Clinical Investigator Payment Best Practices

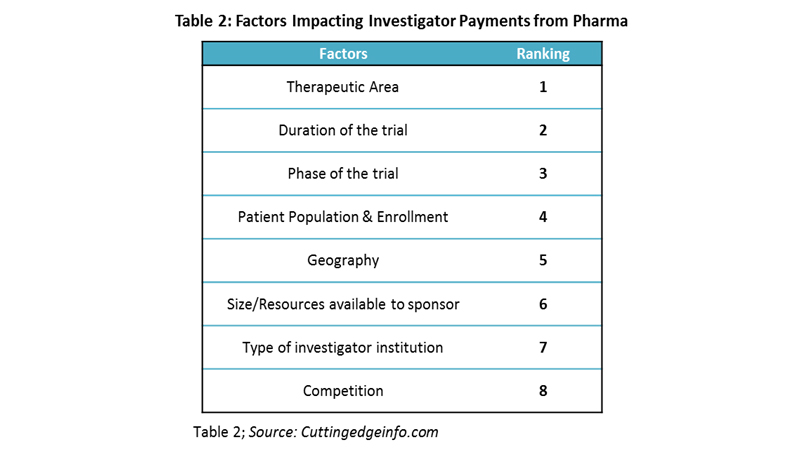

Managing the investigator payment is one of the most challenging aspects of running a clinical trial. Major factors considered by pharmaceutical and biotech companies for investigator payments are therapeutic area of interest, duration of the trial, clinical phase, and patient enrollment. However, only therapeutic area is considered by more than two-thirds of the companies.

The recent emphasis on transparency requires accurate, smooth, and shared payment tracking, which puts additional pressure on sponsors. The payments made to investigators must be unbiased, reasonable, and equal to the fair market estimation. With increasing scrutiny and regulations from government agencies (Sunshine Act), the pharma industry is forced to estimate the fair market value (FMV) more precisely than before. The industry is moving toward formalizing the payments to investigators and key opinion leaders (KOLs) to provide consistent payment rate cards but lacks harmonization in the process. According to experts, the decision to select certain percentiles is more dependent on sponsors’ established management policies and philosophies that dictate how they want their studies budgeted as part of their fair market practices.

Investigator Payments/Grants: An Introduction

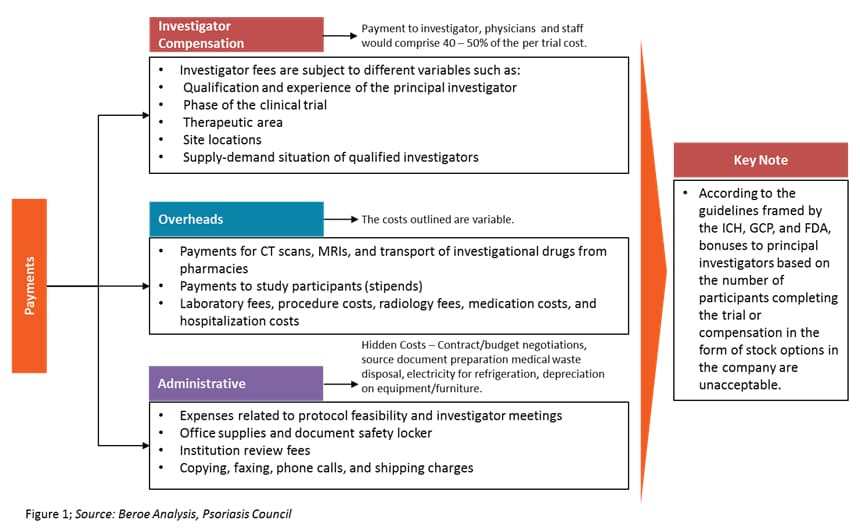

Investigator grants have three components — investigator compensation, overheads, and administrative costs. Among this, the investigator compensation component contributes 40 to 50 percent of the overall trial cost. It includes payments to investigators, physicians, and other staff. Figure 1 defines investigator grants as a category.

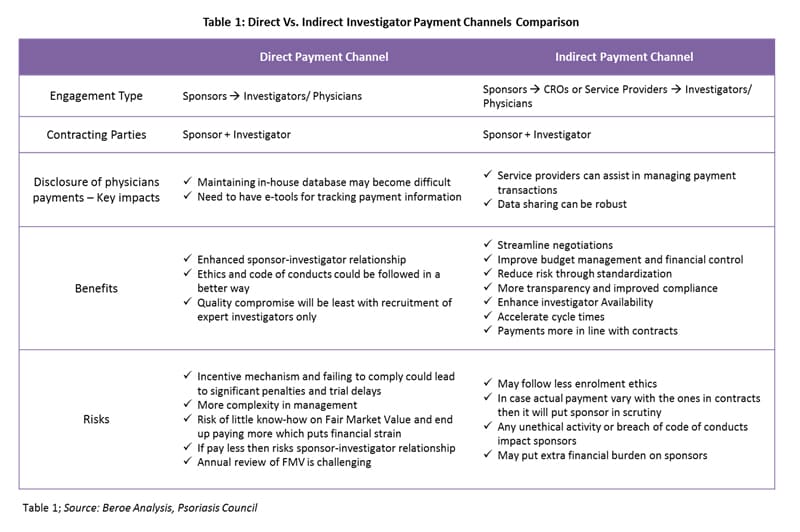

There are both direct and indirect investigator payment channels, each with their own benefits and risks. Table 1 provides a comparison of both channels.

Payment negotiation differs depending on the payment channel. With direct payments, the payment schedule is subject to negotiation with the sponsor company. The principal investigator and departmental administrators should develop a suggested payment schedule based on the spending pattern anticipated for the study. For an outsourced trial (indirect payments), the role of third-party service providers is limited to the operations of a site. CROs, along with the sponsor, would recruit investigators. However, the contracting parties would be the investigator and the sponsor.

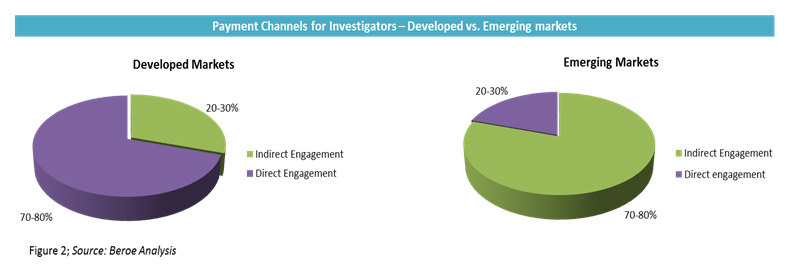

In direct payments, large pharma companies prefer to pay investigators in milestones. On average, the initial payment can be as high as 40 to 50 percent of the total grant, and the rest of the payments are based on enrollment or other milestones depending on study type. In indirect payments, despite the CRO handling the fees, the sponsor is always the primary contract partner and holder with the investigator for liability reasons. However, this phenomenon is less pronounced in emerging markets. In emerging markets such as India and China, the adoption levels for indirect engagement are as high as 80 to 100 percent, as major pharmaceutical companies do not have a direct presence in such regions. The adoption rate of payment channels for developed versus emerging markets is provided in Figure 2.

Factors Influencing Investigator Payments

Investigator payment holds the largest share of the clinical trial budget, making it crucial to estimate payments accurately. Factors considered by pharmaceutical companies for investigator payments and their importance are provided in Table 2.

Fair Market Value Evaluation

FMV started when the Office of Inspector General (OIG) regulations were published in 2003. In later years, the Centers for Medicare & Medicare Services (CMS) instigated the definition of the FMV. Even with the clear definition, the rules do not provide advice on determining the FMV, which puts pharmaceutical firms/industry sponsors at financial and legal risk. Industry sponsors should avoid any situation of incentivizing or offering additional payment to the investigators, as they may end up with heavy penalties.1

Challenges Faced During Fair Market Value Payment

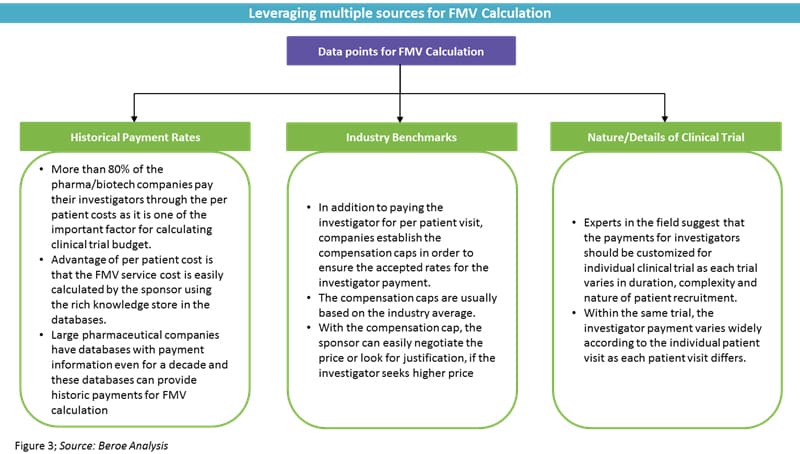

Pharmaceutical firms are facing challenges in how, when, and what to pay investigators, as they need to follow FMV pricing. Most of the time, the industry sponsor does not have accurate FMV pricing and depends on either historical or benchmark pricing. Medicare data does not fall into the definition of FMV pricing and does not accurately reflect FMV pricing, as it has been associated with inaccuracies.1 Several companies offer benchmark tools, but they do not exactly match up to the local requirements and, hence, do not reflect the perfect FMV benchmark.

FMV Calculations

The general rule of thumb is to look at how old the benchmark data is and the source of the data. If the original data is derived from Medicare data, the FMV benchmark will be lower than the accurate value.1

Interestingly, dedicated payment provider solutions like DrugDev, Medidata, Greenphire, and Bioclinica (Clinverse) collectively manage about 7 to 10 percent of the market. Otherwise, payments are handled by CROs under typical full-service engagements or in-house by sponsor teams.

In addition to the industry sponsors, physicians are also ignorant when it comes to healthcare finances, given all the medical insurance and billing policies in place.2 As a result, clinical trial sites and sponsors do not have an accurate source or information to perform the FMV calculation. Even though the entire cost of clinical trial is incurred by the sponsor, the day-to-day role of the sponsor in the clinical trial is minimal. However, the sponsor creates budgets for the day-to-day activities of the site investigators.

Does a perfect percentile exist for FMV calculation?

According to experts, the decision to select certain percentiles is more dependent on the sponsor's established management policies and philosophies that dictate how they want their studies budgeted as part of their fair market practices. Oncology is paying at higher percentile ranges than other therapeutic areas, as it is the leading area of research in the industry. According to Evaluate Pharma, oncology and immunomodulators encompass about 34 percent of all active studies. In addition, most of this type of research is being conducted at academic and other large institutions, which tend to have a higher cost-basis for overhead and additional administrative and support fees. With respect to other therapeutic areas, there is no real high-range benchmark for each area.

Conclusion

Every company and their organizational structure varies when it comes to dealing with FMV for trials. FMV is a concept, so there are no specific numbers for maximum overhead percentages or acceptable fees. FMV must be embodied by sponsors to ensure fair practices, with the goal of avoiding briberies or kickbacks which could damage the objective process of running clinical trials and provide undue influence on medical professionals caring for patients.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe

T