Analyzing supplier model crucial for cost savings in armored car services procurement in North America

Abstract/Business Case

1 Introduction

Many buyers are seeking to know if they are paying the right amount for armored car services. The procurement strategy to optimize the buyer’s cash supply chain is discussed in this whitepaper.

2 Main

More often than not, buyers of armored car services come across big differences in prices quoted by each supplier. This whitepaper provides insights on the factors that supplier take into account while quoting the prices and how the supply market is structured. Taking the pricing trends and supply market dynamics into account, the procurement strategy that buyers can adopt in the U.S. market is analyzed.

3 Recommendation

This whitepaper highlights the factors that must be taken into account when sourcing armored car services and suggests the best fit strategies for buyers from retail and banking industry.

Problem Statement / Introduction

This whitepaper intends to provide market and pricing insights on the armored car industry in North America and how the buyers should choose their engagement strategy.

Buyers from retail industry and Financial Institutions (FIs) in North America find it difficult to benchmark the prices for armored car services (also known as Cash-In-Transit services), given the huge difference between prices quoted by regional and national suppliers.

This paper tries to give perspectives on why such big price differences exist between the suppliers. This paper also provides insights on how the supply market is structured and analysed when the buyer can adopt various engagement models.

Supplier landscape for armored car services in the U.S.

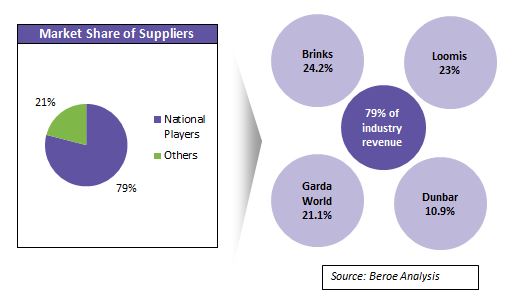

The US armored car industry is estimated to have around 200 service providers, with the national players dominating the market. There are four major suppliers -- Brinks, Loomis, Dunbar and Garda -- constituting close to 80 percent of the market share with nation-wide operating capabilities.

The cash supply chain operates a capital intensive industry with high fixed costs. This automatically drives consolidation to achieve economies of scale. There has been consolidation in recent years including Dunbar’s acquisition of New York-based Titan Armored Car & Courier, as well as Garda’s acquisition of Norman’s Armored Car.

Though the market is highly consolidated, the competition among suppliers is high. Due to undifferentiated nature of the business, competition among suppliers is primarily based on pricing. The smaller local companies are able to compete effectively by focusing on operational excellence. This has led to a spate of acquisitions by the large players to penetrate their market reach and operate more efficiently.

Cost break-up for armored car services

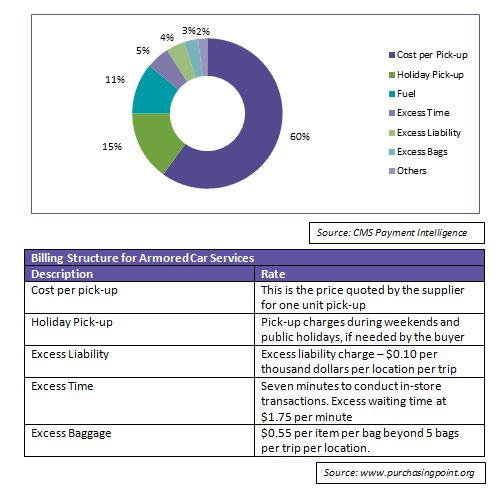

Cost parameters such as shipment liability, excess time fee and excess baggage fee are fairly consistent across the various tiers of suppliers. The major difference arises in the service costs, which is the cost per pick-up. This cost includes cost for picking-up the cash, transporting it and depositing it in the bank or in the supplier’s depot.

Huge price differences in the supply market

Above are some of the examples of the differences in the prices quoted by the local and national suppliers. It can be noted that the prices from national suppliers are 50 percent higher on an average and in some extreme cases, by more than 200 percent.

Reasons for huge price difference

Distance of the supplier’s depot from the buyer’s location

In the U.S., no armored car service provider has more than 200 depots, and as a result they have to travel long distances to service some of their buyer’s sites.On the contrary, armored car carriers ideally look to make 50–60 collections in an eight-hour working day. This means that, feasibly, they are not able to stray any more than about 100 miles away from their depot for collections.

Locations outside the operating radius of the supplier attracts a premium charge, as the supplier has to employ additional resources to cater to the buyer’s requirements, and fewer opportunities for route optimization, which increases the operating costs.

Local and regional suppliers tend to have multiple depots within their region of operations, which increases their radius of operating efficiently and lowers the cost of operations. Hence, a regional supplier can offer better prices to the buyer.

Economies of scale for the supplier

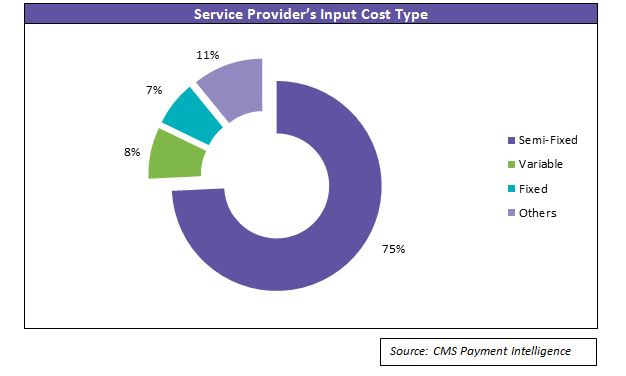

The graph shows that three-fourth of the supplier’s input costs is semi-fixed, in other words, they are variable over medium term. Semi-fixed costs include labor costs, armored car prices and cash management equipments. These costs can be reduced by increasing efficiency in the process.

Armored car service providers usually have softwares to optimize their pick-up routes. The greater the number of service points a service provider has in close proximity to one another, the greater the efficiency as the labor costs and capital equipment costs get shared across more number of buyers and pick-up sites. This automatically makes the supplier more competitive in that area.

If the buyer’s location is closer to the operating route of the supplier, the pricing will be better.

Engagement Model – Analysis

For large buyers with nation-wide armored car service requirements, there are realistically two engagement options available, either engage a single national player for all locations or engage with multiple local suppliers in regions where there are requirements.

Engagement Model 1 – Single National Supplier

Buyer power is medium, as the number of suppliers with nation-wide capabilities is just four. However, a large integrated contract with one national supplier increases the buyer power, as he can leverage the volume of the contract.

Buyer Involvement

- Decreased effort to track supplier performance and manage relationships

- This frees up buyer’s resources, which is one of the core objectives of outsourcing

Cost Savings Opportunity

- The prices of local players cannot be matched in regions where the national player’s footprint is low

- The buyer can leverage higher volume and negotiate better prices for the contract

Quality Achievement

- The large suppliers adopt best-in-class processes, equipment and keep up with the technological changes, all of which ensure quality and uniform services at all locations

Risk in Implementation

- The customer can only consider supplier as a single point of failure of service delivery, even where the supplier has subcontracted

- Any financial instability of the supplier will result in a huge impact for the buyer

Enagagement Model 2 – Multiple Regional Suppliers

Buyer power is high, as the services are undifferentiated in nature and competition is based on prices.

Buyer Involvement

- Responsibilities tend to be duplicated within one organization and across suppliers, thereby increasing costs

- The buyer will have leverage over local suppliers to schedule pick-ups at his convenient time

Cost Savings Opportunity

- The prices of local suppliers will be low compared to national players, as they might have optimized route or depot closer to the buyer’s location

Quality Achievement

- The quality levels of the smaller players is uncertain, which is a big risk considering the nature of business

- Fewer points of contact to resolve issues

Risk in Implementation

- Preventing lock-in to a single supplier and encouraging competitiveness among suppliers and ensuring capability of suppliers selected for the full range of services decreases the risk involved

- The buyer can change a supplier without a big impact

Which procurement strategy should the buyers choose?

For buyers with regional or local requirements, engaging with a local supplier will be an ideal solution. For large buyers, however, the strategy will highly depend on the location where the service is required.

In case of high-street retailers, the location of their stores would most likely be in central business areas, where the chances of landing competitive prices are higher from national suppliers. If the retailer has few remote shop locations, then it makes sense to adopt a hybrid strategy with national suppliers for most of the urban locations and local suppliers for the few remote stores to keep the costs low.

However, for financial instituitions, the locations of off-site ATMs are most likely to be a combination of urban and remote locations, with remote locations being high in number. In this case, the ideal strategy would be to enagage with multiple local suppliers regionally.

Conclusion

The best performing companies actively look for the best cash supply chain models and adopt the best model to meet their requirements, as opposed to companies who have remained with the same supplier for a long period of time, without looking at the underlying cost structures. Buyers with market knowledge and pricing visibility of the armored car services market can take advantage of the competition among the suppliers and achieve cost savings.

Buyers must also keep abreast with the market changes and challenge suppliers to pass on the cost savings, whenever needed. For example, the low fuel costs over the last couple of years would have decreased the operating costs of the supplier. If some of these savings is not passed on by the supplier, the buyer can challenge the supplier to reduce prices and so on.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe