Strategic analysis key to adopt alternate fuel fleet given its limitations

Abstract

Introduction

Company cars are generally provided to sales personnel and executives for business purposes. Currently, more than 95 percent of the company cars run on petrol/diesel.

In the last few years, OEMs have started investing heavily on alternate fuel variants. Organizations have also started considering electric/hybrid vehicles for their fleet.

As fuel contributes close to 33 percent of the TCO of a vehicle, fleet managers need to do a strategic analysis of alternate fuel market before adopting them to their car fleet.

Problem Statement

Climate change and global warming has prompted governments across the globe to promote electric/hybrid vehicles. In European Union (EU), multiple countries are planning to ban old diesel vehicles and impose restrictions on diesel vehicles within city limits. Few countries are even planning to ban petrol vehicles.

Business fleet, which accounts for 40-50 percent of the passenger cars in most of the mature markets, is a major area of focus for them and they are implementing policies and tax laws to promote electric vehicles.

Considering these factors, this whitepaper will provide insights on the potential of an electric fleet and also explore if it is time to shift towards alternate fuel fleet by addressing the following points:

- Current share of petrol/diesel/alternate fuel vehicles and recent changes in preference of alternate fuel vehicles

- Advantages/disadvantages of shifting to alternate fuel vehicles and challenges to be addressed before shifting to Electric Vehicle (EV) fleet

- Impact of car sharing models and autonomous vehicles on EV market

- Action plan for companies to prepare for change

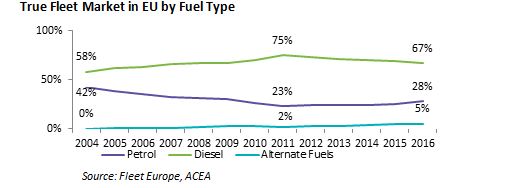

Passenger Vehicle Market by Fuel Type

Passenger vehicle market is dominated by internal combustion engines. Petrol and diesel together contributes close to 95 percent of the global passenger car market. Alternate Fuel Vehicles (AFVs) cover less than 5 percent of the market.Though percentage share of diesel and petrol vehicles vary by country based on the taxation, share of AFVs is less than 5 percent in most of the markets.

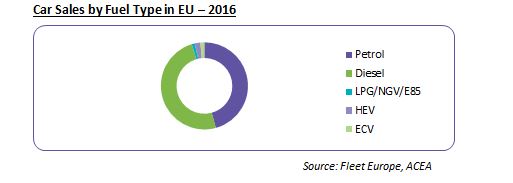

Car Sales by Fuel Type in EU

European passenger car market is dominated by diesel with close to 50 percent market share. However, preferred status for Diesel is reducing across EU countries.

- Though AFVs have only 4.7 percent share in EU, it is expected to increase in the next few years

- Government regulations, incentives and EV charging infrastructure is expected to support sales of AFVs

- Countries such as Germany, France, UK, and Norway are taking initiatives to support diesel ban through scrappage programs, which also include additional incentives, if the replacement vehicles are electric powered

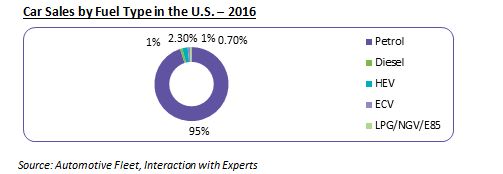

Car Sales by Fuel Type in the U.S.

US passenger car market is dominated by petrol vehicles with close to 95 percent market share. Since their inception in US market in 1999, close to 4.1 million hybrid vehicles were sold in the U.S. This is the second highest in the word after Japan. Sale of AFVs which include EV, Hybrid Electric Vehicle (HEV), Liquified Petroleum Gas (LPG), Natural Gas Vehicle (NGV) and E85 (ethanol-gasoline blend) is more than diesel.

True Fleet Market in the U.S. by Fuel Type

Similar to passenger car market, petrol dominates the fleet market in the U.S. More than 90 percent of the vehicles run on gasoline. There is an increasing trend of adopting AFVs in fleet market. However, diesel is still not the preferred model.

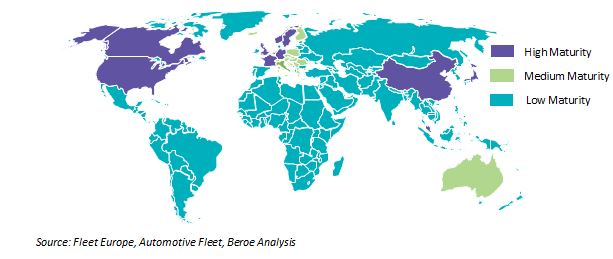

Alternate Fuel Market Maturity by Region

Globally, Norway leads in green score with ~40 percent AFVs. Government policies are supportive for a shift to AFV from Diesel.

· In North America, both the U.S. and Canada provides incentives for fleets to shift to electric vehicles

· Most of the Western European countries also promote the use of EV for fleets

· Countries such as Germany, France, UK and Norway are taking initiatives to support diesel ban through scrappage programs

· China and Japan are the major Asian countries promoting EVs

Pros and cons of shifting to alternate fuel vehicles

Electric vehicles provide attractive prospects for fleet managers to achieve their CO2 emission targets. However, it may not be suitable for all drivers. Following section highlights the pros and cons of shifting to electric vehicles.

Regulations/Legislations in favor of alternate fuel vehicles

Governments across the globe are framing regulations to increase the use of alternate fuel/low emission vehicles. Key regulations governing company cars in mature fleet markets are mentioned below:

Ban on Gasoline/Diesel Vehicles

Company Car Taxation and EVs

Mature markets for company cars in Western Europe and the U.S. are bringing regulations to support the adoption of EVs in fleet market.

United States

- In the U.S., vehicle laws are under state supervision. Incentives provided for operating alternate fuel fleet vary by state. It varies from $2,500 to $7,500

- However, US federal government provides $7,500 income tax credit for the owners of EVs

- Internal Revenue Service (IRS) tax credit is available for the purchase of selected plug-in EVs

- Credit worth over $2500 is awarded to vehicles which draw propulsion energy from a battery with at least 5 kilowatt hour capacity. For each additional kilowatt hour capacity after 5 kilowatt, it will be $417

- However, maximum tax credit available credit for the owners of electric vehicles is $7500

Europe

- In most countries, Benefit-in-kind tax charged for an employee as well as the tax on the company car registration is linked to CO2 emission. Hence the tax value reduces for EVs

- Percentage of tax charged and incentives provided vary by country

- In United Kingdom, multiple taxes for company cars like Benefit-in-Kind (BIK), Capital Allowances, National Insurance Contributions (NIC) and Vehicle Excise Duty (VED) are linked to carbon emission. Benefit-in-Kind tax is zero for electric propelled vehicles

- Incentive program for purchasing electric plug-in cars is available in UK. The program reduces the up-front cost of eligible cars by providing a 25% grant towards the cost of new plug-in cars capped at £5,000. Both private and business fleet buyers are eligible for this grant

Other Regions

- Though most of the countries provide incentives for purchasing EVs and HEVs, there are no specific legislations for acquiring company cars

In the next 2-3 years, top OEMs mentioned above are planning to come up with a longer list of EVs and HEVs.

Car Sharing Models and their Impact on Electric Fleet

• Organizations across the globe are finding it challenging to acquire EVs in their company car fleet as ROI is low for these vehicles

• However, car sharing suppliers are supporting companies by providing hybrid and EVs

• Research by various organizations reveals that one shared car is equal to 12 company cars

• Organizations can also expect financial incentives from government

• They are providing incentives for employees to opt for EVs

• As most employees do not need to drive, indirect savings can be achieved from additional productive time. A study by Millard Ball reveals that 3% to 25% savings can be achieved through implementing corporate car sharing program

Autonomous vehicles and their impact on EV market

• Industry analysts predict that by 2030, current fleet management approach will change to an integrated travel category managed by a mobility manager which addresses all travel needs of employees

• Currently top car manufacturing companies as well as ride sharing platforms such as Uber and Lyft are piloting their autonomous car fleets in the U.S. and Europe

• Once autonomous vehicles are launched in the market, most of them could be fitted with electric engines

• A fleet of autonomous ride sharing vehicles could boost the sale of electric engines as user does not need to worry about recharging the vehicle.

In future, an employee could request an autonomous EV through his app. He can get picked up at his door step and dropped at his office. On the way to office, he could spend time preparing for a meeting or be relaxed. Once the employee gets down, the vehicle would find a parking space, where it could charge by itself.

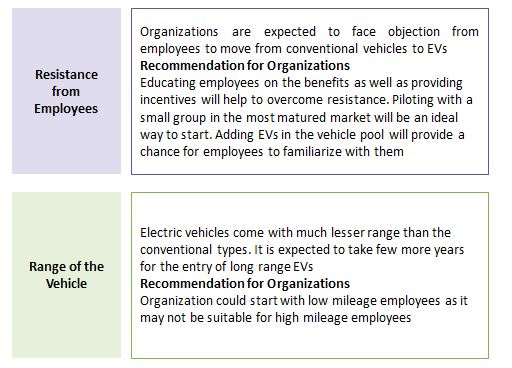

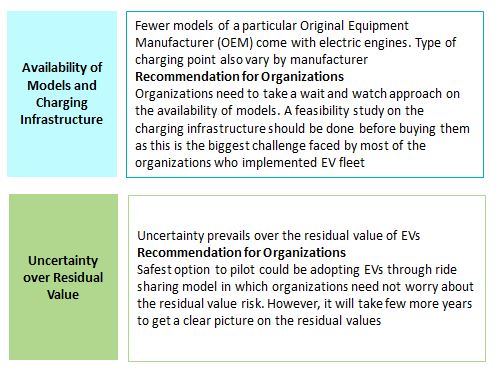

Challenges to be addressed

Impact on Total Cost of Ownership (TCO)

Savings

- Direct savings on fuel as cost of electricity is much lower than gasoline

- Immediate benefit from subsidy and incentives

- Lower maintenance cost as it does not require oil change or other costs on exhaust systems

Additional Expense

Though operational cost is expected to reduce, initial acquisition cost is much higher than internal combustion engine vehicle. As uncertainty prevails over residual value, lower residual value will be calculated by leasing companies. Hence, lease cost is expected to increase. Insurance cost is also higher than normal combustion engine vehicles. As a result, TCO is higher than petrol/diesel vehicles.

Bright Future

Industry experts predict that cost of manufacturing batteries will become cheaper in the coming years. According to Bloomberg New Energy Finance analysts, TCO of electric cars will be lower than petrol/diesel engine vehicles by 2022.

Case Examples

Case Study 1

Company Name: Sanofi

In France, Sanofi introduced electric shuttle buses for daily commuting. Car sharing with EVs is used for travelling between their offices and for external meetings.

Those who opt for EVs are provided mobility credit, which could be used for multiple mobility options. They are planning to expand the scheme to Frankfurt, Boston and Singapore.

Case Study 2

Company Name: Cisco

Cisco is planning to reduce CO2 emission of their company cars through a combination of alternate mobility vehicles and EVs. 25 percent of Cisco’s vehicles in the Netherlands are PHEVs.

Cisco is planning to increase the number of PHEVs in the Netherlands. They are also planning to introduce EVs in other European countries.

Conclusion

Shifting to electric vehicles is a way of making the fleet greener and OEMs are making a lot of investments in EVs. Extended range electric vehicles having a plug-in battery, electric motor and internal combustion engine are also introduced into the market, which help organizations to use it for a longer distance.

Benefit of existing fuel remains

Though EVs help organizations to reduce CO2 emission and save tax in the form of incentives and tax credits, present day EVs have their own limitations in the form of range, higher initial cost and lack of charging infrastructure. Currently, TCO of traditional petrol and diesel fuel vehicles is much lower than EFVs making them a preferred option for fleets. Hence, it is advisable to continue with diesel engines as the major fuel type for 4-5 years while adopting EVs as a temporary alternative in mature markets.

Action Plan for Procurement

- Pilot electric vehicles in mature markets through different models (ride sharing, lease, etc. ) available in market and evaluate the best fit

- Engage in discussions with existing suppliers to understand the new developments in the market

- Enact a policy by allowing employees to familiarize with electric vehicles through incentives and gamification

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe