CATEGORY

Barley

Malt Barley is used to produce beer through fermentation of sugars present in them. The production also includes hops, adjuncts and yeast.

Beroe LiVE.Ai™

AI-powered self-service platform for all your sourcing decision needs across 1,200+ categories like Barley .

Market Data, Sourcing & Supplier Intelligence, and Price & Cost Benchmarking.

Schedule a DemoBarley Market Monitoring Dashboard

Understand the correlation between costs, margins, and prices impacting your category on a real time basis on Beroe LiVE.Ai™

Schedule a DemoBarley Industry Benchmarks

Savings Achieved

(in %)

The average annual savings achieved in Barley category is 5.30%

Payment Terms

(in days)

The industry average payment terms in Barley category for the current quarter is 75.6 days

Compare your category performance against peers and industry benchmarks across 20+ parameters on Beroe LiVE.Ai™

Category Strategy and Flexibility

Engagement Model

Supply Assurance

Sourcing Process

Supplier Type

Pricing Model

Contract Length

SLAs/KPIs

Lead Time

Supplier Diversity

Targeted Savings

Risk Mitigation

Financial Risk

Sanctions

AMEs

Geopolitical Risk

Cost Optimization

Price per Unit Competitiveness

Specification Leanness

Minimum Order Quality

Payment Terms

Inventory Control

The World’s first Digital Market Analyst

Abi, the AI-powered digital assistant brings together data, insights, and intelligence for faster answers to sourcing questions

Abi is now supercharged with GPT4 AI engine. Enjoy the ease of ChatGPT, now on Abi

Use the Barley market, supplier and price information for category strategy creation and Quaterly Business Reviews (QRBs)

Schedule a DemoBarley market frequently asked questions

As per Beroe's analysis, for the 2019/2020 period, the net production is valued at 153.3 MMT while the consumption is around 149.4 MMT.

As per the report, Turkey and Australia are the emerging supply countries that observed a whopping 26% and 13% increase respectively.

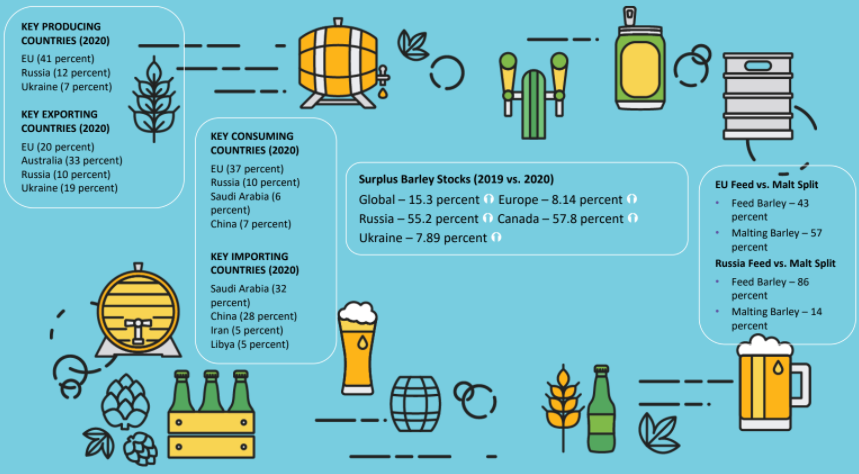

Following the insights from the barley procurement intelligence report shared by Beroe, the key importing countries of the industry are: Saudi Arabia (32 percent share) China (28 percent share) Iran (5 percent share) Libya (5 percent share)

According to the barley market report shared by Beroe, the key consuming countries are: E.U .(37 percent share) Russia (10 percent) China (7 percent) Saudi Arabia (6 percent) Similarly, the key producing countries are: E.U. (41 percent) Russia (12 percent) Ukraine (7 percent)

The ideal contract length that prevails in the barley market is 2.5 ' 3 years. The benchmark prices are decided as per CBOT and Wheat MATIF Euronext.

According to Beroe's report, the top malt barley supplier with their listed capacities are: Soufflet Group ' 2,148,000 MT Malteurop Groupe ' 2,138,000 MT Cargill Malt ' 2,126,000 MT GrainCorp Malt 1,333,000 MT Boortmalt Gr. Axereal ' 1,093,000 MT

According to Beroe's analysis, the E.U. region is the most unfavorable for the production of barley as its climate is a little wet. However, unlike the E.U., regions like Russia and Canada are considered favorable for barley production.

As per the barley markets report by Beroe, the largest regional malting capacity split is being held by the E.U. with a nearly 45% share. It is followed by Asia, North America, South America, and Russia with 28%, 12%, 8%, and 8% shares respectively.

The bulk global demand for barley is likely to change in the coming years due to a decline in the acreage of barley cultivation due to the availability of cheaper alternatives like Soy and Corn.

As per Beroe's study, the largest barley market based on the production size is being captured by Europe with production being close to 7.2 MMT. Next-in-line is the APAC region with a market size of 4.4 MMT, followed by North America and South America with production size being 1.9 MMT and 1.3 MMT respectively.

Barley market report transcript

Barley Global Industry Outlook

-

The barley production for MY 2022-23 is projected to be higher at 149.4 million metric tons, up from 145.4 million metric tons during MY 2021-22

-

Spain, Hungary, and Romania's barley production have been affected by Europe's warm temperature and dry weather. However, the effect of adverse weather is anticipated to remain minimal in France. According to the information currently available, the area of winter barley in France is estimated to reach 1.30 million hectares, an increase of 1 percent from 2022 and 3.9 percent over the 5-year average

-

Given that Russia and Ukraine are two of the world's top five producers of barley, the ongoing conflict between the two nations will influence the worldwide barley market. The production of barley in Ukraine could decrease by about 34.7 percent this year. Hence, it may affect supply of malt moderately

-

Major producers of malting barley are Europe, Canada, and the US, with Europe having most of the top maltsters. However, maltsters are spread all around the world

Barley and Malt Barley Global Supply – Demand Analysis

-

The EU (34.4 percent) is the largest producer of barley, followed by Russia (14.1 percent), Australia (9.0 percent), Canada (6.7 percent), Ukraine (4.1 percent), and Argentina (2.8 percent). The bulk of the global demand comes from the feed sector followed by Food, Seed, and Industrial (FSI)

-

Global barley consumption is forecasted to increase by 2-3 percent in 2022/23, driven by an increase in demand from the food and feed sector. Increase in demand for barley as a raw material for alcoholic beverages is expected to be a major driver for the market growth of barley in coming years

Market Outlook: 2023/24 F

-

The barley production for MY 2022-23 is projected to be higher at 149.5 Million metric tons , up from 145.5 Million metric tons during MY 2021-22. For My 2023/24, barley production is expected to grow marginally, due to an anticipated 3 percent to 4 percent increase in output in Canada, a slight increase in production in the EU, and offset by unfavorable production conditions in Argentina

-

Australia is expected to set a third consecutive record grain crop along with strong growth in exports. Barley production is estimated to reach 13.7 Million metric tons (MMT) in MY 2022/23, the fourth largest on record

Global Barley and Malt Barley Trade Dynamics

The adverse impact of heat and dry weather on some European Union (EU) countries, particularly Spain, has resulted in significant production losses and an increase in barley imports. Due to the dry weather, Argentina's expected barley production is down from 5.3 Million metric tons last year to 4.2 Million metric tons this year (2022/23). The export is also probably going to drop significantly.

-

According to the latest information, barley imports in Algeria from all sources are forecast at 400,000 tons in 2022/23, a decline of 50 percent compared to last year. All major suppliers of Algeria (the EU, Argentina, and Ukraine) have not shipped barley in 2022/23, due to lower production and low exportable supplies

-

For 2022/23, barley supply in Canada is forecasted at 10.6 Million metric tons, up by 33–34 percent compared to last year, primarily driven by the rebound in production. Additionally, a 3–4 percent rise in the overall supply is projected for 2023–2024

Why You Should Buy This Report

- Analysis of barley market, supply-demand trends, and trade dynamics of regional (Europe, Canada, Russia, Ukraine) and global markets.

- Porter’s five force analysis of global barley market, supplier market share and key profiles of players like Soufflet Group, Malteurop Groupe, Cargill Malt, etc.

Interesting Reads:

Discover the world of market intelligence and how it can elevate your business strategies.

Learn more about how market intelligence can enable informed decision-making, help identify growth opportunities, manage risks, and shape your business's strategic direction.