Sustainable packaging enables aerosol producers to reap benefits

Abstract/Business Case

Introduction

According to the IPCC, carbon emissions from consumer packaged goods contribute to about 10-14 percent of the global greenhouse gases, while packaging across industries contributes about 15-17 percent of the total carbon emissions.

Sustainability initiatives across various packaging materials such as paper, plastic and glass is transforming the consumer packaged goods industry in terms of reducing the carbon footprint. Aerosol cans have long been a challenging packaging category when it comes to improving the sustainability of the package and bringing about significant reductions in carbon emissions.

Currently, both the brand owners and the manufacturers of aerosol products face mounting pressures to improve sustainability in their products, especially with the sustainability developments seen in their counterparts such as glass, flexible packaging and plastics.

The packaging format has faced criticism on sustainability issues following which many changes in both the contents and the propellants have been implemented, resulting in the current form. However, not many significant developments have been seen on the sustainability front.

The packaging faces various challenges such as design complexity, the use of VOCs, regulatory issues, concerns regarding safety, etc. Currently, the aerosol market has a consolidated supplier base and is plagued by raw material and availability issues. This scenario has lead to the suppliers and brand owners alike moving away from traditional formats.

An efficient alternative which is gradually making its presence felt in the market is plastic aerosol cans. This move could significantly alter the supplier landscape for aerosol cans over the next few years and nick the power out of the hands of large players such as Ball and Crown in the aerosol space.

This paper discusses the direction of the aerosol industry when it comes to addressing the sustainability issues, the challenges and the potential solutions to it. It also throws light on the ongoing shift in the supply base and provides an overview of the current trends in the market in terms of packaging design and material shifts and how the brand owners would be able to successfully adapt to these changes.

Sustainability - the buzz word in today’s supply chain

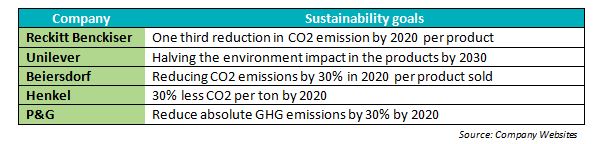

Top global FMCG companies such as Reckitt Benckiser, Unilever, and Henkel have committed to ambitious sustainability goals to be implemented by 2020.

For many FMCG companies, packaging contributes to about 50 percent of their carbon emissions which is at par with the emissions from their own production activities. Hence packaging is considered to be a key area of focus to reduce their carbon emissions.

Convenience, on-the-go lifestyle and improved user experience has led to increased penetration of aerosol packaging in various new end use segments creating additional demand. This in turn has contributed to the demand for improvements in terms of product design, penetration into new end use segments and increased sustainability in aerosol cans.

Growing demand for Aerosol Packaging

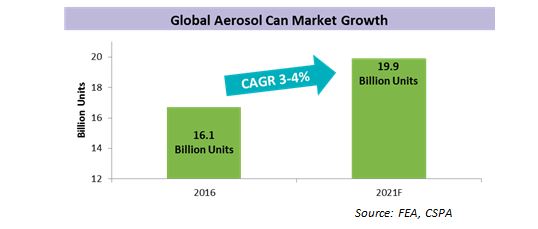

Aerosol cans, one of the largest metal packaging segments has been projected to grow at about 3-4 percent CAGR from 2016-2021. Increasing penetration of aerosol format in new end use segments such as food, beverages, and oils, and growing use in personal care products would be the major drivers for this growth.

Supply base shift to emerging regions

Developed regions such as North America and European Union have become mature markets experiencing flat growth rates for aerosol cans. Accordingly, global FMCG companies and suppliers alike have shifted their focus on emerging markets such as India, Brazil, and China. In order to achieve their global sustainability goals the brand owners had to increase the sustainability of their products in these growth markets.

Majority of the growth is expected to come from APAC and LATAM, where the domestic players have limited capability to develop and implement innovative sustainable solutions in metal aerosol cans. The sustainability issues arising with aerosol cans would stand to worsen, creating further pressure on the packaging.

Sustainability challenges in aerosol cans

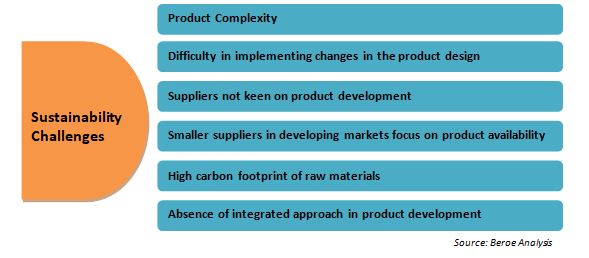

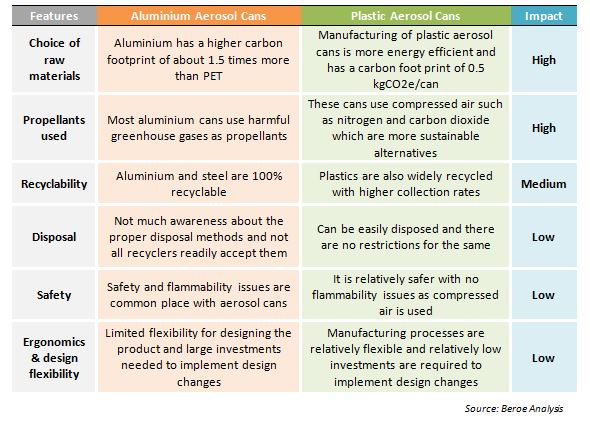

Although aerosol cans have been in use for over 60 years, there has been very limited development in terms of improving the sustainability of the product. The following are some of the challenges in improving the sustainability of aerosol cans.

Raw materials have high carbon footprint

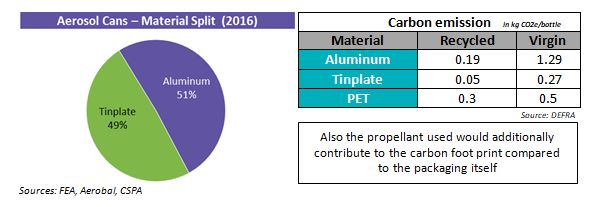

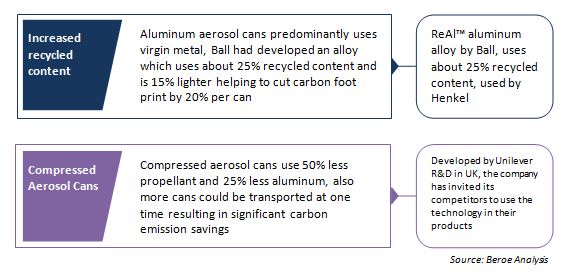

Most aerosol cans are made of aluminium or tinplate steel. While the tinplate aerosol cans contain about 25 percent recycled content, Aluminium aerosol cans use mostly virgin material and manufacturing it is energy intensive resulting in increased carbon footprint.

Absence of integrated approach to product development

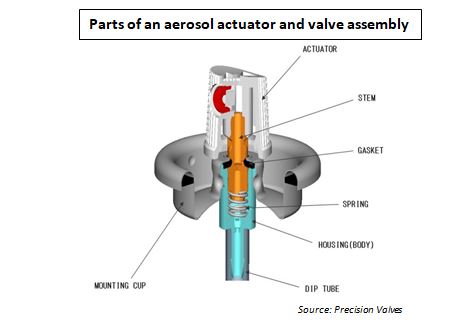

The aerosol valve and actuator is made up of 9 different components which are supplied by more than 5 different suppliers which is a hindrance when it comes to implementing innovative ideas. An innovation in any one of these components would require the entire supply chain to make changes accordingly.

In addition to product complexity the brand owners are also reluctant to implement changes in view of avoiding cost escalations and product quality. For instance, most products are formulated according to the propellant that is used, and any change in the propellant used could alter the product.

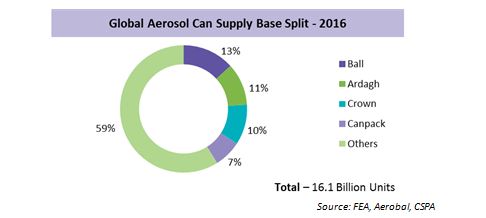

Consolidated supply base reluctant to innovate

Another reason for limited innovations in this space is due to the consolidation of the supply base with about 41 percent of the market held by four large suppliers globally. These suppliers have brought very limited developments in the product.

The smaller suppliers in high growth, developing markets are keen on improving product availability rather than product development.

Imminent need for change

Brand owners are now actively seeking sustainable packaging solutions for their products to compete efficiently in the market. While sustainability was earlier an option, it is now seen as a necessity due to:

- Growing consciousness among consumers about climate change and the sustainability aspects of the products they use

- The on-going regulatory changes

- Increasing health risks

- Issues regarding abuse and flammability

Emergence of sustainable solutions in aerosol cans

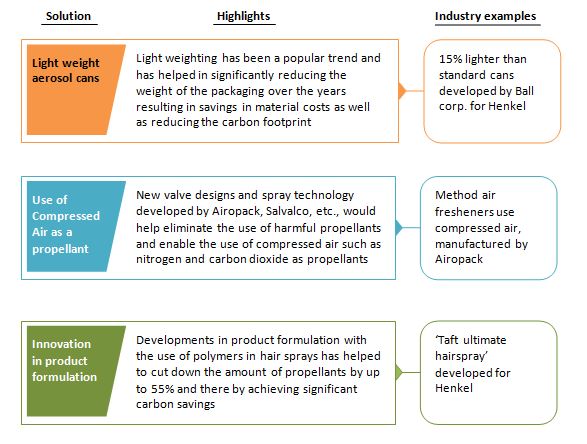

The increasing need for sustainable and cost-effective solutions for aerosol cans has led to quite a few developments. These were primarily for accommodating the regulatory threats in future and also to increase the penetration of aerosol packaging in newer end use segments.

One of the significant and promising solutions is the emergence of plastic aerosol cans and the use of compressed air in place of other forms of propellants.

Advent of plastics as a sustainable option in aerosol products

Plastic aerosol containers have been successfully launched commercially and are increasingly being used in end use applications such as hair mousse, shaving foams, and hand gels by many large brands such as Gillette, Vogue, Amando, Elizabeth Arden, and OxMed.

Greater design and shape flexibility, BPA free, rust free, low inventory costs, flexible lead times, printing and sleeving decoration options, etc., are some of the benefits that they offer. Apart from this they have lower storage and transport costs.

Many key players such as P&G, L’oreal, Johnson & Johnson, Cipla, 3M, Airolux, Petapak holdings, Appe, and Afa dispensing are increasingly involved in the development of plastic aerosol containers.

Recommendations

Rising energy prices, changing demand factors, increasing scarcity of raw materials and increasing cost of compliance would require the supply chain professionals take stock of the current dynamics in the aerosol industry and device environmentally friendly yet cost effective solutions for their products.

Increasing number of brands have been adopting plastic aerosol cans in the products. The design flexibility and unique user experience helps the brands to stand out from competition especially in competitive segments such as personal care and beauty.

Brand owners would also be able to have a greater appeal to their customers on the sustainability aspects of plastic aerosol cans and would be able to decrease their carbon foot print by about 30-40 percent than by using metal aerosol cans. Over the next five years, plastic aerosols could become more environmentally sustainable owing to the technology developments in more sustainable material types.

From the supply base point of view, it would be beneficial to the brand owners to adopt an alternative packaging material such as PET for aerosol products and improve their bargaining leverage with the consolidated supply base for metal aerosol cans.

Recommended Reads:

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe