Engagement with FBAP providers can bring cost savings to shippers

Abstract/Business Case

1 Introduction

The ever increasing complexity of supply chain demands visibility, which is causing procurement managers to seek possibilities through freight bill auditing. This practice is adopted by US-based companies over a long period of time to save costs. Currently, several Europe-based companies are exploring the possibility to leverage Freight Bill Audit and Payment (FBAP) providers with an objective to gain visibility and improve process efficiency.

2 Main

Majority of the supply chain managers are facing challenges in handling their spend on logistics services such as freight, couriers and other value added services. Most of the organisations predominantly set a hierarchial approval for certain premium services. However, it involves delays in execution and also lacks visibility, implying the process being not documented efficiently.

3 Recommendation

Organisations can engage a FBAP solution provider to document critical supply chain data with real-time invoice details. These firms can help the shipper/ buyer to explore cost saving opportunities with the help of data analysis tools. For instance, a shipper may go to the market with an RFP aiming at a cost saving of 10 percent this year by re-bidding all his freight contracts. However, he can only analyse the outcome through the visibility he gains with an end-to-end electronic freight payment solution that can offer a complete picture of the costs. This allows him to benchmark performance against the shipper's own actual data and also set future procurement budget with great focus.

Introduction

Shippers perform carrier's freight bill auditing either in-house or outsource to a FBAP service provider. Shippers prefer outsourcing FBAP services to streamline their transportation spend. Some firms still conduct the auditing process internally to retain control in certain regions. It is also dependent on the nature of contracts between freight service providers and shippers.

· Majority of the top firms in the US outsource their freight auditing function. However, it is still to a greater extent done in-house in Europe. Latin America and APAC still have most of their audits performed in-house

· With increased complexity in supply chains, logistics managers are facing challenges in terms of gaining visibility on their freight payments. To be specific, they have difficulty in controlling spend and managing end-to-end cash flow, which is vital in maintaining a healthy working capital and financial efficiency

With major FBAP firms such as CIS, Controlpay, CT Logistics, and nVision Global, evolving with features such as analytic tools and carrier negotiation, shippers can leverage these to achieve both cost saving, gain end-to-end payment visibility and improve overall cashflow of the organisation.

Current scenario

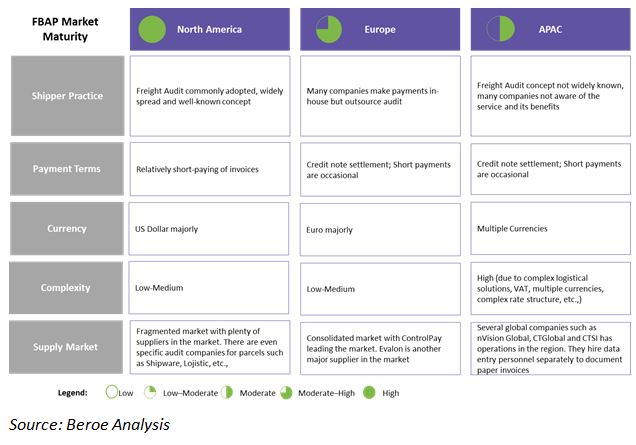

Majority of the top companies in the U.S. have outsourced their freight auditing and payment to a FBAP service provider with the primary objective of saving costs. Performing audit and payment in-house is expensive by about 50 percent when compared to outsourcing. Now, the practice of outsourcing is on the rise among companies in Europe and APAC. However, the objective is to address increasing difficulty in managing payments with complex supply chains. The relaxation in regulations pertaining to transactions in developing countries is also promoting FBAP services in APAC. The European supply market is also experiencing growing maturity with suppliers such as Controlpay and Elavon.

Types of audits

There are pre-payment audits and post-payment audits. Earlier, all freight audits were post-payment audits. Freight invoices were checked against negotiated rates and agreements after the bills were already paid. Claims for any overcharges had to be filed with the carriers.

Currently, pre-payment audit has become the norm. This benefits the shippers as they could make adjustments before the invoice is paid.

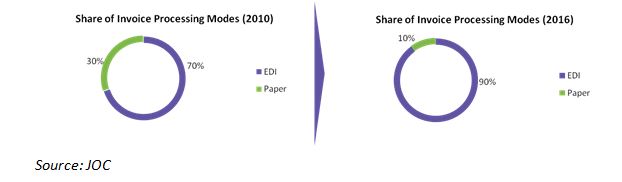

Invoice processing modes

Over the years, invoice processing mode has been shifting from the traditional paper based invoices to EDI (Electronic Data Interchange), through which the efficiency of the auditing process is increased. EDI-based transactions typically save 1-2 percent on freight spend when compared to paper-based invoice auditing and payment as audit fee for paper invoices are 75 percent more expensive. Electronic documentation of the process aids in building data for analytics.

Trends

Majority of the shippers view freight auditing services as a major strategy to prevent duplication and overcharges in terms of access, fuel surcharge, class, weight and distances to reduce cost.

· Fee for pre-auditing is per invoice processing basis, while for post auditing 30-50 percent of recovery amount is charged as a fee

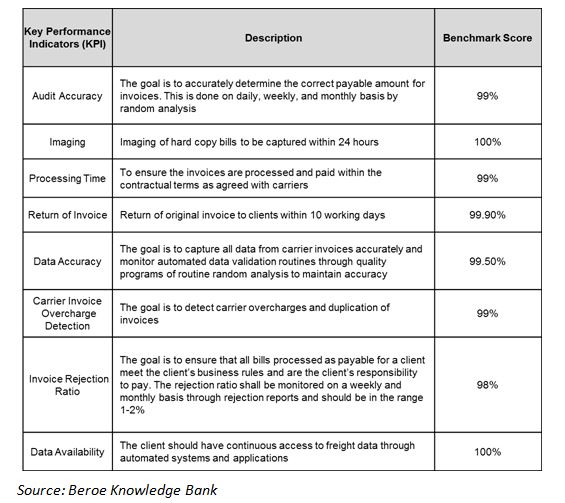

· Some of the major KPIs used in measuring the effectiveness of FBAP service providers are audit accuracy, data accuracy, processing time, shipper access to data through automated systems and applications, carrier invoice overcharge detection and others

Challenges faced by logistics managers

The ever increasing length and complexity of supply chains have caused challenges in terms of gaining visibility on their freight payments. To be specific, they have difficulty in controlling spend and managing end-to-end cash flow, which is vital in maintaining a healthy working capital and financial efficiency. For instance, they don't want to spend on express courier service for a non-critical shipment.

Many companies adopt different strategies to save costs on transportation spend, however, they tend to impact the overall process efficiency. In short, logistics managers look for following solutions without impacting the process.

· Savings on total logistics spend

· Increased financial control

· Gain visibility for analysis

Solution Proposed

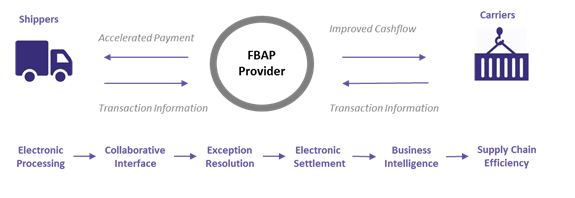

Outsourcing the process of invoice auditing and payment to an FBAP service provider can help organisations achieve cost saving on logistics spend and cash flow. Over the years, FBAP providers have evolved greatly. Through implementation of EDI in invoice processing, shippers will be able to build centralized data on end-to-end transport payments. This will help the shipper to build a business intelligence tool and perform analytics reporting for future procurement budgeting.

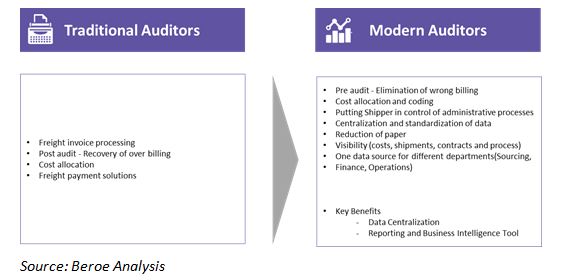

Traditional vs Modern FBAP Provider

Characteristics of a Modern FBAP Provider

Source: Beroe Analysis

Barriers in implementation in Europe and APAC

The practice of outsourcing freight bill audit and payment is common in the US. The supply market is mature when compared to other regions such as Europe and APAC. This is due to a variety of reasons such as:

Savings on logistics spend

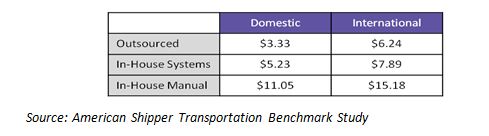

An integrated, fully electronic freight payment system can help businesses uncover cost savings. A recent study conducted by American Shipper suggested that the cost to process and pay an invoice through a FBAP provider is cheaper by up to 50 percent, when compared to cost incurred while performing in-house.

Cost to Process and Pay an Invoice

Engagement practices

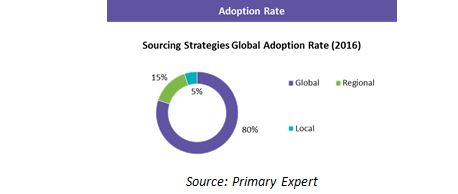

Sourcing Model

An ideal large shipper with global logistics needs engages with a single FBAP provider. The provider should have global capabilities and be able to build a centralized data and process payment with multiple payment centers across the globe.

This strategy allows shippers to gain visibility in terms of invoices audited, payment processed, shipments delivered with the purchase order generated under a single window system. They receive shipment record data from TMS of the shipper. The optimized spend can be tracked through the business intelligence and reporting which can be delivered as value added services.

Pricing Model

In APAC and Latin America, contracts are structured based on volume of invoices and a one time project fees. In the matured markets, the engagement models offered are on a transactional basis alone.

FBAP service providers have off shore locations in APAC and Latin America to reduce overheads. In some cases the data entry process itself is outsourced to another tier of service providers. For example, Trax Technologies which is a FBAP service provider has data entering center in Costa Rica for converting paper into electronic invoices.

KPIs

For service level agreement (SLA) with the service provider, KPIs can serve as guidelines enabling better contract management and superior service level qualities.

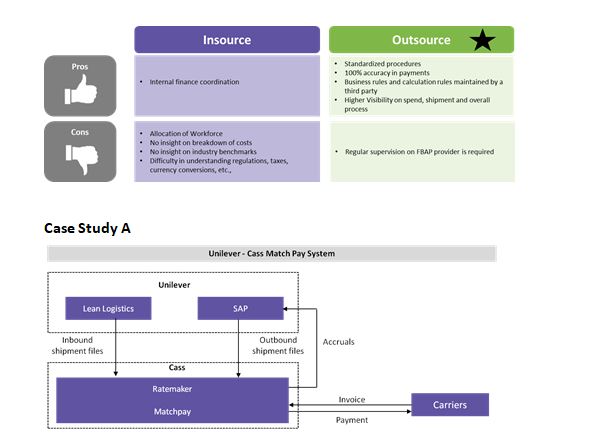

Insource vs Outsource

A modern FBAP service provider promotes strong relationship between a shipper and carriers. Shippers always wanted to make payments later and carriers intend to receive payments faster. An ideal FBAP provider helps in increasing the DPO (Days Payment Outstanding) through their analytics without renegotiating the contract. Thus improving the cash flow and overall process efficiency.

Source: US Bank

- Electronic Invoicing: Cass is progressing toward reduction of paper-based invoicing to the maximum extent through direct involvement with Unilever’s carriers

- MatchPay System: Cass matches invoice data from carriers for both inbound and outbound data against authoritative records provided by Unilever (which it receives on a daily basis) for auditing and processing for invoices

- For inbound shipments, Cass receives a unique shipment record from lean logistics TMS of Unilever

- For outbound shipments, Cass receives a unique shipment record from Unilever’s SAP system and uses its Ratemaker for pre-rating generation so that Unilever’s accounting group can be provided with accruals

- Business Intelligence: CassPort, a web portal of Cass provides reporting and analytical tools to Unilever which would help Unilever in making fruitful business decisions

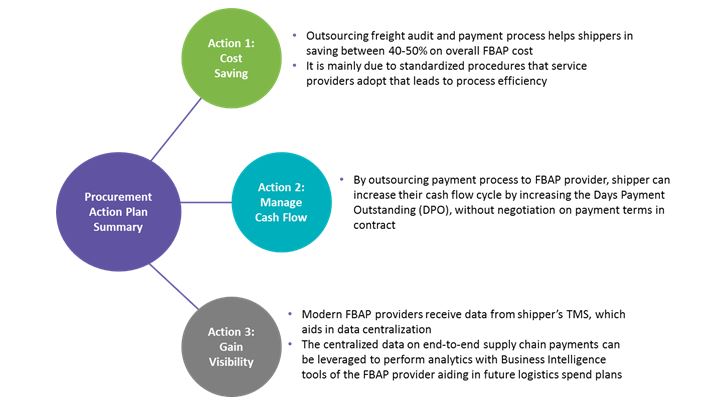

Procurement action plan summary

Following section summarizes about key action points of procurement of leveraging FBAP service providers for cost saving and payment process visibility.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe