Supplier engagement models can help curtail exploration spend

Abstract

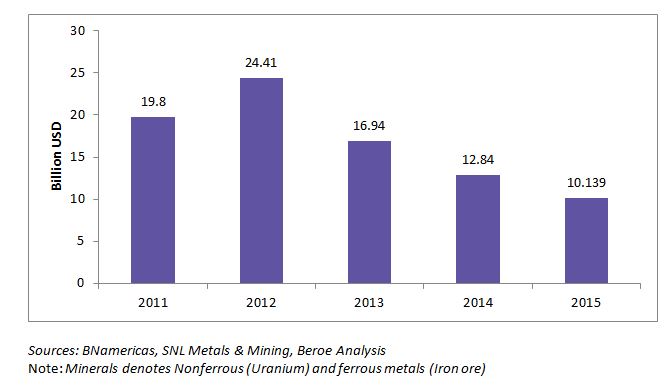

The continuous volatility in commodity prices has impacted the exploration activity directly. The exploration spend has been truncating since 2012 and this has distorted mining companies’ capex and expansion plans.

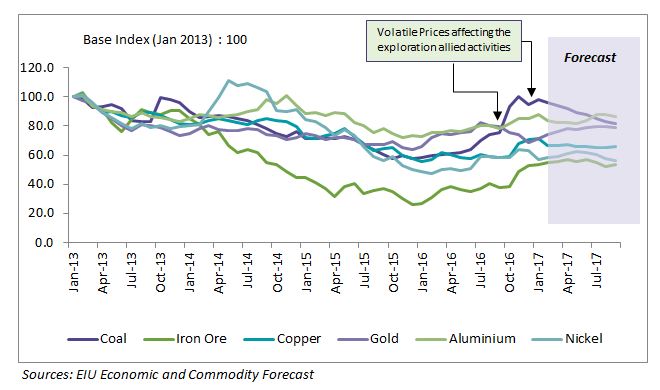

The volatility in commodity prices is expected to last for the upcoming quarters. As most of the exploration activities are for short term and last for less than one year, even short term volatility in commodity prices distorts the exploration and allied activities.

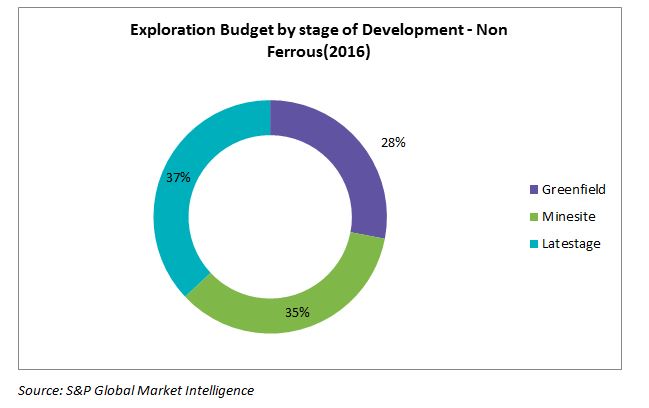

The dip in grassroot exploration and increase in mine-site exploration indicate that mining companies are cutting down their expenditure on high risk exploration activities.

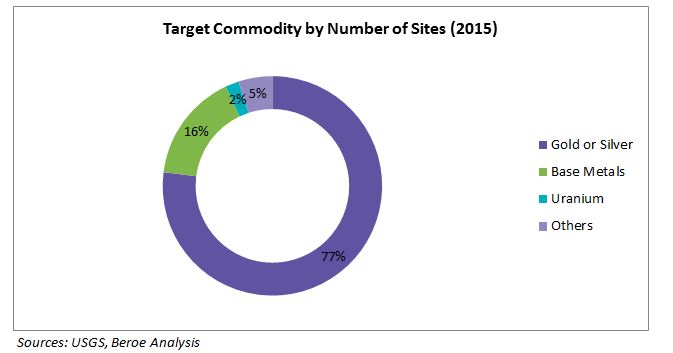

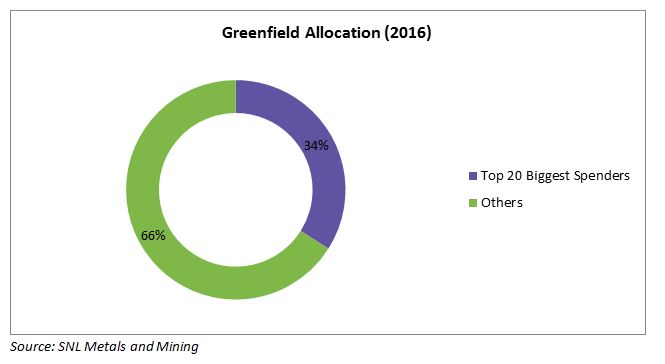

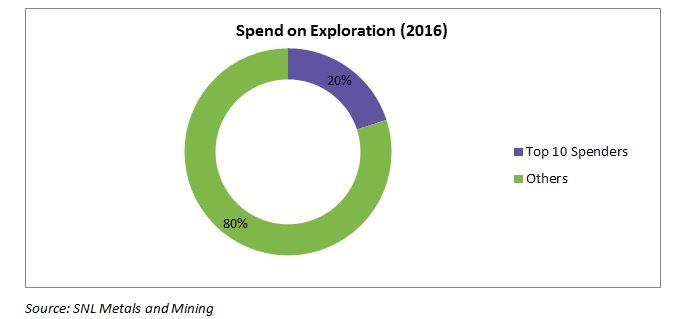

The end-use industry is highly skewed towards the gold sector. Therefore, there is very little significance among suppliers for mining companies from other sectors. The junior mining companies too have very less significance with the tier 1 mining companies taking up major share in green-field and overall expenditure.

One key issue that all mining companies face is in optimizing their exploration activities with compressed budgets.

This whitepaper aims to address the need to optimize and make the exploration spend more efficient for the mining companies. Additionally, key sourcing strategies have been suggested to ensure low cost and supply security of exploration equipment, exploration and allied services.

Introduction

The volatility in the commodity prices has bewildered the mining companies and it reflects in their expansion plans. This coupled with rising labor wages has limited the scope of capital expenditure plans in projects. This has directly impacted the spending on exploration activities and equipment.

As the mining super-cycle is not expected to start until 2018, it delays the spending on exploration allied activities.

However, mining companies can use this scenario as a negotiation lever and a cost-saving opportunity to enter into procurement contracts with mining equipment companies and optimize the operations using new techniques.

Exploration spending trend on minerals

Commodity price index

Mining exploration market???????

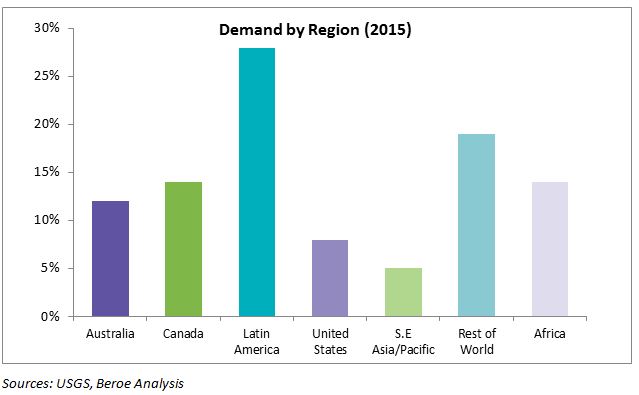

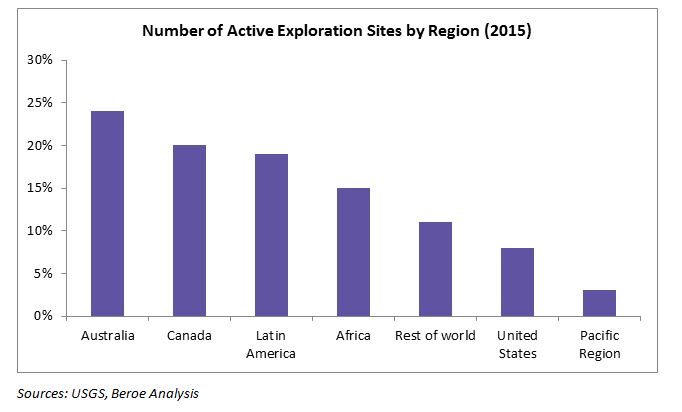

In Latin America, exploration was mainly driven by spend on copper and gold. Copper accounted for 85 percent of the base metal exploration. Though Australia has the highest number of exploration sites, about 74 percent of the exploration is taking place near old deposits signifying risk aversion by mining companies. The key risk here pertains to cost of exploration followed by employee safety. Further, junior mining companies accounted only for about 44 percent of the total exploration budget in 2015 compared to 50 percent in 2011. This is mainly due to the inability of companies to secure finance and streamline their focus on fewer projects.

Risk to non-precious exploration mining companies

The non-precious exploration mining companies i.e., non-gold and non-silver mining companies have very low significance among the equipment manufacturers, drilling service providers as they account for very low share of exploration sites. Small share may lead to high prices of equipment and services.

The above data is based on 1,930 exploration sites. Rest of world includes Asia, Commonwealth of Independent States, Europe and the Middle East. Pacific region includes Fiji, Indonesia, Japan, Laos, Malaysia, New Zealand, Papua New Guinea, Philippines, Solomon Islands, Thailand, Vanatu and Vietnam.

Companies are increasingly spending more on late-stage and mine-site exploration. The late stage exploration is being done to make sites attractive for acquisition. On the other hand, mine-site option is considered as a cheaper and less risky means of replacing and adding reserves.

The top 20 spenders accounted for about 1/3rd of the total green-field exploration, while top 10 spenders accounted for 1/5th of the total exploration spend. This indicates that junior mining companies are more risk-averse and highly vulnerable to volatility in commodity prices.

Some key issues in exploration and allied activities

With decline in exploration spend, exploration efficiency has become one of the key concerns for the mining companies to remain profitable. Though, in many of the cases, the drilling and exploration services have been outsourced to bring down capital expenditure on exploration equipment, the labor wages directly impact the surveying and exploration costs.

Depending on the region, labor can account for 35-45 percent of the exploration drilling operational cost. Skilled labor needs to be employed for such operations which adds to the cost.

Moreover, exploratory drills need to be specialised to drill upto 900 to 1000 meters or more.

Further, as most of the new exploration sites are located in remote areas, it increases the cost of exploration and allied activities.

For instance, in case of Canada, exploration costs increased with distance from transportation infrastructure. The most remote project cost 6 times the least remote project.

Mapping the deposits and exploring minerals via helicopters is a Herculean task as it involves high rental costs for helicopters and risk to the safety of the people.

What steps can mining companies take to optimize the exploration and allied activities?

Using drones can have significant benefits to the mining companies for their exploring and mapping activities. Some of the advantages are mentioned in the flowchart.

One of the main advantages is the cost of operating a drone. It may cost around $2,000 to rent a helicopter for an hour. The cost reduces to almost 1/10th in case a drone is employed for exploration and aerial mapping activities.

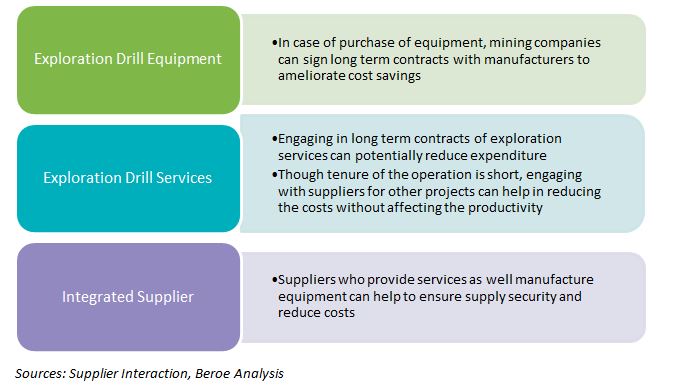

Engagement models with suppliers

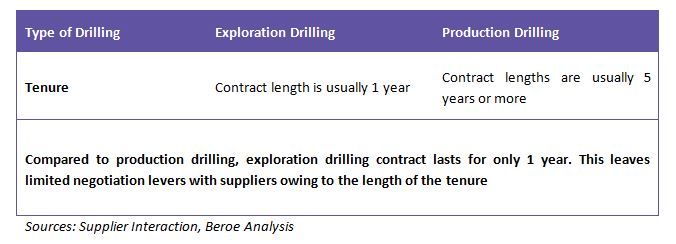

Long-term engagement with suppliers or drill service providers shall help in reducing potential expenditure and at the same time secure the supply and services.

Conclusion

Implementing the above solutions shall help mining companies to accrue savings and achieve safety of employees. Further, implementing long term contracts could help in increasing the significance of the mining exploration companies. Other key benefits include supply security and productivity boost.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe