Processing Cost Optimization: Copper Mining, Chile

Abstract

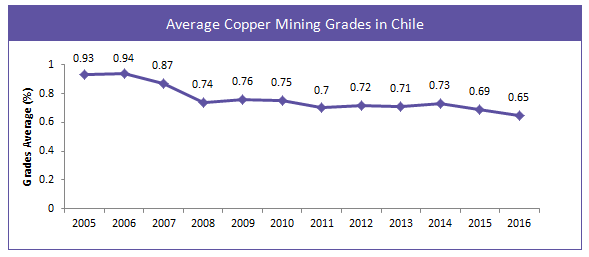

A major challenge for any miner / mine developer is the linear decline in Ore grades. Copper miners in South America especially Chile are not new to this situation as the dominenece of mining industry over prolonged period of time resulted in depeleted accessible reserves.

Also, average grade of copper ores has been falling steadily over the past several years. This decline forces a difficult scenario for Chile in meeting its annual metal production target.

Though the demand for commodity market saw a rise, mining companies are struggling with bearish bottomline, and, an increased productivity gap due to the following factors

1. Scarcity of near surface targets, challenging geo-political juristictions and depleting ore grades had increased the cost of drilling, blasting, loading and hauling costs of metals and minerals

2. Entry Barrier: Requirement of heavy capital influx for exploration and production of metals and minerals

3. Shortage of skilled labors due to major demographic bulge of workers approaching retirement age

As grades declined, companies would have to mine out more so as to be processed inorder to reach the same level of copper concentrate output. Meanwhile, copper mining companies encounter another challenge in form on frequent labor strikes over contract disputes. This again affects the mining costs.

This white paper aims in providing strategies for Copper mining companies so as to enable cost savings over the course of operational activities. Innovation and stragtegies shall increase the gap between the cash costs and realised unit price positively and thus ameliorate savings.

Introduction

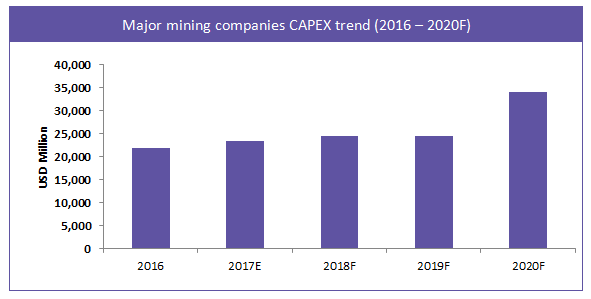

Mining companies are enduring an unavoiadable risk of depleting ore reserves. This increases the distance between the mine working face and the processing plant. Resultant scenario forces major mining companies to budget for an increase their CAPEX for the coming years until 2020

Growing demand for Copper has increased the mining and processing costs.

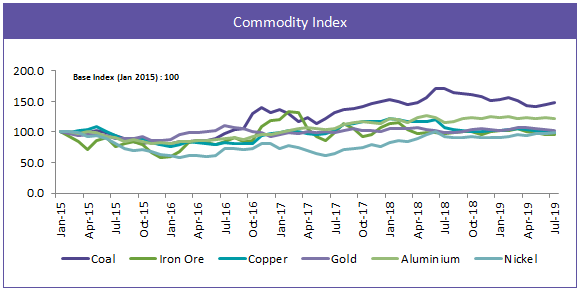

The sector is expected to witness surge in demand and substantial price increase mainly for battery related mining materials such as Nickel, Cobalt, and Lithium etc. However other commodities are expected to stay flat or witness marginal increase in coming years until 2020. The mining companies must therefore implement cost saving strategies

A rebounding capex cycle is a sign of healthier industry. However, The scarcity of ore reserves have increased the distance between the mining face and the processing unit, which has increased the mining and processing costs.

Introduction of Solution

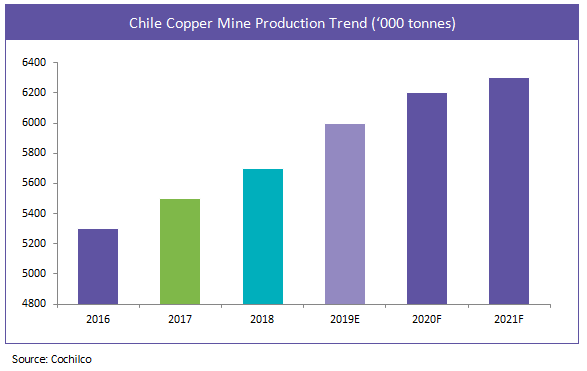

Latin America represents around 40% of the global total copper mine production, which is estimated to be around 8 million tonnes in 2018. The domestic Copper output is expected to increase at a CAGR of 3% for the period 2018- 2021.

The main obstacle of the forecast production growth in Chile for the mining companies is the rise in production costs, as they dig deeper and process larger amounts of rock to obtain the same amount of copper, they used to do decade ago.

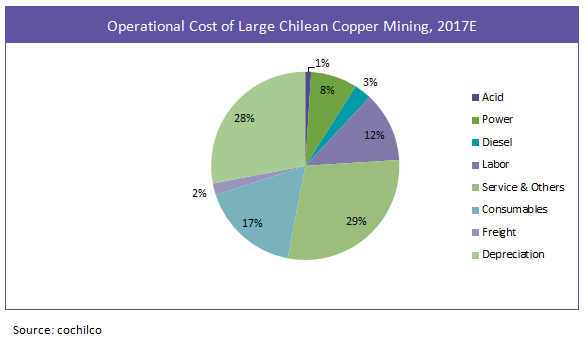

Source: Cochilco, News articles

As Chile’s copper ore grades declined, it would take higher amounts of mined copper ore to be processed to reach the same level of copper concentrate output.

Service and purchase of consumables represents 46% of the total operational costs. Major mining companies are benefited from lower energy and fuel costs.

Procurement Action Plan Summary

Major mining companies would increasingly implement new technologies or upgraded equipment to reduce their mining and processing costs to dig deeper and process larger amounts of ore to obtain the same amount of copper. This technology which will base on developments of innovations for mining at great depths.

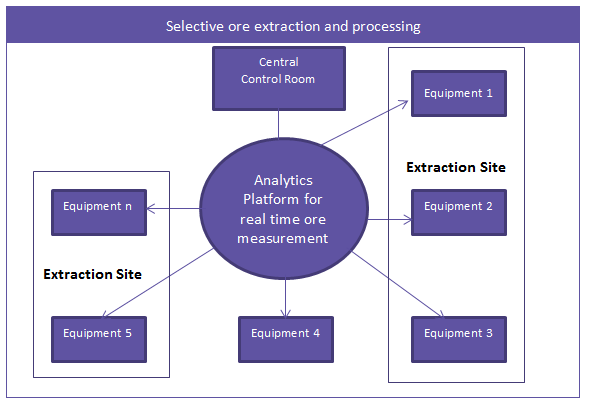

Action 1: An enabling technology for selective ore extraction and processing

- Real time ore grade measurement.

- Maximizing resource conversion and metal recovery

- Ruggedized High Frequency ElectroMagnetic Spectroscopy and High Speed X-ray Fluorescence; and other sensors, can be implemented in shovel, which provides on-site bulk ore classification and sorting.

- This technology was demonstrated and able to provide

- 20% increase in margin;

- 25% less energy;

- 25% less water;

- 40% less tailings

Selective ore extration and processing techniques is a potential cost saving technique, which can be performed with muti sensor technology and analytics platform for real time ore grade measurement.

- Inspite of selecting ore extraction, the cost of mining and processing is high. In recent times the copper mining industry is approaching a turning point.

- However in 2018, The cash costs of domestic miners were up 6.9% to US 1.39/lb than last year when compared to its global peers’ average.

- Due to declining ore grades, major copper mines are soon going to be underground, which eventually increase mining costs. Implementation of ore transportation systems will result in greater ore output and cost savings.

Action 2: Implementing continuous haulage system

- Installation of electric Rail Veyor haulage system is used to transport material to the existing infrastructure, with the processing plant without diesel emissions.

- Rail-Veyor is an electrically powered series of two-wheeled interconnected mini rail cars that can operate 24/7 and travel along a light rail track at speeds up to 8 metres per second.

- The remote controlled Rail-Veyor technology is comprised of simple components that allow continuous material haulage without diesel emissions and with significantly less capital and maintenance costs than other options.

Case Study: Chuquicamata Copper Mine

- One of the largest open pit mines in the world, planned to transform it into a underground mine owing to degrading quality of the ore and impractical operating conditions.

- Haulers had to drive down 11 km to bring up lower grade ore to the surface. Thus, The mining company planned to invest around USD 4 billion to replace the existing truck shovel system with the hauler system.

- Transformation of the century old mine from open pit to underground operations by block caving method is expected to extend the mine life for 40 years.

- Scope of the contract includes engineering, supply of equipment and materials, and site assistance for 12 underground crusher stations combined with a conveyor package.

- Estimated production output – 140,000t/d

Conclusion

- Mining companies are incuring increased mining and processing costs owing to depleting copper ore grades.

- Haulage (Ore, Overburden, Workforce and Equipment) and processing costs represents over 80% of the total production costs in mining, for extracting vast amounts of rock to process a small percentage of valuable metal is not only environmentally disruptive

- By implementing above strategies of selective ore extraction and continuous haulage system would improve mining costs and better margins.

- Implementing sensors for selective ore extraction methode would provide 20% increase in margin and consume 25% less energy.

References

cochilco.cl

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe