Ivory Coast to be a potential cashew- sourcing destination for India

Abstract/Business Case

There is a huge demand for cashews globally with the U.S., the EU and Japan being the key global export markets. India is one of the largest cashew producers and processors in the world. However, a large share of the production gets absorbed by local demand. To capture the high-value export market, India is dependent on raw cashew nut imports from other growing regions such as African nations. Additionally it is preparing to increase its domestic production to increase local sourcing.

The paper assesses the supply-demand scenario of cashews in India including trade, and projects the acreage expansion in future. Currently, the big cashew processors in India are importing raw cashew nuts from Benin, Ghana, Ivory Coast, Togo and Guinea Bissau. Maharashtra, Andhra Pradesh, Orissa are the top cashew growing states in India. Recently, Olam set up a cashew processing facility in Vishakhapatnam to capture the growing cashew demand and leverage the availability of skilled labor in India.

The paper analyses the cashew industry in India and the top cashew growing countries in Africa, namely - Côte d’Ivoire, Nigeria and Tanzania. The objective is to understand whether there will be adequate supply of cashew nuts in India to utilize its growing processing capacities. And also to understand which African country would be the most suitable sourcing destination for India.

Further, the whitepaper attempts to assess which country will be the top global supplier of cashew kernels in future. A detailed qualitative and quantitative research has been carried out to draw comparison between these countries based upon various parameters such as raw cashew production, processing capacities, quality of cashews, labor availability and investments.

Global Production

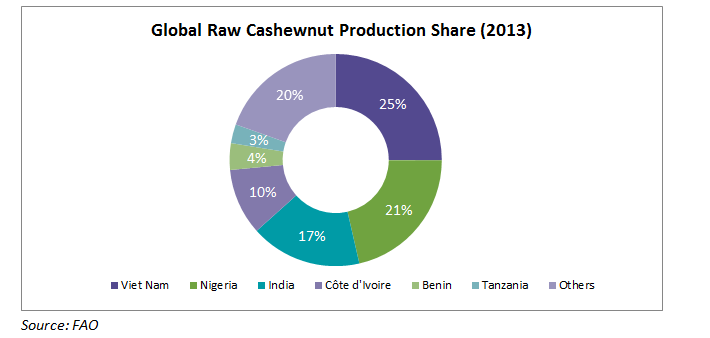

Africa is the largest cashew nut producer in the world. Nearly 80-85 percent of the total tree nuts in Africa consist of cashews. Nearly 40 percent of the global production of Raw Cashew Nuts (RCN) is from West and East Africa, with major countries being Nigeria and Ivory Coast. Africa exports 80-90 percent of its RCN in-shell to India, Vietnam and Brazil where it is processed and exported to the consuming markets of North America and Europe.

Asia is another large cashew nut producer with majority of plantation taking place in Vietnam and India. Latin America also contributes moderately to cashew nut plantation with Brazil being the top producer in that region.

Supply-demand scenario in India

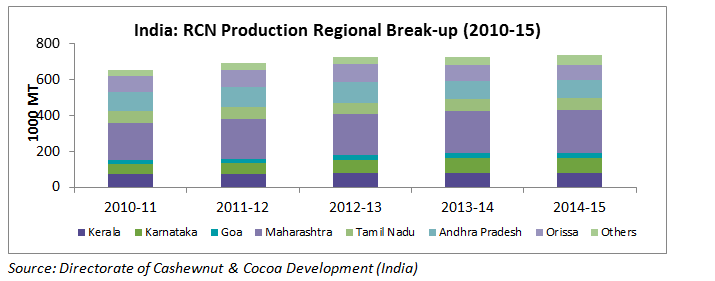

RCN cultivation in India is carried out in coastal states. On western coast, it is carried out in Goa, Maharashtra, Karnataka and Kerala. On eastern coast, it is carried out in West Bengal, Orissa, Andhra Pradesh and Tamil Nadu.

The area under cashew cultivation is constantly increasing in India. Acreage expanded at a CAGR of 1.7 percent during 2010-11 and 2014-15 period with the largest expansion growth in Orissa. Nearly 70-75 percent of cashew cultivation in India is carried out by small and marginal farmers living in the coastal belt of India.

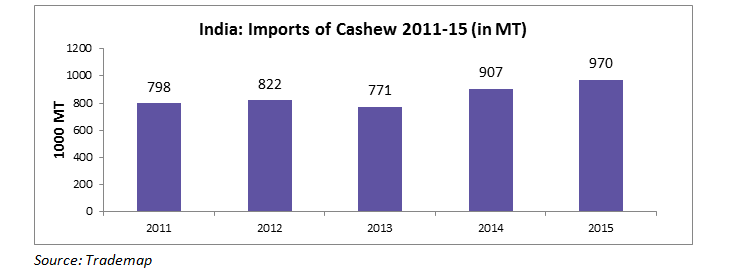

India is one of the major producers, processors as well as consumers of cashew. The domestic produce is not able to meet the overwhelming demand, hence Indian processors end up importing from the African and other Asian countries.

India’s current processing capacity is 2.5MMT which can produce nearly 0.55MMT of processed cashew kernels. Current capacity utilization stands at 60-65 percent. However, there is expansion in processing capacity especially with increased investments in Orissa and Andhra Pradesh.

Currently, India produces nearly 7-8 lakh MT of raw cashew which can utilize only 1/3rd of the total processing capacity. Therefore there is heavy dependency on imports of raw cashews. African nations such as Ivory Coast, Tanzania, Benin, Guinea Bissau, Ghana and Nigeria contribute 85-90 percent of total cashew imports in India.

Cashew supply-demand scenario in Africa

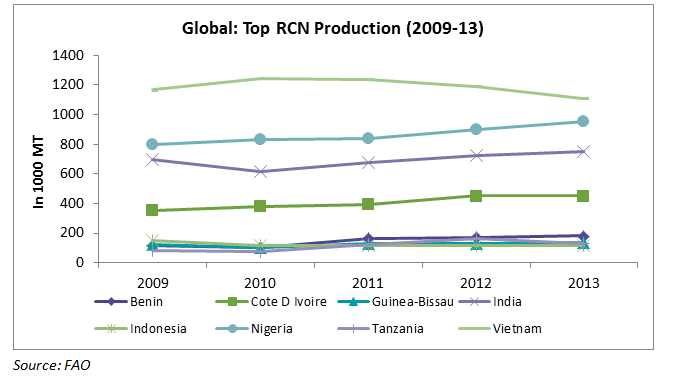

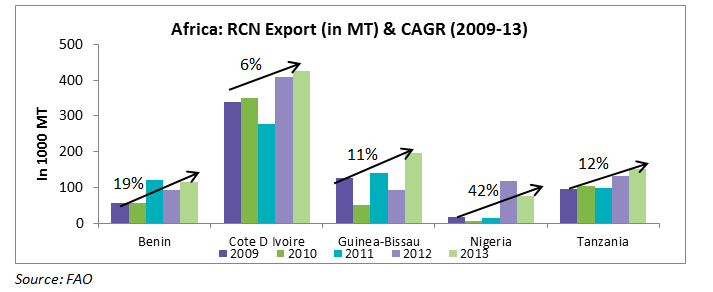

Africa produces nearly 40-45 percent of the global RCN production. Africa’s production has increased from 1,469,100 MT in 2009 to 1,846,142 MT in 2013 which represents a CAGR of 5.4 percent. However, there was a fall in production in 2014 to 1.4 MMT which rose nearly to 1.5 MMT in 2015. Nigeria and Tanzania are the top growing countries in Africa.

Domestic demand of cashew is minimal in Africa and there are not many processing facilities in Africa to process cashews to tap export demand. However, in recent past, processing scenario seems to be evolving and growing with government/non-governmental initiatives taking place to ensure sustainable cashew cultivation and growth in processing.

African Cashew Initiative (ACI), the sustainable trade initiative (IDH) are a few of them which are aimed at strengthening cashew cultivation, processing and trade altogether. Some of the large processing companies such as Olam have invested in expanding processing capacities in Africa. In 2012, Olam opened a processing facility in Côte d’Ivoire with annual production capacity of 30,000 MT. Olam has raw nut processing facilties in Tanzania, Mozambique, Côte d’Ivoire and Nigeria.

As a result of these initiatives, there has been a rise in the processing capabilities in Africa with quantity of processed cashew rising from 10, 000 MT in 2011 to 52,000 MT in 2014. However, there was a drop again in 2015 to 38,000-40,000 MT as African farmers did not prefer to sell raw cashew in domestic market. This is because local buyers delay payments to farmers whereas foreign buyers make quick payments at spot prices. Altogether Africa processes 10-15 percent of its production mainly for the export market.

Due to low processing capabilities, African cashew nut production is directly exported to processing countries such as Vietnam, India and Brazil.

Exports from the top growing African countries have been continuously rising since 2009. The share of export out of total production in these countries was about 40 percent in 2009 and it increased to 50-55 percent in 2013.

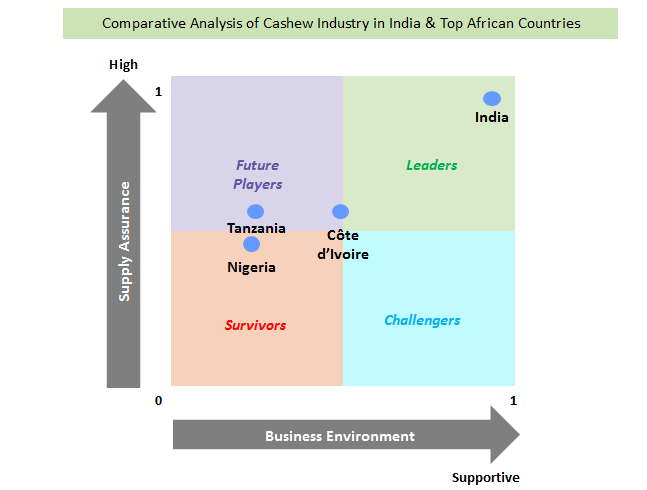

Although Africa’s presence in cashew plantation is very strong, there are challenges in processing. On the other hand, India’s domestic production is less compared to its demand (domestic and export) but there are huge processing capacities. For an end-user industry buyer, both aspects are crucial to ensure uninterrupted supply at competitive prices. To understand the overall capability of the top African nations vis-à-vis India, a comparitive analysis was carried out. The analysis brought to fore which country would be the ideal sourcing destination in near future and why.

Comparitive Analysis: India, Côte d’Ivoire, Nigeria and Tanzania

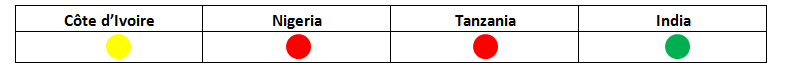

Below is a detailed comparative analysis of the overall cashew industry of the major growing countries in Africa - Côte d’Ivoire, Nigeria and Tanzania; and India. The analysis has been carried out of 7 key aspects – raw material (RCN) availability, ageing issue in trees, processing capabilities, labor quality, product quality, R&D and technology investments and overall business environment. The table in each section represents favorability of individual country for that particular parameter. The legends represent the following: Green: High, Yellow: Moderate, Orange: Low and Red: Very Low

1. Raw Material (RCN) availability

Côte d’Ivoire: In Africa, Côte d’Ivoire’s cashew nut production has been continuously rising since past 5 years. For 2014-15, its production was 700,000 MT which is a jump of nearly 20 percent from its 2014 production of 590,000 MT. By 2020, the production is expected to reach 650,000 MT.

Nigeria: While Nigeria had witnessed huge cashew nut production in past, there was decline in 2014. In 2014/15, Nigeria’s cashew nut production was only 145,000 MT; however the production is expected to increase in 2015/16 to 175,000 MT. Overall currently production is very low in Nigeria. Nigerian production is estimated to touch 250,000 MT by 2020.

Tanzania: Tanzania is witnessing rise in cashew production. In 2012/13, its production was 127,000 MT and it increased to 189,000MT in 2013/14 and further to 195,000 MT in 2014/15. Despite the increase in numbers, the production is low. Production in Tanzania is expected to grow at 10-12 percent CAGR till next 5 years and is estimated to reach 240,000 MT.

India: Cashew nut production in India in rising constantly and is expected to reach nearly 900,000 MT in 2020. Andhra Pradesh (AP) and Orissa are expected to witness production growth of 3-4 percent. As against only southern coastal states, cashew plantation has also begun in Gujarat, Chhattisgarh, Assam and Madhya Pradesh. However, availability of agriculture land is a limiting factor in India in addition to competition it faces from other cash crops in India such as cotton, coffee, spices, chilli as these provide better returns to farmers.

Africa, on the other hand, has enough arable land available and with cashew being one of the few cash crops in the region, its cultivation is taken up well by many small farmers.

2. Ageing issue of trees

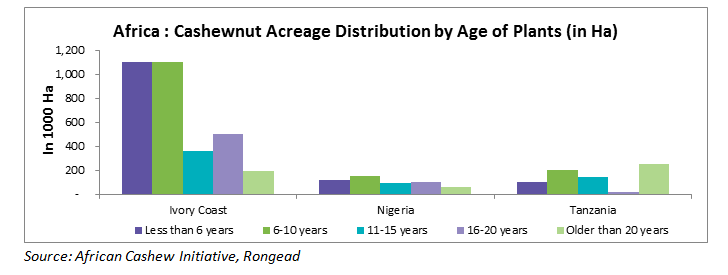

A cashew tree starts bearing fruits only after 4-5 years of age. After 15 years of age, the productivity of cashews start declining and hence its important to replace old trees by plants new/young trees.

Côte d’Ivoire: Most of the trees are relatively young and new with yields. Nearly 10-15 percent of the acreage is less than ten years of age. Further acreage expansion is also taking place and improved varieties are being planted.

Nigeria: There is high rate of tree falling in Nigeria in recent times, without any replacement with newer and high-yielding varieties.

Tanzania: Tanzania’a cashew acreage has been almost constant in past 4-5 years. Compared to Côte d’Ivoire, plants in Tanzania are senile and less productive.

India: Many new cashew nut trees are being planted in India. Prakasam, Srikakulam, Vizianagaram, Visakhapatnam, West Godavari and East Godavari are the key regions in Andhra Pradesh where new tree plantation is taking place.

Forecasted Production (till 2020)

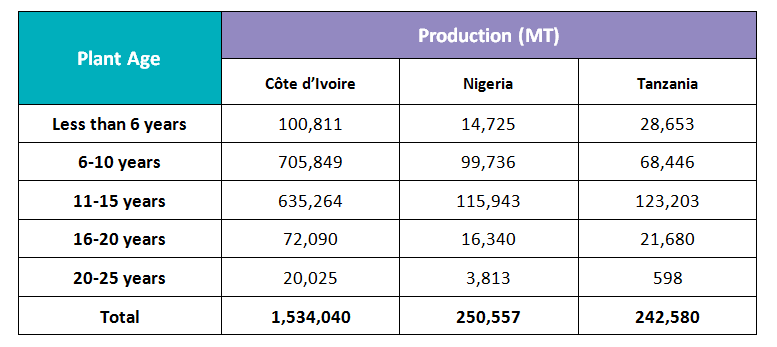

The above graph depicts the distribution of cashew nut trees in Ivory Coast, Nigeria and Tanzania, as per the plants’ age. The key aspects considered for the projection include: current planting scenario, yields of cashew trees under different age groups, wastage occurrence ( as per historical productive acreage) and historical growth rate in acreage expansion. India’s production is expected to grow at nearly 4 percent CAGR in the coming 5 years and thus estimated production in 2020 is nearly 900,000 MT.

3. Processing Capabilities

Côte d’Ivoire: Processing capabilities are still very limited although the country is getting immense government attention due to its increased cashew production. In recent past, Olam invested heavily to build cashew processing facility with an annual processing capacity of 30,000 MT.

Nigeria: The installed processing capacity of Nigeria is 48,000 MT however its utilization is only 25-30 percent. There are 7 processing plants in Nigeria each by the following players: Olam, Foodpro, Esteema Diamond, Abod success, KD Foods, ACET Nigeria and Valency. However, Olam’s processing facility (Capacity: 28,000 MT) in Nigeria is about to get shut as the capacity utilization is below 30 percent and processing costs are very high.

Tanzania: Tanzania’s cashew processing capacity was 94,000 MT in 2012. The Cashew Nut Board of Tanzania (CBT) is planning to set up new processing facilities to increase the capacity to 30,000 MT. In additon, Tandahimba Newala Co-op Union is also in the final stages of completing its processing facility with capacity of 30,000MT.

Overall the African processing industry faces 3 key issues:

- Firstly, lack of policy support from the government

- Secondly, in case of manual processing, availability of skilled labor is a key requirement. However, Africa is not likely to produce comparable results as the skills are to a great extent not easily transferrable and adoptable. Labor management including skill training and development is a very challenging task in Africa. Mechanization is also an issue as adaptability to new technology is very slow. There are challenges in finding machine spare parts which increasing the overall maintenance cost.

- Thirdly, low domestic demand for cashews and no market for broken cashews and cashew by-product including cashew nut shell and cashew peel.

India: There are increased cashew processing investments in India by large companies such as Olam, Rajkumar Impex, VLC Group. Currently the ratio of manual to automatic/semi-automatic processing in India is 60:40. There is strong demand of broken kernels in domestic Indian market and this level of processing suits the specificity of cashew demand in India. The overall value-chain realization from cashew is also high in India as by-products such as cashew nut shell liquid, cashew juice, cashew apples are also sold. India’s current installed processing capacity is 25 lakh MT and is increasing further. Capacity utilization is about 60-65 percent in India.

4. Product Quality: Although the quality of raw cashew nut is better in Africa, due to poor handling and packaging techniques, spoilage rate is also high. This results in high rate of rejections of kernels from Africa.

5.Labour Quality:

Africa: Mechanization is very limited in African countries and if manual processing has to take place, there is requirement of skilled labor. Manual processing would require highly skilled labor to minimize breakage of cashew kernels. Cashew peeling needs improvement in African countries as improper peeling ways results in losses. In Nigeria, kernels are sold at a discounted price of $100-150/MT.

India: The quality and skill-set of labor is high which results in high quality of whole kernel. This is the direct benefit obtained from higher percentage of manual processing as whole grade Indian cashews command higher price than African kernels.

6. R&D and technology investments:

Côte d’Ivoire: Steps towards technological advancements are taking place. Ivory Coast is partnering with Vietnam at various levels (govt., processors, and investors). This would help the country in creating improved cashew varieties, get access to Vietnam’s processing technology, and facilitate technology transfers between the two nations. Ivory Coast is also planning to set up a plant to manufacture bioplastics from cashew apple juice (by-product utilization) in 2017/18.

Nigeria and Tanzania: There is dearth of technology innovations in Nigerian and Tanzanian processing industries as well as in developing improved varieties of cashew plants. This leads to high processing costs and lower yields compared to other countries such as Brazil, Vietnam, and India. In both these countries, about 30 percent of the trees produce 80 percent of the cashews and remaining 70 percent produce only another 20 percent. This reflects the productivity disparity in both countries.

India: There is a constant agricultural research going by ICAR and processing companies towards developing improved varieties and good agricultural practices. Research by AICRP (All India Coordinated Research Project) on cashew and DCCD (Directorate of Cashewnut and Cocoa Development) has resulted in cashew cultivation in the hilly terrains of North-eastern India such as Tripura, Meghalaya, Mizoram and Assam. The productivity in these states is comparable to that of Maharashtra.

7. Business Environment:

Côte d’Ivoire: The overall regulatory environment is in a nascent stage but evolving. Prices are fixed and regulated by the marketing body - Council of Cotton and Cashew (CCC). Smuggling across road borders (which was widely prevalent till 3-4 years back) is also being checked with the help of CCC. However, lack of government financing (especially raw material financing) is a very limiting factor for the processing industry to invest in processing plants.

Nigeria: There are minimal government incentives in Nigeria for cashew processors, compared to other countries. As a result, processing cost is very high ($520/MT).

Tanzania: The Cashewnut Board of Tanzania (CBT) sets the price for cashew in Tanzania. However, farmers receive lesser than the set price in many instances. CBT introduced the Warehouse Receipt System to bring transparency in payments to farmers and facilitate competitive buying by processors. While it has streamlined payments, it has also lead to increase in black market sales.

India: The overall business and regulatory environment for cashew production, processing and export is very supportive in India. Various non-governmental organizations and agencies such as SERP (in Andhra Pradesh), ITDA are facilitating large processing companies in organizing farmer co-operatives and increase direct procurement from farmers. This would reduce cost and ensure traceability of the product.

The Krishnapatnam Port in Andhra Pradesh is providing land and labor to processors for setting up factories. The port possesses about 12000 acres of land which it plans to lease out/sell for cashew processing. Some of the major cashew processors such as Vijayalaxmi cashews, Maruthi, Kohinoor and Bharat Cashew would be using the port for trials.

The Cashew Export Promotion Council of India (CEPCI) is a key government body for promoting and regulating cashew export from India. It helps in making the overall trade process for cashew smooth with the partnering country.

Conclusion

India – Slow production growth but surge in processing! Will continue to be a promising and secure cashew kernels sourcing destination in future

Currently, India is the largest processor of cashews and the scenario is going to remain the same in medium-term (2-3 years). While India’s cashew acreage is expanding in existing and new territories, the growth is slow. Availability of arable land is a limiting factor in India and hence growth in plantation would be slow in the medium term. Moreover, there are other cash crops in India such as cotton, spices and coffee which also compete with cashew in India.

In future, cashew nut production in India is expected to reach nearly 9 lakh MT by 2017-18, from the current levels of 7.4 lakh MT. This represents production increase at a CAGR of about 6 percent. Planting of new trees now is taking place but cashew trees start bearing fruits only after 4 years hence acreage expansion will be visible only in 5-6 years. Until then, India’s dependence on raw cashew nut imports from Africa would continue.

Africa – A challenging geography for cashew processing! Will take 7-10 years to develop into a global sourcing location for cashews kernels

In African scenario, cashew processing which did pick up 6-7 years back has become stagnant again. In Africa, manual processing is going to be a challenge as the skills required are not being picked up by the labor in Africa. Thus skill transfer would be a limiting factor. In case of mechanization; there are persistent challenges in technology adoption, obsolete technology, non-availability of spare parts in local or nearby markets and thereby increasing the overall maintenance and post-installation costs. Moreover, as cashew by-products also do not have ready market in Africa, the overall realization from the complete value chain is not high. Further, there is still a huge stigma attached to the overall business stability in Africa which also discourages processors to set up big facilities in Africa.

Ivory Coast with its double digit growth rate in production could reach close to India in future, in terms of raw cashew nut production, but the same does not stand true for other African countries. Nigeria is losing ground eventually as the quality of cashew nut is deteriorating with lower outturns. Some new destinations such as Benin, Guines-Bissau are also coming up into picture with better quality of cashews.

While Africa as a region is expected to come up on the cashew kernel map in another 8-10 years, India is going to be the leading processor and exporter of cashews globally for another 5-6 years. Below is the mapping of India, Ivory Coast, Tanzania and Nigeria based upon detailed analysis of cashew industry in current scenario and prospects of growth in near future (5-6 years).

India has comparative advantage in terms of its huge processing capacities which is estimated to expand further due to increase in demand of cashews in domestic and export market. Demand of cashews in Indian market is expected to grow at 10-12 percent in future thus calling for higher processing needs. Moreover, there is demand for broken cashews also in domestic market, thus supporting the level of mechanization. As a result, India clearly stands out as the preferred cashew supplier in medium term (5-6 years) as against African countries.

Vietnam is a strong competitor for India as processing is advanced there with less cost. Going forward, India also needs to improve its existing processing facilities to compete with Vietnam and gain higher share of export market with increased mechanization.

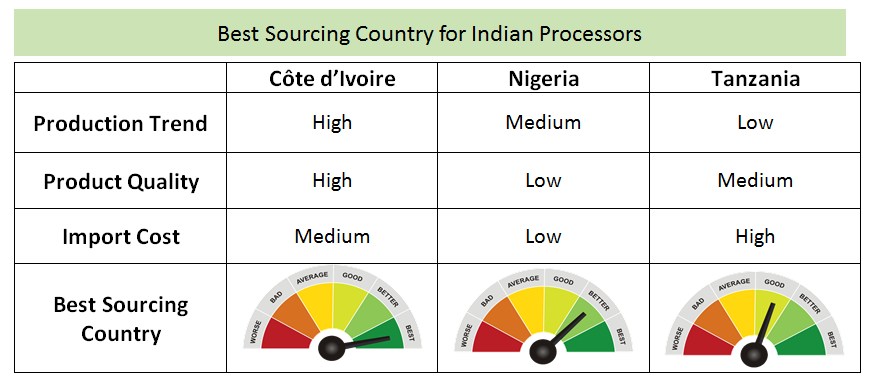

Based upon the above analysis and considering the aspects such as raw material (RCN) availability, ageing issue in trees, labor quality, product quality, and overall business environment, Ivory Coast is the most promising sourcing destination for Indian processors in future. The most important aspect considered here is the assurance of supply due to increase in production and increased investments by the government in expanding acreage in future.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe