COVID-19 Impact on Clinical Trial Ancillary Supplies

Introduction

With COVID-19 impacting the clinical trial supply chain, it is key for healthcare companies to keep their trials running. To ensure this continuity, it is important for drug products to be distributed among regions, receive biological samples from these regions, and transfer them back to central labs [1]. With countries introducing new restrictions in logistics due to increasing COVID-19 cases, it is important to understand how clinical trial ancillary supplies can be managed, like sourcing from the right suppliers, managing distribution to all trial sites, stock management, and responses to new regulations [2].

The pandemic has disrupted the clinical trial supply chain, creating a shortage of ancillary supplies for clinical trials. The lockdown has also resulted in logistical challenges involving the transportation of ancillary supplies to various parts of the world. Diversification of the supply base by global trial logistics companies is giving sponsors alternatives in Asian regions (such as India) and the Middle East. On the other hand, the demand for clinical trial ancillary supplies has spiked during the pandemic owing to the sheer increase in the number of clinical trials being conducted. Premier providers for cold chain clinical trials have experienced revenue growth as a result of commercial agreements with top pharma companies.

Trends within Clinical Trial Auxiliary Supplies (CTS)

Industry Overview

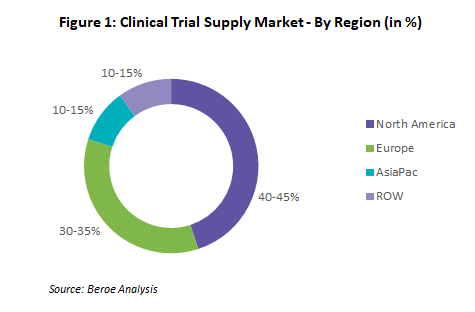

The global clinical trial supply market is expected to grow at a CAGR of 7.2 to 7.4 percent and is estimated to reach $3.0 billion by 2026, from $1.8 billion in 2019. The globalization of clinical trials, increased demand due to COVID-19, regulatory restrictions, and increasing pressure to reduce the R&D spend are the key drivers of this category. Major services in CTS, such as storage, distribution, and supply chain management, are outsourced to attain flexibility and to focus more on research. North America and Europe occupy the major share in the global CTS market due to the majority of trials being conducted in these regions, with a larger supplier presence as well (Figure 1). Although North America holds the highest market share for ancillary supplies by revenue, based on supply availability, Europe has more global players; hence, there is a higher supply availability to meet the demand.

Supply Landscape

The supplier market for clinical trial supplies includes specialist players such as Covance, Catalent, Marken, Paraxel, and so forth, and third-party logistics providers such as World Courier, DHL, FedEx, and so forth, all of which occupy equal share in the industry. Large players are moving toward consolidation to expand their supply base and global reach. Figure 2 describes the type of suppliers in this category. It is important for pharma to work with the right mix of suppliers to ensure uninterrupted trials.

Figure 2: Clinical Trial Supplies (CTS) – Supplier Types

|

Type of Suppliers |

|

|

Specialist Players |

Third-Party Logistics |

|

|

Source: Beroe Analysis

Regional Reforms

- In the U.S., dependency on China for supplies puts them at high risk of supply shortages due to ongoing tensions and disruptions of inspections of supply firms in China [3]. The recent announcement of the U.S. government is to finalize an executive order that would provide long-term incentives for U.S.-based companies to domestically produce medications and medical supplies in the U.S. [4].

- The European Union is also working toward a process that could lead to reforms in drug manufacturing to limit the shortage of clinical supplies. They have also realized the drawbacks of being dependent on foreign supplies from India and China, and are focused on increased domestic manufacturing for clinical supplies [5].

- In APAC, Japan has realized their reliance on imported medical supplies from China and South Korea, with the country losing its ability to produce locally. In response to this, the Japanese government announced on April 7, 2020 that it would provide $2 billion in subsidies to help Japanese companies move their supply chains back to Japan [6]. India is also dependent on China for certain supplies. However, the pandemic situation is leading to the revival of the ancillary industry and for pharma to become a self-reliant sector [7].

Shift toward Direct-To-Patient (DTP) Deliveries

The FDA and other health authorities such as European Medicines Agency, China, Korea, Singapore, and so forth are allowing DTP shipments for investigational product supply as an alternate distribution method. Moving to DTP deliveries to ensure patient adherence and participation in clinical trials has increased post March 2020. From April 2020, Marken has seen an increase in the number of onboarded DTP trials within a week , in contrast to the previous timeline of several weeks [8] [9].

In the EU, regulations do not engage DTP, and the sponsor has to get approval from the authorities. Once approval has been received, working together with a clinical supply manager who has years of experience with DTP in other countries (such as the U.S.) will facilitate the trial [10]. This has eventually led to a large number of job openings for clinical supply chain managers among suppliers, such as Thermo Fisher Scientific, IQVIA, and Covance in the UK, Belgium, France, and the U.S.

Key Technologies

The use of technology in clinical trial supplies changes the dynamics of logistics services by decreasing the wastage of supplies and increasing the patient-centric approach of clinical trials. Following are the widely adopted technologies that increase efficiency.

- Data Analytics-based Decision Making (IRT): The integration of enrollment data and inventory levels using IRT, simulation software services, and so forth will have a positive impact on overages and wastage levels. Ten percent cost-efficiency boosts have been reported from analytics [11]. During IRT selection, it is key to select a system that integrates with pharma’s CDMO supplier for process optimization and EDC platform [12].

- Block Chain Technologies (BCT): Block chain implemented into CT can be beneficial in terms of time, cost, process ease, data safety, and patient control. BCT is implemented in the pharma procurement supply chain financial services platform to improve efficiency, transparency, and financial operations.

Conclusion

The COVID-19 outbreak has greatly impacted the clinical trial ancillary supply value chain from the pre-clinical phase until data analysis. One of the main reasons for such a huge impact is a general lack of demand forecasting and feasibility planning. Continuous changes in regulations and regional governing bodies will affect the importation of clinical trial supplies. In the future, pharma companies can adopt collaborative approaches for the procurement of trial ancillary supplies and have a diversified supplier base. Recommended measures to counteract situations of shortage or supply chain disruption would be to engage in collaborative supply chain planning, whereby sponsors can maintain transparency in sourcing, have clarity on inventory status, and demand forecasting to mitigate future risk in the supply chain. Diversification of the supply base can also mitigate any adverse impact of macroeconomic factors. The world is moving toward a decentralized model of clinical trial conduct to enable a high patient retention rate as a result of COVID-19.

References

|

[1] |

J. Spinner, "Marken: COVID-19 shaking up clinical trial supply chain," www.outsourcing-pharma.com, April 2020. [Online]. Available: https://www.outsourcing-pharma.com/Article/2020/04/02/COVID-19-disrupts-clinical-trial-supply-chain. [Accessed August 2020]. |

|

[2] |

MESM, "MESM (Avantor Clinical Services)," MESM, 2020. [Online]. Available: https://www.mesm.com/blog/managing-your-clinical-trial-ancillaries-supply/. [Accessed August 2020]. |

|

[3] |

FTI Consulting, Inc, "COVID-19: Impact on Global Pharmaceutical and Medical Product Supply Chain Constrains U.S. Production," 21 March 2020 . [Online]. Available: https://www.fticonsulting-asia.com/insights/articles/covid-19-impact-global-pharmaceutical-medical-product-supply-chain. [Accessed 08 September 2020]. |

|

[4] |

P. V. Arnum, "COVID-19's Impact on Global Pharma Supply Chains," 1 April 2020. [Online]. Available: https://dcatvci.org/6425-covid-19-s-impact-on-global-pharma-supply-chains. [Accessed 08 September 2020]. |

|

[5] |

Reuters, "EU eyes overhaul of pharma rules to tackle vaccine, antibiotic shortages," Reuters, 02 June 2020. [Online]. Available: https://www.reuters.com/article/us-health-coronavirus-eu-shortages/eu-eyes-overhaul-of-pharma-rules-to-tackle-vaccine-antibiotic-shortages-idUSKBN23924D. [Accessed 08 September 2020]. |

|

[6] |

L. Yang, "Pandemic Exposes Perils of Global Reliance on China for Drug Supplies," 20 May 2020 . [Online]. Available: https://www.voanews.com/science-health/pandemic-exposes-perils-global-reliance-china-drug-supplies. [Accessed 08 September 2020]. |

|

[7] |

PTI agency, "Urgent action required to revive the pharma ancillary industry: IPA," 09 June 2020. [Online]. Available: https://health.economictimes.indiatimes.com/news/pharma/urgent-action-required-to-revive-the-pharma-ancillary-industry-ipa/76271284. [Accessed 08 September 2020]. |

|

[8] |

Marken, "MARKEN’S DIRECT TO PATIENT SERVICES EXPAND TO MEET NEEDS OF CLINICAL TRIAL INDUSTRY DURING CORONAVIRUS PANDEMIC," 09 April 2020. [Online]. Available: https://www.marken.com/press-releases/markens-direct-to-patient-services-expand-to-meet-needs-of-clinical-trial-industry-during-coronavirus-pandemic/. [Accessed 08 September 2020]. |

|

[9] |

4G Clinical, "The Complete Guide To Direct-to-Patient Clinical Trials," www.4gclinical.com/, May 2020. [Online]. Available: https://www.4gclinical.com/the-complete-guide-to-direct-to-patient-clinical-trials. [Accessed August 2020]. |

|

[10] |

B. Swites , "The Rise of Direct-to-Patient," February 2020. [Online]. Available: http://www.samedanltd.com/magazine/13/issue/319/article/5241. [Accessed 08 September 2020]. |

|

[11] |

C. Henry, "Wastage levels dip in clinical trial supply," www.pharmalogisticsiq.com, February 2018. [Online]. Available: https://www.pharmalogisticsiq.com/logistics/news/wastage-levels-dip-in-clinical-trial-supply. [Accessed August 2020]. |

|

[12] |

J. Spinner, "Almac: How to build a solid clinical trial supply chain," 22 July 2020. [Online]. Available: https://www.outsourcing-pharma.com/Article/2020/07/22/Almac-offers-clinical-trial-supply-chain-advice. [Accessed 08 September 2020]. |

|

[13] |

Contract Pharma Staff, "Yourway and Firma Ink Clinical Supply Deal," 12 May 2020. [Online]. Available: https://www.contractpharma.com/contents/view_breaking-news/2020-05-12/yourway-and-firma-ink-clinical-supply-pact/. [Accessed 08 September 2020]. |

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe