Quota abolishment to have a bearing on sourcing strategy for cane sugar in the UK

Introduction

This whitepaper analyses the potential impact of sugar quota abolishment in 2017 for the UK and impending changes in political climate on the cane sugar refining market to devise an optimal long term sourcing strategy.

Abstract

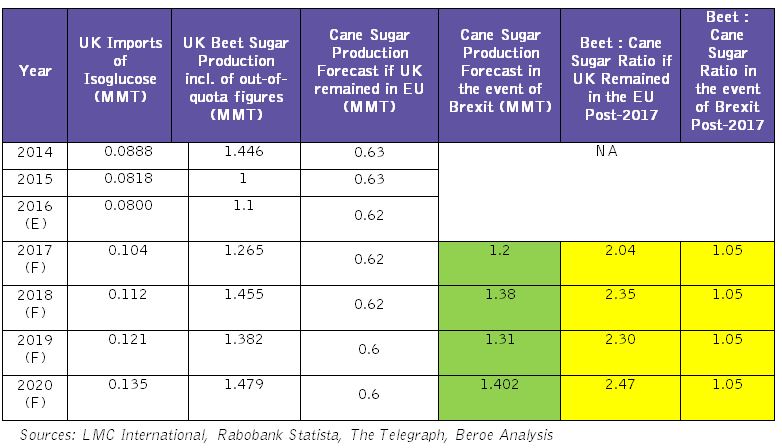

Within the sugar and sweeteners market, the EU imposes a cap on beet sugar production, while high import duties are applied for cane sugar. The sugar quota is 13.5 MMT and this is set to be abolished in October 2017. This would raise the production of beet sugar which is cheaper to produce. The UK is likely to remove the quota system post-2017. Since the major cane sugar refineries are located in the UK, the political scenario of Brexit could allow cane sugar refiners to protect their interests by lobbying for removal of EU imposed trade regulations and ensure cheap raw material sourcing.

After 2017, if trade restrictions for cane sugar remain in place, the beet: cane sugar production ratio without removal of trade restrictions has a forecasted average of 2.29 in 2017-20 period, showing that beet sugar production is more than double the cane sugar production. However, in the event of Brexit, the average forecasted ratio for the period drops to 1.05, indicating that cane sugar can closely compete with beet sugar. Thus, the key takeaway of the analysis is that the cane sugar industry is likely to be positively benefited by political changes in the UK as well as the impending abolishment of quotas. Using reasonable assumptions, the average sugar market price in the UK is forecasted at ~385-405 EUR/MT by December 2017. To be more competitive, cane sugar producers should be able to offer sugar at this forecasted price, which is ~9 percent lower than current market prices.

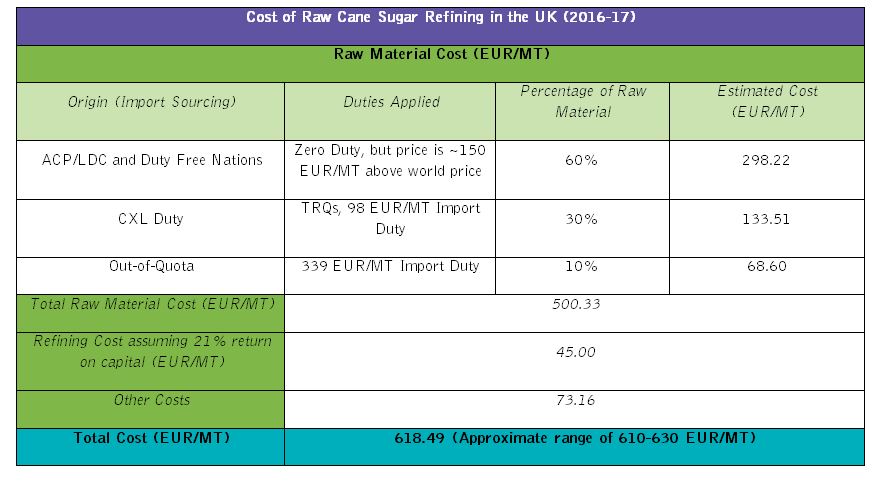

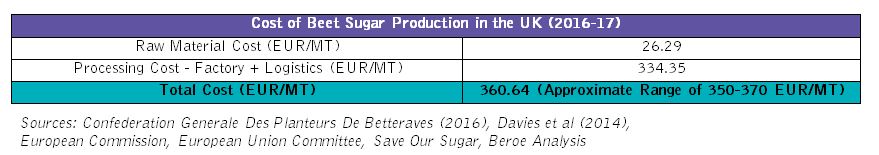

Cost analysis for raw cane sugar refiners and beet sugar producers was conducted to determine if they could offer sugar at such low prices. For cane sugar producers, raw material is imported from various regions. Using valid assumptions, weightages of 60 percent, 30 percent and 10 percent were calculated for raw material from ACP/LDC nations, CXL duty imports and Out-of-Quota imports. Based on this, adding refining cost based on a 21 percent return on capital, the total production cost was calculated at 610-630 EUR/MT. Total production cost for beet sugar producers, who source locally grown raw material, was calculated at 350-370 EUR/MT.

The production cost of UK raw cane sugar refiners is higher than the forecasted market price of 385-405 EUR/MT for 2017. However, it is inferred that post-2017, removal of CXL duties is a feasible regulatory amendment for raw cane sugar trade. Upon CXL duty removal, raw cane sugar refiners could reduce their production cost by ~25 with further reduction likely through lesser dependence on ACP/LDC nations and by production as well as sales of high volumes. Therefore, the conclusion is that raw cane sugar refiners in the UK would be able to compete with beet sugar producers to offer sugar at market prices by end of 2017.

Based on the above analysis, it is inferred that the buyer of sugar can negotiate short term contracts (quarterly) with beet and cane sugar suppliers. This would allow the buyer to monitor the market to determine the competitiveness of cane and beet sugar. There is a potential for switching from cane sugar refiners to beet sugar producers as suppliers and vice versa depending on the level of competitive pricing. Considering that the prices are also likely to decline which would result in a cost advantage to the supplier, it could be feasible to resort to spot buying for small volumes until the lowest price point is reached.

The Issue: Currently, UK cane sugar refiners have to import raw material from outside the EU, which is subject to heavy duties. In contrast, beet sugar producers can source cheap raw material within the EU. This restricts the ability of cane sugar refiners to compete with beet sugar producers. The whitepaper endeavors to calculate the impact of quota abolishment and potential removal of trade restrictions on the cost effectiveness of cane sugar production in the UK. It also measures their ability to compete with beet sugar producers post-2017 upon lifting of production quotas. Finally, the whitepaper will detail the 2017-18 outlook for buyers of sugar in the UK based on assessment of the cane sugar refiners’ relative strength in the market and recommend the ideal suppliers.

Analysis: Forecast of HFCS imports and sugar production from 2016-2020

Quotas for sugar and HFCS will be abolished by 2017. Therefore, the market forecasts are made with two periods to be taken into consideration – pre-Brexit period from 2016-2017 and post-Brexit period assumed from 2017-2020, which will have a bearing on the trends. The estimates and forecast for the production of sugar and HFCS in the UK is given below. While the UK does not produce any HFCS, it is a net importer from the EU.

UK sugar production in pre-Brexit period (2015-2016): The quotas are not likely to be scrapped since negotiations on regulations will take atleast 2 years and hence, the UK production of sugar is estimated to be constant, especially for cane sugar which has trade restrictions and accounts for 40 percent of the UK sugar market. Beet sugar production decreased in 2015 by 31 percent due to a decline in acreage, while cane sugar figures are estimated to be similar.

EU sugar in post-Brexit and quota removal period (2017-2020): UK production figures are estimated to rise by 15 percent upon removal of sugar quotas in 2017. This has been used by Beroe to forecast the production figures from 2017 onwards, assuming a constant demand for sugar among consumers and year-on-year cyclic fluctuations based on oversupply, stocks and reduction or increase of acreage.

With respect to cane sugar, the industry could have suffered a shut down due to high beet sugar and isoglucose production due to high import duties despite removal of quotas for the latter two in 2017. However, owing to Brexit, it is assumed that cane sugar producers get support from the UK government such as relaxed EU regulations and reduced import duties. Therefore, Beroe forecasts that cane sugar refineries will initially produce their full capacity of 1.2 MMT of cane sugar in 2017, which will be followed by a gradual increase in volumes mirroring the rise in beet sugar volumes, since demand is a constant factor for both.

Key Analysis: The average cane sugar production in 2017-20 period was forecasted at 0.61 MMT provided the UK remained in the EU. However, post Brexit the average now rises to 1.323 MMT. The ability of cane sugar to compete with beet sugar due to amended trade regulations upon Brexit is also calculated by the cane: beet sugar ratio. The ratio without Brexit has a forecasted average of 2.29 in 2017-20 period, showing that beet sugar production is more than double the cane sugar production. However, for the post-Brexit scenario, the average ratio for the period drops to 1.05 indicating that cane sugar can closely compete with beet sugar. Thus, the key takeaway of the analysis is that the cane sugar industry is likely to be positively benefited by Brexit.

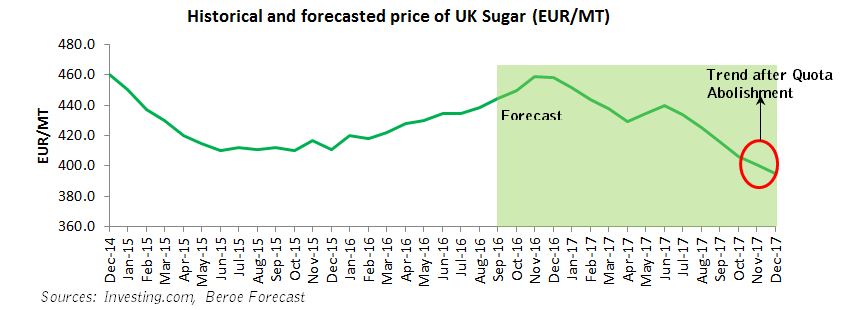

Analysis: forecast of UK sugar prices after quota abolishment

From the previous section, it is concluded that the removal of quotas will have a favorable impact on the cane sugar industry which will be able to compete with beet sugar. Therefore, it is necessary to forecast the sugar prices for the period when quotas would be removed. This will provide a clear indication of the price that cane sugar producers will be required to offer in order to compete with beet sugar producers. The UK does not manufacture isoglucose and hence this commodity is not considered here.

Forecast of prices before quota removal: In mid-2017 from May to June, an upward trend of 1.7 percent in prices (on average as compared to April 2017) is forecasted due to likelihood of high demand.

Forecast of prices after Brexit and quota removal (July 2017-December 2017): A downward trend is forecasted from July 2017 onwards due to anticipation of harvest. However, assuming that the production quotas are lifted by October 2017, the decline in prices is forecasted to be marked. Brexit could also favor quota abolishment during this period, also allowing favorable regulations for cane sugar producers to be implemented.

Key Analysis: By October 2017, removal of production quotas could accelerate the production of beet sugar, which in turn could flood the market with high supply. Concurrently, Brexit could allow the UK to implement favorable trade regulations for cane sugar, thus allowing cane sugar producers to compete with beet sugar producers. The previous section calculated the expected beet: cane sugar production ratio in 2017 at 1.05 post quota abolishment and Brexit, which implies a close competition between the two.

For the cane sugar producers to be competitive, they should be able to offer sugar at a price of ~385-405 EUR/MT by December 2017, which is ~9 percent lower than current market prices. It is likely that beet sugar producers can offer this price as current regulations already favor them in terms of competing in the market. To assess the likelihood of cane sugar producers being able to compete with the low prices of beet sugar, it is necessary to determine the current cost of cane sugar production in the UK as well as the costs incurred post-Brexit.

Analysis: Estimation of the 2016-17 production cost for UK sugar producers

The cost of producing 1 MT of cane and beet sugar is estimated below using reasonable assumptions.

Key Analysis: The cost of refining raw cane sugar is ~71.5 percent or nearly three-quarters higher than the cost of producing beet sugar in the UK. This is primarily due to the raw material costs for cane sugar being much higher than the raw material cost for beet sugar. High cane sugar raw material costs are attributed to the duties imposed on raw material imports. The imports from CXL countries and other nations not coming under tariff- free imports are necessitated by inadequacy of supply from ACP/LDC regions. In contrast, beet sugar is grown within the EU and hence the sourcing costs are lower. With the potential abolishment of quotas in 2017, it is likely that trade regulations are amended in favor of cane sugar refiners. Therefore, it is necessary to determine what changes could be made to the trade regulations and how this will impact the refining cost for cane sugar refiners in 2017.

Forecast: Production cost for UK cane sugar refiners post-quota abolishment in 2017-18 and predicted regulatory environment

Davies et al. (2014) predicts three possible regulatory environments which could occur by 2017. These 3 scenarios are analyzed to determine the most likely situation.

- Scenario 1: No Regulatory Amendments for Trade - ACP/LDC nations cannot supply the entirety of raw material requirements due to supply issues. The UK government has a pro-cane refiner stance and therefore will not refrain from amending trade regulations post-Brexit

- Scenario 2: Removal of CXL Duty - The cane sugar refiners have been lobbying for removal of CXL tariff and as such, this is the most likely scenario

- Scenario 3: Removal of all duties - It is likely that CXL quotas could be removed, but the possibility of some duties still remaining in place for imports of sugar from regions other than ACP/LDC and CXL countries like Brazil exists. Therefore, this is not the most likely scenario

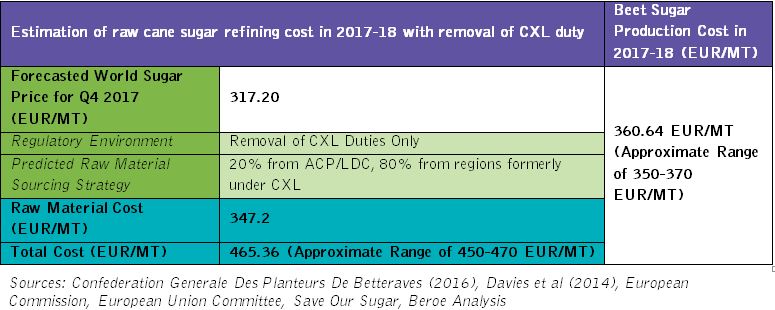

Key Analysis: The most likely regulatory environment in 2017-18 is the removal of CXL duty along with abolishment of production quotas for sugar in the UK. Assuming other costs remain constant, the raw material cost for cane sugar refiners is recalculated and the total cost is estimated for these two regulatory environments.

Key Analysis: The UK government has a favorable stance towards cane refiners. With Brexit and upon likely quota abolishment in 2017-18, the UK could likely lift the CXL duties of 98 EUR/M. This will imply a lesser dependence on ACP/LDC regions and more on other duty-free nations. Therefore, assuming that 80 percent of raw material would then be sourced from duty-free regions other than ACP/LDC, Beroe estimates a cost in the range of 450-470 EUR/MT in 2017-18 assuming forecasted prices for that period. This in turn implies a raw material cost reduction of ~30.6 percent and a total cost reduction of ~25 percent from the current cost.

Although the projected total cost of production is still higher than beet sugar costs which are expected to remain stable in 2017-18, cane sugar refiners would likely look to bring down the costs further by increasing production due to abolishment of production quotas. Increasing production volumes and sales could bring down the cost further. In addition, cane sugar refiners could further increase the proportion of raw material imports from regions other than ACP/LDC, since the latter regions often price sugar above world prices. As there would be no tariffs incurred by sourcing from other regions, cane sugar refiners could reduce costs further to the level incurred by beet sugar producers.

Therefore, this analysis establishes that post-2017, cane sugar refiners could compete effectively with beet sugar producers. As of now, cane sugar accounts for 17 percent of total sugar available in EU, whereas it comprises 80 percent of the world market share, with beet sugar constituting the rest. With the lifting of trade restrictions, the cane sugar market share in the EU could rise rapidly.

Conclusion: Outlook for UK sugar buyers in 2017-18

Currently, beet sugar accounts for the bulk of sugar production in the UK due to lower costs, whereas cane sugar refiners are facing challenges of higher production costs. Therefore, cane sugar production is only 38.6 percent of the total production. However, as forecasted earlier, the ratio of beet : cane sugar production is projected at 1.05 for 2017-18, which means that cane and beet sugar production will be almost equal due to abolishment of production quotas as well as trade tariffs. Cane sugar could potentially record a ~10.1 percent increase in production market share while beet sugar could register a concurrent decline in market share.

Conclusion: Owing to the high unpredictability of the market, the ideal sourcing strategy would be to negotiate short term contracts (quarterly) with beet and cane sugar suppliers. This would allow buyers to monitor the market and assess the competitiveness of cane and beet sugar. Considering that the prices are also likely to decline by 10 percent which would result in a cost advantage to the supplier, it would be feasible to resort to spot buying for small volumes until the lowest price point is reached.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe