Brazil, the next best sourcing destination for ethyl acetate procurement for the U.S.

Abstract

Donald John Trump, the 45th President-elect of the United States of America, had taken a hard line during his campaign and has spoken strongly, vowing to revisit and negotiate the NAFTA (North American Free Trade Agreement), the trilateral free trade agreement between Canada, Mexico, and the U.S. NAFTA has increased the overall trade between these countries from $1.14 trillion in 2005 to $2.29 trillion in 2015, primarily because the agreement eliminated tariffs. Mr. Trump’s agendas also spoke about the improvement of infrastructure, pharmaceutical and manufacturing sectors within the U.S. with the final aim to create job opportunities for thousands of Americans.

Ethyl acetate, widely used in construction, automotive (specialty grade) and pharmaceutical industry (pharmaceutical grade), is likely to witness an increase in its market till 2020. The U.S. ethyl acetate market is import-driven and with the chances of NAFTA being eliminated/re-negotiated high, its procurement is definitely expected to witness a hit.

This white paper aims to highlight what could be best cost country sourcing for procuring ethyl acetate once NAFTA has been renegotiated or eliminated.

Introduction

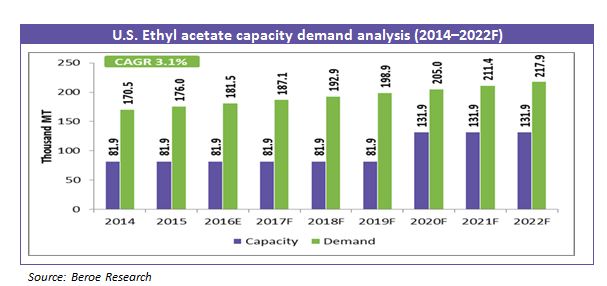

The U.S. ethyl acetate market is currently estimated at 176 thousand MT, growing at a CAGR of 3.1 percent till 2022 fueled by the rise in demand from downstream paints and coatings and adhesives sector. The demand is likely to arise from Trump’s mandate as his focus is mainly towards improving the domestic infrastructure and industry.

The supply market is highly consolidated with Eastman being the only domestic producer catering to the demand. Eastman has a current installed capacity of 81.9 Thousand MT (TMT) per annum. Any shutdown or force majeure in Eastman Chemical’s ethyl acetate plant is likely to affect the regional supply.

Trade dependency

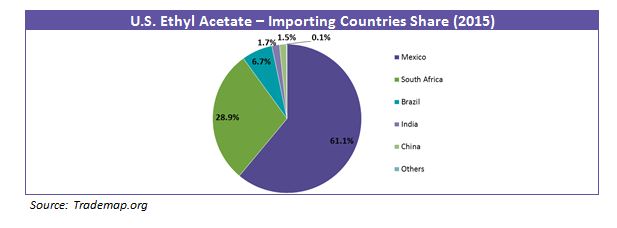

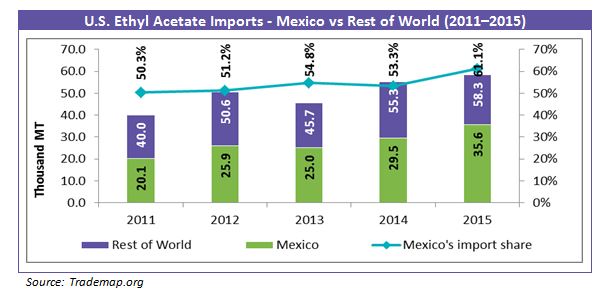

The U.S. is a net importer of ethyl acetate, mainly from Mexico. Its dependency on the country has been increasing over the years (21 percent increase from 2014 to 2015).

Celanese is the only player in Mexico with an installed capacity of 105 thousand MT per annum catering to the domestic market and the excess being imported into the U.S.

What if NAFTA is eliminated or renegotiated?

NAFTA (North American Free Trade Agreement) is the trilateral free trade agreement between Canada, Mexico, and the U.S. NAFTA has increased the overall trade between these countries from $1.14 trillion in 2005 to $2.29 trillion in 2015, primarily because the agreement eliminated tariffs.

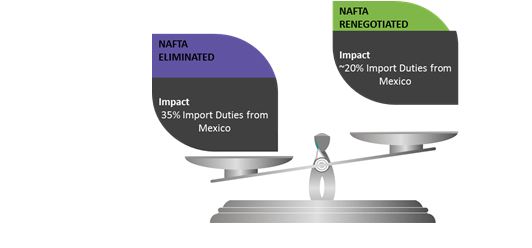

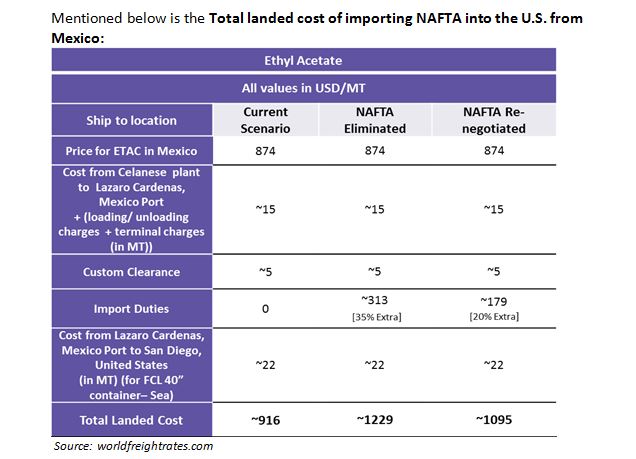

NAFTA has currently ensured free movement of ethyl acetate between Mexico and the U.S. Trump, in his mandate, mentioned that he would re-visit NAFTA to provide greater benefits to the U.S. businesses. However, the elimination or renegotiation of NAFTA would result in an increase in the cost of ethyl acetate sourcing from Mexico.

Ideally there are two scenarios, either NAFTA is completely eliminated or it gets re-negotiated. In both the scenarios, one thing is certain; the import duties are likely to be levied on ethyl acetate imports from Mexico, thereby making imports costlier.

Based on the above calculations, NAFTA elimination or re-negotiation is expected to make sourcing ethyl acetate from Mexico expensive.

So what is next plan of action for sourcing for ethyl acetate? With the current heavy dependency on Mexico for sourcing ethyl acetate, the ideal question would be which is the next best-cost country sourcing option for procuring ethyl acetate at a competitive price?

Is there a country that could replace Mexico as a sourcing destination?

South Africa and Brazil are the other two major importing destinations from where ethyl acetate is imported.

South Africa has a single plant, Sasol with a capacity of 55,000 MTPA. It exported around 30,000 MTPA to the U.S., and Belgium in 2015 and utilized around 34 percent to cater to the domestic demand. The capacity is therefore not sufficient to cater to the growing U.S. ethyl acetate market demand.

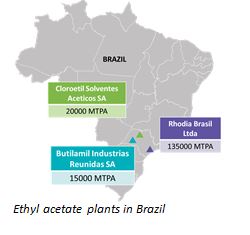

Brazil currently has a total production capacity of 170,000 MTPA with three domestic manufacturers of ethyl acetate.

The three players (Butilamil Industrias Reunidas SA, Cloroetil Solventes Aceticos SA and Rhodia Brasil Ltda) are located very close to the port of Santos, which reduces the total landed cost (TLC) of ethyl acetate to the U.S. from Brazil.

Brazil produces ethanol, feedstock of ethyl acetate from sugarcane which is abundant in the region.

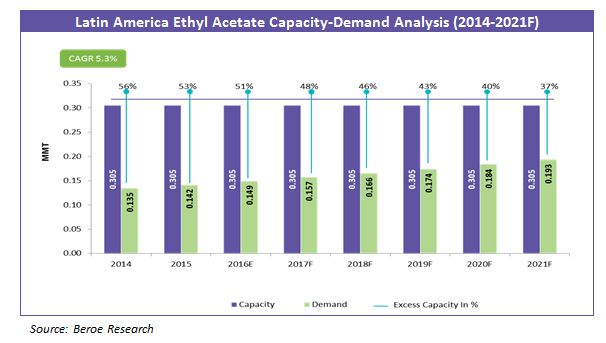

The current Latin American market is well supplied with demand anticipated to grow at a CAGR of 5.3 percent till 2021. After considering the imports and exports, there is still sufficient capacity to cater to the domestic growth and also the anticipated import demand for ethyl acetate from the U.S.

With NAFTA anticipated to go through dynamic changes, and Brazil producing specialty, cosmetic and pharmaceutical grade ethyl acetate, sourcing from Brazil would likely be the best sourcing option.

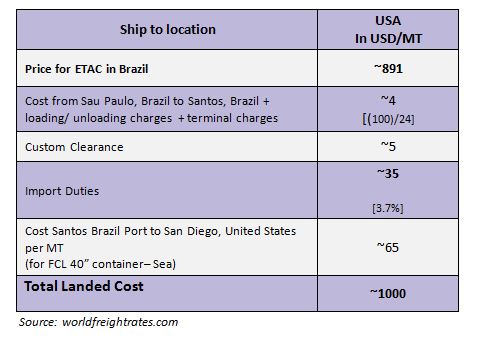

Given below is the TLC of ethyl acetate from Rhodia Brasil Ltda, Brazil via Santos to Port of San Diego, the U.S.

Brazil pays only 3.7 percent as export duty while shipping ethyl acetate to the U.S. as it is considered as a Most Favored Nation (MFN) for the U.S.

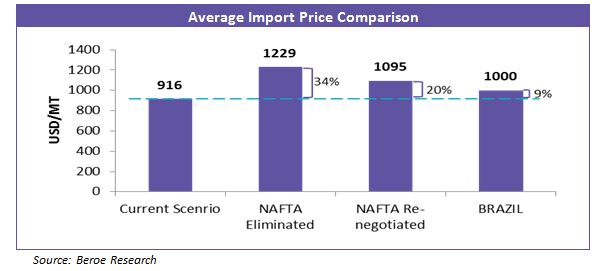

To summarize the average import price comparison, given below are the four scenarios.

The above price comparison is a clear indication that the import price from Brazil would be ideally cheaper than the import price from Mexico post NAFTA getting eliminated or re-negotiated.

With that being said, importing from Brazil would be a viable option as long as the tax after NAFTA renegotiation is above 9-10 percent. If the tax after NAFTA talks remains between 2-8 percent it would still be a viable and cheaper option to continue sourcing ethyl acetate from Mexico.

Conclusion

NAFTA being eliminated or renegotiated is expected to cause a rise in prices when sourcing ethyl acetate from Mexico. While the U.S. nearly imports around 36 thousand MT from Mexico from a single plant, Brazil has around 170 thousand MT of installed capacity coming from 3 plants. In addition, the cost of importing ethyl acetate from Brazil would ideally be much cheaper owing to Brazil being considered as a Most Favored Nation.

Post the decision on NAFTA (whether it gets eliminated or renegotiated) sourcing ethyl acetate from Brazil would be the best sourcing strategy that can be adopted to cut costs and at the same time ensure supplier security.

Assumptions:

A few assumptions have been considered before providing the best cost country sourcing solution, as nothing is concrete with respect to the fate of NAFTA.

- NAFTA is scrapped/re-written after negotiation post Q4 2017 – This is taking into account, that Trump would open talks for renegotiation or eliminate NAFTA completely. Ideally, around 6 months would be required to get it approved in the senate and another 6 months as a notice period to the other partner members.

- Mexican CIF prices goes up by 35 percent + other taxes – This assumption is taken in the scenario where in Trump, as mentioned in his mandates, decides to levy 35 percent import duties on imports from Mexico to the U.S. The other taxes include custom clearance and other minor duties.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe