Procurement KPIs & Priorities

Abstract

Introduction

KPIs & KRAs for measuring ‘procurement performance’ begins by raising the bar high with a vision about what is next for world-class procurement.

World-class procurement organizations have excelled at cutting costs, but cost saving is no longer the most important aspect.

Best-in-class organizations are concentrating on raising the bar even more by deploying market intelligence, managing risk, and establishing meaningful supplier relationships through procurement KPIs and benchmarking.

Problem Statement

Ask 10 different CPOs to rate their procurement functions, and you will end up with 10 different answers. This is largely because of the difference in competency levels, disproportionate focus on annual cost savings, and lopsided importance to different performance indicators. Hence, a balanced approach is required.

The most important aspect of procurement KPIs are finding ways to actually implement them in transactions that does not fall under the traditional "time & material" model as most of the offerings in recent times have evolved to fixed-price model or one-stop pricing. Hence, balanced scorecards that suit and fit all sizes are required to measure procurement performance.

This balanced scorecard, or rather its framework, will add strategic metrics—not just from a financial point of view but also from a supply chain view point.

Cost Success: A Thing of the Past

It is no longer a challenge for leading procurement organizations to reduce their labor, outsourcing, and technology costs or, in other words, become cost successful -- but such extreme lean performance has exacted a toll.

Treat procurement as a ‘valued business partner,’ and cost savings will automatically overtake cost of procurement

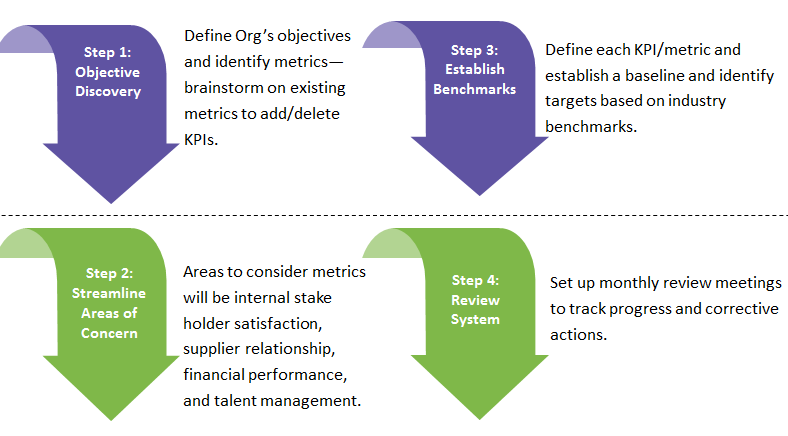

Approach to set a balanced scorecard for procurement

The rapid evolution of sourcing practices is making it difficult to assess procurement. The following steps are the prerequisites of balanced procurement performance scorecard:

Deploying the above approach shifts organizational focus (resources, processes, systems) towards activities that truly have an impact.

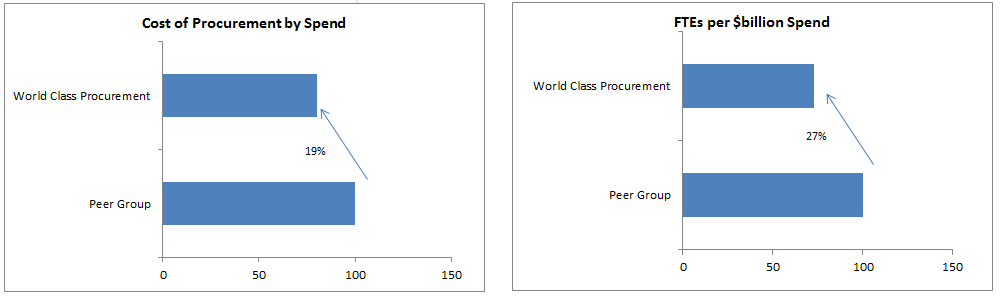

Comparing World-Class Procurement with Other Procurement Organizations (Peer Group)

According to Hackett, world-class procurement organizations spend 20 percent less (up to $6 million in cost savings for a typical large company) and have 27 percent fewer full-time-equivalents (FTEs), while generating more than double the cost savings of typical procurement organizations. On the other hand, how important is ROI for procurement organizations?

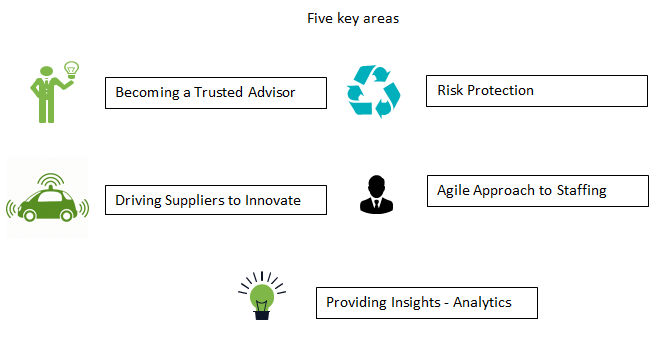

What are world-class procurement organizations doing differently from other peer groups?

Priority I: Strategic Metrics or KPIs, Which Must Become a Priority from a Sourcing Perspective?

Choosing a Sourcing Methodology

- The methodology needs to be constantly updated based on market and global conditions. Sourcing with cross-functional teams, use of Porter’s five forces model when appropriate, and high visibility along with transparency during the selection process are critical aspects of this methodology.

Please find below an example in which some metrices have been implemented.

Scorecard for Sourcing

Sourcing efficiency can be measured by Spend per FTE (Full-Time Equivalent) :

- Compare Company ‘A’ with other companies as to how efficient they are in managing their spend. Another metric may be Addressable Spend per Total Spend.

- You may measure operational efficiency as number of purchase orders (PO) per FTE, number of invoices/FTE, percentage of order to ship on time, etc.

- Another measure of efficiency can be the organizational cost divided by the Purchasing Benefits generated, so it is a kind of ROI (Return on Investment).

Sourcing effectiveness is evaluated through Price Competitiveness and Purchasing Benefits.

Price Competitiveness:

Compare your prices with published market prices available from ICIS, IHS, or YQ Matrix.

Purchasing Benefits:

- Include metrices like Savings, Avoidances, Capital and Working Capital Savings, and Revenue Generation.

- The effectiveness of your organization can be measured with Purchasing Benefits per Addressable Spend, so this percentage shows how effective you are in your sourcing projects.

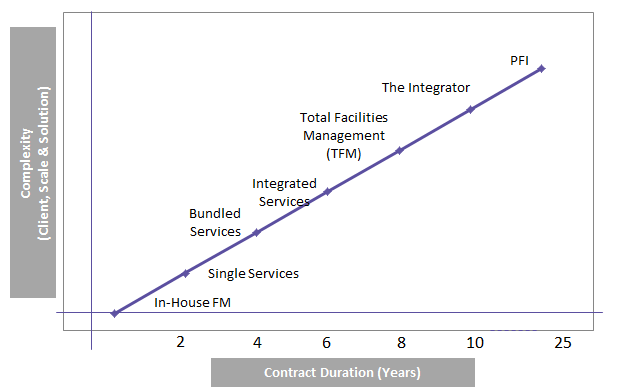

Case: Facility Management

It is vital to understand the different sourcing models available in the market for various FM services. This will enable organizations to negotiate with suppliers opting for the most suitable sourcing model that gives them the leverage to monitor work as well as their supply chain in any facility management project.

Key Takeaway: The most common contract type in engagement at present is the IFM model and the most common duration is three years with an option to extend. According to industry findings, there is growing recognition that longer durations are more appropriate for IFM and TFM contracts.

Contract Performance Is Proportional to Contract Duration:

There are predominantly four stages: mobilization, implementation, continuous improvement, and preparation for pre-tender.

- Performance is consistent through mobilization. Performance then increases throughout implementation due to an increased focus by both client and service provider.

- Continuous improvements are then made, though these tend to be on a diminishing returns basis.

- Performance then tends to plateau, as typically seen prior to preparing for retender.

- Hence, longer contract duration can be recommended for more complex projects.

| Type of Estate /Facility | Single Services | Bundle Service Outsourcing | IFM+Integrated Services | Integrator Services |

| Small Simple Estate | 2+1 years | 4 years | 5+2 years | 7+3 years |

| Large Complex Estate | 4 years |

5+2 years |

7+3 years | 7+3 years |

Priority II - Strategic Metrics or KPIs That Need to be Prioritized from the Perspective of Stakeholders

A suggested framework relies on the main activities in purchasing: transforming the KPI results into scores (in relation to clients and suppliers). We have already looked at the sourcing methodology. Other aspects next in priority are as follows.

Let us look at the metrics that can be assigned for the stakeholders a procurement organization deals with:

Metrics for Clients:

- Service Satisfaction Level

- Risk Level and Time to Protection

Purchasing Benefits – Savings/Avoidances (It can be in total dollar terms as well as total dollar divided by addressable spend, so it gives the effectiveness of your sourcing projects in percentage.)

- ROI

- Satisfaction Level can be achieved by a survey to measure how satisfied your client is with your services.

Metrices for Suppliers:

Before we set the metrics, it is important that the purchase organization advise the clients to ensure that the following prerequisites are in place. These should be showcased as the organization’s mapping capability (under ‘Becoming a Trusted Advisor’).

Number of Supplier Alliances:

- Limited number of suppliers with a key impact (significant dollar spend percentage) on your total cost of goods.

- Often 20 percent or fewer of your suppliers account for 80 percent of the spend. The emphasis should be on suppliers that can differentiate you or give you a distinct competitive advantage.

- Characteristics of such alliances:

- Long-term evergreen contracts

- Participating in new-product design sessions

- Joint efforts for process improvement

- Exchange of executives and cycle-lead time reduction

Percentage of Suppliers Certified:

- Certification is not a guarantee that the suppliers are perfect, but it does indicate that they are pursuing excellence and at least have an understanding of their processes, and how they perform their work.

- Certification or Compliance is a significant first step in any joint effort to improve supply chain processes. If the supplier is dedicated to its own program of process improvement via Lean or Lean Six Sigma, joint cooperative ventures are more likely.

Scorecard Metrics for Suppliers: Example

First, you create five dimensions: Quality, Financial, Technology, Risks, and Services. These are applicable to any supplier falling under the category Services, such as

- Raw materials supply

- Logistics

- Packaging

- MRO

For each KPI, you create a scale, and this scale is aligned to a score from 0 to 100. Each time these KPIs are measured, quarterly or yearly, you have a score that can reflect the supplier performance in that period. You can also sophisticate the model by imposing different weights for each KPI as well as different weights for each dimension. Thus, you can aggregate all KPIs into one final score.

Action Plan

Adopting KPI priorities and metrics is a challenging proposition involving many moving parts. You may select some KPIs you defined for each activity and construct a balanced scorecard that reflects the entire Purchasing activity. As described in the activity Supplier, you can define different weights for each KPI as well as different weights for each activity. Doing so enables you to aggregate all KPIs into one final score and track the Purchasing evolution as a whole.

Conclusion

Procurement organizations should keep a close watch on adoption rates and procurement trends, particularly for supply chain innovations in order to achieve exponential growth.

This should enable stakeholders to clearly articulate the tangible benefits of embedding Procurement into the business planning and decision making processes. However, it also means getting the basics right: bringing spend under contract, auditing and monitoring progress, reducing costs and making better use of systems and technology. The results could be amazing.

Organisations with mature Procurement functions enjoy lower cost growth, greater business flexibility, increased market certainty and – as a result – significant competitive advantage over their peers.

Businesses that can deliver on rising customer service expectations at efficient cost levels through competency and innovation in their supply chain operations will, in all probability, emerge as market leaders. Thus, cost saving is not the only procurement collar.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe