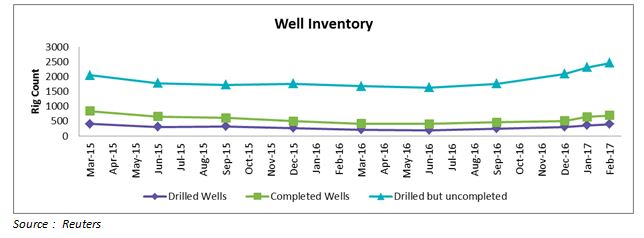

During 2014-2016, downturn in oil price left large numbers of drilled wells incomplete as the services companies shut down rigs, laidoff workers and retreated from the field to reduce the cost. US Shale producers’ drilling rate is at its highest in last two years. Though rig count and number of wells drilled is increasing, the wells are left incomplete due to lack of enough supply from the service companies.

Fracking, one of the key completion operations faced shortage of crew supply leading to delayed completion. A typical frack crew consists of 25 to 30 workers to operate the frack equipment set up consisting of truck-mounted pumps, storage tanks for fluids and sand, hoses, gauges and other connection. Dismissal of thousands of workers during the crude rout has left oil companies difficult to find crew for the fracking operation.

By 1Q of 2017, a record number of 1764 wells were left unfinished in Permian basin alone. Shortage of completion crew is seen as the key reason for increase in the Drilling But uncompleted (DUC) wells.

In February 2017, out of the 395 wells drilled by the E&P operators, only 300 wells went through the completion stage with production as planned. Inspite of increasing incompleted wells, E&P operators continue to drill new wells as the lease requires operators to adhere to the minimum drilling plan within the time limit to keep their leases. Though it is not required to produce oil immediately, wells must be drilled.

Leasing regulation

Increased rig count is not proportional to the production-ready wells due to worker shortage for well completion operations. To meet the state regulation on land leasing, E&P operators have not scaled down their drilling operation as they have to complete the planned number of wells to be drilled and produce a minimum of oil. Therefore, operators are forced to maintain the acitivity to keep the license active.

In Q1 2015 and Q2 2015, several E&P operators had their license cancelled for not adhering to the drilling program or production schedule. A new lease for drilling would cost 5 times than what companies are paying now.

Increased cost of labor

As the drilling activity soared, Shale operators faced an increased demand for labor to meet the operation requirements. Roughly 163,000 oil jobs were lost in the Shale basins. Texas, the most productive oil producing state, lost about 98,000 jobs. People who left the oil & gas industry migrated to other sectors. As the shortage of labor reached bottleneck, E&P operators returned to their previous employees to manage the shortage. However, due to the risk involved in getting back to industry, demand for the crew joining the E&P companies has increased. There is an increase in cost of specialized well crews by about 60 percent. E&P companies are engaged in bidding wars to lock up their crew and manage their drill cost.

Managing crew for well services

Lack of contracts as a result of budget cuts by E&P operators and projects delays affected the financials of well services contractors. To sustain the market turmoil due to low crude price, service contractors down sized their service offerings and the supply of service personnel. As a result, close to 70% of the well service equipments were cold stacked while 2/3rd of well service work force were laid off. As the demand was lower in 2014 and 2015 for the well services, service contractors couldn’t take cognizance of shortage. However, from the second half of 2016, the demand for well services started to rise as the E&P operator pushed to increase their oil output from the shale basins.

Service contractors looked back to bring the idled equipment back to the industry to meet the rising demand. However, they faced the issue of managing the crew for well service operations. One of the top fracking service providers faced a shortage of frack crew. The service provider could manage to have only 4 crew members against its earlier capacity of 12 crew members for fracking. This led to delays in well completion and the backlogs for fracking service soared up to their highest in latest years. By Q1 2017, frack operators in Permian basin had their order books full through Q3 2017 while bigger players had orders booked upto Q1 2018.

Same issue of managing the crew was faced by drilling contractors and well service contractors. Increasing rig count meant that , more cold stacked were getting back to market. However, drilling contractors were left with crew shortage leading to increased drilling backlog.

Sourcing strategy to overcome the worker shortage

With pressure on E&P operators to keep up the drilling rate and production, operators had to change their sourcing strategy to manage the worker shortage in Shale basin.

Pool Sourcing

With significant shortage of talented workforce for well service operation, private E&P operators & service contractors worked on recalling their previous employees who were laid off during the crude price turmoil. However, 80 percent of them have moved on to other industries and were not ready to come back to the oil & gas industry. Therefore, to mitigate the immediate worker shortage, E&P operators and service contractors are limited to manage with the current workforce and the 20 percent of the returning workers. Apart from drilling, services such as fracking, perforation, and cementing are non-continuous ones with a utilization rate of 60 percent.

Therefore, E&P players and service companies can prefer to pool their source to manage the shortage. Under pool sourcing, small E&P operators and service contractors can avail the service of specialised well service workers to manage the delays in well completion.

Sourcing from Canada

Canada looks as the immediate destination for US Shale operators to mitigate the worker shortage on immediate requirement basis during the spring break-up. Spring break-up in Canada is stoppage between winter and summer, where the oil companies are banned from moving their rigs or heavy field service equipment due to the ban. Road ban and load limits reduce the ability of field services companies to transport drilling or completion equipment through the road to avoid damages to the road. Until the road bans are lifted, drilling and completion industry are shut down. Workers are furloughed and equipment idled.

Considering the proximity and with the facility of NAFTA visa, US shale companies can recruit from Canada on temporary basis to manage the backlog in drilling and other well service operations.

SOW-based sourcing – managing the increasing labor cost

SOW-based sourcing is a prevailing hiring model in IT industry wherein, companies recruit people on requirement basis. Given the shortage of specialized workers in Shale basins, the SOW-based sourcing is a temporary sourcing method adopted by the E&P company or service contractor to hire the talent for a specific service with a defined type, level and quality to perform. This is typically an outsourcing method, wherein the oil company hires contingent workforce to manage the shortage and reduce the cost. With lower crude oil price prevailing in the market, several smaller E&P operators prefer to use SOW-based sourcing to reduce the increasing labor costs across Shale basins.

SOW-based sourcing is seen as an alternative to the full-time staffing for several E&P operators considering the risks involved in the industry due to the volatility of crude price.

Things to be considered for SOW-based sourcing: Though E&P companies are used to SOW-based sourcing, care must be taken to avoid worker misclassification.

Example: In 2014, a group of drilling rig consultants performed drilling operations for an offshore drilling company in Gulf of Mexico. Though they were recruited as consultants, the company reclassified them as independent contractors. By reclassifying them as employees, company denied them payment for their overtime work. However, when they filed lawsuit under Fair Labor Standards Act, company was fined for misclassifying them.

Conclusion

With increasing backlogs for drilling and completion activities, US field service contractors are under pressure to recruit the required workforce to manage the field crew. Worker shortage appears to be a long-term issue looking at the ground reality and it is likely to impact the E&P operators’ plan to boost the crude output. Therefore, it is essential for E&P operators to manage the drilling crew to keep the drilling lease valid. SOW-based sourcing of fresh graduates from universities and trade schools can be the best sourcing strategy for E&P companies considering the continuous drilling plan. For oilfield service contractors, it is essential to maintain the crew to bid for field service contracts. Pool sourcing can be the most suitable sourcing strategy for the contractors given the limited availability of talent in Shale basin.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe