Able partnership helps to address capex decisions in contract manufacturing

Abstract

Contract manufacturing is growing rapidly and it has become necessary for a competitive edge in the market. Mostly large CPG and pharmaceutical buyers require huge number of assets to carry out their production, research and product development processes. With a shorter product life, the technology of those assets becomes obsolete after a certain time period. These companies by then accumulate a huge capital locked up as inventory in these assets. Many organizations are therefore taking this issue seriously.

Who should procure the equipment and assets required for production while engaged for a contract manufacturing arrangement; buyer or the CMO?

This paper will address the challenges that companies face in managing assets in contract manufacturing arrangements. It provides a brief overview on decision making for asset purchase and valuation methods.

Introduction

A capital investment for plant and equipment is a very important purchase decision for any organization; it requires a substantial amount of spend, both for initial purchase and over the life of the asset. Whatever may be the source of investment, the organization needs to understand the subsequent spend such as interest expense along with payment terms, if borrowed; a long-term commitment to manage the asset, if leased; MRO and disposal cost, if purchased. So the equipment acquisition decision should qualify for performance and value addition throughout its expected life and beyond.

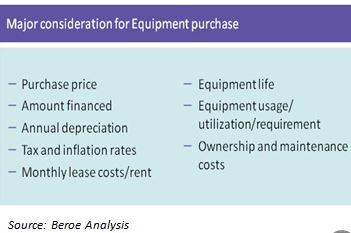

Though identifying the need for upgrading, replacing, or adding to existing capital equipment and machinery often begins in a department outside of supply management, the ultimate decision and execution on the capital purchase is mostly done by senior management and the procurement team. The supply professionals act as enablers and provide valuable inputs on technologies, purchasing and pricing structure during the decision making process. To develop an accurate matrix for the buying or leasing option, the buyer should analyze and understand the cost factors involved in each option.

General practices in industry

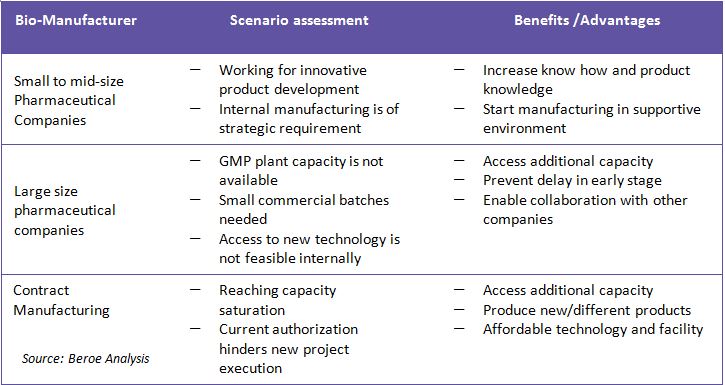

There is no one common solution for all models for CMO engagement. CMO provides a variety of services to the buyer companies -- starting from production development phase to product commercialization phase. The nature of these CMO contracts in the pharmaceutical industry would highly depend on the type of drugs such as small molecule-chemical based, large molecule-biologics based or patented, and generic drugs, the nature of contracts and level of commitment (in terms of resources and efforts).

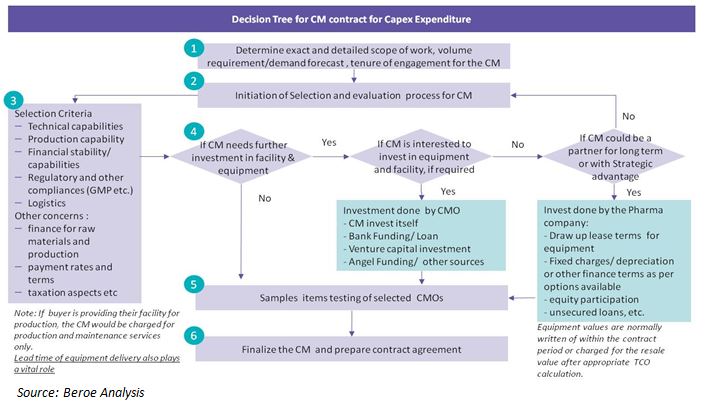

Therefore the decision should be taken on the basis of a detailed lifecycle cost analysis or total cost of ownership analysis for each of the various options available. Lifecycle costing looks at the purchase price or lease commitment, delivery, installation, training, spare parts, maintenance, depreciation, disposal of existing equipment, future disposal of this new equipment or expense of moving to another location, plant layout changes, and interest expense as needed etc. Though lifecycle analysis is a tiresome process, it has potential to offer an improved basis for comparing equipment suppliers, equipment models, and purchase options, etc. Following is a simple decision enabler:

Other scenario comparison for capex investment

If any buyer has to invest, it definitely ensures that there is sufficient business to cover the cost of owning the equipment and servicing the capital invested through capital repayment, interest and depreciation, etc. The service contract for product development (PDS) CMO services is more collaborative in nature, where buyers do share some of their IPs and assets in terms of technology transfer to the partnering CMO. A CMO may not need exclusive capital investment as the time requirement or demand during PDS services is small in quantity. However, if the same CMO is used during the commercialization stage, then buyers may consider making the required investment. CMO services for commercialization phase deals with large volumes and are more ideal for co-investment deals or infrastructure sharing models and even asset leasing deals. Many companies such as Sanofi, Merck, and Pfizer have sold some of their sites to their long associated CMOs as part of a contract to reduce their fixed cost associated with managing these facilities. In such cases, the CMOs are generally allowed to share these manufacturing facilities for other buyers to achieve economies of scale.

In the following cases, the buyer does the capital investment for CM:

- no available CM with the required technical qualifications, and/or

- the company wants to continue an existing contract manufacturing arrangement due to any of the following reasons:

- the buyer or their promoters managing the team already have a stake in the CM company

- the buyer has some commitment to the CM for continuing an existing contract and do not want a disruption in supplies and quality control, or do not wish to disclose the formulation to a new CM.

This investment can be done in several ways, following are a few examples:

- Equity participation in the CM company, and hence participate in the overall profits or losses of the CM company

- Equipment lease, with option to purchase after a specified period. The monthly lease rent will be set off against the contract manufacturing payments due to the CMO

- Secured or unsecured loans - for secured loans the machinery or equipment may not be possible to mortgage, hence some other form of security may be obtained - which is very difficult to secure because only a financial institution or bank may do so in most countries. Private companies are not allowed to secure mortgages from another company.

In all of the above cases, there is an inherent financial risk involved - with a possibility to lose a part or the whole invested fund.

Few emerging trends in the industry

1 . Accessing 3rd party facility for production

A new emerging business model presents a different solution that provides ready-to-use and GMP-compliant bio manufacturing facilities with integrated support services. This new concept offers flexibility for GMP bio-manufacturing in a pay-as-you-use model. Such concepts are mostly adopted in clinical or in product development case with small quantity requirement.

2. Partnerships -used equipment suppliers

Companies look for a trusted strategic partner who can provide support through the entire selling and buying activity of equipment for manufacturing. Major drivers for the above strategy are cost pressures for new investment and underutilization of assets: the average asset utilization of any of the global top 25 pharma companies is only around 45 percent. Hence, companies are looking to eliminate redundancies to enhance efficiency and increase productivity.

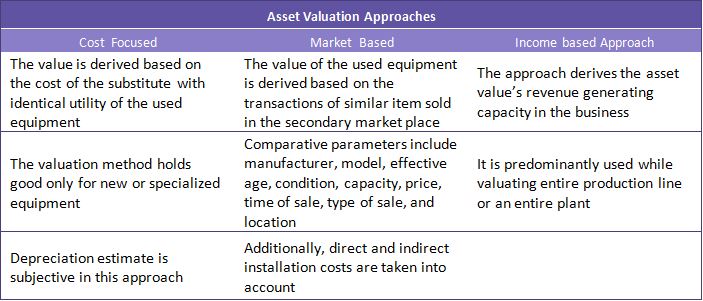

Basically, these suppliers offer a complete range of value added services for both the used or redundant asset owners and those looking to purchase them. Such partnering vendors have to understand all about the pharmaceutical laboratory, processing, and packaging equipment. They should have an established network across the industry and be able to provide comprehensive customer support from certified appraisals to strategic management services, etc. Experienced equipment dealers can also very effectively support the recovery needs of large pharmaceutical companies with multiple sites around the world. In general, used assets or process equipment is often sold at 40-50 percent depending on the remaining life of asset (sometimes even < 20 percent) of the cost of new systems. The sale of used pharmaceutical equipment helps asset owners recover some of the initial investment made in assets that are no longer useful to them. The purchase of used equipment provides savings for buyers and significantly reduced lead times.

Liquidation options

Since a large amount of capital is locked up as plant and equipment, a proper liquidation strategy would help in recovering some value out of such assets when compared to scraping/disposing them. The organization should leverage various liquidation channels and gain as much as possible from the surplus assets.

The decision for liquidation depends on various considerations such as requirement of warehousing space for unused equipment, target resale value, closing of accounts, and the nature of demand for the type of equipment.

- In house liquidation teams could be of two types: asset disposal networks and dedicated asset management team

- Asset disposal networks/team is cross functional and it helps in effective assessment of the market value of the equipment so as to optimize losses. TEVA Pharmaceuticals, pharma companies from Germany and ERCROS in Spain follow this model

- A dedicated asset management team has centralized control and knowledge of surplus and used equipment within the organization across various production lines and across units giving them an edge over asset disposal networks which are formed on an ad hoc basis. Ex: BASF Chemicals and Dow Chemicals practice this model

- External liquidation channels are preferred because of their bigger buyer reach, knowledge of the markets, integrated services that tend to reduce transaction costs

External liquidation channels include equipment dealers/distributors, classifieds and Ads, E retail markets, auction houses, private treaty sales and asset management companies. External channels are mostly preferred because they reduce the huge cost burden of maintaining an internal team. Also, lack of experience and exposure to real value of redundant assets or the market place to redeploy or sell the assets or insufficient knowledge on the world-wide buyer-base makes it less profitable as a venture.

Market-based asset valuation is the commonly followed valuation approach in the market. The following can be considered as benchmark for returns at each life cycle stage for used equipment:

Conclusion

There are no standard agreements to highlight remuneration structures for new equipment purchases while engaging with CMOs. The financial arrangements are prepared on a case-to-case basis depending on the various aspects of a contract.

Also, the historical relationship between the brand owners/ buyers and the CM companies should be meticulously evaluated. Few basic questions can help in evaluating actual synergy between both the parties, such as:

- Have they stood by each other in times of crisis in the past?

- Will they do so in future?

- Should the company engage with the same management team or a different management team would be better?

The answers to these questions can help the parties arrive at a decision that provides mutual benefit.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe