Adequacy ratio helps understand the actual profitability in a gold mining firm

Abstract

Standardized cost reporting has been lacking in the mining industry; majorly in gold mining industry. The poor performances of gold miners have called into question the reliability and validity of cost reporting methods adopted in gold mining industry.

The whitepaper introduces the drawback of all-in sustaining cost reporting measure adopted by gold mining firms and the challenges they face in using by-product and co-product accounting. The paper highlights the initiatives taken in this regard and analyzes Cipher’s development of a reliable cost reporting method. The whitepaper focuses on the new method of understanding the reported cost by use of adequacy ratio.

Introduction

There is no standardized cost reporting in the mining industry due to varying mining geology and nature of operations. Among all mining commodities, gold suffered the most in the recent past with its price reducing by 44 percent from Q1, 2012 till date. With the reducing gold price, major gold miners have sustained negative earnings and cash flow reports combined with massive write-down of assets.

Problem Statement

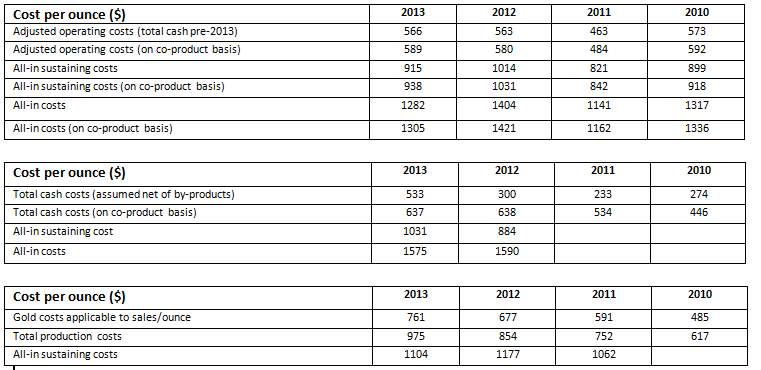

In 2013, gold mining industry implemented a more reliable cost reporting method “All-in-sustaining costs”, thereby discarding the old method of industry accepted non-GAAP reporting item called “cash cost”. All-in sustaining cost includes sustaining capital, and general and administrative expenses in addition to the actual cost of production at mine site. However, it fails to include the initial project capital and hence do not present the real picture of cost of mining.

Major drawback with all-in sustaining cost as a universal measure is that mining companies have great liberty in classifying the sustaining costs and project capital expenditures. Accountants can legally make a company appear more profitable than it really is.

An additional layer of confusion comes from by-product and co-product accounting, another non-GAAP measure adopted in 2013. The difference between co-product and by-product accounting is that co-product accounting attempts to assign operating costs to each metal produced based on its relative contribution to revenue and thus eliminate the limitation of using by-product accounting. Generally, by-product accounting is used when a single metal contributes at least 80 percent to the revenue. This is frequently ignored by companies when reporting cash costs.

Challenges Introduced:

- All-in sustaining cost is reported by world’s three largest gold mining companies – Barrick Gold, Goldcorp and Newmont

- By-product and co-product accounting adopted by major mining companies

Proposed solution

Development of a reliable cost reporting for the gold mining industry by Cipher: Inclusion of IMP (Investment in mining property) in determination of cash flows from gold mining operations makes the recent reporting method unreliable.

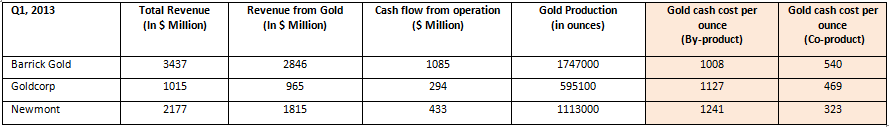

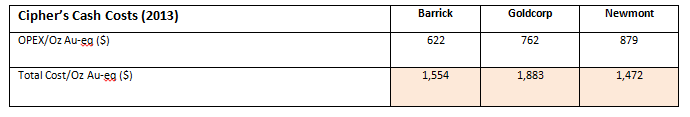

Cipher’s Analysis: They calculate a total cash cost per ounce of gold equivalent production (oz Au-eq) by dividing total revenue by the average price of gold over the reporting time. This allows us to accurately relate any financial item to a standardized unit.

Total Cost = (Revenues – cash flow from operations) + Investment in mining properties

Oz Au-eq = Revenue/average gold price

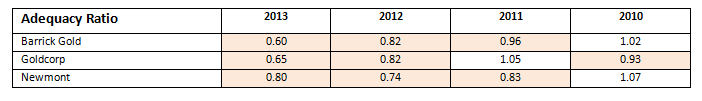

Cipher utilizes a methodology called the adequacy ratio to understand the financial health of a gold mining company.

Adequacy Ratio = Revenues/(OPEX + IMP + debt repayments + dividends paid)

A ratio >1.0 is healthy and a ratio <1.0 over an extended period means that the gold mining company has continuously raised money from outside sources to fund its operations.

The adequacy ratio exemplifies that gold companies do not generate sufficient revenues from operations to sustain their existing business models. To reach sustainable profitability, gold miners must produce only those ounces that return robust cost margins and terminate trying to grow production.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe