Injectables Outsourcing: India Vs Global – an Opportunity for Big Pharma

Abstract

1. Introduction

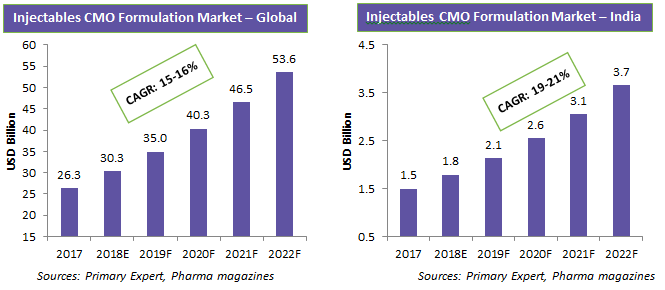

The global injectables contract manufacturing organization (CMO) market is fragmented, with many players having similar processing and technological capabilities. CMOs with unique capabilities, such as handling high potency drugs, are expected to dominate the market. In the U.S. and Europe, there are many injectable CMOs with U.S. FDA and EU GMP-approved facilities. At present, the injectables market is dominated by developed-market CMOs, and most big pharma companies source from developed markets. The U.S., Europe, India, and China are the major consumption markets for injectables. The Indian injectable CMO market is also fragmented, and growing at a faster pace than the U.S. and European markets.

2. Main

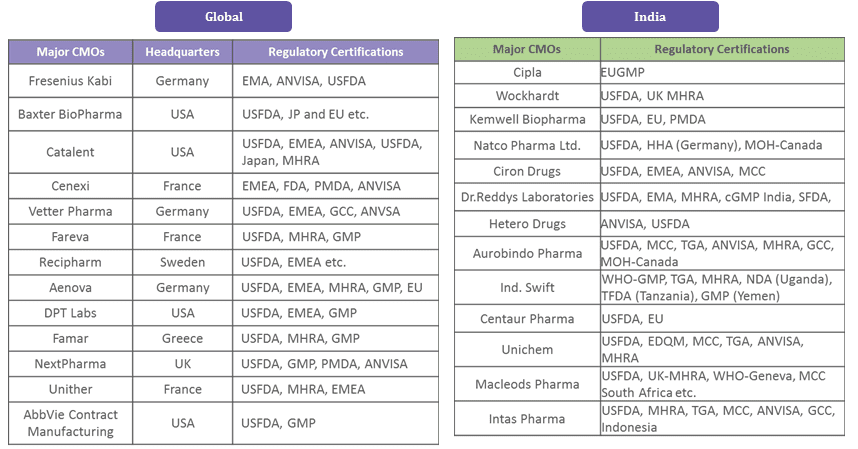

This white paper focuses on the increasing demand for injectables and the major sourcing regions. India has over 20 CMOs with U.S. FDA/EU GMP certifications for injectables. Most Indian injectable CMOs cater to local demand, but that is changing. The Indian injectables CMO market is growing quickly, due to increasing demand and outsourcing of big pharma to emerging markets for cost savings. Many countries are looking to reduce their healthcare expenditure, and to achieve this, developed nations are looking at India for a supply of injectable drugs at lower prices. In the near future, this will drive more CMOs to obtain U.S. FDA/EU GMP certifications for their facilities, and in turn drive the growth of the India injectables CMO market.

3. Recommendation

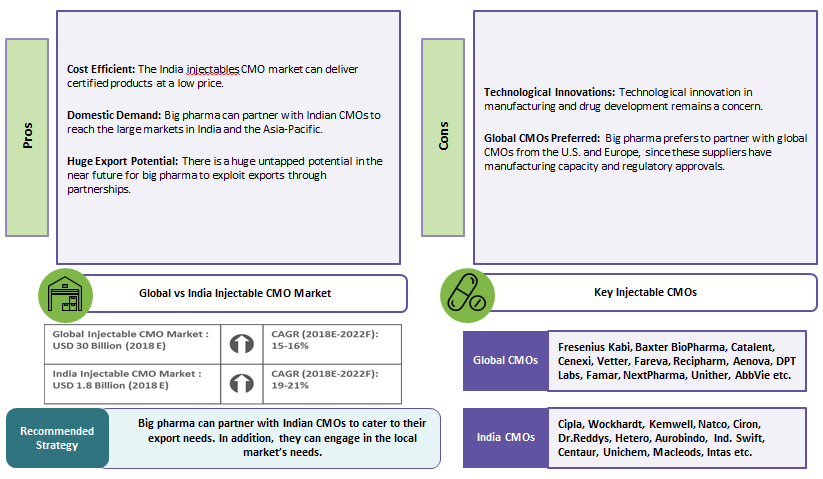

India is a favorable sourcing destination for injectables. India has many injectable CMOs with U.S. FDA/EU GMP-approved facilities capable of exporting to developed markets. A few big pharma companies have partnered with Indian CMOs for their injectables requirements in the U.S., Europe, and other markets as well. Therefore, other pharma companies can capitalize on this by partnering with Indian CMOs to export injectables to developed markets.

Increasing Demand for Injectables

Mergers and acquisitions and increased demand for pre-filled syringes that provide accuracy, safety, and convenience are the latest trends in the Indian injectable CMO market. For example, in 2017, Pfizer acquired Hospira for $17 billion. That move has helped Pfizer expand its generic sterile injectables portfolio, leading to a strengthening of its business presence. Baxter International Inc. acquired Claris Injectables to boost its supply to Baxter customers and registered a high return on investment (ROI).

There are two main drivers of the Indian injectable CMO market. The first is a high prevalence rate of cancer, which is leading to an increase in demand for sterile injectables. The second is pre-filled syringes, which are emerging as one of the fastest-growing choices by doctors as a method for convenient unit dose medication delivery.

Key Findings

India Injectables Market – Pros and Cons:

Injectables Supplier Concentration/Sourcing:

The major CMOs are concentrated in the U.S. and Europe, and they dominate the injectables market. However, in India, there are many injectables CMOs with U.S. FDA/EU GMP certifications. Moreover, the injectables CMO market in India is growing at a much faster pace due to increased outsourcing, demand for generics, and domestic demand.

Conclusion

India is a favorable sourcing destination for injectables and has many potential injectable CMOs with U.S. FDA/EU GMP-approved facilities capable of exporting to developed markets. A few big pharma companies have already partnered with Indian CMOs for their injectable requirements for the U.S., Europe, and other markets. Therefore, other pharma companies can capitalize on this and partner with Indian CMOs to export injectables to developed markets. Many countries are looking at reducing their healthcare expenditures. To achieve this, developed markets are looking at India to supply injectable drugs at lower prices. In the future, this could lead more CMOs to obtain U.S. FDA/EU GMP certifications for their facilities, and help drive the growth of the Indian injectables CMO market.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe