Adopting AI-chatbots helps to improvise the banking experience

Abstract/Business Case

1 Introduction

Retail banking customers often have to endure long turnaround times to have their queries resolved. However, with advancement in technology, it is possible to have a quicker resolution. In this whitepaper, we discuss an upcoming technology that could make banking faster and more convenient.

2 Main

With increasing competition in the banking sector, customers’ demand on turnaround time has been increasing. Despite technological developments, customers sometimes have to go through multiple iterations over phone, email or IVR systems to complete even basic banking transactions.

3 Recommendation

One of the options that banks have is to leverage a technology based on artificial intelligence. Termed AI-chatbots or Chatbots, these are computer programs used as virtual assistants that can act on human conversations.

Problem Statement / Introduction

Technology spend in the banking space continues to be high, driven by the ever increasing need for more efficient banking services. In today’s competitive banking landscape, customer expectations on response/turnaround times are increasing at a pace that large banks are struggling to catch up with, compared to their new generation peers. Also, the online lending institutions following an algorithmic approach enabling quick credit disbursements have resulted in upping the expectations of retail customers towards turnaround times.

Customer-bank contact channels are also heavily tilting towards the digital platform. Despite this digital shift, customers still have to rely heavily on time-consuming phone and IVR systems for even basic banking enquiry and operations. Hence banks are looking to leverage advances in technology such as artificial intelligence to reduce the time for customer transactions right from the application stage to credit disbursement and collections.

Proposed Solution(s) /Implication(s)

One such initiative that is gaining popularity in banking circles is the use of chatbots which are essentially computer programs that can comprehend and act on people conversations. This whitepaper seeks to explore the potential for these artificial intelligence-based chatbots in the banking industry including pitfalls and supplier landscape.

AI-Chatbots – How do they fit in the banking ecosystem?

Virtual Assistants:

These are bots powered by artificial intelligence coupled with deep banking-specific domain knowledge that facilitate customers to ask banking-related questions without visiting the bank or calling up customer service centres. Banking activities can be done through conversation-like interactions thereby reducing turnaround time. This is facilitated by a combination of natural language processing, voice technologies and speech-to-text software across mobile and other web platforms.

Banking Activities:

Chatbots can be applied for activities such as bank statement requisition, checking balances, spend breakdown analysis (by merchant, category, payment gateway, payment mode, spend amount buckets, etc.), credit card balance, and payments. These are currently being achieved by leveraging quick messaging platforms such as Facebook Messenger, Slack, iMessage and also SMS. Chatbots can be enabled through customer’s banking mobile application.

AI also enables the bots to go a step further and predict customer needs (learnings from past conversations) such as asking for breakdown of food costs when the customer asks for category wise analysis of credit card spend. With domain knowledge built-in, customers can get information on banking terms, acts, trends, etc.

To extend these capabilities to payments, these standalone chatbots need to be integrated with the banking applications. The chatbots can also be used to analyze financials at the customer level across different bank accounts by connecting the respective bank applications.

Investment and Portfolio Analysis:

Domain knowledge can also be extended to include investment and portfolio analysis by the customer. Authorized transactions can be conducted by integrating with the banks’ security transaction applications. In addition, customers can use chatbots to analyze portfolio, compare returns across securities and also perform ROI calculations.

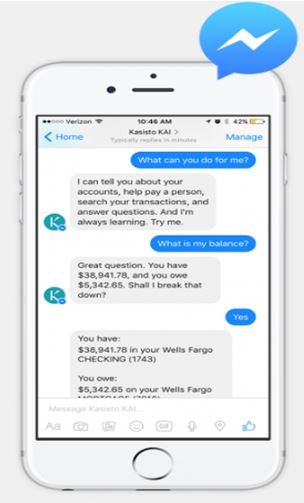

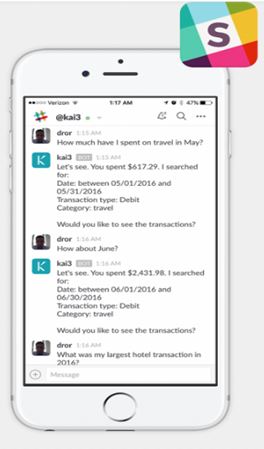

Here is a snapshot of intelligent conversations on two messenger applications – Facebook messenger and Slack.

Source: Kasisto’s MyKai Banking Bot

Supplier Landscape and Adoption

While there are a fair amount of suppliers in the AI chatbot space, only few of them cater to the banking sector such as Kasisto, a US-based supplier with a dedicated solution for banks (MyKai). The other prominent names in the AI-based chatbot space include Trim, Penny, Digit, Abe.ai and Niki.ai.

In terms of adoption, notable names in the banking space who have begun using virtual assistants are DBS in Asia through its Digibank application and Royal Bank of Canada (RBC) for general operations such as checking of account balance and information disbursement. Bank of America has also announced plans to use chatbots on Facebook Messenger. HDFC Bank has also begun using AI-based chatbots for customer enquiry services.

Challenges and Way Forward

Considering the criticality associated with the banking sector, there is very little room for incoherent messaging and wrong interpretation. The underlying algorithm is based on a machine learning approach and hence the conversations and actions are expected to get better with more iteration.

Improvements in machine learning can also address language or speech disparity issues such as accent and pronunciation differences. This is achieved by studying multiple conversations and identifying similarities/patterns in speech to match words and phrases to their meanings.

Further, machine learning is being leveraged to bring about greater financial discipline and increase savings and investments of customers. Customers can quickly interact, compare and clarify on investment instruments ranging from tax savings to interest earned, reducing the thought-to-action time.

Procurement Action Plan Summary

While AI-based chatbots offer promising efficiency opportunities for banks and customers alike, banks would have to conduct robust pilot runs before bringing them to the mainstream banking transaction space.

Also, recognizing that this cannot be fool-proof, banks need to parallely develop an effective redressal mechanism that swiftly addresses wrongful actions initiated by the chatbot environment covering both bot triggered and customer triggered actions.

Conclusion

Though AI-based chatbots cut across industries, its application in the banking sector (where ROIs on technology are always not as expected) definitely looks promising considering the premium customers place on turnaround times in this digital age. Albeit at a nascent stage, there is a great need to perform robust test runs before these virtual assistants start to handle end-to-end transactions for a retail banking customer.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe